Market Overview

The market size of the Australia Air Ambulance Service is currently valued at approximately USD ~ million. It is primarily driven by increasing demand for emergency medical services across the country. Factors contributing to this growth include the expansion of air ambulance operations due to the growing healthcare needs of remote and rural populations, technological advancements in air ambulance equipment, and government support for healthcare infrastructure. Additionally, insurance companies are increasingly covering air ambulance services, further boosting the market demand.

Dominant cities in the market include Sydney, Melbourne, and Brisbane, as these urban centers represent major hubs for both air ambulance operations and healthcare services. These cities are not only the most densely populated regions in Australia but also house numerous healthcare institutions and trauma centers that necessitate the use of air ambulances. Remote and rural areas, particularly in Western Australia and Queensland, also contribute significantly to the market due to the need for rapid transportation of patients to medical facilities. The dominant position of these cities and regions is attributed to their strategic geographical location and robust healthcare

infrastructure.

Market Segmentation

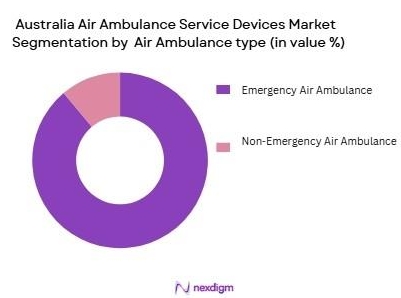

By Air Ambulance Type:

The Australian air ambulance market is segmented into emergency and non-emergency air ambulance services. Emergency air ambulance services have a dominant market share due to the increased frequency of critical medical incidents, such as accidents, heart attacks, and strokes, which require fast and efficient transportation. The demand for these services is growing due to higher incidences of severe trauma in remote regions, driving hospitals and insurance companies to invest heavily in air ambulance services. Emergency services also benefit from government contracts and public-private partnerships, further strengthening their position in the market.

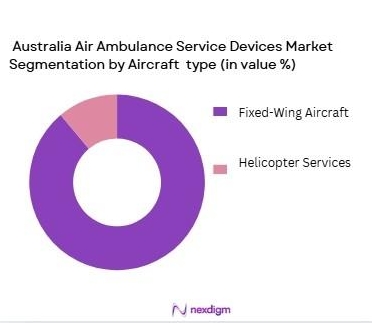

By Aircraft Type:

The Australian air ambulance service market is segmented by aircraft type into fixed-wing aircraft and rotor-wing (helicopter) services. Rotor-wing services are dominating the market share due to their flexibility and faster response times, especially in densely populated urban areas and remote locations that lack runways for fixed-wing aircraft. Helicopters are better suited for shorter distances, urban rescues, and can land in areas where fixed-wing aircraft cannot. Additionally, rotor-wing services are increasingly being employed in specialized medical transport operations, enhancing their market dominance.

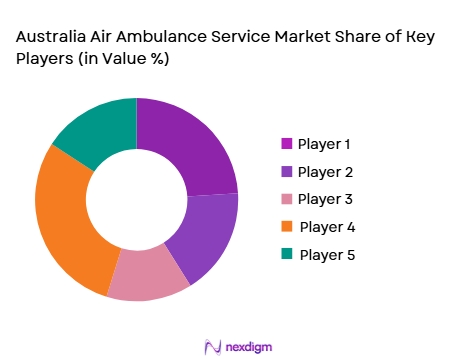

Competitive Landscape

The Australian air ambulance service market is dominated by a few major players, including the Royal Flying Doctor Service, Care Flight, and LifeFlight, along with other regional operators. The consolidation in the market highlights the influence of these key companies, which benefit from long-established reputations, substantial infrastructure investments, and government collaborations. These companies have the resources and capabilities to manage large fleets of aircraft, provide advanced medical care during transport, and respond to emergency situations nationwide.

