Market Overview

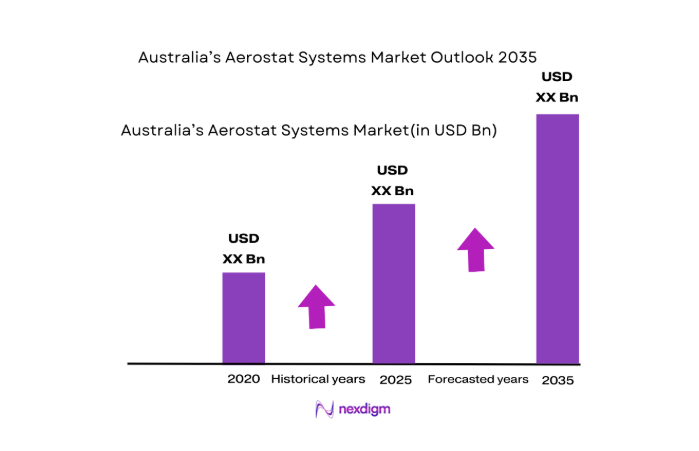

The Australia Aerostat Systems market is valued at approximately USD ~, with steady growth driven by an increasing demand for aerial surveillance and persistent monitoring in defense and border security applications. This market’s growth is also propelled by the continued advancements in aerostat technology, such as improved tethering systems, extended operational endurance, and sensor integration. The government’s defense modernization programs, particularly focused on ISR (Intelligence, Surveillance, and Reconnaissance) capabilities, have further strengthened the market’s position, as Aerostat Systems provide cost-effective alternatives to traditional aircraft and satellites. The demand from other sectors, including telecommunications and disaster management, also contributes to this market expansion.

The dominant areas in Australia’s Aerostat Systems market include major defense hubs like Canberra and Sydney. Canberra remains the epicenter due to its proximity to defense decision-makers and procurement authorities, including the Department of Defence. Sydney is another key location due to its role in advanced aerospace technology development, with key defense contractors and system integrators operating out of the city. Additionally, the Australian government’s focus on securing borders, combating illegal activities, and enhancing military readiness has made regions with high defense investments prime locations for the deployment and operational use of aerostat systems. Australia’s strategic positioning in the Asia-Pacific region further accelerates the demand for surveillance solutions.

Market Segmentation

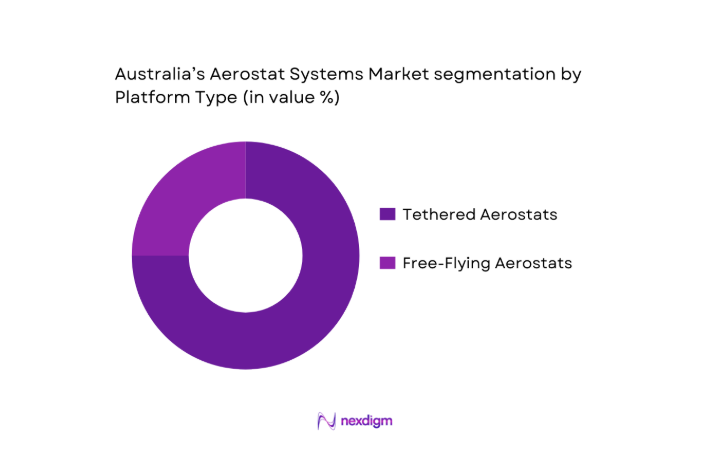

By Platform Type

Australia’s Aerostat Systems market is segmented by platform type into tethered and free-flying aerostats. The tethered aerostat segment dominates the market share due to its persistent surveillance capabilities and cost-effectiveness for long-term operations. Tethered systems are widely adopted by defense forces for surveillance over vast areas without requiring frequent maintenance or deployment. These platforms can carry high-powered cameras and radar, providing near-continuous coverage of borders and coastal areas. Moreover, tethered systems offer a high level of stability and can remain operational for weeks or even months, making them ideal for defense applications. Their lower operational costs, compared to manned aircraft or satellites, further contribute to the dominance of tethered systems in Australia’s market.

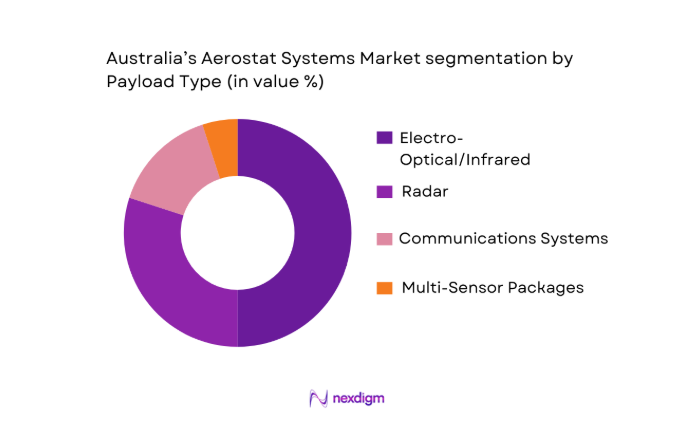

By Payload Type

The payload type segmentation in Australia’s Aerostat Systems market includes electro-optical/infrared (EO/IR) systems, radar systems, communications systems, and multi-sensor packages. The EO/IR systems currently hold the largest share of the market, driven by their ability to provide high-resolution surveillance data during day and night operations. These sensors are widely used in border security, surveillance of critical infrastructure, and defense operations, providing real-time intelligence that helps in rapid decision-making. The increasing demand for improved situational awareness and the integration of advanced imaging technologies have made EO/IR systems the most popular choice in payloads for aerostat platforms.

