Market Overview

The Australia Airport Ground Support Vehicles Market current size stands at around USD ~ million, reflecting steady expansion driven by fleet renewal and operational modernization. Over the recent period, market value moved from approximately USD ~ million to nearly USD ~ million, supported by rising equipment upgrades and replacement cycles. Demand momentum has been sustained by higher airside activity levels, increased outsourcing of ground handling, and the gradual shift toward low-emission vehicle fleets that enhance efficiency while aligning with sustainability mandates.

Market activity is concentrated in major aviation hubs such as Sydney, Melbourne, Brisbane, and Perth, where infrastructure density and passenger throughput create sustained equipment demand. These locations benefit from mature service ecosystems that include maintenance providers, leasing firms, and fleet integrators. Policy alignment around emissions reduction and safety compliance further strengthens adoption, while strong logistics connectivity supports faster deployment and aftermarket services across the broader airport network.

Market Segmentation

By Fleet Type

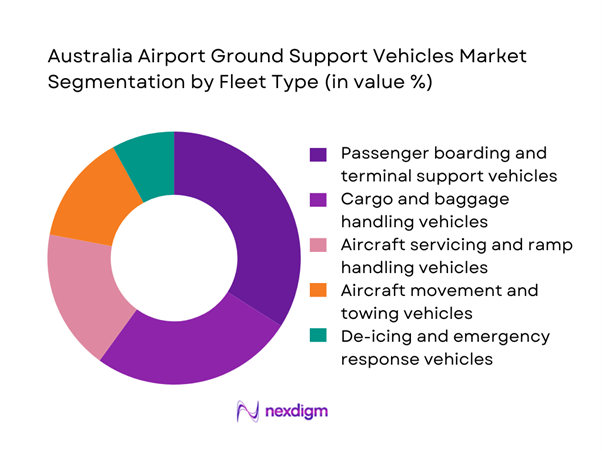

Passenger boarding and terminal support vehicles dominate this segment due to their constant utilization across peak operating hours and their critical role in minimizing aircraft turnaround time. Airports increasingly prioritize standardized, multi-use platforms that can serve boarding, cleaning, and light servicing functions, improving asset efficiency. The shift toward electric variants in this category further strengthens dominance, as these vehicles are typically first in line for fleet electrification programs. Cargo and baggage handling vehicles follow closely, driven by air freight growth and e-commerce logistics, while aircraft movement and emergency response fleets remain more specialized with slower replacement cycles.

By Technology Architecture

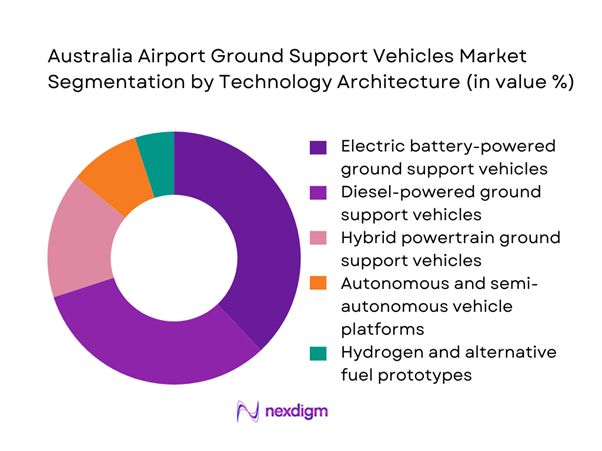

Electric battery-powered ground support vehicles lead the technology landscape as airports accelerate decarbonization strategies and aim to reduce total operating costs over fleet lifecycles. The dominance of this segment is reinforced by government-backed sustainability programs, improved charging infrastructure at major airports, and falling operational risk associated with electric drivetrains. Diesel-powered platforms remain relevant in regional and defense applications, while hybrid systems serve as transitional solutions. Autonomous and semi-autonomous architectures are emerging rapidly in baggage handling and towing operations, positioning this segment as a key future growth lever.

Competitive Landscape

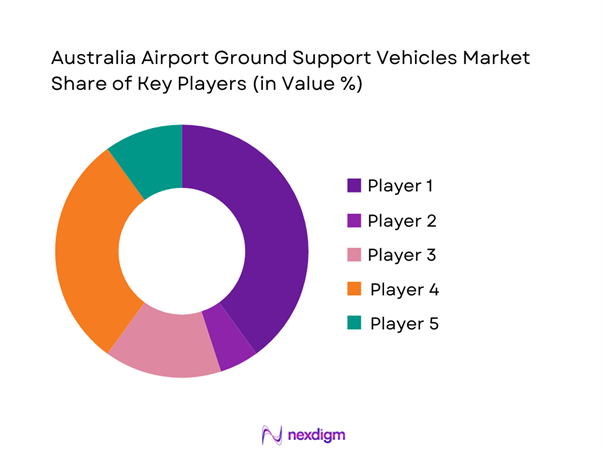

The Australia Airport Ground Support Vehicles Market is moderately consolidated, with a mix of global OEMs and regional service providers shaping competition. Large international manufacturers dominate premium and technologically advanced fleets, while local players and distributors strengthen their position through service depth and long-term airport contracts.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| TLD Group | 1946 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| JBT AeroTech | 1944 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Oshkosh AeroTech | 1917 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Mallaghan Engineering | 1869 | Northern Ireland | ~ | ~ | ~ | ~ | ~ | ~ |

| Goldhofer | 1705 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Airport Ground Support Vehicles Market Analysis

