Market Overview

The Australia Air Traffic Control (ATC) Equipment Market is valued at approximately USD ~ billion in 2025. The market is primarily driven by advancements in air traffic management systems, increased air travel demand, and the growing need for enhanced airspace management. Moreover, ongoing infrastructure development in major Australian airports, such as Sydney, Melbourne, and Brisbane, alongside government-backed investments in modernizing ATC systems, is pushing the growth of the market. Additionally, the introduction of remote tower technology and new navigation systems further supports the market’s expansion.

Australia’s major cities, such as Sydney, Melbourne, Brisbane, and Perth, dominate the ATC equipment market due to their status as key international and domestic hubs. These cities’ airports experience high traffic volumes, demanding sophisticated ATC systems for efficient operations. Furthermore, Sydney stands out as a critical node for air traffic management given its role as the busiest airport in Australia. The country’s emphasis on modernization and adoption of next-gen ATC technologies, including ADS-B and remote tower solutions, further reinforces these cities’ market dominance.

Market Segmentation

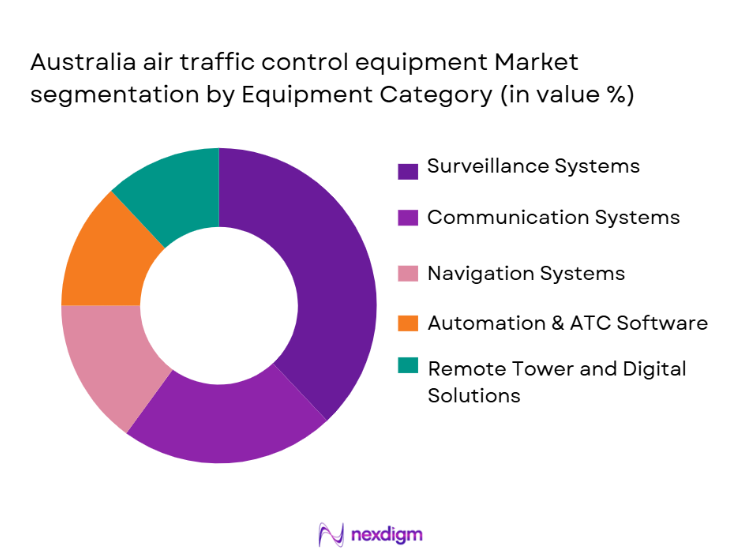

By Equipment Category

The Australian ATC equipment market is segmented into several categories based on the equipment used for air traffic management. These include surveillance systems, communication systems, navigation systems, automation & ATC software, and remote tower & digital solutions. Among these, surveillance systems hold a dominant market share in 2024. This dominance is attributed to their critical role in airspace monitoring, with technologies like radar, ADS-B, and multilateration forming the backbone of Australia’s air traffic control systems. As Australia’s air traffic continues to grow, the demand for precise surveillance systems increases to ensure airspace safety and minimize delays. Additionally, ongoing upgrades to radar and satellite-based surveillance systems further bolster the position of this sub-segment.

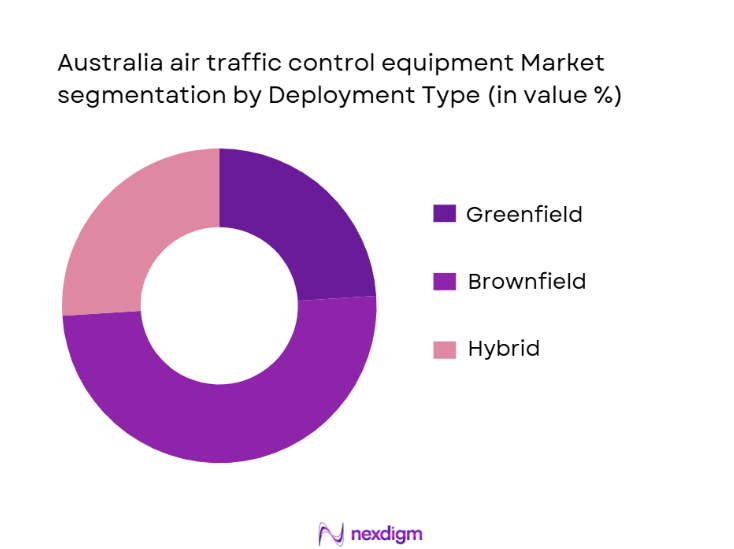

By Deployment Type

The market is also segmented by deployment type into greenfield (new installations), brownfield (modernizations), and hybrid (legacy to next-gen transitions) deployments. The brownfield segment is expected to dominate the market share in 2024. This is because most of Australia’s airports are well-established with existing ATC infrastructure, and they are now undergoing modernization to integrate advanced technologies such as remote towers, ADS-B, and automation solutions. Upgrading the existing ATC systems is a more cost-effective approach for these airports compared to completely new installations. Additionally, government-backed modernization programs and the need to improve airspace efficiency in line with growing traffic make this sub-segment the dominant one in Australia.

