Market Overview

The Australia Air Combat Maneuvering Instrumentation (ACMI) market is valued at USD ~ billion, with significant growth driven by both defense spending and advanced technological developments. ADF (Australian Defense Force) continues to modernize its training systems, integrating advanced ACMI technology to improve pilot training and readiness. The government’s focus on enhancing defense capabilities and modernizing training infrastructures supports the market’s growth. Key drivers include the continuous demand for high-tech instrumentation, data analytics, and integration with multi-national forces in joint training exercises.

Australia’s ACMI market is heavily influenced by the presence of the Royal Australian Air Force (RAAF), based in Canberra, which dominates the regional air combat training ecosystem. Cities like Canberra and Sydney are the primary hubs for military procurement, operational command, and training centers. Additionally, partnerships with allied nations such as the U.S. and the U.K. strengthen the adoption of advanced ACMI technologies within Australian forces. This geopolitical positioning ensures Australia’s leadership in regional defense operations, boosting the domestic ACMI market demand.

Market Segmentation

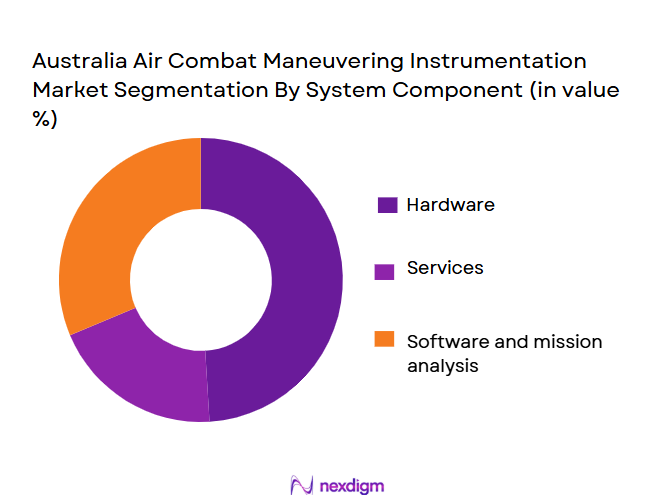

By System Component

The Australian ACMI market is segmented by system components into hardware, software & mission analysis platforms, and services. In 2024, hardware remains the dominant segment, contributing significantly to the market share due to the increasing investment in high-performance combat systems, including pods and sensors. Hardware in the form of mission systems for fighter aircraft and related infrastructure is essential for training and simulations, driving market dominance. Furthermore, Australia’s focus on modernizing its air combat training assets has increased the need for specialized, durable hardware components capable of enduring rigorous military training conditions.

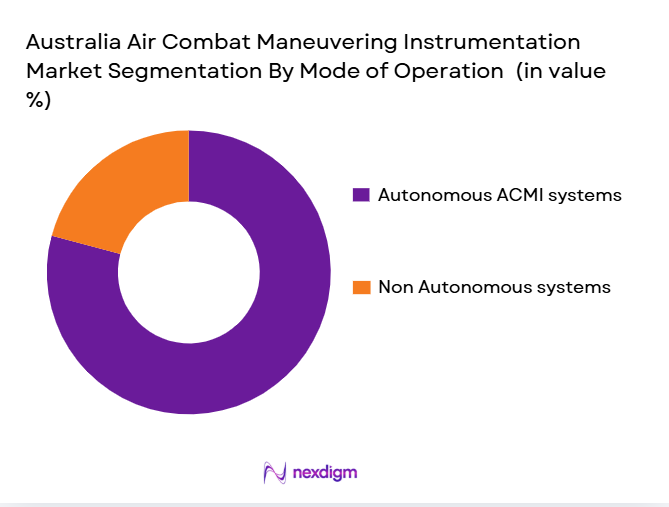

By Mode of Operation

The market is segmented by mode of operation into non-autonomous systems and autonomous ACMI systems. Autonomous ACMI systems lead the market in 2024, driven by advances in GPS technology and the increasing demand for flexible, cost-effective training solutions. Autonomous systems allow for greater training range and reduced need for ground support, making them particularly attractive for integration with advanced fighter aircraft like the F-35. These systems facilitate more realistic, dynamic training environments for pilots, contributing to their rising adoption within the Australian military.

