Market Overview

Explanation of Market Size and How It Is Driven

The Australian air taxi market, valued at USD ~ billion in 2023, is driven by technological advancements in electric vertical takeoff and landing (eVTOL) aircraft, growing urbanization, and the need for efficient transportation solutions. The expansion of government initiatives supporting urban air mobility, as well as private sector investment in air taxi fleets and infrastructure, is fueling market growth. Furthermore, an increasing focus on sustainability and the adoption of clean energy aviation technologies have contributed to the rising demand for air taxi services.

Australia’s key cities, such as Sydney, Melbourne, and Brisbane, dominate the air taxi market due to their high population density, significant traffic congestion, and advanced infrastructure. These cities have adopted smart city technologies and are investing in vertical takeoff and landing (VTOL) infrastructure. Sydney’s government is actively pursuing initiatives that integrate eVTOL solutions, while Melbourne’s booming tourism and business sectors create a high demand for air taxi services. The regulatory support from Australian authorities is also vital in the market’s dominance in these areas.

Market Segmentation

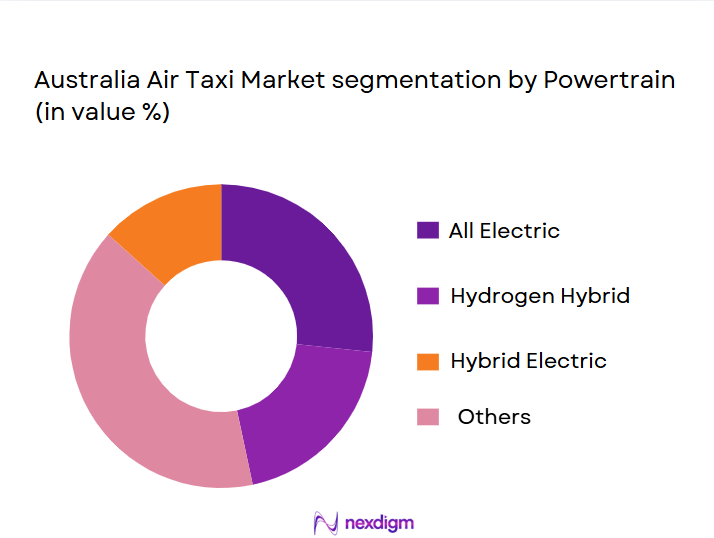

By Power train Type

The Australian air taxi market is segmented by aircraft type, including eVTOL Multicopters, eVTOL Tilt-Rotor, Hybrid Electric VTOL, Hydrogen Fuel Cell VTOL, and legacy helicopter air taxi conversions. Currently, the eVTOL Multicopter segment holds the dominant market share. This dominance is attributed to their efficient design for urban air mobility, lower operational costs, and suitability for short-range urban travel. The increasing focus on electric propulsion technologies has also positioned eVTOL Multicopters as a key segment, with several companies, including Joby Aviation and Volocopter, focusing on advancing this technology.

