Market Overview

The Asia Pacific unmanned systems market has seen substantial growth, with the market size estimated to be valued at approximately USD ~ billion. The market has been driven by factors such as increasing defense budgets, rising demand for autonomous aerial and ground systems, and advancements in robotics technology. As the region experiences robust industrial growth and increased security concerns, unmanned systems are increasingly being deployed in various sectors, including defense, agriculture, and environmental monitoring. Additionally, technological innovations, such as AI-powered unmanned systems and improved communication infrastructure, are contributing to this growth.

Countries like China, Japan, India, and South Korea have emerged as dominant players in the Asia Pacific unmanned systems market. China’s rapid advancements in drone technology and its significant defense investments have placed it as a leader in both military and commercial drone applications. India is a fast-growing market due to its defense modernization plans and increasing adoption of drones in agriculture and logistics. Japan and South Korea also contribute with their advanced technological infrastructure and government-led initiatives to promote autonomous systems.

Market Segmentation

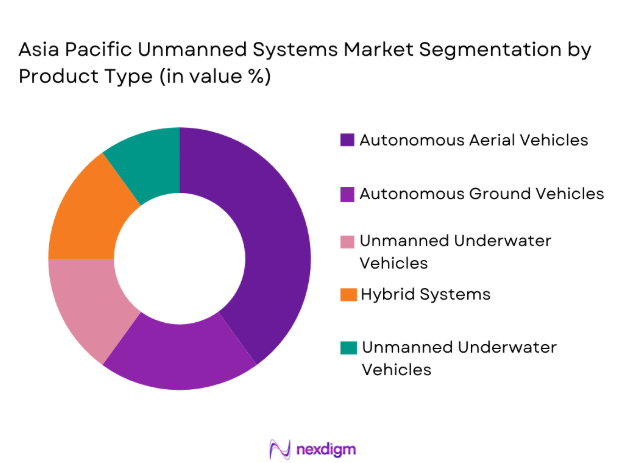

By Product Type:

The Asia Pacific unmanned systems market is segmented by product type into autonomous aerial vehicles (UAVs), autonomous ground vehicles (UGVs), unmanned underwater vehicles (UUVs), and hybrid systems. Recently, UAVs have dominated the market share due to increased applications in surveillance, security, and defense. UAVs are extensively used for monitoring borders, inspecting infrastructure, and conducting rescue missions, driving their demand. With advancements in battery life and AI capabilities, UAVs are seeing wider usage across agriculture, logistics, and environmental monitoring. Their relatively low cost and high efficiency make them the most widely deployed unmanned system in the region, contributing significantly to the market’s growth.

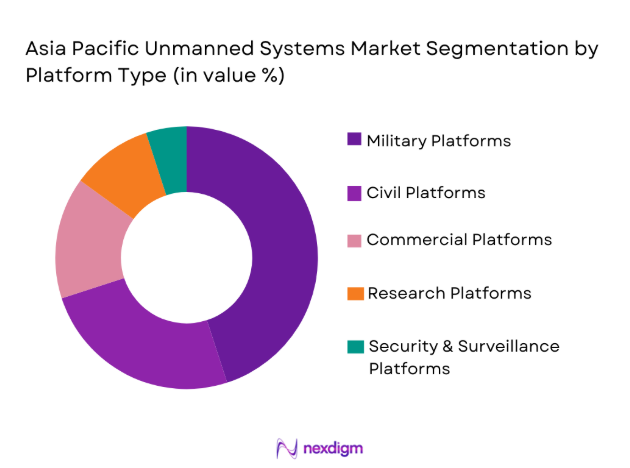

By Platform Type:

The Asia Pacific unmanned systems market is segmented by platform type into military platforms, civil platforms, commercial platforms, research platforms, and security & surveillance platforms. Military platforms dominate the market share, with nations focusing heavily on drone-based surveillance, reconnaissance, and combat systems to enhance their defense capabilities. The increasing demand for surveillance and border patrol missions has driven military platform adoption. Civil platforms follow as the second-largest segment, as both governmental and non-governmental organizations leverage unmanned systems for environmental monitoring, agricultural monitoring, and infrastructure inspections. The versatility and efficiency of these platforms are key factors for their dominance.

