Market Overview

The Australia Airport Information System Market market current size stands at around USD ~ million, reflecting sustained modernization spending across major aviation hubs and regional gateways. Recent deployment activity has reached ~ systems annually, driven by terminal upgrades, airside optimization, and growing reliance on integrated operational databases. Investment momentum has been reinforced by digital transformation programs supporting passenger processing, resource planning, and disruption management, with technology refresh cycles accelerating across public and privately operated aviation facilities nationwide.

Dominance in this market is concentrated across metropolitan aviation clusters led by Sydney, Melbourne, and Brisbane, where infrastructure scale and traffic density create higher technology adoption intensity. These locations benefit from mature aviation ecosystems, stronger vendor presence, and policy environments supportive of smart transport infrastructure. Regional growth is supported by networked airport authorities and defense-linked facilities, where standardized platforms and centralized data governance frameworks are strengthening the role of information systems in safety, efficiency, and service reliability.

Market Segmentation

By Application

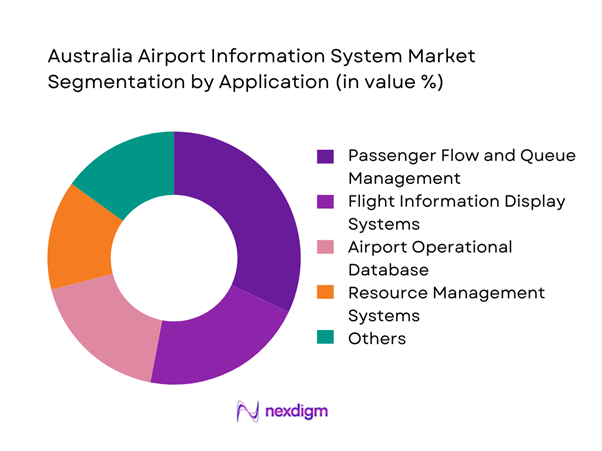

Passenger Flow and Queue Management leads adoption due to its direct impact on service efficiency, security coordination, and terminal capacity utilization. Australian airports increasingly prioritize real-time passenger movement visibility to address congestion during peak travel windows. The segment benefits from integration with biometric processing, automated border control, and digital wayfinding systems. With higher passenger throughput concentrated in urban gateways, this application captures sustained procurement focus from airport operators seeking to enhance traveler experience and operational predictability. Continued emphasis on contactless processing and data-driven staffing optimization further reinforces dominance across both domestic and international terminals.

By Technology Architecture

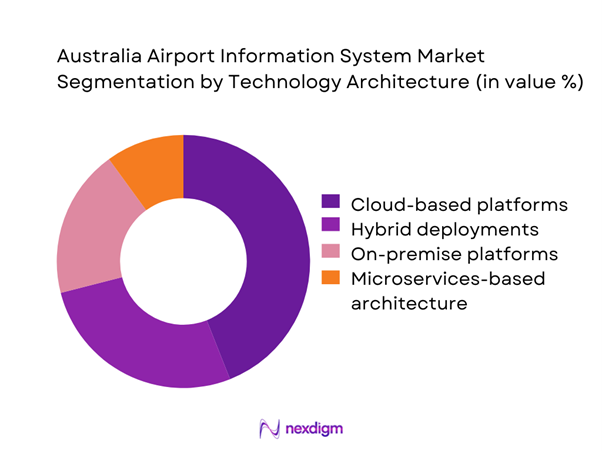

Cloud-based platforms dominate technology architecture due to scalability, lower maintenance burden, and alignment with national digital infrastructure strategies. Airport authorities increasingly favor centralized data environments that support multi-terminal coordination and remote system management. Cloud deployment also enables faster upgrades and easier integration with third-party aviation services, including airline systems and security platforms. This architecture benefits regional airports by reducing dependence on local IT resources while improving resilience and cybersecurity compliance. As more airports adopt software-as-a-service procurement models, cloud-native solutions continue to gain preference over traditional on-premise deployments.