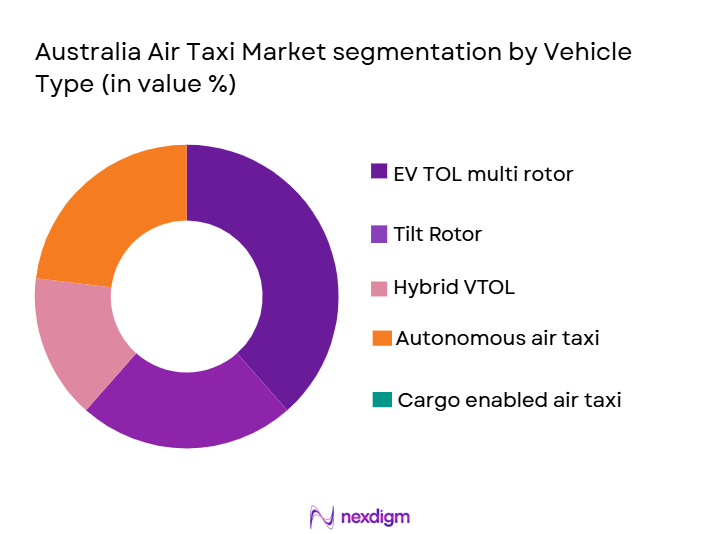

By Vehicle Type

The market is also segmented by service type into intracity air taxi, intercity air taxi, on-demand urban mobility, scheduled air shuttle services, and medical & emergency air taxi services. Among these, the intracity air taxi segment is dominating the market. This is due to the increasing congestion in urban centers and the demand for rapid, point-to-point transportation. Intracity air taxis are seen as a solution for avoiding ground traffic, offering faster travel times and appealing to business travelers and the general public in large metropolitan areas like Sydney and Melbourne.

Competitive Landscape

The Australian air taxi market is dominated by a few major players, including global leaders such as Joby Aviation, Volocopter, and Archer Aviation, as well as local startups focused on integrating eVTOL technology into Australia’s urban air mobility ecosystem. This market is rapidly evolving, and these key players are vying for dominance through strategic partnerships, technology innovation, and regulatory approvals. Companies with strong R&D capabilities, a robust infrastructure strategy, and partnerships with key stakeholders like urban planners, vertiport developers, and airlines are likely to lead the market in the coming years.

| Company | Establishment Year | Headquarters | Fleet Type | Technology | Regulatory Approvals | Market Focus |

| Joby Aviation | 2009 | USA | ~ | ~ | ~ | ~ |

| Volocopter | 2011 | Germany | ~ | ~ | ~ | ~ |

| Archer Aviation | 2018 | USA | ~ | ~ | ~ | ~ |

| Lilium | 2015 | Germany | ~ | ~ | ~ | ~ |

| Vertical Aerospace | 2016 | UK | ~ | ~ | ~ | ~ |

Australia Air Taxi Market Analysis

Growth Drivers

Urban Congestion & Regional Connectivity Needs

Australia’s urban areas, particularly Sydney, Melbourne, and Brisbane, experience significant congestion due to increasing population density. In 2023, Sydney’s population reached 5.6 million, and Melbourne’s at ~ million, leading to an increase in traffic congestion. According to the Australian Bureau of Statistics (ABS), traffic congestion costs Australian businesses an estimated AUD ~ billion annually in lost productivity, which contributes to the demand for alternative transportation solutions such as air taxis. The Australian government is investing in urban mobility solutions to alleviate this issue, with projects like the “Smart Cities” initiative to enhance transportation efficiency.

Electric Propulsion Advancements

The global push for cleaner transportation technologies has spurred advancements in electric propulsion, particularly within the aviation industry. In Australia, the government has committed to reducing carbon emissions, with a target of net-zero emissions by 2050. Electric propulsion technologies are seen as a critical enabler of this goal. For instance, Australia’s National Electric Vehicle Strategy outlines initiatives for increased adoption of electric transport across sectors. Additionally, Australia’s domestic electric aircraft projects, including those involving eVTOLs, benefit from government-funded initiatives such as the $~ million investment by the Australian Renewable Energy Agency (ARENA) for green aviation projects in 2023.

Market Challenges

Certification and Regulatory Approval Complexity

The certification process for new aviation technologies like eVTOLs in Australia is complex due to strict regulatory requirements set by the Civil Aviation Safety Authority (CASA). CASA is responsible for ensuring that all new aircraft meet safety standards before they are cleared for operation. In 2023, CASA granted preliminary approval for only three eVTOL designs, with the process expected to take several more years for full commercial deployment. These regulatory hurdles delay the market’s ability to scale and bring eVTOLs to commercial service. Furthermore, the lack of established regulatory frameworks for eVTOLs poses a challenge to faster market adoption.