Competitive Landscape

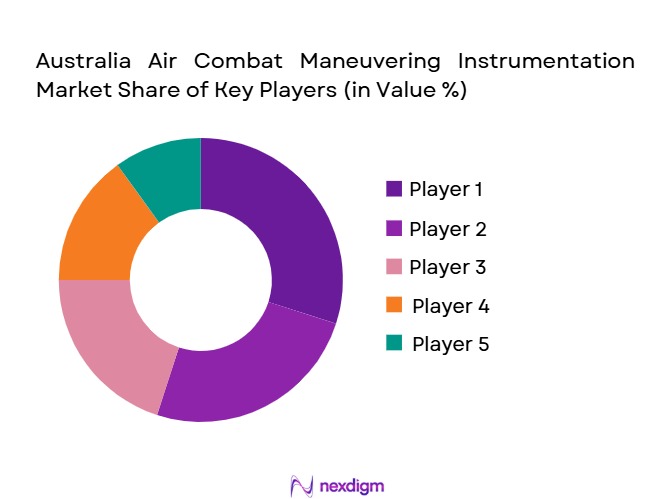

The Australian ACMI market is dominated by a mix of local and international players, with global defense technology companies such as Cubic Corporation, L3Harris Technologies, and Elbit Systems leading the way. These companies are significant players due to their advanced technologies and ability to deliver integrated training solutions for air combat maneuvers. Their continuous innovation in software platforms and hardware components supports their dominance in the market. Additionally, partnerships between these players and Australian defense agencies help drive market penetration.

| Company | Establishment Year | Headquarters | Technology Integration | Revenue | Product Portfolio | Key Market Focus | Strategic Partnerships |

| Cubic Corporation | 1951 | San Diego, USA | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | Melbourne, Australia | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems Ltd. | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1980 | Stockholm, Sweden | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

Australia Air Combat Maneuvering Instrumentation Market Analysis

Growth Drivers

Urbanization

Indonesia’s rapid urbanization is a fundamental driver for air quality monitoring system adoption. Urban population represents approximately ~% of Indonesia’s total population in 2024, highlighting substantial migration into cities where air quality issues are more pronounced. Major metropolitan regions such as Jakarta regularly record PM2.5 concentrations far above healthy limits — with an average of ~ µg/m³ in 2024, which is more than seven times the WHO recommended value. This urban concentration explains why cities are prioritizing the deployment of monitoring infrastructure, as heightened population density increases exposure to pollutants from vehicles, industry, and construction. Urban growth intensifies pressure on existing environmental systems, stimulating demand for advanced monitoring systems capable of providing real-time data to inform policy, public health responses, and regulatory enforcement.

Industrialization

Industrial activities significantly influence the demand for air quality monitoring systems in Indonesia. Industry (including construction) accounted for about ~% of Indonesia’s GDP in 2024, reflecting the large scale of industrial production and related emissions. The country’s manufacturing sector, a key component of industrial output, recorded approximately USD ~ billion in total output in 2023, up from USD ~ billion in 2022. These sectors contribute to urban air pollution through emissions from factories, power plants, and construction dust — factors that feed directly into deteriorating air quality levels documented across the archipelago, especially on Java, Sumatra, and in the Greater Jakarta region. The high contribution of industry to economic output means emissions from heavy manufacturing and construction are persistent, requiring continuous air quality surveillance to comply with environmental standards and to enable targeted mitigation measures.

Technical Challenges

The complexity of deploying air quality monitoring systems in Indonesia’s diverse environments presents technical challenges. These challenges include the difficulty of ensuring reliable sensor calibration and the need for ongoing maintenance and upgrades to ensure system accuracy and longevity. Additionally, the integration of new air quality systems with existing infrastructure requires addressing interoperability concerns, particularly in remote or rural areas where infrastructure may be less developed. The absence of a standardized framework for air quality monitoring across regions also creates discrepancies in the quality of data collected, which complicates the effectiveness of environmental policy and regulation. Furthermore, the technical capabilities of available air monitoring equipment may not be sufficient to address the fast-changing environmental conditions in densely polluted cities like Jakarta, adding complexity to real-time data management.

