Market Overview

The Australia Airport Baggage Handling System market current size stands at around USD ~ million, supported by system deployments of ~ systems across major and regional aviation hubs. In the most recent assessment cycle, new installations reached ~ systems while refurbishment programs covered ~ systems, reflecting sustained infrastructure renewal. Capital flows into automation programs stood at USD ~ million, enabling upgrades in conveyor intelligence, screening integration, and digital monitoring layers that collectively strengthened operational resilience and throughput capacity across airports.

The market shows strongest concentration in metropolitan aviation clusters such as Sydney, Melbourne, and Brisbane, where high passenger throughput, complex terminal layouts, and multi-airline operations drive continuous modernization of baggage infrastructure. These cities benefit from mature systems integrator ecosystems, strong aviation safety compliance frameworks, and policy environments that favor automation-led efficiency. Secondary growth corridors are emerging around Perth and Adelaide, supported by cargo traffic expansion and regional connectivity initiatives that increase demand for scalable and modular baggage handling solutions.

Market Segmentation

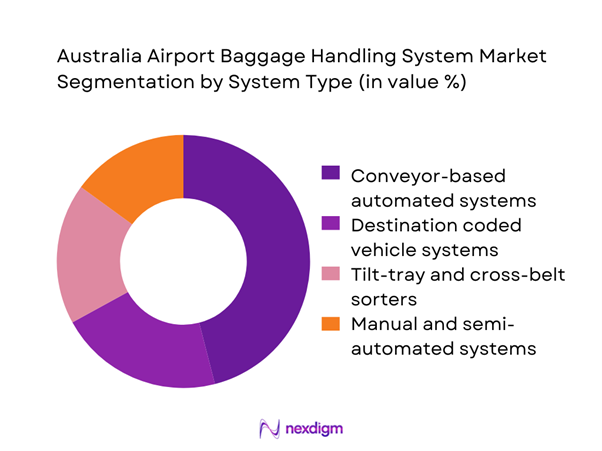

By System Type

Conveyor-based automated systems dominate the Australia Airport Baggage Handling System market due to their adaptability across both greenfield and brownfield airport projects. These systems align well with the operational realities of Australian airports, where phased upgrades are more common than complete terminal rebuilds. The dominance is reinforced by the availability of local service partners, lower lifecycle complexity, and compatibility with in-line screening requirements. High-speed sorters and destination coded vehicle solutions are gaining traction, yet adoption remains concentrated in large hubs where passenger volumes and transfer complexity justify higher automation depth and long-term efficiency gains.

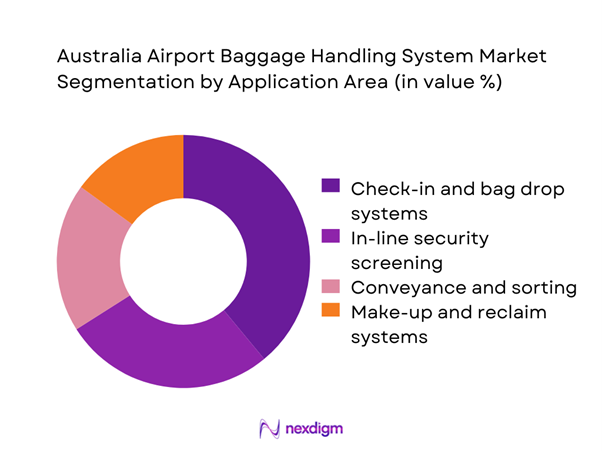

By Application Area

Check-in and bag drop automation represents the leading application area, driven by the need to reduce terminal congestion and improve passenger processing speed. Australian airports prioritize these systems to manage seasonal traffic peaks and labor constraints. In-line security screening integration follows closely, supported by regulatory emphasis on aviation safety and streamlined passenger journeys. Baggage reclaim and transfer systems continue to evolve, particularly in international hubs, but investment intensity remains highest at the front-end of the passenger experience where visible efficiency gains translate directly into service quality improvements.

