Market Overview

The Australian airport sleeping pods market is a rapidly growing sector within the broader airport services industry. The market size has been increasing due to factors like the rise in air travel, the growing demand for passenger comfort, and the increasing trend of non-aeronautical revenue streams for airports. According to credible industry sources, the market is valued at approximately AUD ~ in 2025. The need for relaxation spaces during layovers, long connections, and overnight delays is driving the growth of airport sleeping pods. Additionally, the expansion of international airports in Australia, such as Sydney and Melbourne, further fuels the demand for such facilities.

Australia’s major international hubs, including Sydney, Melbourne, and Brisbane, dominate the airport sleeping pods market. Sydney, as Australia’s largest airport, sees the highest demand for sleeping pods due to its large number of international and domestic flights. Melbourne also has a substantial market share due to its position as a key business and leisure travel destination. Brisbane’s increasing focus on enhancing passenger experiences has led to the introduction of sleeping pods, and it continues to contribute significantly to the market. These cities lead the market due to their high passenger volumes, international flight routes, and focus on improving non-aeronautical revenues.

Market Segmentation

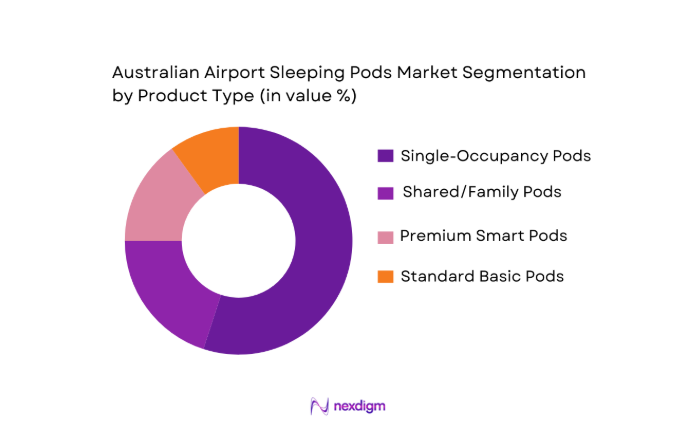

By Product Type

The Australian airport sleeping pods market is segmented by product type into single-occupancy pods, shared/family pods, premium smart pods, and standard basic pods. Among these, single-occupancy pods have the dominant market share in 2025, with a significant preference among solo travelers seeking privacy and comfort during layovers. The convenience of booking, privacy, and the growing trend of personalized experiences in airports are the main drivers of this segment’s dominance. The availability of options for customizability, such as adjustable lighting, temperature control, and secure personal storage, further contributes to the growth of this segment.

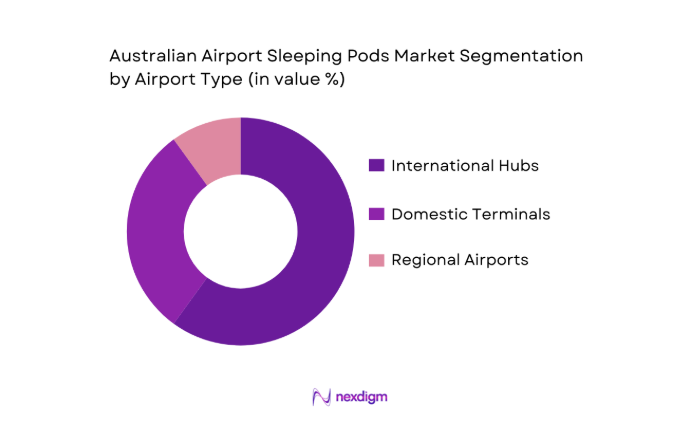

By Airport Type

The Australian airport sleeping pods market is also segmented by airport type, including international hubs, domestic terminals, and regional airports. International hubs, particularly Sydney and Melbourne, dominate this segment, accounting for the majority of the market share in 2025. This dominance is attributed to the high footfall of international travelers who require amenities like sleeping pods during long layovers or delayed flights. The demand for sleeping pods is particularly high in terminals with high volumes of connecting international flights, where passengers are looking for ways to rest in between connections.

