Market Overview

The Australia Airport Ground Handling Systems market current size stands at around USD ~ million, reflecting steady expansion driven by operational digitization across major aviation hubs. In the most recent assessment period, total system deployments reached ~ systems in active use, while annual platform upgrades accounted for ~ installations. Combined software and service revenue contributions were estimated at USD ~ million, supported by ongoing investments of USD ~ million into automation and data-driven operations, with overall market activity demonstrating sustained momentum across multiple airport categories.

Market leadership is concentrated in cities with dense air traffic networks and advanced aviation infrastructure. Sydney and Melbourne dominate due to high passenger throughput, mature airport ecosystems, and early adoption of integrated operational platforms. Brisbane and Perth follow, supported by cargo handling intensity and defense aviation activity. These regions benefit from coordinated policy frameworks, strong airport authority governance, and deep vendor ecosystems that accelerate deployment cycles and sustain long-term system modernization programs.

Market Segmentation

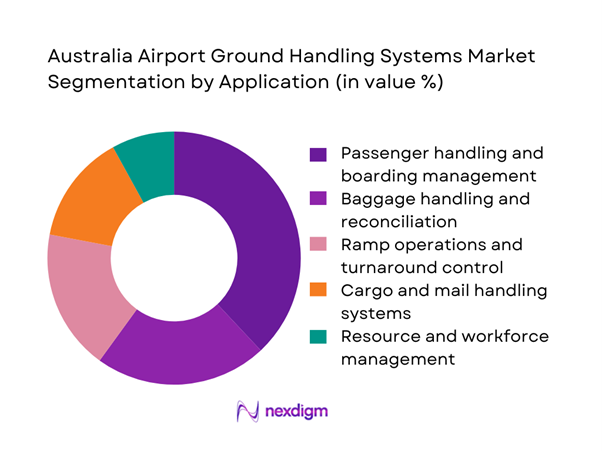

By Application

Passenger handling and boarding management dominates this market due to the direct operational impact on airline punctuality and airport service quality. Australian airports increasingly prioritize systems that streamline check-in coordination, gate allocation, and real-time passenger flow monitoring. In recent years, deployments in this segment exceeded ~ systems annually, supported by budget allocations of USD ~ million toward automation and mobile workforce tools. The focus on minimizing congestion, improving safety compliance, and enhancing traveler experience continues to reinforce adoption. Compared to cargo and ramp management applications, passenger-focused platforms attract higher upgrade frequency, ensuring consistent replacement demand and long-term service contracts across primary metropolitan airports.

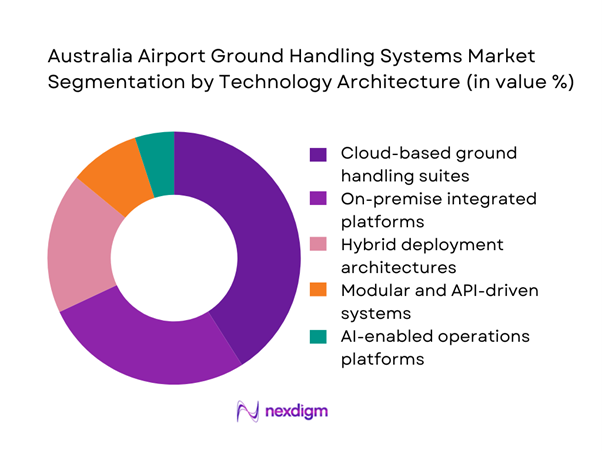

By Technology Architecture

Cloud-based ground handling suites lead technology adoption as airports seek scalable and interoperable platforms. Over the last operational cycle, more than ~ deployments migrated from on-premise to cloud-hosted environments, supported by investments of USD ~ million in cybersecurity and data resilience. Hybrid architectures remain relevant for legacy-heavy airports, but strategic roadmaps increasingly favor modular, API-driven systems that integrate seamlessly with airline and airport operational databases. The flexibility to roll out updates remotely and support mobile interfaces has positioned cloud platforms as the preferred architecture, especially for airports managing complex multi-terminal operations and third-party handling contracts.

