Market Overview

Based on a recent historical assessment, the Asia Pacific turboprop aircraft market is projected to reach a value of USD ~ billion. This growth is primarily driven by increasing demand for regional connectivity and the need for cost-effective, fuel-efficient aircraft. Factors such as the rising middle class, improving air transport infrastructure, and a growing preference for shorter regional flights contribute to the market’s expansion. Turboprops are favored for their efficiency on short regional routes, particularly in areas with smaller or less-developed airports, where jet aircraft may not be cost-effective. The ongoing development of low-cost airlines further boosts demand for these aircraft.

The market is heavily dominated by key players from countries such as India, Japan, and China, owing to their large aviation markets and rapidly expanding regional routes. India, in particular, plays a significant role due to its government’s push for regional air connectivity under its UDAN scheme. Japan and China maintain dominance in the sector due to well-established aviation infrastructures and a strong demand for both commercial and military turboprop applications. These countries are expected to continue driving the market forward with investments in both civil and defense aviation sectors.

Market Segmentation

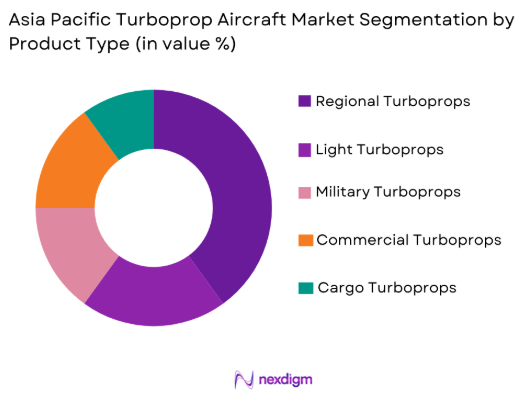

By Product Type

The Asia Pacific turboprop aircraft market is segmented by product type into regional turboprops, light turboprops, military turboprops, commercial turboprops, and cargo turboprops. Recently, regional turboprops have a dominant market share due to increasing demand for efficient regional connectivity. The preference for these aircraft is driven by their fuel efficiency, shorter operational range, and suitability for regional and smaller airfields, where jet traffic is less feasible. These advantages make them ideal for the booming regional tourism and domestic travel markets across the Asia Pacific, particularly in less urbanized areas. As airports invest in infrastructure and passengers increasingly opt for low-cost air travel, regional turboprops are set to remain at the forefront of the market.

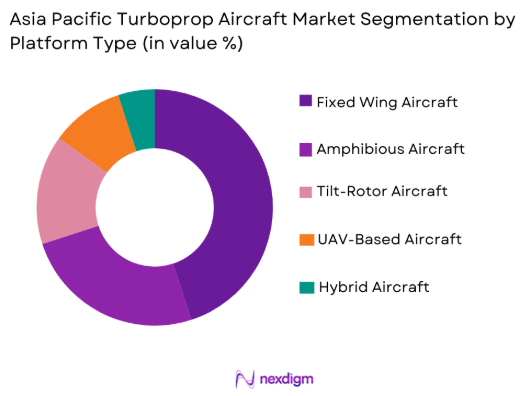

By Platform Type

The Asia Pacific turboprop aircraft market is segmented by platform type into fixed wing aircraft, amphibious aircraft, tilt-rotor aircraft, UAV-based aircraft, and hybrid aircraft. Recently, fixed-wing aircraft have a dominant market share due to their stability, proven technology, and wide usage in both commercial and military applications. Fixed-wing turboprops offer superior performance over various terrains, making them ideal for connecting underserved airports in Asia Pacific regions. The widespread adoption of fixed-wing turboprops is also attributed to their proven track record in military operations, ensuring that this platform remains a preferred option for both civilian and defense sectors.

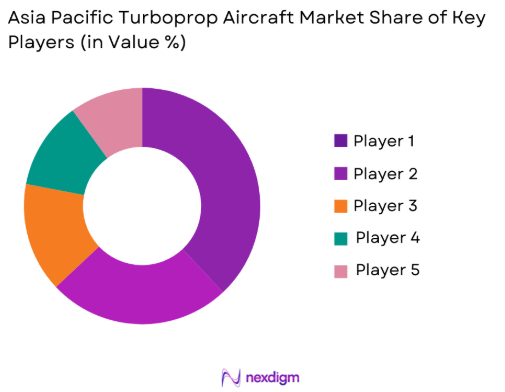

Competitive Landscape

The competitive landscape of the Asia Pacific turboprop aircraft market is characterized by major players consolidating their positions through mergers, acquisitions, and strategic partnerships. The market is highly competitive with a strong presence of key manufacturers such as ATR, Bombardier, and Textron, which lead the development of advanced turboprop models. Companies are focusing on delivering cost-effective solutions, meeting regulatory standards, and capitalizing on the increasing demand for regional connectivity. With several players focusing on technological innovation, there is a continuous push towards enhancing fuel efficiency, reliability, and operational performance.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| ATR | 1981 | France | ~ | ~ | ~ | ~ | ~ |

| Bombardier | 1942 | Canada | ~ | ~ | ~ | ~ | ~ |

| Textron Aviation | 1923 | USA | ~ | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics | 1940 | India | ~ | ~ | ~ | ~ | ~ |

| Viking Air | 1970 | Canada | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Turboprop Aircraft Market Analysis

