Market Overview

The Australian airport snow removal vehicle and equipment market is valued at approximately AUD ~ in 2025. The growth of the market is primarily driven by the increasing demand for efficient snow and ice management at major airports across the country. Snow removal equipment in airports is crucial for ensuring the smooth operation of aviation services during winter months. Factors such as the increasing frequency of snowstorms in Southern Australia, combined with the requirement for operational runways and taxiways, are bolstering the demand for snow removal vehicles. Market drivers include infrastructure investments, technological advancements in snow removal, and government regulations on airport safety standards.

Australia’s major airports, including Sydney Kingsford Smith Airport, Melbourne Tullamarine Airport, and Brisbane Airport, dominate the market for airport snow removal equipment. These cities experience significant international and domestic flight traffic, requiring stringent snow and ice management to ensure safety and minimal disruptions. Sydney, being the most critical international hub in Australia, drives demand due to its international flights that operate throughout the year, regardless of the weather conditions. Melbourne, located in a region that experiences severe winter weather, is another leader in the market, pushing for advanced snow removal systems to maintain airport operations during snow events.

Market Segmentation

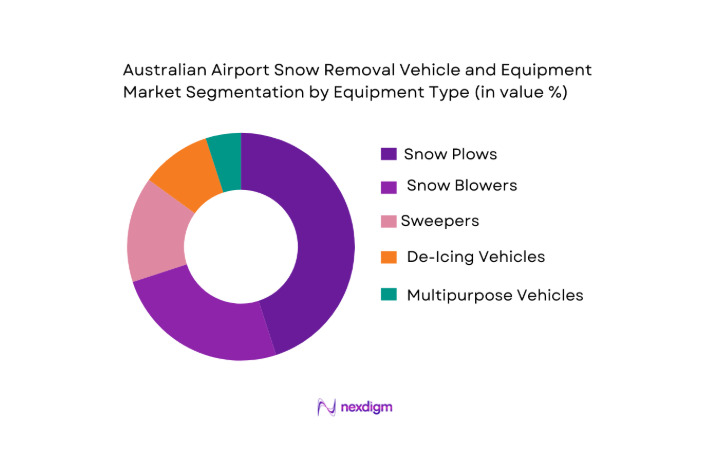

By Equipment Type

The Australian airport snow removal vehicle market is segmented by equipment type into snow plows, snow blowers, sweepers, de-icing vehicles, and multipurpose runway vehicles. Snow plows hold the dominant market share in Australia, primarily due to their proven efficiency in clearing snow from runways, taxiways, and airport aprons. Snow plows are highly valued for their durability, simple operation, and ability to clear large areas quickly, making them a go-to choice for airport authorities. As airports focus on optimizing snow removal processes to ensure minimal disruptions to air traffic, snow plows remain the primary equipment used during winter months.