Competitive Landscape

The Australian ATC equipment market is dominated by several global and regional players, each offering solutions tailored to the specific needs of the Australian air traffic management system. Companies like Thales Group, Indra Sistemas, Frequentis, and Raytheon hold significant market share due to their comprehensive portfolios and established relationships with Australia’s air navigation service providers. These companies have become key players in Australia’s airspace management modernization initiatives, working closely with Airservices Australia and other government entities to deliver advanced systems for radar, communication, navigation, and automation.

The competitive landscape is characterized by technological innovation, local partnerships, and a strong focus on product customization for Australia’s unique air traffic management needs. Additionally, the market is becoming increasingly competitive with new entrants focusing on niche technologies like remote tower solutions and AI-driven air traffic management systems.

| Company | Establishment Year | Headquarters | Product Portfolio | Technological Expertise | Local Partnerships | Market Presence |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ |

| Indra Sistemas | 1986 | Spain | ~ | ~ | ~ | ~ |

| Frequentis AG | 1947 | Austria | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | USA | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | USA | ~ | ~ | ~ | ~ |

Australia Air Traffic Control Equipment Market Analysis

Growth Drivers

Increasing Air Traffic and Passenger Movements

The growing demand for air travel in Australia, driven by both domestic and international traffic, necessitates advancements in air traffic management systems. As airports like Sydney, Melbourne, and Brisbane experience heightened passenger and cargo movements, the demand for more efficient and reliable ATC systems continues to rise, propelling market growth.

Government and Infrastructure Investment in Modernization

The Australian government’s commitment to enhancing air traffic management through substantial infrastructure investments, such as upgrading radar systems, automation technologies, and transitioning to remote towers, significantly drives the demand for modern ATC equipment. These modernization initiatives aim to improve airspace safety, optimize traffic flow, and support the expansion of Australian airports.

Market Challenges

High Capital Expenditure and Integration Costs

One of the key challenges for the market is the high cost of purchasing, deploying, and maintaining advanced ATC systems, especially for smaller or regional airports. The transition from legacy systems to modern solutions, such as automation and remote towers, presents a significant financial barrier for airports operating on limited budgets.

Cybersecurity Risks and Regulatory Compliance

As ATC systems become more interconnected with advanced technologies like cloud platforms and AI-driven automation, the risks of cyberattacks and data breaches increase. Additionally, maintaining compliance with ever-evolving aviation regulations and safety standards adds complexity to both system upgrades and daily operations.

Opportunities

Adoption of Remote Tower Solutions

The shift towards remote tower technology presents a major opportunity for the market, allowing airports to reduce operational costs and enhance air traffic management efficiency. This technology enables remote monitoring and control of airport operations, even in remote or low-traffic locations, creating growth opportunities for providers of remote ATC solutions.

Integration of Artificial Intelligence and Automation

There is a growing opportunity to integrate AI and machine learning into air traffic control systems, enabling real-time predictive analytics, optimized flight routing, and automated decision-making. This technology promises to reduce human error, increase efficiency, and enhance safety, thus driving the demand for next-gen automation solutions in ATC systems.

Future Outlook

Over the next five years, the Australian ATC equipment market is expected to see steady growth, fueled by continuous upgrades to air traffic management infrastructure. Advancements in technology, such as satellite-based navigation (GNSS), remote tower solutions, and automation systems, will drive demand across the market. Additionally, ongoing federal and state government initiatives to enhance air traffic safety, improve airspace management, and reduce congestion at major airports like Sydney, Melbourne, and Brisbane will provide substantial growth opportunities for both legacy equipment providers and emerging tech companies. The market is also likely to see new entrants offering next-generation systems focusing on efficiency and cost-effectiveness, especially in surveillance and communication technologies.

Major Players in the Market

- Thales Group

- Indra Sistemas

- Frequentis AG

- Raytheon Technologies

- Collins Aerospace

- Leonardo S.p.A.