Competitive Landscape

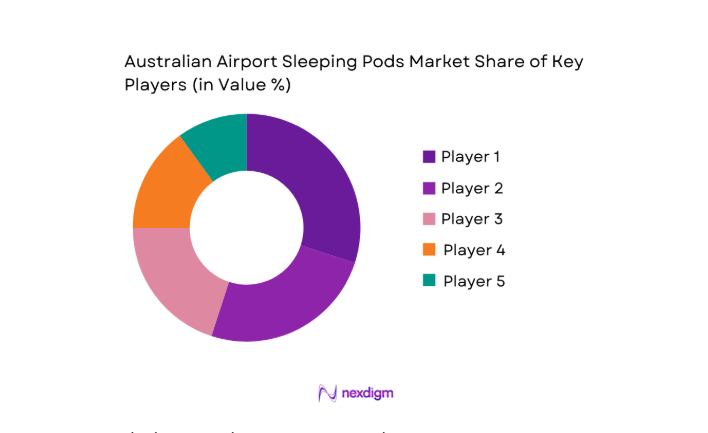

The Australian airport sleeping pods market is competitive, with a few major players dominating the industry. These players include global brands such as YOTEL and Podtime, along with local operators like Airport Sleeping Pods and NapCabs. The market is seeing an influx of both international and regional players who are developing customized solutions for airports in Australia. These companies compete based on factors like pod design, technology integration (e.g., smart pods with IoT), pricing models, and the ability to offer flexible booking systems.

| Company | Establishment Year | Headquarters | Pod Types Offered | Technology Integration | Global Footprint | Revenue Model |

| YOTEL | 2007 | United Kingdom | ~ | ~ | ~ | ~ |

| Podtime | 2012 | United States | ~ | ~ | ~ | ~ |

| Airport Sleeping Pods | 2015 | Australia | ~ | ~ | ~ | ~ |

| NapCabs | 2009 | Germany | ~ | ~ | ~ | ~ |

| Sleepbox | 2010 | United States | ~ | ~ | ~ | ~ |

Australia Airport Sleeping Pods Market Analysis

Growth Drivers

Passenger Transit Hours & Layover Trends

The increase in global passenger traffic directly drives demand for airport sleeping pods, as travelers often experience long transit hours and layovers. In 2024, the Australian airport passenger traffic is expected to exceed ~, with major hubs like Sydney and Melbourne seeing substantial growth in layover durations. The World Bank projects a steady recovery of international air travel post-pandemic, with global air passenger numbers forecasted to reach ~ by 2025. This surge in travel, particularly in major international airports, results in more passengers seeking comfortable spaces to rest during extended layovers. Airports are increasingly focusing on passenger experience, leading to the adoption of services like sleeping pods.

Airport Non‑Aeronautical Revenue Incentives

Australian airports are increasingly seeking non-aeronautical revenue sources, with amenities like sleeping pods being a part of this strategy. According to data from the Australian Government Department of Infrastructure, Transport, Regional Development, and Communications, non-aeronautical revenues accounted for approximately ~ of total airport revenue in 2024. This trend is expected to continue, with airports focusing on improving the passenger experience through value-added services such as sleeping pods. As global airports aim to diversify their income streams, the demand for innovative services like sleeping pods is expected to rise, helping airport operators generate significant revenue beyond ticket sales.

Market Challenges

Terminal Space Constraints & Slot Allocations

One of the main challenges facing the growth of sleeping pods in Australian airports is the limited space in terminals. As major airports in Australia continue to experience congestion due to growing passenger traffic, available real estate for new services like sleeping pods becomes scarce. Sydney Airport, for instance, is operating at near full capacity, with terminal space constraints further exacerbated by ongoing infrastructure projects. This challenge is intensified by competition for terminal space from other essential services like retail and baggage handling. Additionally, slot allocations, particularly at peak hours, may hinder the ability to expand sleeping pod services effectively.

Regulatory Compliance & Safety Standards

The introduction of sleeping pods in airports must comply with strict aviation safety regulations. The Civil Aviation Safety Authority (CASA) in Australia sets stringent guidelines for airport amenities, ensuring they meet safety standards for passenger welfare and fire safety. The integration of smart technology in sleeping pods must adhere to data protection regulations, with recent legislative developments emphasizing cybersecurity for all connected devices. In 2024, CASA’s updated guidelines ensure that sleeping pods must meet safety standards, especially in terms of fire hazards, emergency exits, and ventilation systems, making compliance an ongoing challenge for pod operators.

Market Opportunities

Smart Pod Integrations

The integration of smart technology in sleeping pods presents a significant opportunity for growth in the Australian market. By 2025, IoT-enabled pods that offer features such as smart booking systems, temperature control, and security monitoring are becoming increasingly popular. According to a report from the Australian Government’s Department of Industry, Innovation, and Science, technological integration is key to enhancing the passenger experience and generating new revenue streams. Smart sleeping pods that offer these advanced features have a distinct market advantage, and as technology adoption increases, these pods are expected to meet the growing demand for comfort and convenience among tech-savvy travelers.