| Company Name | Year of Establishment | Headquarters | Aircraft Fleet Size | Key Services | Geographical Coverage | Major Partnerships |

| Royal Flying Doctor Service | 1928 | Longreach, Queensland | ~ | ~ | ~ | ~ |

| CareFlight | 1986 | Sydney, New South Wales | ~ | ~ | ~ | ~ |

| LifeFlight | 1986 | Brisbane, Queensland | ~ | ~ | ~ | ~ |

| MedSTAR | 1988 | Adelaide, South Australia | ~ | ~ | ~ | ~ |

| Air Ambulance Australia | 2004 | Brisbane, Queensland | ~ | ~ | ~ | ~ |

Australia Air Ambulance Service Market Analysis

Growth Drivers

Urbanization

The rapid pace of urbanization in Indonesia has significantly increased the demand for air quality monitoring systems. In 2024, over ~of Indonesia’s population resides in urban areas, a number that continues to rise as more people move to cities in search of better opportunities. This rapid urban growth has led to increased pollution levels in cities like Jakarta, Surabaya, and Bandung. Urban areas are more prone to higher pollution levels due to dense vehicular traffic, construction activities, and industrial emissions. The Indonesian government has been addressing air quality concerns through stricter regulations and monitoring, driving the growth of air quality monitoring systems to safeguard the health of the urban population.

Industrialization

Indonesia’s industrial sector, particularly in manufacturing, mining, and energy, plays a critical role in the nation’s economic output. The industrialization process has seen significant growth, with manufacturing contributing to about 20% of Indonesia’s GDP in 2024. However, this rapid industrial development has also led to increased air pollution, especially in industrial zones such as Batam and Surabaya. The expansion of industries and the rise of manufacturing plants that emit pollutants have spurred the need for air quality monitoring systems to ensure compliance with environmental standards. With industries driving the country’s economic engine, the need for accurate air quality monitoring is becoming more urgent to mitigate adverse environmental impacts.

Restraints

High Initial Costs

The high initial investment cost associated with deploying air quality monitoring systems remains a significant barrier to widespread adoption in Indonesia. These systems require advanced technology and substantial infrastructure, which results in high upfront costs. Small and medium-sized enterprises (SMEs) and local municipalities find it challenging to invest in air quality monitoring due to budget constraints. As a result, while large cities and industrial hubs can afford to implement these systems, rural and less-developed regions face difficulties in adopting these technologies. The high cost of installation and ongoing maintenance also limits the expansion of air quality monitoring systems across the country.

Technical Challenges

The technical challenges associated with air quality monitoring systems in Indonesia include issues related to calibration, data accuracy, and system integration. In remote areas, connectivity issues and lack of technical expertise hinder the effective deployment and maintenance of these systems. Additionally, there is a lack of standardized protocols for air quality data collection and reporting, which can affect the consistency of data across the country. These challenges are often exacerbated in urban areas with high levels of pollution, where continuous monitoring is crucial. The need for skilled technicians to operate and maintain air quality systems further complicates the issue.

Opportunities

Technological Advancements

Technological advancements offer significant opportunities for growth in the air quality monitoring market in Indonesia. The advent of low-cost, IoT-based air quality monitoring systems has made it easier to deploy sensors in various locations, including rural and remote areas. By 2024, the increasing use of mobile monitoring units and miniaturized sensors has made air quality data collection more accessible and cost-effective. Additionally, the integration of AI and machine learning for real-time data analysis can enhance the accuracy and predictability of air quality levels. These innovations offer tremendous potential for expansion, particularly in less-developed regions where air quality monitoring is needed the most.

International Collaborations

International collaborations present significant opportunities for the Indonesian air quality monitoring market. Indonesia has partnered with global organizations like the World Health Organization (WHO) to implement air quality improvement programs. These collaborations help in providing financial and technical assistance, enabling the country to enhance its air quality monitoring infrastructure. Moreover, collaborations with international technology companies can bring advanced monitoring systems and expertise to Indonesia, accelerating the adoption of state-of-the-art air quality monitoring technologies. These partnerships have the potential to foster the growth of the market and ensure better air quality management.

Future Outlook

Over the next decade, the Australia Air Ambulance Service market is expected to show significant growth driven by ongoing improvements in healthcare services, advancements in aviation technology, and increased awareness about the importance of rapid medical evacuation. The growth is further supported by the government’s commitment to rural and regional healthcare, which includes investment in air ambulance services to meet the demand for emergency and non-emergency medical transport in remote areas. The expansion of telemedicine capabilities and innovations in helicopter designs are expected to drive future market growth, ensuring a higher quality of care during transport.