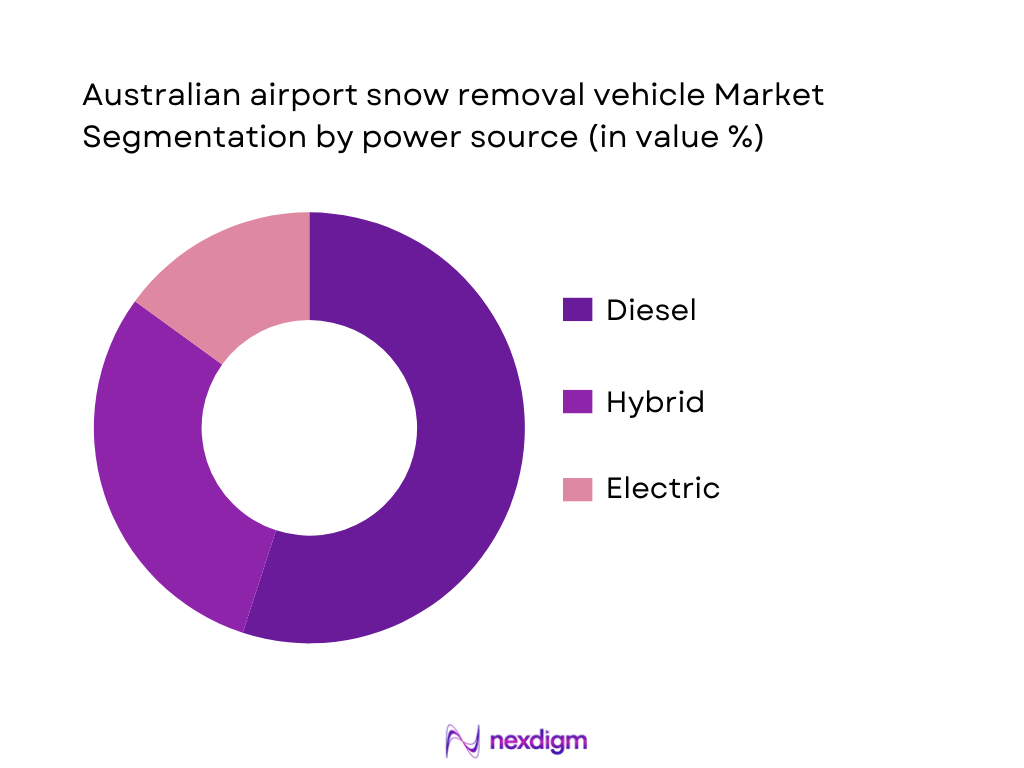

By Power Source

The market is segmented by power source into diesel, hybrid, and electric-powered snow removal vehicles. Diesel-powered snow removal equipment dominates the market in Australia due to its reliability, extensive refueling infrastructure, and strong operational power, making it suitable for heavy-duty snow clearing. Diesel-powered vehicles also have a higher availability and lower initial cost compared to electric or hybrid options. However, with growing environmental concerns and government incentives for reducing carbon emissions, hybrid and electric-powered vehicles are gradually gaining traction, especially in newer airport infrastructure or regions with stricter environmental regulations.

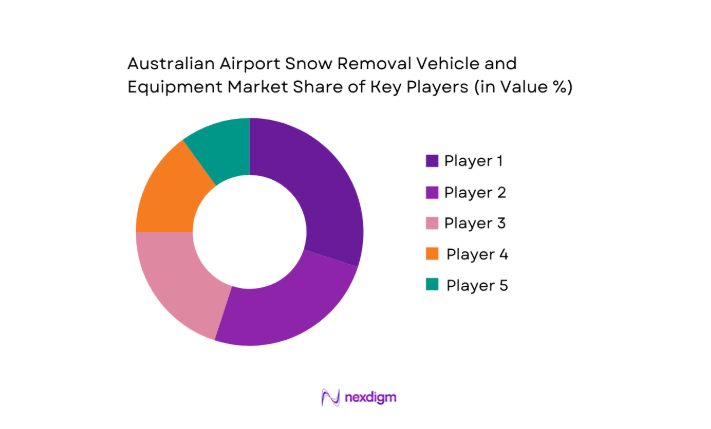

Competitive Landscape

The Australian airport snow removal vehicle market is highly competitive, with several major global and local players providing specialized equipment. Key players include Dulevo International, Alamo Group, Aebi Schmidt, and Bucher Industries. These companies offer a wide range of snow removal equipment such as snow plows, blowers, and de-icing vehicles. The competition is driven by innovation in snow removal technologies, such as the development of electric and hybrid equipment, as well as superior after-sales service and maintenance offerings.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Technology | Market Focus | Annual Revenue | Fleet Size |

| Dulevo International | 1976 | Italy | ~ | ~ | ~ | ~ | ~ |

| Alamo Group | 1835 | USA | ~ | ~ | ~ | ~ | ~ |

| Aebi Schmidt | 1999 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Bucher Industries | 1962 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Oshkosh Corporation | 1917 | USA | ~ | ~ | ~ | ~ | ~ |

Airport Snow Removal Vehicle and Equipment Market Analysis

Growth Drivers

Efficiency

The demand for efficient snow removal systems in Australia is driven by the need to ensure minimal disruptions to air traffic, especially during adverse weather conditions. Airports are focusing on optimizing their snow removal operations, using machines that can clear runways faster and more effectively. The Australian government’s investment in airport infrastructure, particularly for snow-prone areas, supports these efficiency measures. For instance, Sydney Kingsford Smith Airport is investing AUD 500 million into its infrastructure to improve operational efficiency, including upgrading its snow management systems, which directly enhances efficiency in runway snow removal processes. These investments are aligned with the ongoing push for efficiency in the aviation sector.

Runway Clearance SLA

The increasing focus on runway clearance and meeting Service Level Agreements (SLAs) is becoming a key driver for the adoption of advanced snow removal equipment in Australian airports. Snow and ice removal is critical for meeting the operational requirements of the aviation industry, particularly for international airports that need to maintain high operational standards. The Australian Transport Safety Bureau (ATSB) monitors these SLAs, ensuring that airports meet stringent requirements for runway safety during winter months. In fact, Melbourne Tullamarine Airport reported achieving an average runway clearance SLA of 98.7% during winter operations, driving the demand for high-performance snow removal equipment.

Market Challenges

Capital Intensity

The capital intensity of snow removal equipment remains a significant challenge for the Australian airport market. The high initial costs associated with purchasing and deploying snow plows, sweepers, and de-icing equipment can be prohibitive for smaller airports. The Australian Government’s forecast for 2025 indicates that capital expenditure in airport infrastructure, including snow removal systems, is expected to grow at a steady pace, but it continues to be a barrier to entry for some regional airports. While major airports can absorb these costs, smaller regional airports are finding it challenging to secure funds for snow removal equipment, especially in the face of other operational and maintenance priorities.