Competitive Landscape

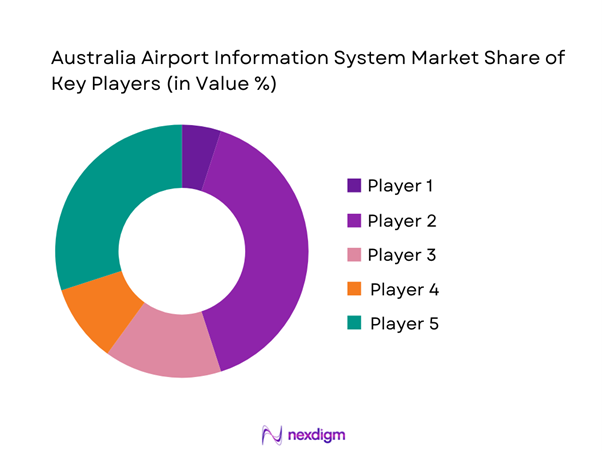

The Australia Airport Information System Market shows moderate concentration, with a small group of international aviation technology providers holding strong positions across major airports, while specialized vendors serve regional and defense-linked facilities. Long procurement cycles and high integration requirements create entry barriers, reinforcing incumbent advantage and favoring firms with established airport transformation track records.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| SITA | 1949 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Amadeus IT Group | 1987 | Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Indra Sistemas | 1993 | Spain | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Airport Information System Market Analysis

Growth Drivers

Rising passenger traffic and terminal capacity expansion across major Australian hubs

Passenger volumes processed through key gateways have increased to ~ travelers annually, driving deployment of ~ systems to manage real-time operations and service flow. Terminal expansions across metropolitan aviation clusters have required integrated databases to coordinate gates, stands, and baggage handling resources. Over the last two operating cycles, airport authorities have allocated USD ~ million toward digital platforms that improve throughput predictability and minimize disruption impacts. This expansion in physical capacity is closely aligned with technology upgrades, reinforcing demand for scalable information systems across both landside and airside functions.

Government-led airport modernization and digital transformation programs

Public infrastructure programs have directed USD ~ million into aviation digitization initiatives, enabling the rollout of centralized operational platforms across multiple airport networks. These programs support deployment of ~ systems that standardize data governance, safety reporting, and emergency response coordination. Federal and state agencies have prioritized technology upgrades as part of broader smart transport agendas, accelerating procurement cycles for airport information systems. The scale of government-backed modernization has increased system penetration in secondary airports, expanding the addressable market beyond traditional metropolitan hubs.

Challenges

High upfront investment and long procurement cycles for airport IT systems

Initial deployment costs often exceed USD ~ million for large facilities, creating budgetary pressure on airport operators and extending approval timelines. Multi-year tendering processes delay system rollouts, limiting the pace of technology refresh across terminals and airfields. Smaller operators face additional constraints due to limited capital reserves, restricting deployment volumes to ~ systems annually. These financial and procedural barriers slow market expansion, particularly in regional aviation clusters where digital transformation priorities compete with essential infrastructure spending.

Complex integration with legacy infrastructure and third-party platforms

Many airports operate on legacy operational databases and proprietary airline systems that complicate integration with modern platforms. Upgrading requires synchronization across ~ systems, increasing implementation risk and extending project timelines. Integration complexity drives additional spending of USD ~ million on customization and middleware solutions, elevating total ownership costs. These challenges reduce procurement confidence among airport authorities, particularly when multi-stakeholder coordination is required across airlines, security agencies, and ground service providers.

Opportunities

Expansion of smart airport initiatives and biometric-enabled passenger processing

National aviation strategies are promoting biometric corridors and automated border control, creating opportunities for deploying ~ systems that integrate identity management with operational databases. Investment pipelines for smart terminals have reached USD ~ million, supporting new use cases in passenger flow analytics and predictive staffing. As adoption scales across international and domestic terminals, airport information systems become the backbone for data orchestration, positioning vendors to expand service scope beyond traditional flight information displays.

Rising demand for AI-driven predictive operations and resource optimization

Airport operators are increasingly adopting AI tools to forecast congestion, equipment utilization, and irregular operations. This trend supports deployment of ~ systems equipped with advanced analytics engines that process operational datasets in real time. Spending on AI-enabled airport platforms has approached USD ~ million, reflecting growing confidence in technology-led efficiency gains. These capabilities open new revenue streams for solution providers offering performance optimization modules integrated within core information systems.

Future Outlook

The Australia Airport Information System Market is expected to advance steadily through the next decade as airports align operational technology with national digital infrastructure agendas. Continued investment in smart mobility, cybersecurity frameworks, and passenger experience platforms will strengthen system adoption across metropolitan and regional facilities. Integration of artificial intelligence and cloud-native architectures is set to redefine how airport authorities manage capacity, safety, and service quality in an increasingly data-driven aviation environment.