Partnerships with Airlines & Loyalty Programs

There is a significant opportunity for growth through partnerships with airlines and loyalty programs. Airlines can offer sleeping pods as part of premium services for their high-value customers, providing them with a restful layover experience. The Australian government’s focus on boosting tourism through strategic partnerships further supports this opportunity. With increasing air traffic and the expansion of frequent flyer programs, airlines are looking for ways to enhance the overall travel experience. According to the International Air Transport Association (IATA), Australian airlines are focused on enhancing passenger services, creating a fertile ground for partnerships between sleeping pod providers and airlines.

Future Outlook

Over the next decade, the Australian airport sleeping pods market is poised for strong growth. The increasing demand for enhanced passenger experiences, particularly during long layovers and delayed flights, is expected to drive the market. Technological innovations, such as the integration of IoT and smart features in sleeping pods, will also play a significant role in the market’s expansion. Additionally, as airport operators increasingly focus on non-aeronautical revenue generation, the demand for services like airport sleeping pods is expected to rise. The introduction of new airports and terminals in the region will further contribute to this growth, offering ample opportunities for both local and international players.

Major Players

- YOTEL

- Podtime

- Airport Sleeping Pods

- NapCabs

- Sleepbox

- GoSleep

- Minute Suites

- Jetquay

- SmartCarte

- ZzzleepandGo

- Restworks

- SmartPods

- MetroNaps

- Capsule Inn

- SnoozeCube

Key Target Audience

- Airport Operators

- Airline Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airport Retailers

- Travel Management Companies

- Airport Design & Infrastructure Development Firms

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying critical market variables that drive the demand for sleeping pods, such as passenger traffic data, airport terminal capacities, and layover durations. This step includes reviewing secondary data from industry sources and conducting interviews with airport authorities.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled, including the adoption rate of sleeping pods, key airports using the service, and usage trends. We evaluate demand in both international and domestic airports to determine where sleeping pods can have the most impact.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses regarding market growth drivers are validated through interviews with airport managers, concessionaires, and pod manufacturers. Expert consultations offer insights into potential market challenges, technological trends, and competitive dynamics.

Step 4: Research Synthesis and Final Output

In the final step, all collected data is synthesized to provide a comprehensive view of the market. This includes validating primary data with secondary research, ensuring an accurate depiction of the market dynamics, and delivering actionable insights.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In‑Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Overview

- Timeline

- Growth Drivers

Passenger Transit Hours & Layover Trends

Airport Non‑Aeronautical Revenue Incentives

Operational Integration - Market Challenges

Terminal Space Constraints & Slot Allocations

Regulatory Compliance & Safety Standards

Capital & Retrofit Costs - Market Opportunities

Smart Pod Integrations

Partnerships with Airlines & Loyalty Programs

Premium & Subscription Services - Industry Trends

Contactless & Sanitization Features

Dynamic Pricing Algorithms

Integration with Airport Passenger Flow Analytics - Government & Regulatory Landscape

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By Unit Deployment, 2020-2025

- By Pricing Models, 2020-2025

- By Product Type (In Value %)

Single‑Occupancy Pods

Shared/Family Pods

Premium Smart Pods

- By Booking Mode (In Value %)

Airport Kiosk Booking

Pre‑book via App/OTA

Airline/Alliance Integrated Booking - By Airport Type (In Value %)

International Hubs

Domestic Terminals

Regional & Remote Airports - By End‑User (In Value %)

Business Travelers

Transit/Connection Travelers

Leisure Travelers

- Market Share of Major Players

- Cross Comparison Parameters (Total Installed Units, Revenue per Deployment Hour, Pod Feature Index, Maintenance & Uptime Ratio, Average Utilization Hours per Month, Concession Revenue Share Percentage)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profile of Major Players

9hours

GoSleep

MetroNaps

Minute Suites

Jetquay

NapCabs

Podtime

Sleepbox

SmartCarte

SnoozeCube

YOTEL

ZzzleepandGo

Restworks

AirportSleepingPods

Local/Australian Startup

- Price Sensitivity Factors

- Utilization Behavior By Segment

- Service Expectations & Feature Preferences

- Channel Preference

- By Value, 2026-2035

- By Unit Deployment, 2026-2035

- By Pricing Models, 2026-2035