Market Overview

The Australia Airport Passenger Boarding Bridge Market market current size stands at around USD ~ million, reflecting steady demand from terminal expansion programs and fleet modernization initiatives. Recent periods recorded transactional activity near USD ~ million and USD ~ million, driven by replacement cycles and new gate installations across primary hubs. Deployment volumes reached approximately ~ units in one period and ~ units in the next, supported by long-term concession models and multi-year procurement frameworks.

New South Wales and Victoria dominate adoption due to concentrated international traffic, higher gate density, and mature airport operator ecosystems. Queensland follows, supported by sustained tourism flows and terminal redevelopment programs. Western Australia shows targeted demand linked to resource-driven travel patterns and charter operations. These regions benefit from advanced infrastructure readiness, strong supplier presence, and policy environments favoring accessibility standards and passenger experience upgrades.

Market Segmentation

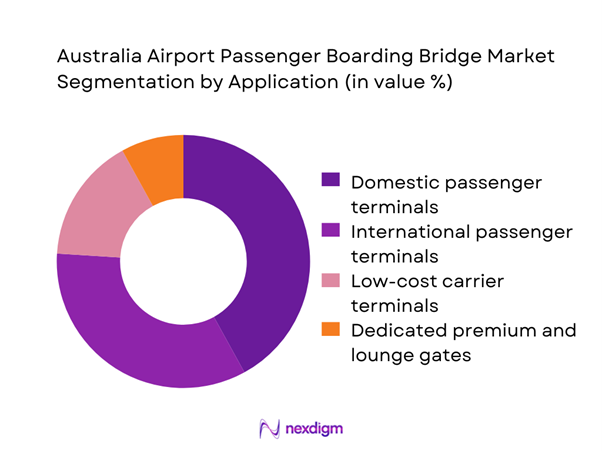

By Application

Domestic passenger terminals lead demand as capacity optimization and rapid turnaround requirements drive continuous upgrades across major and secondary hubs. International terminals follow closely, supported by border processing modernization and premium passenger experience investments. Low-cost carrier terminals maintain steady uptake through standardized, cost-efficient bridge designs aligned with high-frequency operations. Dedicated premium and lounge gates contribute incremental demand, reflecting airline differentiation strategies. Recent procurement cycles indicate deployments of ~ units across domestic-focused projects and ~ units in mixed-use terminals, reinforcing the application-led structure of the market and its alignment with long-term airport master plans.

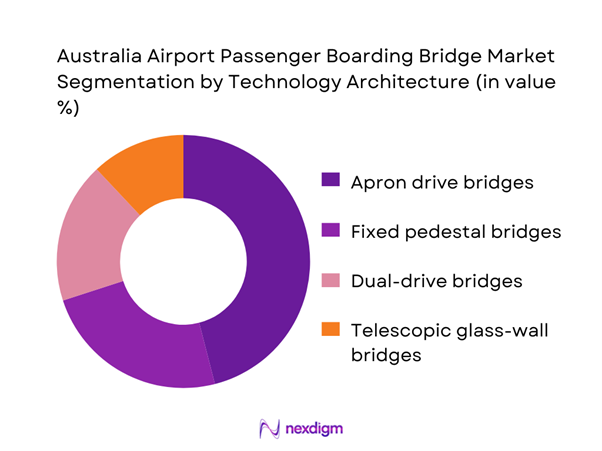

By Technology Architecture

Apron drive bridges dominate installations due to flexibility across varied aircraft types and compatibility with constrained apron layouts. Fixed pedestal bridges remain relevant in high-throughput gates where standardized aircraft operations prevail. Dual-drive systems are gaining traction in wide-body and mixed-fleet environments, improving docking precision and reducing turnaround risks. Telescopic glass-wall designs see selective adoption in premium terminals, emphasizing aesthetics and thermal efficiency. Recent deployment patterns show ~ units of apron drive systems and ~ units of dual-drive configurations, reflecting a technology mix shaped by operational efficiency goals and long-term maintenance considerations.

