Market Overview

The Australia airport passenger screening systems market current size stands at around USD ~ million, reflecting steady expansion driven by airport modernization and rising security infrastructure spending. Recent deployment volumes reached ~ systems, with cumulative installed base crossing ~ systems nationwide. Capital allocation toward advanced imaging and automation accounted for investments of nearly USD ~ million, supporting upgrades across major gateways and regional hubs. Operating costs per screening lane averaged USD ~ million, reflecting integration complexity and workforce requirements.

Market activity is concentrated in metropolitan aviation corridors led by Sydney, Melbourne, and Brisbane, supported by dense passenger flows and advanced infrastructure readiness. These cities benefit from mature security ecosystems, strong vendor presence, and proactive regulatory oversight. Secondary growth nodes include Perth and Adelaide, where defense-linked aviation and international connectivity sustain steady demand. Regional airports are gradually adopting modular screening systems as policy frameworks encourage standardized security benchmarks across the national airport network.

Market Segmentation

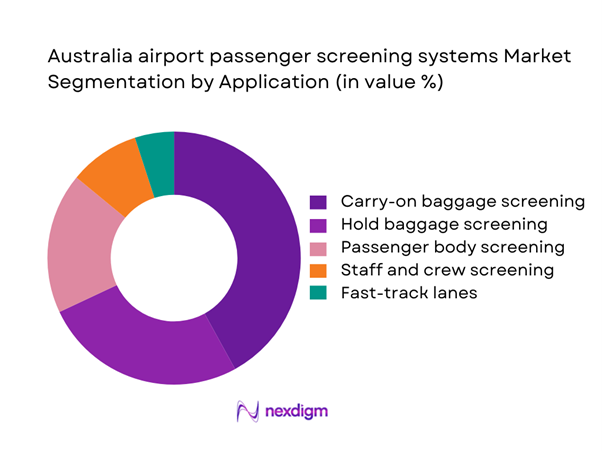

By Application

Carry-on baggage screening dominates the Australia airport passenger screening systems market due to its universal deployment across all passenger touchpoints and its direct impact on throughput efficiency. High daily passenger movement necessitates continuous upgrades of X-ray and CT-based solutions, driving sustained procurement cycles. Operational reliance on this segment is reinforced by regulatory emphasis on cabin safety and the need to minimize manual checks. As airports prioritize seamless passenger journeys, investments increasingly focus on intelligent carry-on screening lanes that reduce re-screening rates, enhance compliance consistency, and improve checkpoint flow management across peak travel periods.

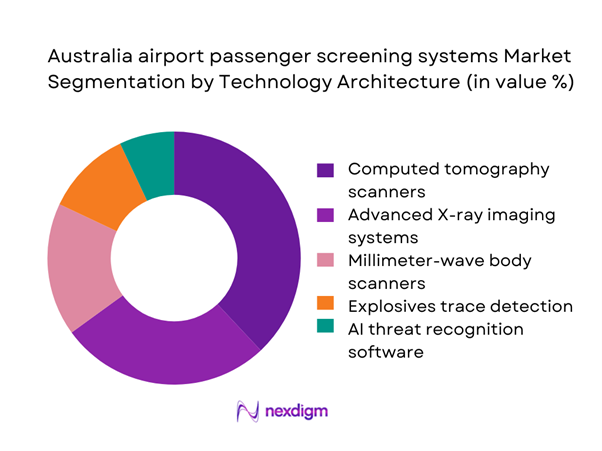

By Technology Architecture

Computed tomography based screening systems lead technology adoption as airports transition from conventional imaging to advanced threat detection platforms. The dominance of CT architecture is driven by its ability to deliver higher detection accuracy while reducing false alarms, enabling smoother passenger flow. Airports investing in terminal expansion and refurbishment increasingly standardize CT as the core security layer. This shift is further supported by policy alignment with international aviation security benchmarks, encouraging uniform technology baselines. As lifecycle costs stabilize and integration improves, CT platforms continue to displace legacy systems across both major hubs and secondary airports.