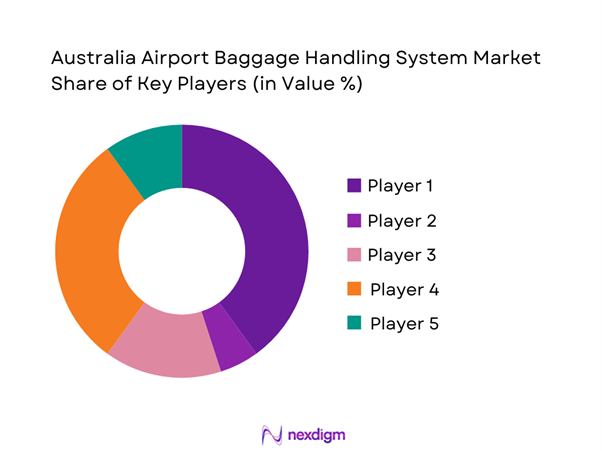

Competitive Landscape

The Australia Airport Baggage Handling System market reflects a moderately concentrated structure, led by a small group of global system integrators supported by specialized local engineering and service firms. Long project cycles, stringent aviation standards, and high system integration complexity create significant entry barriers, favoring established players with proven delivery records and strong after-sales capabilities.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Siemens Logistics | 1989 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Vanderlande Industries | 1949 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Daifuku Co., Ltd. | 1937 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| BEUMER Group | 1935 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Alstef Group | 1961 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Airport Baggage Handling System Market Analysis

Growth Drivers

Rising passenger traffic and airport capacity expansion

Passenger movements across Australian airports reached ~ passengers in the latest operational cycle, driving the need for baggage systems capable of processing ~ bags per peak hour in major terminals. Expansion programs covering ~ terminals and ~ gates created demand for new conveyor lines, sortation modules, and screening interfaces. Public and private airport operators allocated USD ~ million toward baggage infrastructure upgrades, ensuring capacity alignment with traffic recovery and long-term tourism growth. These investments accelerated adoption of modular systems that can scale alongside passenger growth without disrupting live operations.

Government investment in airport infrastructure modernization

Federal and state programs directed USD ~ million toward aviation infrastructure enhancement, including the modernization of baggage handling assets across ~ airports. These initiatives supported the replacement of aging mechanical components with digitally monitored systems across ~ terminals. As part of broader transport connectivity strategies, baggage system upgrades became a priority for improving reliability and safety compliance. The flow of structured funding enabled airports to undertake multi-year automation roadmaps, strengthening demand consistency for system integrators and service providers.

Challenges

High capital expenditure for system upgrades

Comprehensive baggage handling upgrades typically require USD ~ million per terminal, covering mechanical equipment, control software, and civil works across ~ processing zones. For mid-sized airports handling ~ passengers annually, these costs create budgetary strain and extend payback periods. The scale of upfront investment limits the pace of adoption for advanced technologies such as individual carrier systems and high-speed sorters. As a result, many operators opt for phased retrofits, which can dilute efficiency gains and prolong transition timelines.

Complexity of retrofitting in operational terminals

Retrofitting baggage systems in terminals processing ~ bags daily introduces significant logistical challenges. Installation windows are often limited to ~ hours per night, stretching project timelines across ~ months. Temporary routing solutions add operational risk and require additional labor resources of ~ technicians per shift. These constraints elevate implementation costs and increase the probability of schedule overruns, making airport authorities cautious about undertaking large-scale upgrades during peak traffic cycles.

Opportunities

Expansion of regional and secondary airports

Regional aviation programs supported the upgrade of ~ airports, creating demand for ~ new baggage systems tailored to lower throughput but higher reliability standards. Investments of USD ~ million in these locations favor compact, energy-efficient designs that reduce operating overhead. As regional tourism and fly-in fly-out workforce movements increase, these airports become strategic nodes for system suppliers seeking volume growth beyond saturated metropolitan hubs.

Deployment of RFID and real-time tracking solutions

Airports introducing RFID-enabled baggage handling reported tracking coverage across ~ bags annually, supported by infrastructure investments of USD ~ million. The deployment of ~ readers and ~ integration points enhances visibility across check-in, transfer, and reclaim stages. These systems reduce mishandling incidents and support data-driven process optimization, creating a strong value proposition for airlines and airport operators seeking measurable service quality improvements.

Future Outlook

The Australia Airport Baggage Handling System market is positioned for steady evolution as airports balance modernization needs with operational continuity. Over the next decade, automation depth is expected to increase across both international and regional facilities, supported by digital integration and sustainability-driven upgrades. Policy alignment around aviation safety and infrastructure resilience will continue to shape procurement priorities. As passenger expectations rise, system reliability and service responsiveness will remain central to competitive differentiation.

Major Players

- Siemens Logistics

- Vanderlande Industries

- Daifuku Co., Ltd.