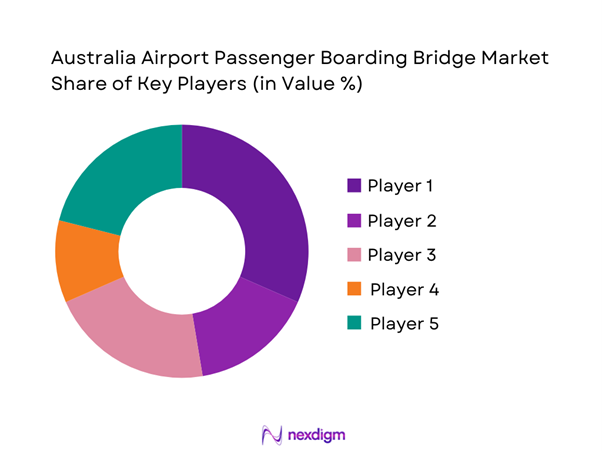

Competitive Landscape

The market exhibits moderate concentration, with a limited group of global and regional engineering specialists supplying large-scale projects through long-term service agreements and framework contracts. Competitive dynamics are shaped by lifecycle service capability, automation readiness, and compliance with stringent safety and accessibility standards.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| ThyssenKrupp Airport Systems | 2003 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| JBT AeroTech | 1947 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| ADELTE Group | 1998 | Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| FMT Aircraft Gate Support Systems | 1974 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| CIMC-TianDa Airport Support | 1992 | China | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Airport Passenger Boarding Bridge Market Analysis

Growth Drivers

Rising passenger traffic at major Australian hubs

Sustained growth in air travel demand has intensified gate utilization rates, pushing airports to expand docking infrastructure. Recent operating periods recorded incremental passenger flows near ~ million travelers, resulting in higher boarding bridge usage cycles and accelerated maintenance requirements. Terminal operators responded with procurement programs valued around USD ~ million to add new bridges and upgrade automation features. The expansion of international routes and domestic connectivity increased average gate occupancy to ~ hours per day, reinforcing the need for efficient docking systems that reduce turnaround delays and support consistent service quality across peak travel windows.

Expansion and redevelopment of international terminals

Large-scale terminal redevelopment programs have emerged as a core driver, with project allocations reaching USD ~ million across phased construction schedules. These initiatives introduced ~ units of new-generation boarding bridges featuring enhanced accessibility and climate control. Redevelopment strategies prioritize modular bridge systems to support flexible gate configurations and mixed-fleet operations. The integration of automated docking solutions across ~ gates has reduced manual intervention and improved safety outcomes, aligning infrastructure upgrades with long-term capacity planning and passenger experience mandates.

Challenges

High capital expenditure and long payback periods

Boarding bridge installations require substantial upfront commitments, with single-project outlays often approaching USD ~ million depending on scope and automation level. Airport operators face extended recovery horizons as revenue streams rely on aeronautical charges and long-term concessions rather than immediate returns. Recent financial planning cycles show capital allocations spread across ~ years, constraining the pace of fleet renewal. This financial structure limits rapid adoption of advanced systems, particularly at regional facilities where passenger volumes remain near ~ million annually and revenue predictability is lower.

Complex installation in brownfield airport environments

Retrofitting bridges in operational terminals presents logistical and engineering challenges, often extending project timelines to ~ months per gate. Constraints such as limited apron space, legacy utilities, and continuous passenger flow increase installation costs by USD ~ million per phase. Recent upgrade programs required coordinated shutdown windows across ~ gates, elevating operational risk. These complexities deter aggressive modernization schedules and necessitate phased deployments that stretch capital planning cycles.

Opportunities

Greenfield airport projects and regional airport upgrades

New airport developments and regional terminal expansions offer a favorable environment for standardized boarding bridge deployment. Planned projects outline infrastructure packages near USD ~ million, incorporating ~ units of bridges designed for scalable operations. Greenfield settings reduce integration complexity, enabling faster commissioning cycles measured in ~ weeks rather than months. Regional upgrades aligned with tourism growth are introducing first-time bridge installations, expanding the addressable market and supporting long-term service contract pipelines.

Retrofit demand for aging boarding bridge fleets

A significant portion of the installed base exceeds ~ years of service life, creating a strong replacement cycle. Recent audits identified ~ units requiring structural or automation upgrades to meet evolving safety and accessibility standards. Retrofit programs valued around USD ~ million emphasize control system modernization and energy efficiency improvements. These initiatives provide recurring revenue streams through phased refurbishments and extended maintenance agreements, reinforcing aftermarket growth potential.

Future Outlook

The market is positioned for steady evolution through 2035, supported by airport capacity expansions, automation adoption, and sustained focus on passenger experience. Policy alignment around accessibility and safety standards will continue to shape procurement priorities. Technology integration with smart airport platforms is expected to redefine operational efficiency. Regional airport upgrades and terminal redevelopment programs will remain central to long-term demand momentum.