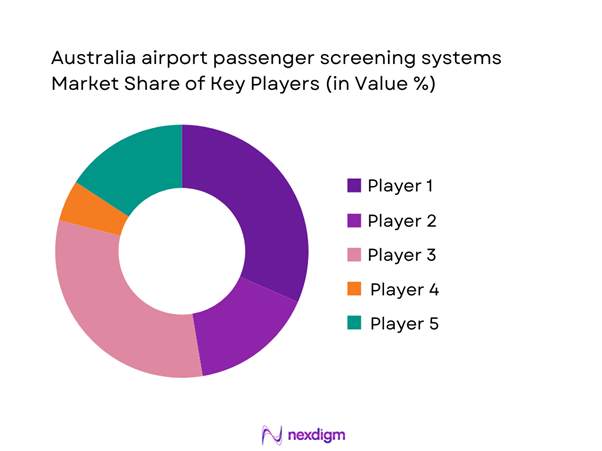

Competitive Landscape

The Australia airport passenger screening systems market reflects a moderately concentrated structure, with a small group of global technology providers anchoring large-scale airport deployments while regional integrators support customization and service delivery. Competitive intensity is shaped by regulatory certification requirements and long-term service contracts, favoring vendors with established compliance track records and local support capabilities.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Smiths Detection | 1851 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Rapiscan Systems | 1993 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Nuctech Company | 1997 | China | ~ | ~ | ~ | ~ | ~ | ~ |

Australia airport passenger screening systems Market Analysis

Growth Drivers

Rising passenger traffic recovery post-pandemic

Passenger movement through Australian airports rebounded to ~ travelers in the recent period, driving renewed utilization of screening lanes and security checkpoints. This recovery pushed operational hours of screening systems to ~ hours annually across major terminals, accelerating wear cycles and upgrade demand. Capital programs worth USD ~ million were directed toward expanding checkpoint capacity and reducing queue times. The sustained return of international travel generated incremental deployment of ~ systems, reinforcing procurement pipelines and supporting stable service contract renewals across metropolitan hubs.

Stricter aviation security regulations and compliance mandates

Regulatory upgrades introduced new screening thresholds that required replacement of ~ legacy systems nationwide. Compliance-driven investments reached USD ~ million, focusing on advanced imaging and automated detection platforms. Certification cycles mandated system audits across ~ airports, increasing demand for standardized solutions with proven regulatory readiness. These mandates also elevated training requirements, resulting in ~ operators undergoing certification programs annually, further embedding technology upgrades into long-term airport security strategies.

Challenges

High capital expenditure and long procurement cycles

Major airport screening upgrades demand upfront investments exceeding USD ~ million per terminal, often stretching approval timelines beyond ~ months. Extended tendering processes delay system rollouts, creating operational strain as passenger volumes rise. Smaller regional airports face funding gaps, with average budget allocations limited to USD ~ million annually, restricting their ability to adopt next-generation platforms. These constraints slow market penetration despite clear technology readiness and regulatory alignment.

Complex regulatory approval and certification processes

Screening equipment must undergo multi-layer validation across ~ compliance stages before deployment, extending time-to-market significantly. Certification costs average USD ~ million per system configuration, creating barriers for rapid innovation cycles. Frequent updates to technical standards require vendors and airports to revalidate ~ systems periodically, adding to operational overhead and increasing project risk. These complexities often lead to staggered deployments rather than synchronized national upgrades.

Opportunities

Next-generation CT deployment across major airports

Large hubs are planning replacement of ~ conventional scanners with CT-based platforms, unlocking upgrade budgets of USD ~ million over the near term. Each terminal modernization program typically involves ~ screening lanes, creating scale opportunities for integrated solution providers. As installation volumes rise, economies of scale are expected to reduce per-lane deployment costs to USD ~ million, accelerating adoption beyond metropolitan airports into secondary gateways.

Expansion of biometric-enabled passenger screening

Biometric integration initiatives target deployment of ~ identity verification points across high-traffic terminals, supported by investments of USD ~ million. These systems are designed to reduce manual checks by ~ interactions per passenger journey, improving throughput efficiency. With pilot programs demonstrating processing time reductions of ~ minutes per traveler, airports are preparing phased rollouts that embed biometric screening into core security workflows, creating new revenue streams for technology and service providers.

Future Outlook

The Australia airport passenger screening systems market is set to advance through a sustained modernization cycle extending into the next decade. Continued regulatory harmonization, infrastructure renewal programs, and technology convergence will reshape procurement priorities. Airports are expected to emphasize integrated security ecosystems that balance operational efficiency with enhanced passenger experience. As digitalization deepens, service-led business models and long-term partnerships will become central to competitive differentiation across the market.

Major Players

- Smiths Detection

- Rapiscan Systems

- Nuctech Company

- Thales Group

- L3Harris Technologies

- Rohde & Schwarz

- Analogic Corporation

- Astrophysics Inc.