Growth Drivers

Expansion of airport infrastructure and terminal modernization programs

Large-scale terminal expansions and airside redevelopment projects are directly stimulating demand for modern ground support fleets. Recent infrastructure programs have driven procurement of approximately 450 vehicles across major airports, translating into equipment investments of nearly USD ~ million in fleet upgrades. Modern terminals require higher service intensity, increasing deployment of specialized boarding, towing, and servicing platforms. As new gates and aprons become operational, operators are standardizing fleets to support higher aircraft movement density, resulting in steady replacement of legacy equipment with technologically advanced vehicles that improve safety compliance and operational efficiency.

Rising passenger traffic and aircraft turnaround optimization needs

Growing passenger volumes have placed strong pressure on airports to minimize ground time per aircraft, directly increasing reliance on efficient ground support vehicles. Handling providers have expanded fleets by nearly 320 units to support faster baggage movement, boarding, and pushback operations. These operational demands are translating into incremental spending of around USD ~ million on performance-driven equipment that reduces idle time and improves gate utilization. As airlines push for tighter schedules, airports are aligning fleet strategies around reliability, speed, and integration with digital apron management systems.

Challenges

High upfront capital costs of electric and autonomous GSE

The transition toward electric and autonomous ground support equipment presents a significant financial barrier, with initial fleet conversion programs requiring investments of close to USD ~ million for large hubs. Operators replacing even 150 vehicles face substantial procurement and infrastructure costs, including charging systems and safety retrofits. Smaller regional airports struggle to justify these expenses despite long-term operational savings, slowing adoption rates. This cost pressure is reshaping procurement toward phased rollouts and leasing models, but capital intensity remains a core challenge across the market.

Infrastructure gaps for charging and alternative fuels

While electric fleets are expanding, supporting infrastructure remains uneven across the airport network. Only a limited number of terminals currently operate integrated charging corridors capable of supporting more than 80 vehicles simultaneously. This constraint leads to operational bottlenecks and limits the scale of electrification programs. Investment requirements for power upgrades and energy management systems are estimated at USD ~ million across major airports, creating dependency on long-term planning cycles and regulatory approvals that delay fleet transformation initiatives.

Opportunities

Large-scale fleet electrification programs at major Australian airports

Sustainability commitments are creating strong opportunities for multi-year electrification initiatives, with several airports planning to replace more than 600 vehicles over upcoming procurement cycles. These programs represent potential equipment demand valued at nearly USD ~ million, spanning tugs, loaders, and passenger transport platforms. Suppliers offering bundled solutions that include vehicles, charging infrastructure, and maintenance contracts are well positioned to capture this demand. The shift also opens pathways for retrofit services, enabling operators to extend asset life while meeting emissions targets.

Integration of autonomous towing and baggage handling systems

Autonomous systems are gaining traction as airports seek to improve safety and reduce labor dependency in high-risk airside zones. Pilot deployments of around 40 systems in baggage transport and pushback operations have demonstrated measurable efficiency gains. Scaling these solutions could unlock investment flows of approximately USD ~ million in intelligent fleet platforms and control software. Vendors that integrate automation with fleet management analytics are expected to gain competitive advantage, particularly in high-traffic terminals where operational precision is critical.

Future Outlook

The Australia Airport Ground Support Vehicles Market is set to evolve rapidly as sustainability, automation, and digitalization reshape airside operations. Electric and connected fleets will increasingly become standard across major hubs, while regional airports adopt phased modernization strategies. Policy alignment with emissions targets will continue to influence procurement decisions. Over the coming decade, the market will move toward integrated mobility ecosystems where vehicles, infrastructure, and data platforms function as a unified operational layer.