Competitive Landscape

The Asia Pacific unmanned systems market is characterized by significant consolidation, with large defense contractors and tech companies dominating the landscape. Major players invest heavily in technological advancements and collaborations to enhance their product offerings. Companies like DJI Innovations, Northrop Grumman, and Lockheed Martin are driving innovation, with an emphasis on autonomous system development and next-generation unmanned solutions. The market is also experiencing new entrants focusing on niche sectors such as agriculture and commercial logistics, which may contribute to further market diversification.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| DJI Innovations | 2006 | China | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | United States | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ |

| Parrot SA | 1994 | France | ~ | ~ | ~ | ~ | ~ |

| AeroVironment | 1971 | United States | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Unmanned Systems Market Analysis

Growth Drivers

Technological Advancements:

The demand for unmanned systems in Asia Pacific is being fueled by technological advancements, particularly in drone and robotic systems. These technologies have rapidly evolved, enhancing system capabilities, including improved battery life, AI-powered operations, and enhanced autonomous functionalities. As drones and autonomous vehicles become more capable of executing complex tasks with minimal human intervention, industries like defense, logistics, and agriculture have increased their adoption of unmanned systems. Furthermore, these technologies reduce operational costs and enhance safety and efficiency, driving growth across multiple sectors. The continuous development of lighter, more durable materials and better propulsion systems further boosts the adoption of unmanned systems in the region. The expanding integration of unmanned systems with artificial intelligence (AI) and machine learning also plays a key role in revolutionizing industries such as surveillance, defense, and environmental monitoring, providing advanced capabilities and expanding their applications.

Regulatory Support and Government Initiatives:

Government initiatives and regulatory support in Asia Pacific are significant drivers for the unmanned systems market. In countries like China, India, and Japan, governments are encouraging the use of unmanned systems for defense, agriculture, and environmental monitoring by offering incentives and forming regulatory frameworks that facilitate the growth of this market. Additionally, the strategic focus on technological sovereignty, particularly in defense applications, drives investments in research and development of indigenous unmanned systems. National security concerns and the increasing emphasis on border surveillance have accelerated the demand for military-grade unmanned systems. These initiatives promote a favorable environment for both local and international companies to invest in and deploy unmanned systems across multiple sectors.

Market Challenges

Regulatory and Certification Challenges:

One of the key challenges faced by the unmanned systems market in Asia Pacific is the regulatory and certification landscape. The lack of uniform regulations across the region makes it challenging for manufacturers to comply with varied certification requirements in different countries. Despite efforts from regulators in countries such as India, Japan, and Australia, there is no cohesive set of standards for unmanned systems across Asia Pacific. This results in operational delays and can create confusion among consumers and manufacturers. Furthermore, countries with stringent airspace restrictions, such as China, pose challenges to the deployment of UAVs for commercial purposes. These regulatory hurdles often slow the adoption of unmanned systems, particularly in industries such as logistics, agriculture, and infrastructure inspection. As a result, it is essential for countries to develop harmonized regulations to streamline operations and ensure the widespread adoption of these systems.

Cost-Related Barriers:

High initial investment costs remain a significant challenge in the unmanned systems market in Asia Pacific. Although prices for drones and other unmanned vehicles have decreased over time, the cost of acquiring and maintaining advanced unmanned systems is still high for many potential buyers. This is particularly true for military-grade UAVs, which require considerable investment in R&D, materials, and manufacturing. Smaller businesses, especially in emerging economies, struggle to invest in these systems, which restricts their market participation. Additionally, the maintenance and operational costs, such as those associated with infrastructure development, training, and data analysis, add to the financial burden. For unmanned systems to gain widespread adoption, manufacturers must continue to reduce costs and provide affordable solutions that offer clear cost-saving benefits.

Opportunities

Agricultural Applications:

The agriculture sector presents a significant opportunity for the unmanned systems market in Asia Pacific. With the growing demand for precision farming and sustainable agricultural practices, unmanned systems are being adopted for tasks such as crop monitoring, soil analysis, and pesticide spraying. UAVs are increasingly used for aerial surveys and data collection, providing farmers with real-time insights into crop health and irrigation needs. The ability to monitor large areas quickly and efficiently without manual labor is a key advantage of unmanned systems in this sector. Furthermore, unmanned ground vehicles (UGVs) are finding applications in harvesting, planting, and autonomous weeding. These systems reduce the reliance on human labor and increase productivity, thereby contributing to the overall growth of the agricultural sector in Asia Pacific. As governments continue to support the integration of technology into agriculture, the market for unmanned systems in this field is expected to expand.

