Market Overview

The Australian airport services market, valued at approximately AUD ~ in 2025, is primarily driven by increasing air traffic, government investment in airport infrastructure, and the rising demand for both passenger and cargo services. The growth of low-cost carriers (LCCs) has significantly increased the passenger base across major airports like Sydney, Melbourne, and Brisbane. Additionally, infrastructure upgrades to meet passenger expectations and operational efficiencies further fuel market expansion. These factors contribute to both aeronautical and non-aeronautical revenue generation within the sector.

Australia’s airport services market is dominated by cities like Sydney, Melbourne, and Brisbane due to their status as major international gateways. Sydney, being the busiest airport in Australia, handles the largest share of international flights, followed by Melbourne and Brisbane, which cater to a mix of domestic and international travel. Additionally, these cities boast high tourist traffic and serve as hubs for major international airlines, thereby driving demand for a wide range of airport services, including ground handling, baggage, passenger services, and cargo logistics.

Market Segmentation

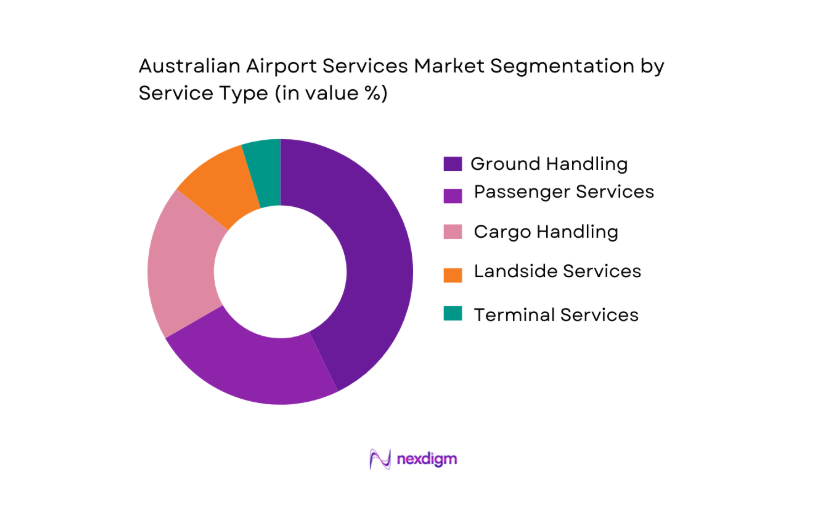

By Service Type

The Australian airport services market is segmented into Ground Handling, Passenger Services, Cargo Handling, Landside Services, and Terminal Services. Among these, Ground Handling services dominate the market share due to the essential nature of their role in facilitating aircraft turnarounds, baggage handling, and refueling services. The ground handling segment is a critical part of airport operations, with major players like Swissport and Menzies Aviation securing substantial contracts with airports. This dominance is largely due to the ever-expanding fleet of airlines in Australia, leading to a growing need for timely and efficient ground services.

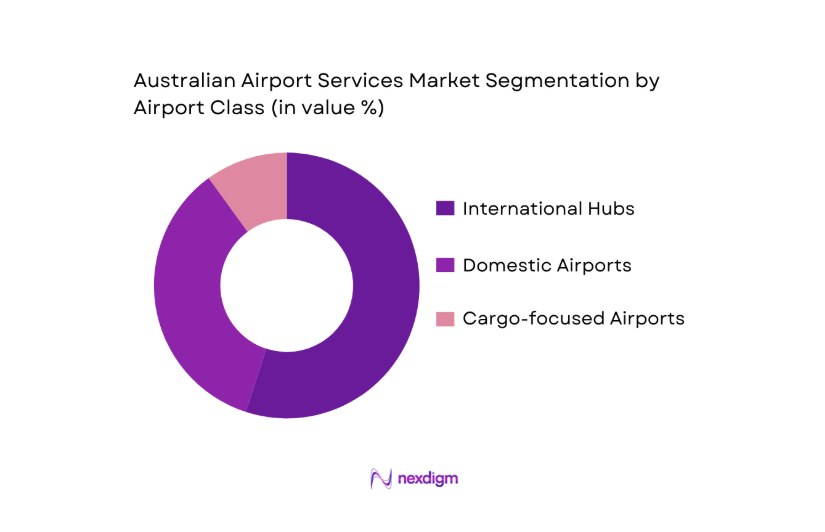

By Airport Class

The Australian airport services market is segmented by Airport Class into International Hubs, Domestic Airports, and Cargo-focused Airports. Among these, International Hubs, specifically Sydney Kingsford Smith Airport and Melbourne Airport, hold the largest market share due to their status as international gateways. The high volume of international passengers and freight has led to a concentration of investments in service technologies like automation and biometric systems. This class of airports is also at the forefront of advanced customer experience initiatives, helping to retain a significant share in the overall market.