Opportunities

Technological Advancements

Indonesia’s air quality monitoring system market is poised to benefit from technological advancements in monitoring equipment. Innovations in real-time data processing, mobile monitoring units, and IoT-connected devices are creating opportunities for more cost-effective and reliable air quality monitoring. The development of low-cost sensors that can be deployed in a wider range of environments is helping to expand monitoring coverage beyond urban centers. Moreover, the introduction of advanced AI-powered data analytics is improving the accuracy and speed of pollution tracking, enabling faster response times and better-informed regulatory action. The integration of these cutting-edge technologies enhances the scalability and adaptability of monitoring systems, offering cost-effective solutions for both urban and rural areas.

International Collaborations

Indonesia’s active participation in international collaborations presents significant opportunities for the expansion of air quality monitoring systems. As part of the ASEAN region, Indonesia engages in cross-border environmental initiatives, particularly in reducing air pollution and improving air quality. These collaborations help bring new funding sources, advanced technologies, and expertise to the Indonesian market. Additionally, partnerships with international organizations such as the United Nations Environment Programme (UNEP) and World Health Organization (WHO) have further strengthened Indonesia’s environmental policies, driving demand for modern air quality monitoring solutions. Such collaborations help the country align with global standards, ensuring that air quality systems meet international best practices and contribute to better regional environmental management.

Future Outlook

Over the next five years, the Australian ACMI market is expected to witness substantial growth, primarily driven by technological advancements in autonomous systems and increased collaboration with international allies. This growth will be fueled by the Australian government’s commitment to enhancing defense capabilities, bolstering pilot training with more realistic simulation technologies. Additionally, market players are expected to continue innovating in terms of data analytics and real-time feedback systems, which are becoming integral to modern military training.

Major Players

- Cubic Corporation

- L3Harris Technologies, Inc.

- Elbit Systems Ltd.

- Leonardo S.p.A. / Leonardo DRS

- Aerotree Defence & Services Sdn. Bhd.

- BAE Systems

- Boeing Company

- ComAvia Systems Technologies Pvt. Ltd.

- General Dynamics Corporation

- Hensoldt AG

- Kongsberg Defence & Aerospace

- Lockheed Martin Corporation

- Prescient Systems & Technologies Pte Ltd.

- IAI (Israel Aerospace Industries)

- Saab AB

Key Target Audience

- Defence Ministries & Government Agencies

- Australian Defence Force (ADF) / RAAF Training Commands

- Defence Contractors & Integrators

- Investors & Strategic Investment Firms

- Market Research & Consulting Firms

- Technology OEMs & Suppliers

- Defense Training Academies & Simulation Centers

Research Methodology

Step 1: Identification of Key Variables

The first step in this research involves constructing a detailed ecosystem map to identify key stakeholders and variables impacting the Australian ACMI market. This phase includes desk research and using secondary databases to analyze industry trends, market drivers, and challenges.

Step 2: Market Analysis and Construction

This step involves compiling and analyzing historical data on the Australian ACMI market, assessing market penetration and the impact of technological advancements. We will focus on understanding the service dynamics, including the balance between hardware, software, and services that define the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, industry experts and stakeholders from military aviation, defense procurement, and ACMI system manufacturers will be consulted. This will validate our hypotheses regarding current and future market trends, including the role of autonomous systems and international partnerships in driving market demand.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the insights from all phases of research to present a comprehensive, validated report. This will include cross-checking data with key industry players, ensuring accuracy, and providing a clear, actionable outlook for stakeholders.