Air Traffic Integration & Safety Barriers

Integrating air taxis into existing air traffic systems is a significant challenge. According to the Australian Transport Safety Bureau (ATSB), the safety risks associated with introducing new, autonomous aircraft into shared airspace are considerable. In 2023, the Australian Government began developing a UAM (Urban Air Mobility) roadmap to define how air taxis can safely coexist with other air traffic, particularly in busy metropolitan areas. The roadmap focuses on the safe operation of eVTOLs, especially in dense airspace environments, where air traffic management systems need to evolve to handle these new vehicles.

Market Opportunities

First-Mover Position in Domestic Regional Air Taxi Networks

The growing demand for domestic regional air mobility services presents a significant market opportunity for Australian air taxi companies. In 2023, regional connectivity in Australia was marked by increasing passenger demand for faster, more efficient transport options outside of major metropolitan hubs. As Australia works to enhance regional connectivity through its “Regional Connectivity Program,” the deployment of air taxis could cater to underserved regions with limited transport options. Additionally, with several companies already investing in regional air mobility solutions, first movers in this space can capture a strong market share in the near future.

Use Case Diversification: Logistics, Emergency Services

Air taxis in Australia present new opportunities for logistics and emergency services. In 2023, the Australian government identified urban air mobility solutions as a critical part of its emergency management strategy. Air taxis are well-suited for rapid emergency response, such as medical evacuations, disaster relief, and fire-fighting operations. Similarly, the growing demand for fast, sustainable delivery services presents a market for cargo drones and air taxis in the logistics sector. The Australian government’s active role in funding such initiatives creates a conducive environment for market growth.

Future Outlook

The Australian air taxi market is poised for significant growth in the next decade. Over the next several years, the market is expected to grow exponentially, driven by the continuous advancements in eVTOL technologies, increasing government support for urban air mobility, and the growing demand for alternative transportation solutions in congested urban areas. As regulatory bodies like CASA continue to streamline approval processes, the commercialization of air taxi services in Australian cities will play a major role in reshaping urban mobility and providing more efficient, sustainable transportation options. Furthermore, innovations in battery technology and aircraft design are expected to lower operational costs, making air taxis more affordable and accessible to a broader demographic.

Major Players in the Market

- Joby Aviation

- Volocopter

- Archer Aviation

- Lilium

- Vertical Aerospace

- Eve Air Mobility

- Beta Technologies

- Urban Aeronautics

- Skyports

- Wisk Aero

- Transcend Air

- Lynx Air

- Karem Aircraft

- AeroVironment

- Aston Martin Lagonda

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Civil Aviation Safety Authority – CASA)

- Urban Mobility Solution Providers

- Aircraft Manufacturers and OEMs

- eVTOL Technology Developers

- Commercial Aviation Operators

- Infrastructure Developers (Vertiport Builders, Charging Stations)

- Environmental and Sustainability Agencies (e.g., Department of Industry, Science, Energy and Resources

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Australian air taxi market. This step includes extensive desk research, leveraging proprietary databases to gather comprehensive data regarding the stakeholders involved and the critical variables influencing market dynamics. Key variables such as regulatory frameworks, technology advancements, and consumer preferences will be identified.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Australian air taxi market. This will include assessing market penetration, aircraft deployment rates, infrastructure readiness, and service delivery models. We will also examine how government policies and initiatives influence the market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding growth drivers, challenges, and future trends will be developed and validated through interviews with key industry experts, including aviation regulators, OEMs, and infrastructure providers. These consultations will provide operational insights and confirm or refine our assumptions.

