Market Overview

The Australia Airport Runway Safety Systems market is valued at USD ~ billion, driven by the ongoing expansion and modernization of airport infrastructure to accommodate increasing air traffic. This growth is supported by government regulations requiring the implementation of advanced runway safety technologies to enhance air traffic management and minimize runway incursions. In addition, the rise in global travel and increasing investments in both commercial and military airports fuel the demand for enhanced safety systems. Furthermore, technological innovations in radar systems, automation, and AI integration are also critical contributors to the market’s development.

Australia’s major airports, such as Sydney, Melbourne, Brisbane, and Perth, dominate the runway safety systems market due to their high volume of passenger traffic and advanced aviation infrastructure. Sydney Airport, being the busiest in the country, has led the way in adopting state-of-the-art safety technologies, setting a benchmark for others. Moreover, with significant investments from both private sectors and government bodies, these airports are at the forefront of implementing runway safety systems to meet safety regulations. The dominance of these airports can also be attributed to their strategic locations, international connectivity, and the growing need for comprehensive safety solutions.

Market Segmentation

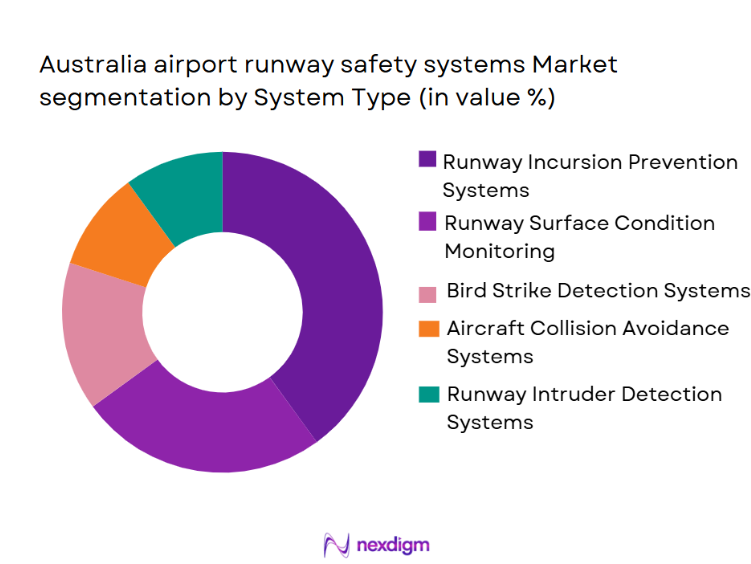

By System Type

Australia’s Airport Runway Safety Systems market is segmented by system type into runway incursion prevention systems, runway surface condition monitoring systems, and bird strike detection systems, among others. In this segment, runway incursion prevention systems dominate the market share due to their critical role in preventing aircraft collisions on the runway. The rise in air traffic volume, combined with stringent regulatory requirements, has led to widespread adoption of these systems across major airports. The technology’s effectiveness in reducing safety risks and improving operational efficiency further strengthens its dominance in the Australian market.