- Executive Summary

- Research Methodology (ACMI Functional Definitions and Scope, Defense Market Sizing Methodology, Australia Specific Defense Budget Allocation Approach, Data Triangulation: Primary & Secondary Sources, Glossary of ACMI Technical & Procurement Terms, Research Limitations & Assumptions)

- ACMI Market Genesis and Capability Evolution

- Australia Defense Force (ADF) Training Infrastructure Overview

- ACMI Role in Pilot Readiness, Joint Exercises & Combat Simulation

- Australia Defense Procurement Landscape & Policy Influencers

- Growth Drivers

Increasing Focus on Integrated Live, Virtual & Constructive (LVC) Air Training

Interoperability Demand with Allied Forces (e.g., US, UK, Japan)

Next‑Generation Platform Integration (5th Gen Fighter Training Support)

Government Defense Modernisation Programmes & Capability Assurance - Market Challenges

High Integration Costs for ACMI Pods & Ground Systems

Technical Barriers: Secure Data Transmission & Standards Compliance

Aircraft Modification Constraints for Legacy Platforms - Opportunities

Autonomous ACMI & GPS‑Enabled Rangeless Training Solutions

Secure & Encrypted ACMI for Multi‑Nation Operations

Local Defense Industrial Participation (Australian SMEs) - Trends

Real‑Time Feedback and Big Data Analytics Integration

Shift to Modular & Software‑Defined Instrumentation Suites

Cloud‑Enabled Debriefing & Training Analytics - Government Regulations

Defense Data Protection & Encryption Standards

Aviation Authority Compliance for Training Systems

Interoperability Standards (Allied Forces)

Testing & Certification Regimes for ACMI - SWOT Analysis

- Strengths

- Weaknesses

- Opportunities

- Threats

- Porter’s 5 Forces

- Regulatory & Reimbursement Framework

UAE Medical Device Registration Protocols

Digital Health Compliance & Data Governance

Reimbursement Policies Impacting RPM Adoption

Standards for Connected Medical Devices

- By Value, 2020-2025

- By Volume , 2020-2025

- By Average Price, 2020-2025

- By System Component (in Value %)

Hardware

Software & Mission Analysis Platforms

Services - By Mode of Operation (in Value %)

Non‑Autonomous Systems

Autonomous ACMI Systems - By System Type (in Value %)

Real‑Time Data Systems

Non‑Real‑Time & Post‑Mission Systems - By Application (in Value %)

Pilot Combat Training

Live, Virtual & Constructive (LVC) Integration

Weapons & Tactics Development

Joint Force / Coalition Exercises - By Deployment Environment (in Value %)

Fighter Aircraft

Lead‑In Fighters / Training Aircraft

Ground‑Based Training & Debrief Facilities

Air Traffic Environment Simulation

- Market Share of Major Players

Key Global Players Serving Australian Market

Defense Prime Contractors & Sub‑Tier Suppliers - Cross Comparison Parameters (Capability Coverage, Interoperability Standard Compliance, Secure Data Telemetry Capability, Throughput/Latency Performance, Support Infrastructure in APAC, Lifecycle Cost Efficiency, Local Defense Industry Partnerships, Training Analytics Depth)

- SWOT Analysis of Key Players

- Strengths

- Weaknesses

- Opportunities

- Threats

- Pricing Analysis of Major Players

OEM Pricing Models

System Integration & Support Pricing - Detailed Profiles of Major Players

Cubic Corporation

L3Harris Technologies, Inc.

Elbit Systems Ltd.

RTX / Collins Aerospace

IAI – Israel Aerospace Industries

Arotech Corporation

Saab AB

SDT Space & Defense Technologies Inc.

ADCOR MAGnet Systems

Prescient Systems & Technologies Pte Ltd.

Leonardo S.p.A. / Leonardo DRS

Thales Group

BAE Systems

Raytheon Australia (Systems & Integration Services)

Local Integrators & SMEs (Australia)

- RAAF Training Command Requirements

- Utilization Patterns & Training Intensity Metrics

- Budget Allocations & Unit Readiness Plans

- Pain Points: Integration Complexity, Data Security, Multi‑Platform Support

- Buyer Decision Criteria & Procurement Cycles

- By Value, 2026-2035

Future Market Growth by Value - By Volume, 2026-2035

Future Market Growth by Volume - By Average Price , 2026-2035

Future Market Growth by Average Price