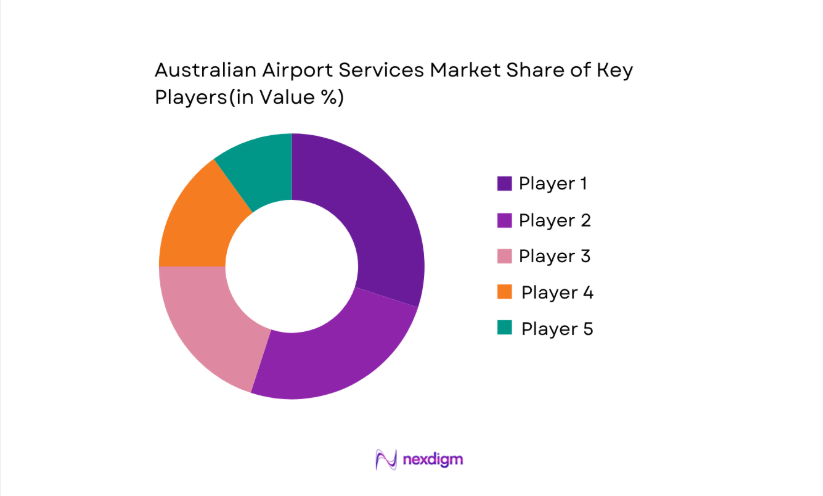

Competitive Landscape

The Australian airport services market is highly competitive, with a mix of global players and local service providers. Key players like Swissport, Menzies Aviation, and Dnata dominate the sector due to their long-standing relationships with airports, advanced technology adoption, and wide service coverage. These players benefit from significant government contracts and established relationships with major airlines. Their consolidated presence ensures high competition among service providers, which further drives innovation in services, pricing strategies, and operational efficiency.

| Company Name | Year Established | Headquarters | Service Coverage | Fleet Size | Technology Integration | Partnerships |

| Swissport | 1996 | Sydney, Australia | ~ | ~ | ~ | ~ |

| Menzies Aviation | 2005 | Melbourne, Australia | ~ | ~ | ~ | ~ |

| Dnata | 1980 | Brisbane, Australia | ~ | ~ | ~ | ~ |

| Qantas Ground Services | 1990 | Sydney, Australia | ~ | ~ | ~ | ~ |

| Airservices Australia | 1995 | Canberra, Australia | ~ | ~ | ~ | ~ |

Australia Airport Services Market Analysis

Market Growth Drivers

Passenger Demand

Australia’s airport services market is significantly propelled by strong passenger demand. According to BITRE’s Aviation Traffic Data, the busiest airports such as Sydney and Melbourne collectively handled over ~ passengers in 2024‑25, indicating a substantial recovery in travel volumes post‑pandemic and driving demand for ground handling, passenger facilitation, and terminal services. This surge in flight movements, up from just ~ flights four years ago to ~ flights in 2024‑25, reflects renewed airline capacity and increased public travel confidence. The rise in passengers necessitates enhanced operational services at airports to maintain efficiency and service quality, directly boosting the market for airport‑related services like check‑in assistance, baggage handling, and security processing.

Tourism Uplift

Tourism growth acts as a crucial catalyst for the airport services ecosystem. The Australian Bureau of Statistics reported that tourism GDP reached AUD ~ in 2024‑25, driven by both domestic and international visitor expenditure on travel‑related services. International tourism consumption alone climbed to AUD ~, underscoring the demand for airport facilitation services such as international passenger processing, customs support, and airport retail services. The Traveller Economy’s contribution also reflects increased demand for airport infrastructure and services as airlines expand routes and frequencies to accommodate inbound tourists. Airports serve as gateways for a tourism sector that supports ~ jobs, indicating broader economic linkages between tourism and airport services growth.

Market Challenges

Regulation Complexity

Regulatory complexity poses a critical challenge for airport services in Australia, limiting operational agility. Airports and service providers must comply with a range of overlapping regulations from bodies such as the Civil Aviation Safety Authority , the Australian Competition and Consumer Commission , and the Department of Infrastructure, Transport, Regional Development and Communications. Compliance spans safety, security screening, noise restrictions, and passenger rights, often requiring time‑intensive approvals and cost‑intensive procedural adjustments. For example, the ACCC’s draft price notifications underscore the regulatory scrutiny on airline and service fees, affecting pricing flexibility for airport services. Navigating these regulatory pathways adds complexity to operational planning and can delay service upgrades, thereby constraining service innovation and responsiveness to market demand.

Capital Expenditure (CapEx) Barriers

The need for ongoing capital investment presents another significant market challenge. Upgrading airport infrastructure — including baggage systems, security screening, and passenger terminals — requires large expenditures, often running into hundreds of millions of dollars per project. For instance, Melbourne Airport’s ongoing baggage handling overhaul involves a AUD ~ investment to significantly expand throughput capacity and reduce bottlenecks. Such substantial CapEx commitments strain airline and airport finances, especially as airports balance recovery efforts with long‑term modernization. These high barriers to infrastructure investment can slow service expansion and delay adoption of new technologies critical for operational efficiency.