- CEIA

- Vanderlande Industries

- IDEMIA

- NEC Corporation

- SITA

- Unisys

- Leidos Security Detection & Automation

Key Target Audience

- Airport operators and infrastructure authorities

- Aviation security agencies including Australian Border Force

- Department of Home Affairs and federal security regulators

- State transport and infrastructure departments

- Airlines and ground handling service providers

- System integrators and managed service providers

- Investments and venture capital firms focused on security technology

- Public procurement and defense acquisition agencies

Research Methodology

Step 1: Identification of Key Variables

Core demand drivers, regulatory frameworks, and technology adoption patterns were mapped to define the analytical scope. Operational benchmarks from airport security workflows were translated into measurable performance indicators. Supply-side capabilities were aligned with service delivery expectations across major and regional airports.

Step 2: Market Analysis and Construction

Quantitative and qualitative inputs were synthesized to construct baseline market structures. Deployment intensity, upgrade cycles, and service penetration levels were modeled to reflect real-world procurement behavior. Scenario frameworks were built to test sensitivity to policy and infrastructure investment shifts.

Step 3: Hypothesis Validation and Expert Consultation

Industry practitioners, airport security managers, and system engineers provided structured feedback to validate assumptions. Insights from regulatory specialists helped refine compliance impact assessments. These consultations ensured practical relevance of technology adoption pathways and investment timelines.

Step 4: Research Synthesis and Final Output

Findings were consolidated into a coherent market narrative linking demand dynamics with competitive positioning. Strategic implications were derived for stakeholders across the value chain. Final outputs were structured to support decision-making on investment, partnerships, and long-term planning.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, passenger screening system taxonomy across CT X ray and biometric platforms, market sizing logic by airport throughput and security lane deployment, revenue attribution across equipment software and service contracts, primary interview program with airports security agencies and system integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Passenger processing and security workflow integration

- Ecosystem structure across airports, regulators, and technology providers

- Supply chain and channel structure

- Regulatory environment and compliance framework

- Growth Drivers

Rising passenger traffic recovery post-pandemic

Stricter aviation security regulations and compliance mandates

Modernization of aging screening infrastructure

Adoption of CT and AI-based threat detection

Government investment in border security

Expansion of regional and remote airport connectivity - Challenges

High capital expenditure and long procurement cycles

Complex regulatory approval and certification processes

Integration issues with legacy airport systems

Skilled workforce shortages for system operation

Cybersecurity risks in connected screening platforms

Budget constraints for smaller regional airports - Opportunities

Next-generation CT deployment across major airports

Expansion of biometric-enabled passenger screening

Public-private partnerships for security infrastructure upgrades

Growth in managed services and lifecycle support contracts

Export of Australian-developed security technologies

Integration of screening data with smart airport platforms - Trends

Shift from manual to automated threat detection

Increasing use of AI for real-time image analysis

Convergence of passenger processing and security workflows

Focus on passenger experience alongside security outcomes

Standardization of screening lanes and checkpoints

Growth in remote monitoring and centralized command centers - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Major international hub airports

Secondary metropolitan airports

Regional and remote airports

Private and charter terminals

Defense and government airfields - By Application (in Value %)

Carry-on baggage screening

Hold baggage screening

Passenger body screening

Staff and crew screening

Fast-track and trusted traveler lanes - By Technology Architecture (in Value %)

Computed tomography (CT) scanners

Advanced X-ray imaging systems

Millimeter-wave body scanners

Explosives trace detection systems

AI-enabled threat recognition software - By End-Use Industry (in Value %)

Airport operators

Aviation security agencies

Border control and customs authorities

Airlines and ground handling companies

Defense and government aviation - By Connectivity Type (in Value %)

Standalone screening systems

Networked on-premise systems

Cloud-connected security platforms

Integrated airport operations systems - By Region (in Value %)

New South Wales

Victoria

Queensland

Western Australia

South Australia

Northern Territory

Tasmania

Australian Capital Territory

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology breadth, regulatory certifications, local service footprint, total cost of ownership, system scalability, AI capability, cybersecurity compliance, integration flexibility)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Smiths Detection

Rapiscan Systems

Nuctech Company

Leidos Security Detection & Automation

Thales Group

L3Harris Technologies

Rohde & Schwarz

Analogic Corporation

Astrophysics Inc.

CEIA

Vanderlande Industries

IDEMIA

NEC Corporation

SITA

Unisys

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035