Competitive Landscape

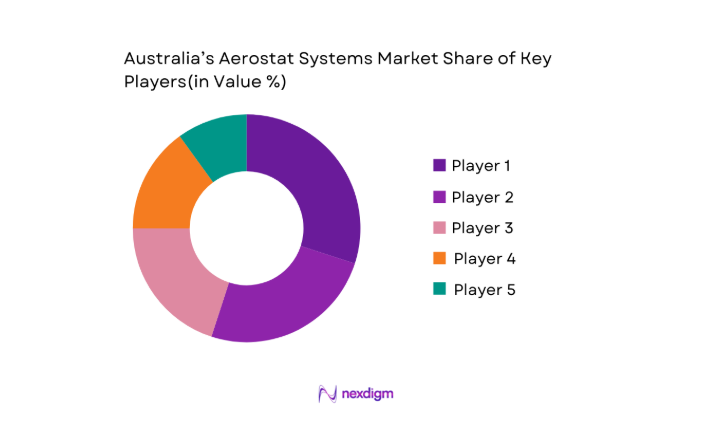

The Australia Aerostat Systems market is dominated by several key players, including global leaders like Northrop Grumman, Lockheed Martin, and local companies such as Aerostats International. These players compete based on their technology offerings, service support, and cost-effectiveness. The consolidation of the market highlights the influence of these companies, with innovation in system design, payload integration, and service offerings being key competitive factors. The dominance of a few global manufacturers in high-tech surveillance and defense systems ensures that their products are widely deployed in Australia’s military, border protection, and emergency response operations.

| Company | Establishment Year | Headquarters | Key Products | Market Share | Service Areas | Technology |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ |

| Aerostats International | 1980 | Australia | ~ | ~ | ~ | ~ |

| TCOM LP | 1985 | USA | ~ | ~ | ~ | ~ |

| Raven Industries | 1956 | USA | ~ | ~ | ~ | ~ |

Australia Aerostat Systems Market Analysis

Growth Drivers

Persistent Surveillance Demand

The increasing demand for persistent surveillance is a major growth driver for the Australia Aerostat Systems market. The rise in security concerns, including border control, illegal activities, and national defense, is fueling this demand. As of 2024, Australia continues to invest heavily in defense and border protection technologies, with the Australian Federal Government allocating an additional AUD 1.2 billion for defense surveillance programs. In 2024, the Australian government also reported a 15% increase in surveillance-related infrastructure investments in response to heightened threats, such as cyberattacks and territorial disputes. This aligns with global trends in demand for continuous monitoring, further supported by the country’s commitment to enhancing border security through automated, long-duration surveillance systems.

Cost per Flight Hour Efficiency vs UAVs/Satellites

Aerostat systems offer a significant advantage over UAVs and satellites in terms of cost-efficiency per flight hour. A typical tethered aerostat system can operate continuously for weeks or months at a fraction of the cost of manned aircraft or satellites. As of 2024, the operational cost of a UAV is estimated at approximately AUD ~ per hour, while a tethered aerostat system costs only AUD ~ per hour for similar surveillance capabilities. With the Australian government’s increased focus on cost-effective defense solutions, this price difference is driving the adoption of aerostat platforms. The 2024 budget forecast includes an additional AUD ~ earmarked for cost-effective border security solutions, such as aerostat systems, further reinforcing the operational efficiency of these systems.

Market Challenges

Airspace Regulation

Airspace regulation remains a significant challenge for the Australia Aerostat Systems market. The Civil Aviation Safety Authority (CASA) imposes strict regulations on the use of aerostats, particularly in non-military applications. In 2024, CASA revised its guidelines, establishing a new set of restrictions for flying tethered systems above 500 meters in non-defense areas, citing concerns over aircraft safety and airspace congestion. The Australian aviation sector, which generated AUD ~ in 2024, faces continuous pressure to balance operational safety with the rising demand for surveillance solutions. These airspace regulations can slow the adoption and deployment of aerostat systems, hindering market growth.

Weather & Tether Reliability

The reliability of aerostat systems is often compromised by adverse weather conditions, such as high winds and storms. The Australian Bureau of Meteorology reported that, on average, extreme weather events in Australia, such as tropical cyclones and severe storms, affect more than ~ of the operational windows for aerostat systems in the region. This issue is particularly pertinent in remote areas where tethered systems are critical for monitoring vast regions. The Bureau’s 2024 report highlights that approximately 15% of surveillance platforms face downtime due to unpredictable weather, creating a barrier for the reliable, continuous operation of aerostat systems.

