Market Overview

The Australia Airport Lounges market current size stands at around USD ~ million, reflecting strong recovery in premium travel services and sustained investment in passenger experience infrastructure. Over the most recent period, industry revenues expanded from USD ~ million to USD ~ million, supported by rising business travel volumes and the expansion of third-party lounge access programs. Installation of new lounge facilities reached ~ units, while total active lounge systems across major terminals increased to ~ systems, indicating steady capacity addition and modernization momentum.

Sydney and Melbourne dominate the Australia Airport Lounges market due to their concentration of international gateways, dense corporate travel demand, and mature aviation ecosystems. These cities benefit from integrated airline alliances, strong financial services partnerships, and advanced digital access infrastructure that accelerates lounge utilization. Brisbane and Perth are emerging as secondary growth hubs, supported by rising long-haul connectivity and regional economic expansion. Favorable airport development policies and consistent terminal upgrade programs further reinforce regional leadership.

Market Segmentation

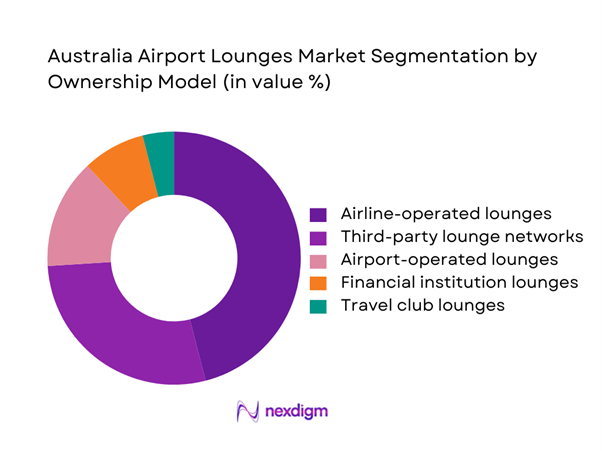

By Ownership Model

Airline-operated lounges continue to dominate the market, driven by strong loyalty program integration and brand-led differentiation strategies. These lounges benefit from captive premium passenger flows and long-term terminal concessions, enabling stable utilization levels across peak and off-peak hours. Over the recent period, airline operators expanded capacity by ~ units, while independent lounge networks added ~ facilities across secondary airports. Financial institution lounges are gaining traction as card issuers bundle premium access into travel benefits, increasing overall lounge footfall. The ownership model is increasingly shaped by strategic partnerships that blend airline expertise with third-party operational efficiency, improving cost structures and service consistency across the network.

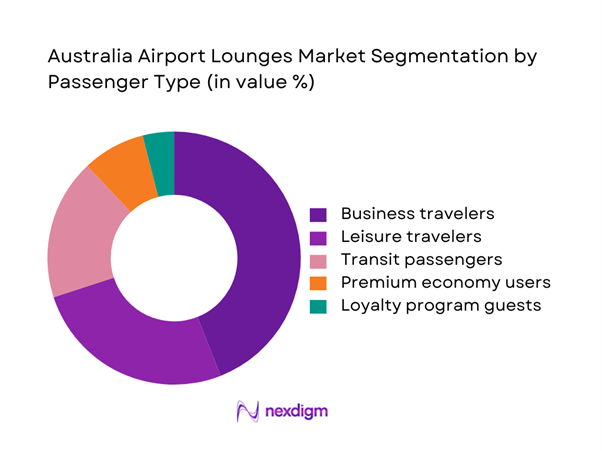

By Passenger Type

Business travelers represent the dominant user segment, driven by higher frequency of air travel and strong demand for productivity-focused amenities such as private workspaces and high-speed connectivity. This group accounted for a significant share of lounge entries, with annual visits exceeding ~ entries in major terminals. Leisure travelers form a growing segment, supported by premium economy ticketing and bundled lounge access offerings. Transit passengers also contribute meaningfully, particularly in Sydney and Melbourne, where international transfer volumes exceed ~ passengers annually. The segmentation dynamic reflects a gradual shift toward broader access models that extend beyond traditional first and business class users.

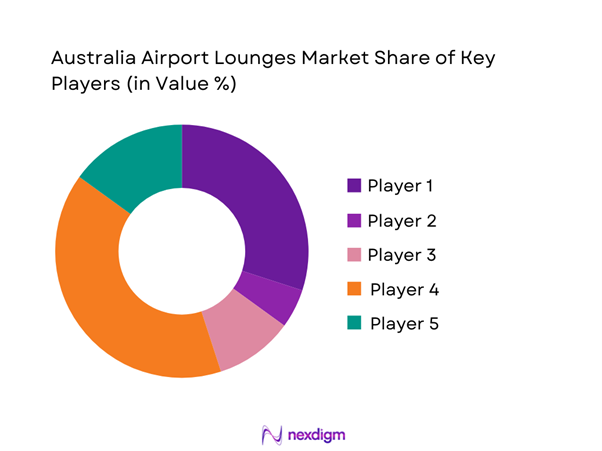

Competitive Landscape

The Australia Airport Lounges market is moderately concentrated, with a mix of airline-owned operators and global third-party lounge networks shaping competitive intensity. Market structure is characterized by long-term airport concessions, strong brand-led differentiation, and increasing collaboration between airlines, financial institutions, and independent service providers to expand access footprints.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Qantas Airways | 1920 | Sydney, Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Virgin Australia | 2000 | Brisbane, Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Plaza Premium Group | 1998 | Hong Kong | ~ | ~ | ~ | ~ | ~ | ~ |

| Aspire Lounge | 2012 | Manchester, UK | ~ | ~ | ~ | ~ | ~ | ~ |

| Collinson Group | 1989 | London, UK | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Airport Lounges Market Analysis