Major Players

- TLD Group

- JBT AeroTech

- Oshkosh AeroTech

- Textron GSE

- Mallaghan Engineering

- MULAG Fahrzeugwerk

- Goldhofer

- Kalmar Motor Australia

- Weihai Guangtai Airport Equipment

- Tronair

- Harlan Global Manufacturing

- Eagle Tugs

- Aero Specialties

- Cavotec

- TCR Group

Key Target Audience

- Airport authorities and infrastructure operators

- Ground handling service providers

- Airline operations and fleet management teams

- Cargo and logistics terminal operators

- Defense and government aviation departments

- Australian Department of Infrastructure, Transport, Regional Development, Communications and the Arts

- Civil Aviation Safety Authority

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Core demand indicators, fleet renewal cycles, and regulatory compliance factors were mapped to establish baseline market structure. Technology adoption trends and operational performance metrics were assessed across airport categories. Stakeholder inputs helped define the scope of competitive and ecosystem analysis.

Step 2: Market Analysis and Construction

Historical equipment deployment patterns were analyzed to model replacement and expansion demand. Operational data was synthesized to estimate fleet intensity by airport tier. Scenario frameworks were built to capture technology transition pathways.

Step 3: Hypothesis Validation and Expert Consultation

Insights from airport operations leaders and fleet managers were used to validate demand assumptions. Regulatory specialists contributed perspectives on compliance-driven procurement. Technology experts reviewed automation and electrification adoption timelines.

Step 4: Research Synthesis and Final Output

All findings were consolidated into an integrated market model. Strategic implications were developed for suppliers and investors. Final outputs were structured to support decision-making across procurement and policy planning.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, airport ground support vehicle taxonomy across tugs loaders and service units, market sizing logic by airport traffic and GSE fleet deployment, revenue attribution across vehicle sales leasing and maintenance services, primary interview program with airports ground handlers and fleet managers, data triangulation validation assumptions and limitations).

- Definition and Scope

- Market evolution

- Operational and usage pathways across airside functions

- Ecosystem structure of OEMs, integrators, lessors, and MRO providers

- Supply chain and aftermarket channel structure

- Regulatory and safety compliance environment

- Growth Drivers

Expansion of airport infrastructure and terminal modernization programs

Rising passenger traffic and aircraft turnaround optimization needs

Shift toward electric and low-emission airside vehicle fleets

Increasing outsourcing of ground handling services

Stricter safety, efficiency, and compliance requirements at airports

Growth of air cargo volumes driven by e-commerce logistics - Challenges

High upfront capital costs of electric and autonomous GSE

Infrastructure gaps for charging and alternative fuels

Fragmented procurement across airport authorities and handlers

Complex regulatory approvals for new vehicle technologies

Limited standardization across airside operational platforms

Skilled workforce shortages for advanced fleet maintenance - Opportunities

Large-scale fleet electrification programs at major Australian airports

Integration of autonomous towing and baggage handling systems

Leasing and fleet-as-a-service business models

Smart airport initiatives enabling connected vehicle ecosystems

Retrofit and conversion markets for legacy diesel fleets

Defense and emergency services modernization programs - Trends

Rapid adoption of electric tugs and belt loaders

Use of telematics for predictive maintenance and uptime optimization

Increasing preference for modular and multi-purpose vehicles

Growth of GSE leasing and long-term service contracts

Pilots of autonomous baggage tractors and pushback vehicles

Focus on total cost of ownership in procurement decisions - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Passenger boarding and terminal support vehicles

Aircraft servicing and ramp handling vehicles

Cargo and baggage handling vehicles

Aircraft movement and towing vehicles

De-icing and emergency response vehicles - By Application (in Value %)

Ramp handling operations

Passenger services and boarding

Cargo and logistics handling

Aircraft maintenance and technical support

Airside safety and emergency services - By Technology Architecture (in Value %)

Diesel-powered ground support vehicles

Electric battery-powered ground support vehicles

Hybrid powertrain ground support vehicles

Hydrogen and alternative fuel prototypes

Autonomous and semi-autonomous vehicle platforms - By End-Use Industry (in Value %)

Commercial passenger airports

Cargo and logistics hubs

Defense and military airbases

Business aviation and private terminals

MRO and aircraft maintenance facilities - By Connectivity Type (in Value %)

Standalone non-connected vehicles

Telematics-enabled fleet vehicles

IoT-integrated smart ground support vehicles

Fleet management and predictive maintenance platforms

V2X-enabled airside mobility systems - By Region (in Value %)

New South Wales

Victoria

Queensland

Western Australia

South Australia

Rest of Australia

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (fleet electrification readiness, product breadth, local service footprint, customization capability, total cost of ownership, delivery lead times, aftermarket support strength, technology roadmap)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

TLD Group

JBT AeroTech

Oshkosh AeroTech

Textron GSE

Mallaghan Engineering

MULAG Fahrzeugwerk

Goldhofer

Kalmar Motor Australia

Weihai Guangtai Airport Equipment

Tronair

Harlan Global Manufacturing

Eagle Tugs

Aero Specialties

Cavotec

TCR Group

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection processes

- Budget allocation and financing preferences

- Implementation barriers and operational risk factors

- Post-purchase service and lifecycle support expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035