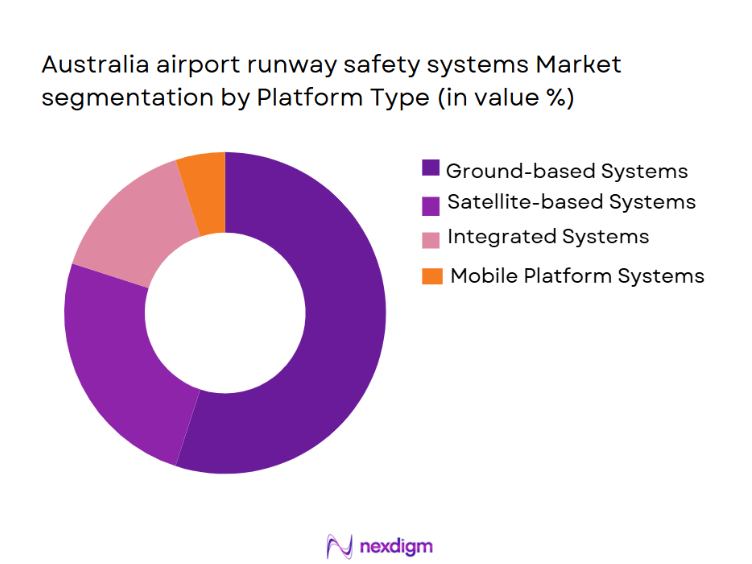

By Platform Type

The market for airport runway safety systems is segmented by platform type into ground-based systems, satellite-based systems, and integrated systems. Ground-based systems currently lead the market due to their reliability, cost-effectiveness, and ability to deliver real-time monitoring across airport runways. These systems are especially favored by airports for their ability to function effectively without dependency on satellite signals, making them more suitable for smaller regional airports as well as large international hubs. Additionally, ground-based systems are often easier to integrate with existing infrastructure, contributing to their widespread adoption.

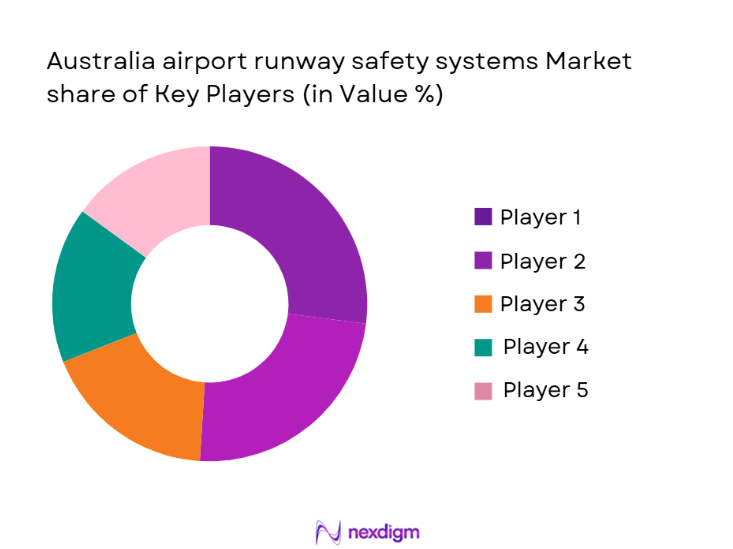

Competitive Landscape

The Australia Airport Runway Safety Systems market is characterized by strong competition among a few leading players that provide comprehensive solutions to airports. The key players include large, well-established companies such as Thales Group, Honeywell, and ADB SAFEGATE, who are continuously innovating to maintain their market leadership. These companies are key players due to their ability to provide both advanced technology and robust customer service to meet regulatory requirements. Additionally, local manufacturers also contribute to market dynamics by offering tailored solutions suited to specific operational needs in Australian airports.

| Company | Establishment Year | Headquarters | Market Share | Product Innovation | Technology Adoption | Geographic Presence | Clientele | Partnerships | Revenue Growth | Service & Support |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell International | 1885 | Morris Plains, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| ADB SAFEGATE | 1905 | Brussels, Belgium | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | Cedar Rapids, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| GE Aviation | 1892 | Cincinnati, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Airport Runway Safety Systems Market Analysis

Growth Drivers

Increasing Air Traffic and Airport Modernization

The rising volume of global air traffic and the continuous modernization of airports in Australia are driving the demand for advanced runway safety systems. Airports are investing heavily in technology to ensure safer operations and meet growing passenger and cargo traffic demands.

Stringent Regulatory Requirements

Government regulations, including those from the Civil Aviation Safety Authority (CASA), mandate the adoption of advanced runway safety systems to mitigate accidents. This regulatory pressure encourages the procurement of modern safety systems to comply with national and international standards.

Market Challenges

High Initial and Maintenance Costs

The high cost of installing runway safety systems, including complex sensors and radar systems, poses a significant challenge, especially for smaller airports or those with limited budgets for technological upgrades.

Integration with Legacy Systems

Many airports struggle to integrate new safety technologies with their existing, outdated infrastructure, leading to potential system incompatibilities and increased operational downtime during the integration process.

Opportunities

Advancements in AI and Automation

The increasing use of artificial intelligence and automation in runway safety systems presents a significant opportunity. AI-powered technologies, such as predictive analytics and automated surveillance, can enhance real-time decision-making and safety outcomes on the runway.