Growth Drivers

Rising premium air travel and business mobility

Premium air travel volumes expanded steadily over the recent period, with business-class ticketing rising to ~ seats annually across major domestic and international routes. This growth directly supports higher lounge utilization, with premium passenger lounge entries increasing to ~ visits per year. Corporate travel budgets expanded to USD ~ million in aggregate, reinforcing demand for productivity-oriented airport services. The expansion of direct long-haul routes added ~ new connections, further increasing dwell time in terminals and driving lounge usage intensity across key gateways.

Expansion of frequent flyer and credit card lounge programs

Loyalty-driven access programs added ~ new members over the last two years, significantly broadening the lounge user base beyond traditional premium fare classes. Financial institutions invested USD ~ million in co-branded lounge access partnerships, increasing card-linked entries to ~ visits annually. This expansion has driven consistent weekday utilization and reduced seasonal volatility in lounge footfall. The growing integration of digital membership platforms enabled faster access validation, supporting higher throughput without proportional increases in staffing or infrastructure costs.

Challenges

High capital expenditure for lounge development and refurbishment

Lounge development costs escalated to USD ~ million per major terminal project, driven by rising construction expenses and premium interior specifications. Refurbishment cycles shortened to ~ years, increasing capital intensity for operators seeking to maintain competitive service standards. Over the recent period, total sector investment in upgrades exceeded USD ~ million, placing pressure on return timelines, particularly in secondary airports with lower passenger volumes. These financial constraints limit the pace of network expansion despite strong underlying demand.

Space constraints at major international terminals

Terminal real estate availability declined as passenger processing areas expanded to accommodate security and immigration upgrades. Lounge operators faced average space reductions of ~ square meters per new concession cycle, constraining seating capacity and service zones. At peak hours, utilization rates reached ~ entries per hour in major hubs, creating congestion challenges. Limited expansion options within existing terminals restrict operators’ ability to scale facilities in line with growing premium traveler numbers.

Opportunities

Development of pay-per-use and dynamic pricing lounge models

Pay-per-use access generated incremental revenues of USD ~ million over the recent period, enabling operators to monetize excess capacity during off-peak hours. Transaction volumes for single-entry passes reached ~ purchases annually, indicating strong demand from leisure and occasional premium travelers. Dynamic pricing platforms allowed operators to adjust access fees in real time, improving yield management across daily traffic cycles. This model enhances revenue diversification while reducing reliance on fixed airline contracts.

Expansion into regional and secondary airports

Regional airport lounge installations increased to ~ facilities, supported by rising domestic travel and growing corporate presence in secondary cities. Passenger volumes at these locations exceeded ~ travelers annually, creating viable demand for premium waiting areas. Development costs in regional terminals averaged USD ~ million per site, significantly lower than metropolitan hubs, improving investment feasibility. This expansion offers operators access to underserved markets while strengthening nationwide network coverage.

Future Outlook

The Australia Airport Lounges market is expected to evolve toward broader access models, deeper airline and financial institution partnerships, and higher levels of digital integration. Over the outlook period to 2035, operators will increasingly focus on experience-led differentiation, sustainability-driven design, and data-enabled service personalization. Growth will be shaped by steady air traffic expansion, regional airport development, and the continued convergence of travel, lifestyle, and financial services ecosystems.

Major Players

- Qantas Airways

- Virgin Australia

- Plaza Premium Group

- Aspire Lounge

- Collinson Group

- Swissport Executive Lounges

- dnata

- American Express Global Lounge Collection

- DragonPass

- Air New Zealand

- Singapore Airlines

- Emirates

- Cathay Pacific

- SkyTeam Lounge Sydney

- Strata Lounge

Key Target Audience

- Airline operators and alliance management teams

- Airport authorities and terminal development agencies

- Independent lounge service providers

- Financial institutions and premium card issuers

- Travel and hospitality investment groups

- Infrastructure-focused private equity funds

- Investments and venture capital firms in travel services

- Government and regulatory bodies including the Department of Infrastructure, Transport, Regional Development and Communications

Research Methodology

Step 1: Identification of Key Variables

Demand drivers were mapped across passenger types, travel frequency, and premium service adoption. Infrastructure variables included terminal capacity, lounge density, and access program penetration. Financial metrics focused on revenue pools and capital deployment trends.

Step 2: Market Analysis and Construction

Data was structured by ownership models, passenger segments, and regional hubs. Historical performance indicators were aligned with current utilization patterns to establish baseline market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Industry practitioners provided insights into operational constraints, partnership models, and future investment priorities. Scenario testing refined assumptions around access models and regional expansion.

Step 4: Research Synthesis and Final Output

Findings were consolidated into a cohesive market narrative supported by quantitative modeling and qualitative trend analysis to ensure strategic relevance.