Growth Drivers

Increase in Regional Connectivity

The increase in regional connectivity within Asia Pacific is a major driver for the growth of turboprop aircraft. With the rise in disposable income, middle-class expansion, and the need for affordable and accessible air travel, countries within Asia Pacific are witnessing greater air traffic and an increased demand for regional flights. Smaller airports in remote or less-developed areas benefit from turboprop aircraft, which can operate in regions with limited infrastructure. Furthermore, these aircraft offer shorter takeoff and landing distances compared to their jet counterparts, making them ideal for smaller, less-developed airfields. As governments and local authorities focus on improving regional connectivity, particularly for tourism, business travel, and government services, turboprop aircraft are increasingly favored due to their operational cost-effectiveness. This rising demand for regional travel, supported by both public and private investments, significantly contributes to the growth of the market.

Technological Advancements in Aircraft Design

The rapid development of fuel-efficient turboprop technology is another key growth driver. Aircraft manufacturers are focusing on reducing fuel consumption and increasing reliability by incorporating advanced materials and cutting-edge engine technologies. For instance, advancements in composite materials allow turboprop aircraft to be lighter, leading to reduced fuel consumption and lower operating costs. Moreover, the integration of advanced avionics systems improves operational efficiency, enhances safety, and reduces maintenance costs. These technological advancements not only make turboprop aircraft more economical but also more environmentally friendly. In response to climate change and sustainability concerns, manufacturers are exploring alternative fuels and hybrid propulsion systems, which will further increase the appeal of turboprops. The push for greener, more sustainable aviation solutions, coupled with the economic advantages of these aircraft, ensures that technological innovation remains a central growth driver in the sector.

Market Challenges

High Operating and Maintenance Costs

One of the significant challenges in the Asia Pacific turboprop aircraft market is the high operating and maintenance costs. While turboprops are more economical than jets for short regional flights, their maintenance expenses can be considerable. The specialized parts and frequent maintenance required for their engines and components make the upkeep of these aircraft costly. Additionally, turboprops are subject to wear and tear from frequent short-haul flights, further escalating maintenance needs. Rising fuel prices also contribute to the operational expenses, which affect profitability, especially for airlines operating on thin margins. Despite their initial cost advantage, the long-term financial burden of operating turboprop aircraft remains a concern, particularly for low-cost carriers that rely on tight cost control strategies. Airlines face the challenge of balancing operational efficiency with the high costs of maintaining a fleet of turboprop aircraft, which can limit their financial flexibility.

Regulatory Compliance and Certification Hurdles

Another major challenge for the Asia Pacific turboprop aircraft market is navigating the evolving regulatory landscape. Aviation authorities across the region have been tightening environmental and safety regulations, including emissions and noise level standards. Compliance with these regulations requires significant investment in upgrading existing aircraft and manufacturing new models with advanced technologies. Additionally, the certification process for new aircraft and modifications can be lengthy and expensive, which delays the market introduction of new, innovative turboprop models. Regulatory discrepancies between countries in the region further complicate the market for manufacturers, as different nations may have varying safety, environmental, and certification requirements. This patchwork of regulations makes it difficult for manufacturers to streamline operations and can lead to increased costs and delays in product development and deployment.

Opportunities

Sustainability in Aviation

The growing emphasis on sustainability presents a major opportunity for the turboprop aircraft market. As the aviation industry faces increasing pressure to reduce carbon emissions and improve fuel efficiency, turboprop aircraft are emerging as a more sustainable alternative to jets, particularly on shorter regional routes. Their lower fuel consumption and ability to operate from smaller airports with less-developed infrastructure position them as an environmentally friendly solution for regional and domestic travel. Manufacturers are capitalizing on this trend by developing hybrid and electric propulsion systems that promise further reductions in carbon emissions, driving the adoption of these aircraft for environmentally conscious operators. Governments and international organizations are also introducing incentives for the adoption of green technologies, further boosting demand for environmentally sustainable aviation solutions.