Major Players

- ThyssenKrupp Airport Systems

- JBT AeroTech

- ADELTE Group

- FMT Aircraft Gate Support Systems

- CIMC-TianDa Airport Support

- ShinMaywa Industries

- TLD Group

- ADB Safegate

- HÜBNER Group

- Mitsubishi Heavy Industries Airport Systems

- Clyde Machines

- AOT Aviation & Ground Support Equipment

- Aerobridge Pty Ltd

- Airport Equipment Australia

- Avicorp

Key Target Audience

- Airport operators and terminal management authorities

- Airlines and airport service operators

- Infrastructure developers and EPC contractors

- Investments and venture capital firms

- Federal Department of Infrastructure, Transport, Regional Development and Communications

- Civil Aviation Safety Authority

- State-level transport and infrastructure agencies

- Facility management and maintenance service providers

Research Methodology

Step 1: Identification of Key Variables

Assessment of demand drivers across passenger traffic trends, terminal capacity planning, and infrastructure renewal cycles. Mapping of technology adoption levels and automation readiness. Identification of regulatory and accessibility compliance requirements.

Step 2: Market Analysis and Construction

Evaluation of historical deployment patterns and capital allocation structures. Construction of market models based on installation volumes and service lifecycle dynamics. Alignment of regional demand indicators with infrastructure investment plans.

Step 3: Hypothesis Validation and Expert Consultation

Validation of assumptions through structured discussions with airport operations leaders and engineering specialists. Refinement of demand scenarios based on procurement timelines and funding mechanisms. Cross-verification of technology trends with system integrators.

Step 4: Research Synthesis and Final Output

Integration of quantitative modeling with qualitative insights. Development of coherent market narratives across demand, supply, and policy dimensions. Finalization of strategic implications for stakeholders.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, passenger boarding bridge taxonomy across apron drive fixed and T bridge systems, market sizing logic by airport expansion plans and gate modernization programs, revenue attribution across equipment sales installation and maintenance services, primary interview program with airports bridge manufacturers and MRO providers, data triangulation validation assumptions and limitations)

- Definition and scope

- Market evolution

- Usage pathways across terminal types

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising passenger traffic at major Australian hubs

Expansion and redevelopment of international terminals

Focus on improving passenger experience and accessibility

Increased aircraft turnaround efficiency requirements

Growing adoption of automated docking technologies

Airport investments aligned with long-term capacity planning - Challenges

High capital expenditure and long payback periods

Complex installation in brownfield airport environments

Maintenance costs and system downtime risks

Integration challenges with legacy airport infrastructure

Exposure to cyclical aviation demand

Dependence on public sector funding cycles - Opportunities

Greenfield airport projects and regional airport upgrades

Retrofit demand for aging boarding bridge fleets

Integration with smart airport and A-CDM platforms

Growth in premium terminal infrastructure

Rising focus on universal design and PRM accessibility

Aftermarket service and lifecycle management contracts - Trends

Shift toward fully automated and sensor-driven docking

Increased use of lightweight composite structures

Design emphasis on energy efficiency and insulation

Standardization of bridge interfaces across terminals

Growing preference for modular bridge systems

Expansion of long-term service agreements - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrow-body aircraft

Wide-body aircraft

Regional aircraft

Business and VIP aircraft - By Application (in Value %)

Domestic passenger terminals

International passenger terminals

Low-cost carrier terminals

Dedicated premium and lounge gates - By Technology Architecture (in Value %)

Fixed pedestal bridges

Apron drive bridges

Dual-drive bridges

Telescopic glass-wall bridges

Climate-controlled enclosed bridges - By End-Use Industry (in Value %)

Commercial airports

Military and government air bases

MRO and technical hubs

VIP and charter terminals - By Connectivity Type (in Value %)

Manual control systems

Semi-automated docking systems

Fully automated docking systems

IoT-enabled predictive maintenance systems - By Region (in Value %)

New South Wales

Victoria

Queensland

Western Australia

South Australia

Northern Territory

Tasmania

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (docking accuracy, automation level, lifecycle cost, local service coverage, regulatory compliance, delivery lead time, retrofit capability, digital integration readiness)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

ThyssenKrupp Airport Systems

JBT AeroTech

ADELTE Group

FMT Aircraft Gate Support Systems

CIMC-TianDa Airport Support

ShinMaywa Industries

TLD Group

ADB Safegate

HÜBNER Group

AOT Aviation & Ground Support Equipment

Mitsubishi Heavy Industries Airport Systems

Clyde Machines

Aerobridge Pty Ltd

Airport Equipment Australia

Avicorp

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035