Logistics and Supply Chain Optimization:

Unmanned systems offer considerable opportunities in the logistics and supply chain industries across Asia Pacific. UAVs are increasingly being used for last-mile delivery, especially in urban areas where traffic congestion hinders traditional delivery methods. Drones can swiftly and efficiently deliver packages to consumers, reducing transportation time and improving operational efficiency. Additionally, unmanned ground vehicles (UGVs) are employed in warehouses for inventory management, autonomous transport, and material handling. These systems enable businesses to automate labor-intensive tasks, thus reducing operational costs. Furthermore, the growing trend of e-commerce in Asia Pacific fuels demand for faster, more efficient delivery solutions. The optimization of supply chains using unmanned systems not only lowers costs but also improves customer satisfaction, making it a key area of opportunity in the region.

Future Outlook

The Asia Pacific unmanned systems market is expected to experience significant growth over the next five years, driven by technological advancements, government support, and increasing demand from defense, agriculture, and logistics sectors. The market is likely to benefit from continuous innovation in AI, battery technologies, and materials that enhance system efficiency and capabilities. Additionally, regulatory frameworks are expected to evolve to accommodate unmanned systems more effectively, creating a favorable environment for expansion. As these technologies mature, the market will witness higher adoption rates in industries that were previously slow to integrate unmanned systems.

Major Players

- DJI Innovations

- Northrop Grumman

- Lockheed Martin

- Parrot SA

- AeroVironment

- General Atomics

- Textron Systems

- Elbit Systems

- Insitu Inc.

- Kratos Defense & Security Solutions

- L3 Technologies

- Thales Group

- BAE Systems

- Leonardo S.p.A.

- Saab AB

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Commercial drone operators

- Defense contractors

- Logistics companies

- Agricultural businesses

- Environmental monitoring agencies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the core variables that impact the unmanned systems market, such as technology trends, regulations, and market size data.

Step 2: Market Analysis and Construction

In this step, a comprehensive market analysis is conducted, including segmentation by product types, platforms, and applications. The data is then used to construct a market model.

Step 3: Hypothesis Validation and Expert Consultation

Experts in unmanned systems are consulted to validate market assumptions, identify emerging trends, and gather insights into regional dynamics.

Step 4: Research Synthesis and Final Output

The data and expert insights are synthesized into a final report, which includes all findings, recommendations, and forecasts for the unmanned systems market in Asia Pacific.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Defense Budgets

Rising Demand for Surveillance & Security Solutions

Technological Advancements in Robotics

Government Support for R&D in Autonomous Systems

Growth in Commercial Applications - Market Challenges

Regulatory and Certification Barriers

High Initial Investment Costs

Technological Limitations

Cybersecurity Concerns

Limited Skilled Workforce - Market Opportunities

Growing Use in Smart Agriculture

Deployment in Environmental Monitoring

Potential for Autonomous Delivery Systems - Trends

Integration of AI and Machine Learning

Miniaturization of Unmanned Systems

Increased Use of Autonomous Systems in Commercial Sectors

Development of Autonomous Swarm Technologies

Advances in Communication Systems for UAS - Government Regulations & Defense Policy

Aviation Safety Standards for Drones

Export Control Regulations

Local Government Support for Drone Usage - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Autonomous Ground Vehicles

Autonomous Aerial Vehicles

Unmanned Surface Vehicles

Unmanned Underwater Vehicles

Hybrid Systems - By Platform Type (In Value%)

Military Platforms

Civil Platforms

Commercial Platforms

Research Platforms

Security & Surveillance Platforms - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket Systems

Integrated Systems

Standalone Systems

Modular Systems - By EndUser Segment (In Value%)

Military & Defense

Agriculture & Forestry

Transportation & Logistics

Energy & Utilities

Environmental Monitoring - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Procurement

Government Procurement

Online Platforms

Distributors & Dealers - By Material / Technology (in Value%)

Carbon Fiber

Aluminum Alloys

Lithium-Ion Batteries

Electric Propulsion Systems

Radar & LIDAR Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (System Type, Platform Type, Fitment Type, EndUser Segment, Procurement Channel, Material / Technology, Regulatory Compliance, Geographical Reach, Technological Innovation, Brand Presence) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

DJI Innovations

Parrot SA

Northrop Grumman

Lockheed Martin

Boeing

General Atomics Aeronautical Systems

Textron Systems

Elbit Systems

AeroVironment

Kratos Defense & Security Solutions

Insitu Inc.

XAG

Delair

Quantum Systems

Aurora Flight Sciences

- High Demand in Military Applications

- Increasing Adoption in Agriculture and Logistics

- Emerging Use in Surveillance and Security

- Growing Potential in Energy and Environmental Sectors

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035