Opportunities

AI‑Enabled Sensor Fusion

AI-enabled sensor fusion represents a key opportunity for the future growth of the aerostat systems market. Advanced algorithms in AI and machine learning (ML) allow for real-time data processing, improving the overall efficiency and accuracy of surveillance platforms. In 2024, the Australian Department of Defence committed AUD ~ to the development of AI-driven systems to enhance the integration of aerostat sensor data for military and civil applications. By leveraging AI, aerostats can now process data from multiple sensors, such as radar, EO/IR, and communications systems, providing more comprehensive surveillance solutions. This technological integration is expected to significantly reduce human errors and enhance mission capabilities, especially in border security and disaster management.

Data Analytics

Data analytics continues to be a crucial factor in the evolution of aerostat systems, enabling decision-makers to extract actionable insights from vast amounts of sensor data. The Australian government has recognized the value of data-driven decisions in enhancing security, with the Department of Home Affairs reporting a ~ year-over-year increase in the usage of analytics for national security applications. In 2024, AUD 350 million was allocated to build advanced analytics infrastructures, specifically for surveillance systems, including aerostats. By using data analytics to process large-scale, real-time data streams from aerostat platforms, agencies can enhance threat detection, border control, and overall security surveillance capabilities.

Future Outlook

Over the next decade, the Australia Aerostat Systems market is expected to experience substantial growth driven by continued technological advancements in tethered aerostat platforms, along with increasing demand for real-time surveillance and border protection. The evolution of multi-sensor packages, artificial intelligence integration, and autonomous operations will significantly enhance the capabilities of aerostat systems. The market will also see increased interest from non-defense sectors, such as telecommunications and environmental monitoring, spurring further innovation and market development.

Major Players

- Northrop Grumman

- Lockheed Martin

- Aerostats International

- TCOM LP

- Raven Industries

- General Dynamics

- L3Harris Technologies

- SkyHook International

- Airbus Defence & Space

- Israel Aerospace Industries (IAI)

- Altaeros

- Drone Aviation Corp.

- RTI Solutions

- Vanguard Aerospace

- BAE Systems

Key Target Audience

- Defense contractors

- Homeland Security agencies

- Government bodies

- Emergency response agencies

- Investments and venture capitalist firms

- Regulatory bodies

- Telecom companies

- Environmental monitoring agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the key drivers and challenges in the aerostat systems market. This includes recognizing major stakeholders, regulatory requirements, and technology trends. Extensive desk research is conducted, leveraging secondary data from government reports, industry publications, and market surveys to build a comprehensive understanding of the current market landscape.

Step 2: Market Analysis and Construction

This step involves analyzing historical data to establish trends in platform types, payload technologies, and demand from key sectors such as defense and telecommunications. This phase also evaluates the competition landscape and assesses the impact of new technologies on market development.

Step 3: Hypothesis Validation and Expert Consultation

To validate market assumptions, in-depth interviews are conducted with industry experts, including engineers, military personnel, and system integrators. These consultations provide valuable insights into the operational challenges and technological advancements driving the market forward.

Step 4: Research Synthesis and Final Output

The final phase consolidates the data gathered from secondary and primary sources. The analysis is then presented to key stakeholders, ensuring that the findings accurately reflect the current and future state of the Australian Aerostat Systems market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

persistent surveillance demand

cost per flight hour efficiency vs UAVs/satellites - Market Challenges

airspace regulation

weather & tether reliability - Opportunities

AI‑enabled sensor fusion

data analytics

autonomous operations - Market Trends

ISR convergence

telecom relay for rural broadband - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By Volume , 2020-2025

- By Average Selling Price, 2020-2025

- By Platform Type (In Value %)

Tethered Aerostats

Free‑Flying Aerostats

Hybrid LTA systems - By Payload Type (In Value %)

Electro‑Optical / Infrared

Radar

Communications Repeaters

Sensor Fusion / Multi‑mission packages - By End User (In Value %)

Defence

Homeland & Public Safety

Telecom & Broadband Relay

Environmental & Disaster Management - By Deployment Mode (In Value %)

Fixed Installations

Rapid Deploy / Expeditionary - By Operational Altitude (In Value %)

Low Altitude Persistent

Medium Altitude Endurance

- Market Share of Major Players

- Cross‑Comparison Parameters (Payload Flexibility Index , Operational Endurance,Tether Strength & Weather Resilience Rating, Data Fusion/API Ecosystem Capability, After‑sales Support Footprint, Certification/Compliance Spectrum , Platform Scalability, Unit Cost vs Mission ROI)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detail Profile of 15 Major Players

TCOM LP

Northrop Grumman

Lockheed Martin

Raytheon Technologies

Raven Aerostar / Raven Industries

General Dynamics

L3Harris Technologies

Aerostats International

SkyHook International

Airbus Defence & Space

Israel Aerospace Industries

Altaeros

Drone Aviation Corp.

RTI Solutions

Vanguard Aerospace

- Mission endurance & operational uptime

- Payload integration readiness

- Lifecycle cost of ownership

- Service / maintenance & training ecosystem

- Forecast By Value, 2026-2035

- By Volume, 2026-2035

- By Average Selling Price, 2026-2035