Expansion of Regional Airports

As regional airports expand to accommodate growing domestic and international traffic, there is an opportunity for the runway safety systems market to provide customized, cost-effective solutions for these smaller hubs that are investing in modernizing their infrastructure.

Future Outlook

Over the next six years, Australia’s Airport Runway Safety Systems market is expected to witness significant growth. The increasing air traffic, alongside growing regulatory pressures for enhanced safety measures, will continue to drive the market. Additionally, technological advancements in radar, sensor systems, and AI integration are likely to transform the safety solutions industry. Moreover, the continuous expansion of major Australian airports and the push for sustainability and operational efficiency will further fuel market growth.

Major Players

- Thales Group

- Honeywell International

- ADB SAFEGATE

- Rockwell Collins

- GE Aviation

- Siemens

- Safran

- Indra Sistemas

- L3 Technologies

- Leonardo S.p.A.

- Raytheon Technologies

- Cavotec

- Beumer Group

- Comtel

- Avlite Systems

Key Target Audience

- Airport authorities

- Airlines and aircraft operators

- Aviation equipment manufacturers

- Government and regulatory bodies

- Investment and venture capital firms

- Airport infrastructure developers

- Aviation safety and technology consultants

- Military and defense organizations

Research Methodology

Step 1: Identification of Key Variables

The first phase of this research involves identifying critical variables that influence the Australian Airport Runway Safety Systems market. A combination of secondary and proprietary databases will be used to understand key trends, regulatory requirements, and technological drivers in the market.

Step 2: Market Analysis and Construction

This phase will focus on analyzing historical data and identifying trends related to the installation and demand for runway safety systems in Australia. In addition to assessing the ratio of installations to system providers, data will be used to forecast future market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses will be validated through interviews with industry experts from leading airport operators, aviation safety consultants, and technology developers. These consultations will provide deeper insights into the practical challenges and opportunities within the market.

Step 4: Research Synthesis and Final Output

This final stage will combine the insights gathered from expert consultations and primary research to provide a validated, comprehensive market analysis. The final report will synthesize all findings into actionable insights for stakeholders.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing air traffic and airport infrastructure investments

Stringent safety regulations for aviation sector

Technological advancements in runway safety systems - Market Challenges

High initial installation and maintenance costs

Integration complexities with legacy systems

Limited awareness and adoption in smaller airports - Market Opportunities

Expansion of airport infrastructure in emerging markets

Increase in government-funded airport safety programs

Adoption of AI and IoT technologies in runway safety - Trends

Shift towards automation and AI-driven safety systems

Integration of smart technologies for real-time monitoring

Growth in collaborative safety networks between airports and air traffic control

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Runway Intruder Detection Systems

Runway Incursion Prevention Systems

Bird Strike Detection Systems

Aircraft Collision Avoidance Systems

Runway Surface Condition Monitoring Systems - By Platform Type (In Value%)

Ground-based Systems

Satellite-based Systems

Mobile Platform Systems

Integrated Platform Systems

Advanced Radar-based Platforms - By Fitment Type (In Value%)

Retrofit Systems

Newly Installed Systems

Modular Systems

Upgraded Systems

Custom-built Systems - By EndUser Segment (In Value%)

Commercial Airports

Military Airports

Private Airports

Cargo Airports

Regional Airports - By Procurement Channel (In Value%)

Direct Sales

Government Tender

Private Contractors

OEM Partnerships

Distributors & Resellers

- Market Share Analysis

- CrossComparison Parameters (Market Share, Product Innovation, Geographic Presence, Strategic Partnerships, Technological Advancements)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Thales Group

Honeywell International

ADB SAFEGATE

Rockwell Collins

Boeing

GE Aviation

Aireon

Indra Sistemas

L3 Technologies

Leonardo S.p.A.

Raytheon Technologies

Siemens

Safran

Cavotec

Beumer Group

- Growing demand from commercial airports due to safety regulations

- Military airports increasing focus on high-security safety systems

- Private airports prioritizing cost-effective safety upgrades

- Cargo airports emphasizing efficient and secure runway management

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035