- Saab AB

- L3Harris Technologies

- SITA

- Adacel Technologies

- Airbus Defence & Space

- BAE Systems plc

- Cobham Limited

- Lockheed Martin

- Ultra Electronics

Key Target Audience

- Air Traffic Control Service Providers

- Airport Authorities

- Military and Defense Agencies

- OEMs (Original Equipment Manufacturers)

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

- Air Navigation Service Providers

- System Integrators and Technology Contractors

Research Methodology

Step 1: Identification of Key Variables

This phase focuses on identifying all key stakeholders within the Australian ATC equipment ecosystem. The initial step involves gathering secondary data through industry databases, government reports, and previous market analyses. Primary interviews with air navigation service providers (ANSPs), OEMs, and airport authorities will be conducted to identify the major variables that influence market growth.

Step 2: Market Analysis and Construction

In this phase, we will compile and assess historical data from the Australian air traffic control equipment market, focusing on the adoption rates of new technologies, existing installations, and market penetration. We will evaluate the demand for upgrades, expansions, and integration of advanced systems into the existing ATC infrastructure.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through interviews with experts from both global and local ATC solution providers. These consultations will help refine our assumptions about market dynamics, technological advancements, and future trends in air traffic management.

Step 4: Research Synthesis and Final Output

The final phase will synthesize data collected from primary research and expert consultations to produce a comprehensive market analysis. This will include an evaluation of market segmentation, competitive landscape, and growth drivers, providing actionable insights for stakeholders in the Australian ATC equipment market.

- Executive Summary

- Research Methodology (Market Definitions & Scope Calibration, Market Sizing Methodology, Data Sources & Triangulation Logic, Assumptions & Limitations, Forecast Validation Protocol)

- Definition and Scope

- National Airspace Structure & Regulatory Environment

- Market Genesis & Evolution

- Supply Chain & Value Chain Analysis

- Technology Architecture & Standards

- Growth Drivers

Air Traffic Growth

Safety Mandates

Surveillance Mandates - Restraints

High CapEx

Skill Shortages

Legacy Compatibility - Opportunities

Remote Tower Deployments

UAV/UTM Integration

Cybersecure ATC - Trends

ADSB Mandates

IPcentric Comms

Satellite NAV

Data Analytics

- Market Value 2020-2025

- Volume Deployment 2020-2025

- ASP & Total Cost of Ownership Trends 2020-2025

- Public Sector CAPEX vs Private Sector Procurement 2020-2025

- Market by Equipment Category (In Value%)

Surveillance Systems

Communication Systems

Navigation Systems

Automation & ATC Software

Remote Tower & Digital Solutions - Market by Deployment Type (In Value%)

Greenfield (New Installations)

Brownfield (Modernization of Existing Systems)

Hybrid (Legacy to NextGen Transitions) - Market by EndUser (In Value%)

Civil ANSPs (Airservices Australia)

Military/Defense ATC

Airport Authorities (Remote Towers)

OEM Integrators & Systems Contractors - Market by Technology Tier (In Value%)

Ground-Based Radar Systems

Satellite & ADSB Based Surveillance

IP-based Communication Networks

AI/ML-Enabled Automation Solutions - Market by Implementation Model (In Value%)

CAPEX Purchase (Full System Acquisition)

OPEX as a Service (Managed ATC Systems)

Public-Private Infrastructure Partnership (PPP)

- Competitive Landscape Overview

- Cross Comparison Parameters (Company Portfolio Coverage, Australia Presence, Local Partnerships, Support Infrastructure, Certification Footprint, AfterSales & Training, Installed Asset Footprint, Innovation Scorecards)

- SWOT Analysis

- Pricing & Contract Benchmarking

- Competitors

Thales Group (France)

Indra Sistemas (Spain)

Frequentis AG (Austria)

Leonardo S.p.A. (Italy)

Saab AB (Sweden)

Collins Aerospace (USA)

Honeywell Aerospace (USA)

Raytheon / RTX (USA)

L3Harris Technologies (USA)

SITA ATC (Global)

Adacel Technologies (Australia)

Airbus Defence & Space

BAE Systems plc

Cobham Limited

Leidos Holdings, Inc.

- Civil Aviation Demand & Fleet Growth

- Military/Defense Radar & NAV Priorities

- Procurement Decision Criteria

- Budget Allocation & Funding Mechanisms

- Forecast by Value 2026-2035

- Forecast by Volume 2026-2035

- Future ASP & Cost Curves 2026-2035

- Forecast by Deployment Type 2026-2035

- Forecast by Aviation Segment 2026-2035