Growing Military Demand

Another promising opportunity for the turboprop aircraft market is the increasing demand from the defense sector. Turboprop aircraft are ideal for military applications due to their versatility and ability to operate in remote, low-infrastructure areas. These aircraft are used for a wide range of military operations, including surveillance, reconnaissance, transport, and tactical operations. As geopolitical tensions rise and defense budgets increase in many Asia Pacific countries, there is a growing emphasis on strengthening air forces with cost-effective, reliable aircraft. The ability of turboprops to perform in a variety of conditions, coupled with their lower operating costs compared to jets, makes them a favored choice for military applications in the region. The continued modernization of defense fleets and the expansion of military air capabilities provide a significant growth opportunity for the turboprop aircraft market.

Future Outlook

The Asia Pacific turboprop aircraft market is expected to witness continued growth over the next five years, driven by technological advancements, sustainability trends, and increasing demand for regional connectivity. With a focus on fuel efficiency and hybrid propulsion systems, manufacturers are poised to deliver more cost-effective and environmentally friendly aircraft. Regional governments’ support for aviation infrastructure development, alongside an increased push for greener aviation solutions, will further boost the adoption of turboprop aircraft in the region. Demand from both commercial and military sectors is expected to remain robust, with an increasing preference for turboprops in regions with limited airport infrastructure.

Major Players

- ATR

- Bombardier

- Textron Aviation

- Hindustan Aeronautics Limited

- Viking Air

- Mitsubishi Aircraft Corporation

- Saab

- De Havilland Aircraft of Canada

- Embraer

- Avanti Aircraft

- Piaggio Aerospace

- China Aviation Industry Corporation

- Korea Aerospace Industries

- Mahindra Aerospace

- Fokker Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft manufacturers

- Commercial airlines

- Military aviation organizations

- Aerospace equipment suppliers

- Aircraft leasing companies

- Aircraft maintenance service providers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables such as market size, segmentation, technological trends, and competitive landscape. These factors are essential for accurate market modeling.

Step 2: Market Analysis and Construction

A comprehensive analysis of historical data, current market conditions, and emerging trends is conducted. This forms the foundation for constructing market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert consultations and primary research with industry stakeholders. This ensures the accuracy of market projections.

Step 4: Research Synthesis and Final Output

Final research findings are synthesized, analyzed, and compiled into a comprehensive market report. This includes actionable insights and forecasts based on validated data.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Regional Connectivity

Advancements in Turboprop Technology

Rising Demand for Cost-efficient Aircraft

Growing Demand from Military Applications

Government Support and Investments - Market Challenges

High Maintenance Costs

Regulatory Hurdles

Operational Limitations in Extreme Weather

Limited Airfield Infrastructure

Rising Fuel Prices - Market Opportunities

Development of Hybrid Turboprop Aircraft

Expansion of Regional Airports

Strategic Partnerships in Aircraft Manufacturing - Trends

Emergence of Electric Propulsion Systems

Increased Focus on Fuel Efficiency

Integration of AI and Automation

Growing Demand for Smaller Aircraft

Shift Towards Sustainable Aviation Solutions - Government Regulations & Defense Policy

Support for Sustainable Aviation Technologies

Increasing Military Procurement in the Region

International Certification Standards

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Regional Turboprops

Light Turboprops

Military Turboprops

Commercial Turboprops

Cargo Turboprops - By Platform Type (In Value%)

Fixed Wing Aircraft

Amphibious Aircraft

Tilt-rotor Aircraft

UAV-based Aircraft

Hybrid Aircraft - By Fitment Type (In Value%)

OEM

Aftermarket

Retrofit

Upgrade

Customization - By End User Segment (In Value%)

Commercial Airlines

Government & Military

Cargo Operators

Private Operators

Charter Operators - By Procurement Channel (In Value%)

Direct Sales

Distributors

OEMs

Third-Party Agents

Online Platforms - By Material / Technology (In Value%)

Composite Materials

Alloy Materials

Hybrid Materials

Hybrid Propulsion Systems

Fuel-efficient Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Aircraft Range, Fuel Efficiency, Operational Cost, Payload Capacity, Production Rate, Regional Availability, Technology Integration, Customer Support, Market Share, Certification Standards)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

ATR

Bombardier

Piaggio Aerospace

Shaanxi Aircraft Corporation

De Havilland Aircraft of Canada

Textron Aviation

Hindustan Aeronautics Limited

Korea Aerospace Industries

Mahindra Aerospace

Viking Air

Avanti Aircraft

Saab Group

Embraer

Airbus

Lockheed Martin

- Demand from Expanding Regional Airline Networks

- Shift Towards More Efficient Aircraft for Military Use

- Growth in Cargo and Freight Transport

- Increased Demand for Affordable Aviation Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035