Market Opportunities

Digital Transformation

Digital transformation presents a significant opportunity for Australia’s airport services market to enhance operational efficiency and passenger experience. The aviation sector is increasingly adopting technologies such as biometrics, automated check‑in, and advanced baggage tracking to streamline services at scale. These solutions address growing passenger volumes and contribute to faster processing times, reducing queues and service bottlenecks. For example, Australia’s largest airports are investing in self‑service kiosks and automated security screening systems to accommodate rising traveler numbers. Digitalization also enables better data integration across airport ecosystems, leading to predictive maintenance, improved resource allocation, and enhanced safety compliance — all vital for sustaining competitiveness in both domestic and international markets.

Sustainability Initiatives

Sustainability is becoming a core priority in airport services, driven by global commitments to reduce carbon emissions and environmental impact. Major Australian airports are adopting sustainable aviation fuel targets, energy‑efficient systems, and waste reduction practices to align with global environmental standards. These initiatives create demand for sustainability‑focused services, including eco‑friendly ground handling equipment, carbon footprint tracking solutions, and green infrastructure upgrades. Such investments not only meet regulatory and consumer expectations but also position airport service providers to tap into emerging market segments that demand sustainable travel options. By integrating sustainability into service offerings, airports and service companies can attract environmentally conscious airlines and passengers, fostering long‑term growth.

Future Outlook

Over the next five years, the Australian airport services market is poised for robust growth. This growth is driven by the continuous recovery in air travel, expansion of airport infrastructures, and the integration of smart technologies to enhance the passenger experience. Airports are investing in automation, biometrics, and self-service technologies to meet the rising demand and improve operational efficiencies. Furthermore, the Australian government’s focus on sustainable airport practices will provide a significant boost to the market’s growth, enabling a competitive edge for local operators.

Major Players

- Swissport International

- Menzies Aviation

- Dnata

- Qantas Ground Services

- Airservices Australia

- SATS Ltd

- Gate Group

- Worldwide Flight Services

- Celebi Aviation

- Balkan Handling

- dnata Australia

- Acciona Airport Services

- WFS

- Toll Group

- MedeAnalytics

Key Target Audience

- Airport Authorities

- Airlines

- Government Agencies

- Cargo Operators

- Investment Firms

- Airport Service Providers

- Venture Capitalists

- Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying and mapping key market drivers, restraints, and growth factors, focusing on stakeholder input and industry-level intelligence. It leverages both primary and secondary data sources to derive the foundational elements affecting the airport services market in Australia.

Step 2: Market Analysis and Construction

In this phase, we examine past market performance, evaluating service types and key drivers influencing the market’s growth trajectory. The analysis will also explore infrastructure expansion patterns and the influence of aviation trends in Australia.

Step 3: Hypothesis Validation and Expert Consultation

Industry expert interviews are conducted to validate market hypotheses and gain insights from stakeholders within airport operations, ground handling companies, and regulatory bodies. These consultations ensure the integrity of the data and improve forecasting accuracy.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all data from expert interviews, secondary research, and market analysis. The aim is to generate a robust report with high-confidence forecasts and actionable insights for strategic decision-making in the Australian airport services market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Market Growth Drivers

passenger demand

tourism uplift

cargo expansion - Market Challenges

regulation complexity

capex barriers

disruptive events - Market Opportunities

digital transformation

sustainability

smart services - Key Market Trends

automation

digital queue management

contactless services - Government Regulatory & Policy Analysis

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By volume, 2020-2025

- By average price, 2020-2025

- By Service Type (In Value %)

Ground Handling

Passenger Services

Cargo Handling & Logistics

Landside & Connectivity - By Airport Class (In Value %)

International Hubs

Domestic & Regional Airports

Cargo‑focused Airports - By Customer Type (In Value %)

Airlines

Passengers

Cargo Operators - By Contract Structure (In Value %)

In‑house vs Outsourced Operators

PPP & Joint Ventures - By Technology Adoption (In Value %)

automation

IoT

biometrics

- Market Share of Key Players

- Cross‑Comparison Parameters(Service Coverage Breadth, Contract Portfolio, Technology Adoption, Service Quality Index, Revenue per Movement, Regional Footprint)

- SWOT Analysis

- Pricing & Fee Benchmarking

- Detail Profiles of Major Players

Swissport International

Menzies Aviation

Dnata

Gate Group Australia

Qantas Ground Services

Sydney Aviation Alliance

Airservices Australia

SATS Ltd

Worldwide Flight Services

Celebi Aviation

Balkan Handling

dnata Australia

Local Specialized Operators

Technology Service Vendors

Mobility & Landside Services Providers

- Key Decision Drivers for Airlines

- Passenger Experience Indicators

- Cargo Operator Procurement Criteria

- Airport Operator KPIs

- By Value, 2026-2035

- By volume, 2026-2035

- By average price, 2026-2035