Step 4: Research Synthesis and Final Output

The final phase includes consolidating data from various sources, including primary and secondary research, and synthesizing this information into actionable market insights. This will provide a comprehensive, validated analysis of the Australian air taxi market, focusing on key trends, opportunities, and competitive dynamics.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach Consolidated Research Framework, Data Sources and Validation Limitations and Future Research Considerations)

- Definition and Scope

- Market Dynamics

- Ecosystem Landscape (Infrastructure, Airspace Usage, Vertiport Plans)

- Value Chain & Service Benchmarking (Aircraft OEM, Operators, Vertiport Developers)

- Historical Overview

- Regulatory and Certification Framework (CASA, Airspace Guidelines)

- Growth Drivers

Urban Congestion & Regional Connectivity Needs

Electric Propulsion Advancements

Smart City and Government Infrastructure Investments

Tourism & Business Travel Demand Expansion - Market Challenges

Certification and Regulatory Approval Complexity

Air Traffic Integration & Safety Barriers

Infrastructure Development (Vertiports, Charging/Fueling)

Cost of Capital & Operational Economics - Market Trends

Rise of Advanced Air Mobility (AAM) Players

Electrification & Sustainable Aviation Focus

Public‑Private Infrastructure Alliances

Adoption of Autonomous and Digital Fleet Management - Market Opportunities

First‑Mover Position in Domestic Regional Air Taxi Networks

Use Case Diversification: Logistics, Emergency Services

Software & Traffic Management Platforms

Partnerships with Airlines & Transit Agencies - Government Regulations and Policy

Civil Aviation Safety Authority (CASA) Airspace Standards

Vertiport Zoning & Urban Integration

Emissions & Environmental Standards

Public Funding and Incentive Schemes - SWOT Analysis

- Porter’s Five Forces Analysis

- By Revenue, 2020–2025

- By Unit Deployments, 2020–2025

- By Average Cost per Flight, 2020–2025

- By Utilization Intensity, 2020–2025

- By Aircraft Type (In Value %)

eVTOL Multicopters

eVTOL Tilt‑Rotor

Hybrid Electric VTOL

Hydrogen Fuel Cell VTOL

Legacy Helicopter Air Taxi Conversions - By Propulsion Type (In Value %)

Battery Electric (BEV)

Hybrid Electric

Hydrogen Electric

Turboshaft / Synergistic Hybrids - By Service Type (In Value %)

Intracity Air Taxi

Intercity Air Taxi

On‑Demand Urban Mobility

Scheduled Air Shuttle Services

Medical & Emergency Air Taxi - By Range Category (In Value %)

Short Range (≤ 50 km)

Medium Range (51–150 km)

Extended Range (>150 km) - By Operating Model (In Value %)

Piloted Services

Optionally Piloted / Autonomous‑Assisted

Full Autonomy (Regulatory Pending)

- Market Share of Major Players (by Revenue & Deployments)

- Cross‑Comparison Parameters

(Company Overview, Certification Status ,Fleet Type & Configurations (eVTOL class)

Vertiport Partnerships & Network Scale, Operational Readiness Level

Regulatory Approvals in Australia, R&D & Battery Technology Capability

Flight Range & Payload Metrics, Strategic Alliances & OEM Backing, Capital Funding & Investment Position

Commercial Launch Timelines, Pricing Strategy per Kilometer/Seat, Service Contracts

Maintenance & Support Infrastructure) - SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profile of Major Players

- Joby Aviation

Archer Aviation

Lilium

Vertical Aerospace

Beta Technologies

Volocopter

Eve Air Mobility

Urban Aeronautics

AeroVironment

Aston Martin Lagonda

Karem Aircraft

Skyports

Wisk Aero

Transcend Air

Lynx Air

- End User Segments (Business Travelers, Commuters, Tourists)

- Price Sensitivity and Elasticity Analysis

- Adoption Drivers in Metropolitan vs. Regional Areas

- Purchase & Service Subscription Behaviors

- Safety, Reliability, and Trust Metrics

- User Experience Expectations

- By Revenue , 2026–2035

- By Unit Deployments, 2026–2035

- By Average Cost per Flight, 2026–2035

- By Utilization Intensity, 2026–2035