- BEUMER Group

- Alstef Group

- SITA

- Fives Intralogistics

- Pteris Global

- Robson Handling Technology

- ULMA Handling Systems

- Leonardo S.p.A.

- Cassioli Group

- Grenzebach

- Logplan

- Dimark

Key Target Audience

- Airport authorities and infrastructure development units

- Airlines and ground handling service providers

- Investments and venture capital firms

- State transport departments and aviation infrastructure agencies

- Civil Aviation Safety Authority and airport security regulators

- System integrators and automation solution providers

- Engineering, procurement, and construction contractors

- Facility management and airport operations teams

Research Methodology

Step 1: Identification of Key Variables

Core variables included system deployment rates, refurbishment cycles, automation depth, and service contract penetration. Demand indicators were mapped across passenger throughput bands and airport typologies. Regulatory compliance requirements and technology adoption patterns were incorporated to define baseline market structure.

Step 2: Market Analysis and Construction

Historical installation activity and upgrade programs were consolidated to build market sizing models. Infrastructure spending flows and airport development pipelines were analyzed to project demand continuity. Segmentation logic was refined based on application criticality and system complexity.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were tested through structured consultations with airport operations specialists, system engineers, and aviation safety advisors. Feedback loops validated deployment timelines, retrofit constraints, and service lifecycle expectations across major and regional airports.

Step 4: Research Synthesis and Final Output

All insights were synthesized into an integrated market framework aligning demand drivers, challenges, and opportunity areas. Scenario logic ensured consistency across outlook narratives and strategic recommendations.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, airport baggage handling system taxonomy across sortation screening and early bag storage modules, market sizing logic by airport traffic and system capacity upgrades, revenue attribution across equipment sales software and maintenance services, primary interview program with airport operators system integrators and MRO providers, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Passenger and baggage flow pathways

- Airport automation ecosystem structure

- Supply chain and systems integration landscape

- Regulatory and aviation safety environment

- Growth Drivers

Rising passenger traffic and airport capacity expansion

Government investment in airport infrastructure modernization

Adoption of automated and contactless baggage processing

Stringent aviation security screening requirements

Airline demand for faster turnaround times

Focus on improving passenger experience and service quality - Challenges

High capital expenditure for system upgrades

Complexity of retrofitting in operational terminals

System downtime risks during peak travel seasons

Shortage of skilled automation and maintenance personnel

Integration challenges with legacy airport IT systems

Cybersecurity vulnerabilities in connected infrastructure - Opportunities

Expansion of regional and secondary airports

Deployment of RFID and real-time tracking solutions

Growth in airport privatization and PPP models

Demand for energy-efficient and low-noise systems

Aftermarket services and long-term maintenance contracts

Integration of AI-driven predictive maintenance platforms - Trends

Shift toward modular and scalable system designs

Increased use of self-service bag drop technologies

Adoption of digital twins for system planning

Greater focus on sustainability and carbon reduction

Rising use of data analytics for baggage flow optimization

Convergence of security screening and baggage handling - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Greenfield airport projects

Brownfield airport expansions

Terminal refurbishment programs

Cargo terminal systems

Remote and regional airport systems - By Application (in Value %)

Check-in and bag drop systems

In-line screening and security integration

Conveyance and sorting systems

Make-up and reclaim systems

Transfer and inter-terminal systems - By Technology Architecture (in Value %)

Conventional conveyor-based systems

High-speed tilt-tray sorters

Destination coded vehicle systems

Individual carrier systems

RFID-enabled tracking architectures - By End-Use Industry (in Value %)

International hub airports

Domestic airports

Low-cost carrier terminals

Charter and regional airports

Airport cargo operators - By Connectivity Type (in Value %)

Standalone systems

Integrated airport IT platforms

Cloud-connected monitoring systems

IoT-enabled predictive maintenance systems

Cyber-secured aviation networks - By Region (in Value %)

New South Wales

Victoria

Queensland

Western Australia

South Australia and Northern Territory

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (system reliability, lifecycle cost, automation level, energy efficiency, integration capability, local service presence, project execution record, cybersecurity readiness)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Siemens Logistics

Vanderlande Industries

Daifuku Co., Ltd.

BEUMER Group

Alstef Group

SITA

Fives Intralogistics

Pteris Global

Robson Handling Technology

ULMA Handling Systems

Leonardo S.p.A.

Vanderlande Australia

Cassioli Group

Logplan

Grenzebach

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035