Competitive Landscape

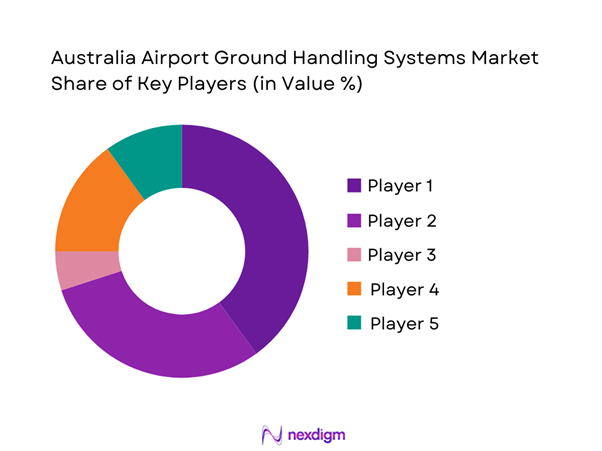

The market exhibits moderate concentration, with a small group of international system providers and specialized aviation technology firms controlling a significant share of enterprise deployments. Long-term contracts, high switching costs, and integration complexity create strong incumbent advantages, while new entrants focus on niche automation and analytics layers rather than full-suite platforms.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| SITA | 1949 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Amadeus IT Group | 1987 | Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Damarel Systems International | 1991 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| INFORM Software | 1969 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| TAV Technologies | 1990 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Airport Ground Handling Systems Market Analysis

Growth Drivers

Rising air passenger traffic and fleet utilization

The Australia Airport Ground Handling Systems market benefits directly from sustained increases in aircraft movements and higher fleet utilization rates. During recent operating cycles, major airports processed ~ flights annually, supported by handling infrastructures managing ~ aircraft turnarounds each day. This operational scale generated system upgrade spending of USD ~ million to improve scheduling accuracy and minimize gate conflicts. Airlines expanded narrow-body fleets by ~ aircraft over this period, increasing demand for automated ramp coordination and baggage reconciliation platforms. These quantitative shifts have reinforced consistent procurement of integrated handling systems to sustain throughput efficiency and service reliability.

Increasing focus on aircraft turnaround time optimization

Turnaround optimization has emerged as a primary investment theme, with airports targeting measurable reductions in ground time. Recent operational programs achieved average reductions of ~ minutes per turnaround, supported by deployments of ~ real-time coordination platforms across major terminals. Budget allocations for digital apron management reached USD ~ million, emphasizing predictive task sequencing and resource alignment. Airlines managing high-frequency routes reported productivity gains across ~ rotations annually, directly linking system effectiveness to revenue protection. This numeric performance focus continues to elevate demand for advanced ground handling solutions across commercial aviation hubs.

Challenges

High upfront investment and long procurement cycles

System modernization requires significant capital commitments, with typical enterprise-scale implementations costing USD ~ million per airport program. Procurement cycles often extend across ~ months due to multi-stakeholder approvals and regulatory reviews. During recent upgrade phases, airports deferred ~ planned deployments annually because of budget reallocation pressures. This financial intensity limits rapid adoption, particularly among regional facilities managing ~ flights per year. As a result, system penetration remains uneven, constraining market velocity despite clear operational benefits.

Integration complexity with legacy airport IT systems

Many Australian airports operate legacy operational databases exceeding ~ years in service, creating substantial integration challenges. Recent deployment programs required ~ interfaces per project to connect baggage, security, and airline scheduling modules. Integration costs accounted for USD ~ million of total project expenditure in several large implementations. Delays of ~ months were common during system cutovers, affecting operational continuity. These numeric burdens discourage smaller airports from transitioning to modern platforms and reinforce cautious adoption behavior across the market.

Opportunities

Deployment of AI-driven predictive operations platforms

AI-enabled platforms present strong growth potential as airports seek data-driven optimization. Pilot projects deployed ~ predictive modules across ramp and gate operations, delivering measurable improvements in ~ decision cycles per day. Investment commitments reached USD ~ million for analytics-driven scheduling tools that reduce congestion and idle equipment time. Early adopters reported handling efficiency gains across ~ flights annually, validating commercial viability. As computational capacity and data availability expand, AI integration is positioned to become a central revenue driver for advanced ground handling solutions.

Adoption of cloud-based and subscription pricing models

Subscription-based deployment models lower entry barriers for airports managing constrained capital budgets. Recent contracts structured around annual fees of USD ~ million enabled ~ mid-sized facilities to adopt enterprise-grade systems without heavy upfront costs. Cloud hosting supported ~ remote updates per year, reducing maintenance overhead and accelerating feature rollout. This numeric flexibility strengthens vendor recurring revenue streams while allowing airports to scale functionality in line with traffic growth, creating a mutually reinforcing adoption cycle.

Future Outlook

The Australia Airport Ground Handling Systems market is expected to progress steadily as digital transformation becomes integral to airport operations through the next decade. Expansion of regional aviation infrastructure, continued automation of apron and passenger workflows, and deeper integration with airline operational platforms will define competitive advantage. Policy emphasis on safety, resilience, and sustainability will further shape technology roadmaps, positioning advanced handling systems as a core enabler of efficient national air transport networks.