Major Players

- Royal Flying Doctor Service

- CareFlight

- LifeFlight

- MedSTAR

- Air Ambulance Australia

- Ambulance Victoria

- Qantas Airways

- Skymed

- Vixens Air Ambulance

- Flying Doctors Australia

- Sonic Healthcare

- TransCare

- International SOS

- AirMed

- Air Rescue

Key Target Audience

- Investment and venture capitalist firms

- Government agencies

- Air ambulance service operators

- Healthcare providers

- Insurance companies

- Emergency services providers

- Aircraft manufacturers and fleet leasing companies

- Regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The first step in the research process involves identifying and defining the key variables that influence the Australia Air Ambulance Service market. This includes reviewing industry reports, conducting interviews with industry experts, and analyzing historical trends. Data will be gathered through secondary research, focusing on government and healthcare agency reports, and primary research, including surveys of key market players.

Step 2: Market Analysis and Construction

In this phase, historical data and growth trends in the Australian air ambulance sector are examined to evaluate market dynamics. This includes an assessment of aircraft fleet sizes, service demand from rural and urban areas, as well as the role of government support and insurance partnerships. Revenue forecasts will be calculated based on these findings.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations, including interviews with air ambulance providers and healthcare professionals, will be conducted to validate market assumptions and forecasts. This process ensures that the insights gained from secondary research are accurate and reliable, incorporating industry practitioners’ perspectives into the analysis.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the gathered data, integrating the findings from expert consultations, and developing comprehensive market models. These models will be used to forecast future market trends, considering variables such as technological advancements in air ambulance services, regulatory changes, and expected growth in demand.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for emergency medical transportation

Expansion of medical tourism and cross-border medical services

Government and healthcare sector investments in emergency healthcare services - Market Challenges

High operational and maintenance costs for air ambulance services

Limited availability of trained medical personnel in remote areas

Regulatory constraints on air ambulance operations - Market Opportunities

Technological advancements in aircraft and medical equipment

Rising demand for non-emergency air ambulance services

Collaborations and partnerships between private and public sectors - Trends

Increasing use of drones for medical supply transportation

Integration of telemedicine in air ambulance services

Shift towards environmentally sustainable air ambulance operations

- Government regulations

Aviation safety and medical transport standards

Health insurance coverage regulations for air ambulances

Government subsidies for air medical services in remote areas - SWOT analysis

Strength: High demand for air ambulance services in rural and remote areas

Weakness: High costs associated with fleet maintenance and operations

Opportunity: Growing market for air ambulances in private healthcare

Threat: Regulatory restrictions affecting operational flexibility - Porters 5 forces

Threat of new entrants: Low

Bargaining power of suppliers: Moderate

Bargaining power of buyers: High

Threat of substitute products: Low

Industry rivalry: High

- By Market Value, 2020-2025

- By Installed Units ,2020-2025

- By Average System Price ,2020-2025

- By System Complexity Tier ,2020-2025

- By System Type (In Value%)

Emergency Air Ambulance Services

Non-Emergency Air Ambulance Services

Fixed-Wing Air Ambulance

Rotor-Wing Air Ambulance

Hybrid Air Ambulance Services - By Platform Type (In Value%)

Single Engine Aircraft

Multi Engine Aircraft

Helicopters

Fixed-Wing Aircraft

Specialized Air Ambulance Platforms - By Fitment Type (In Value%)

Aircraft Mounted Medical Equipment

Mobile Medical Units

Helicopter Medical Equipment

Fixed Wing Medical Equipment

Modular Medical Systems - By EndUser Segment (In Value%)

Private Patients

Government & Public Sector

Insurance Companies

Healthcare Providers

Air Ambulance Service Operators - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Procurement via Government Contracts

Private Sector Procurement

Leasing Providers

Insurance-Based Procurement

- Cross Comparison Parameters(Market Share, Service Type, Technology Adoption, Geographic Presence, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

CareFlight

Royal Flying Doctor Service

Ambulance Victoria

Qantas Airways

MedStar

Gippsland Air Ambulance

LifeFlight

Air Ambulance Australia

AirMed

Skymed

Sonic Healthcare

TransCare

Vixens Air Ambulance

Flying Doctors Australia

International SOS

- Private patients seeking immediate medical care

- Government agencies expanding air ambulance networks

- Insurance companies driving demand for air evacuation services

- Healthcare providers adopting air ambulance solutions for rural areas

- Forecast Market Value ,2026-2035

- Forecast Installed Units ,2026-2035

- Price Forecast by System Tier ,2026-2035

- Future Demand by Platform ,2026-2035