Major Players

- SITA

- Amadeus IT Group

- Thales Group

- Collins Aerospace

- Indra Sistemas

- Siemens Logistics

- NEC Australia

- Honeywell Aerospace

- Damarel Systems

- Veovo

- INFORM GmbH

- IER Blue Solutions

- Materna IPS

- TAV Technologies

- T Systems International

Key Target Audience

- Airport authorities and airport operator groups

- Airlines and ground handling service providers

- Aviation IT system integrators and solution providers

- Government and regulatory bodies such as the Department of Infrastructure, Transport, Regional Development, Communications and the Arts

- Civil aviation safety and security agencies including the Civil Aviation Safety Authority

- Smart infrastructure project developers

- Investments and venture capital firms focused on transport technology

- Public-private partnership consortiums in airport modernization

Research Methodology

Step 1: Identification of Key Variables

Core demand drivers, deployment trends, and technology adoption patterns were mapped across major and regional aviation hubs. Regulatory frameworks and infrastructure investment priorities were assessed to determine their influence on system procurement. Key operational metrics shaping airport digital strategies were shortlisted to guide subsequent analysis.

Step 2: Market Analysis and Construction

Segment-level evaluation was conducted to structure the market by application and technology architecture. Historical deployment activity and spending patterns were synthesized to construct baseline market estimates. Competitive positioning and solution differentiation were analyzed to understand supplier influence on adoption dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Initial findings were validated through consultations with airport operations managers, aviation IT specialists, and policy stakeholders. Feedback was used to refine assumptions related to technology uptake and procurement timelines. Scenario testing helped stress-check growth pathways under different infrastructure investment environments.

Step 4: Research Synthesis and Final Output

All insights were consolidated into a unified analytical framework, ensuring consistency across segmentation, competitive assessment, and outlook projections. Data points were harmonized across sections to support coherent market narratives. The final output was structured to provide decision-ready intelligence for stakeholders.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, airport information system taxonomy across AODB FIDS and A-CDM platforms, market sizing logic by airport count and system deployment scale, revenue attribution across software licenses integration and support services, primary interview program with airport operators IT teams and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Care or usage pathways

- Ecosystem structure

- Supply chain or channel structure

- Regulatory environment

- Growth Drivers

Rising passenger traffic and terminal capacity expansion across major Australian hubs

Government-led airport modernization and digital transformation programs

Growing need for real-time operational visibility and disruption management

Increasing adoption of cloud-based and modular airport IT platforms

Heightened focus on passenger experience and service quality metrics

Strengthening cybersecurity and data governance requirements - Challenges

High upfront investment and long procurement cycles for airport IT systems

Complex integration with legacy infrastructure and third-party platforms

Skills shortage in airport IT operations and system maintenance

Cybersecurity risks and compliance burden under evolving data protection laws

Budget constraints at regional and smaller airports

Vendor lock-in concerns and limited interoperability standards - Opportunities

Expansion of smart airport initiatives and biometric-enabled passenger processing

Rising demand for AI-driven predictive operations and resource optimization

Growth in regional airport upgrades driven by tourism and domestic travel

Adoption of Software-as-a-Service models reducing total cost of ownership

Public-private partnerships in airport digital infrastructure projects

Integration of sustainability and energy management data into airport systems - Trends

Shift from monolithic systems to modular, API-driven platforms

Increasing deployment of cloud-native AODB and RMS solutions

Use of digital twins for terminal and airside operations planning

Convergence of airport information systems with airport security platforms

Growing emphasis on data analytics for passenger journey optimization

Standardization of system interfaces aligned with global aviation IT norms - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Single airport operators

Airport group operators

Regional airport networks

Defense and government-owned airfields - By Application (in Value %)

Flight Information Display Systems

Airport Operational Database

Resource Management Systems

Passenger Flow and Queue Management

Baggage Handling System Integration

Crisis and Irregular Operations Management - By Technology Architecture (in Value %)

On-premise platforms

Cloud-based platforms

Hybrid deployments

Microservices-based architecture - By End-Use Industry (in Value %)

Commercial passenger airports

Cargo and logistics airports

Defense and military airbases

Private and charter aviation hubs - By Connectivity Type (in Value %)

Wired IP networks

Wireless LAN and private LTE

5G-enabled connectivity

Satellite-based communication links - By Region (in Value %)

New South Wales

Victoria

Queensland

Western Australia

South Australia

Rest of Australia

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (deployment scale, system modularity, cloud readiness, cybersecurity compliance, integration capability, pricing model, local support footprint, airport project track record)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

SITA

Amadeus IT Group

Thales Group

Collins Aerospace

Indra Sistemas

Siemens Logistics

NEC Australia

Honeywell Aerospace

Damarel Systems

Veovo

INFORM GmbH

IER Blue Solutions

Materna IPS

TAV Technologies

T Systems International

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035