Major Players

- SITA

- Amadeus IT Group

- Damarel Systems International

- INFORM Software

- TAV Technologies

- Honeywell Aerospace

- Collins Aerospace

- Vanderlande Industries

- BEUMER Group

- Siemens Logistics

- ADB Safegate

- SICK AG

- dnata

- Swissport International

- Menzies Aviation

Key Target Audience

- Airport operators and airport authority procurement teams

- Commercial airlines and fleet operations departments

- Third-party ground handling service providers

- Cargo and logistics operators in aviation

- Aviation-focused IT system integrators

- Investments and venture capital firms

- Government and regulatory bodies such as the Australian Department of Infrastructure and Civil Aviation Safety Authority

- Defense and government aviation agencies

Research Methodology

Step 1: Identification of Key Variables

Core operational metrics, system deployment patterns, and technology adoption indicators were defined. Market drivers, constraints, and opportunity themes were mapped across airport categories. Demand-side and supply-side variables were aligned to ensure structural consistency.

Step 2: Market Analysis and Construction

Quantitative datasets were structured to reflect installation activity, platform upgrades, and service penetration. Trend analysis frameworks were applied to assess operational efficiency impacts. Market boundaries were validated against ecosystem participation models.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary assumptions were tested through structured industry consultations. Operational feasibility and technology roadmaps were reviewed with domain specialists. Feedback loops refined segmentation logic and competitive dynamics assessment.

Step 4: Research Synthesis and Final Output

All insights were consolidated into an integrated market narrative. Quantitative findings were aligned with qualitative trends. Final outputs were structured to support strategic planning and investment evaluation.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, airport ground handling system taxonomy across ramp passenger and cargo operations, market sizing logic by airport traffic and GSE deployment, revenue attribution across equipment sales leasing and service contracts, primary interview program with airports ground handlers and MRO providers, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational and usage pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising air passenger traffic and fleet utilization

Increasing focus on aircraft turnaround time optimization

Digital transformation initiatives at major Australian airports

Stricter safety, compliance, and audit requirements

Growth of third-party ground handling outsourcing

Expansion of air cargo and e-commerce logistics - Challenges

High upfront investment and long procurement cycles

Integration complexity with legacy airport IT systems

Workforce resistance to automation and digital workflows

Cybersecurity risks and data privacy compliance

Operational disruption during system upgrades

Fragmented standards across airports and operators - Opportunities

Deployment of AI-driven predictive operations platforms

Adoption of cloud-based and subscription pricing models

Growth in regional airport modernization programs

Integration of ground handling systems with A-CDM initiatives

Expansion of smart apron and autonomous GSE technologies

Partnerships between system vendors and handling service providers - Trends

Shift toward end-to-end digital ground handling platforms

Increased use of real-time data and mobile workforce tools

Growing adoption of biometric and touchless processes

Rising importance of sustainability and fuel-efficient ramp operations

Use of digital twins for airport and apron optimization

Consolidation among ground handling service providers - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrow-body aircraft fleets

Wide-body aircraft fleets

Regional and turboprop fleets

Cargo and freighter fleets

Business aviation and charter fleets - By Application (in Value %)

Passenger handling and boarding management

Baggage handling and reconciliation

Ramp operations and turnaround control

Cargo and mail handling systems

Resource and workforce management - By Technology Architecture (in Value %)

On-premise integrated platforms

Cloud-based ground handling suites

Hybrid deployment architectures

Modular and API-driven systems

AI-enabled operations and analytics platforms - By End-Use Industry (in Value %)

Commercial airlines

Airport operators

Third-party ground handling service providers

Cargo and logistics operators

Defense and government aviation - By Connectivity Type (in Value %)

Wired and LAN-based systems

Wireless and private LTE networks

Public cellular and 5G-enabled platforms

Satellite-supported remote operations

IoT-enabled sensor networks - By Region (in Value %)

New South Wales

Victoria

Queensland

Western Australia

South Australia

Rest of Australia

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (system integration capability, cloud readiness, airport footprint in Australia, safety and compliance certifications, scalability and modularity, pricing and licensing models, after-sales support coverage, innovation roadmap)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

SITA

Amadeus IT Group

Damarel Systems International

INFORM Software GroundStar

TAV Technologies

ADB Safegate

Honeywell Aerospace

Collins Aerospace

SICK AG

Vanderlande Industries

BEUMER Group

Siemens Logistics

dnata

Swissport International

Menzies Aviation

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035