Maintenance Costs

The maintenance costs of snow removal equipment present a significant challenge for airport operators. Snow removal vehicles, particularly those used in heavy-duty snow clearing, require frequent servicing and maintenance to ensure they remain operational throughout the winter season. The Australian Aviation Authority has noted that routine maintenance for snow clearing vehicles can cost as much as 12% of their original purchase price annually. This burden is especially high for older equipment, which further drives operational costs. With a predicted increase in snow events in regions like Victoria, where maintenance budgets are already stretched thin, these rising costs pose a significant challenge for airports managing their maintenance schedules and budgets.

Opportunities

Electric Fleets

The adoption of electric snow removal vehicles presents a significant opportunity for the Australian airport snow removal market. As part of its climate action goals, Australia is increasingly focusing on reducing emissions across all sectors, including aviation. In 2024, the Australian government announced a funding initiative aimed at supporting airports in adopting electric vehicle fleets, including for snow removal operations. This presents an opportunity for airport authorities to transition to greener alternatives. Electric snow removal vehicles, such as those used at major international airports like Sydney and Melbourne, offer lower operating costs and reduced environmental impact. The demand for electric vehicles is likely to increase, with several airports already integrating these solutions into their long-term environmental strategies.

Digital Runways

The development and implementation of digital runways offer substantial growth potential for the Australian airport snow removal market. Digital runways integrate advanced technologies like sensors, data analytics, and automation to optimize runway management during winter. This trend is particularly beneficial for snow removal, as real-time data can direct snow clearing operations more effectively. Airports such as Sydney Kingsford Smith are investing in digital runway systems, enhancing their ability to manage snow and ice in real time. The Australian Government’s smart infrastructure program, which includes investments in digital runway systems, presents a key opportunity for snow removal companies to capitalize on this technological shift, further improving operational efficiency during adverse weather conditions.

Future Outlook

The Australian airport snow removal vehicle market is set for steady growth in the coming years. The demand for high-efficiency and environmentally-friendly snow removal equipment is increasing as airports invest in newer technology to reduce operational costs and carbon emissions. Over the next decade, technological advancements in autonomous and electric snow removal systems are expected to revolutionize the industry. Government initiatives to reduce the environmental impact of airport operations will likely encourage the adoption of green technology in snow removal vehicles. The market is also expected to witness an increase in hybrid and fully electric snow vehicles as part of a larger shift toward sustainability and energy efficiency in aviation.

Major Players

- Dulevo International

- Alamo Group

- Aebi Schmidt

- Bucher Industries

- Oshkosh Corporation

- Terex Corporation

- Wausau Equipment

- Boschung Group

- Multihog

- John Deere

- SnowEx

- M-B Companies

- Kodiak America LLC

- Kramer-Werke GmbH

- Team Eagle Ltd.

Key Target Audience

- Airport Authorities and Management Teams

- Investment and Venture Capital Firms

- Aviation Equipment Suppliers

- Airport Maintenance and Infrastructure Operators

- Manufacturers of Snow Removal Equipment

- Fleet Management and Service Providers

- Environmental and Sustainability Agencies

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying the key drivers and barriers impacting the Australian airport snow removal vehicle market. It involves desk research and secondary data from credible sources such as government reports, aviation agencies, and market surveys. Key variables such as airport snowfall frequency, equipment purchasing trends, and environmental regulations are analyzed.

Step 2: Market Analysis and Construction

We analyze historical data concerning equipment usage, snow removal efficiency, and regulatory compliance. Market penetration and service provider distribution are reviewed, with a focus on how equipment types have been integrated into airport operations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses will be validated by conducting interviews with key players, including airport operations managers and OEM representatives. Industry expert insights are gathered to refine and validate the market assumptions and refine revenue forecasts.

Step 4: Research Synthesis and Final Output

The final phase includes synthesizing all gathered data to ensure accuracy. Interviews with snow removal equipment manufacturers and after-sales service providers complement the data gathered through the bottom-up approach. The results ensure a robust and comprehensive report of the market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

efficiency

runway clearance SLA

climate variability - Market Challenges

capital intensity

maintenance costs - Opportunities

electric fleets

digital runways - Trends

automation

telematics - Government Regulations & Airport Standards

- SWOT Analysis

- Porter’s Five Forces Analysis

- By value, 2020-2025

- By volume, 2020-2025

- By average selling price, 2020-2025

- By Equipment Type (In Value %)

Snow Plows

Snow Blowers

Sweepers & Rotary Brooms

De‑icing Vehicles - By Power Source (In Value %)

Diesel

Hybrid

Electric - By Airport Type (In Value %)

International Hubs

Domestic/Regional Airports

By Operation Mode (In Value %)

Autonomous/Assisted

Manual - By Service & Support (In Value %)

After‑sales Warranty Coverage

Training & Certification

- Market share of major players

- Cross‑Comparison Parameters(Equipment performance, Fuel/energy efficiency, Technology adoption, Service network density, Regulatory compliance readiness)

- SWOT analysis of key players

- Pricing analysis of major players

- Detailed Profile of Major Players

Dulevo International S.p.A.

Alamo Group Inc.

Aebi Schmidt Holding AG

Bucher Industries AG

Terex Corporation

SnowEx

John Deere

Kramer‑Werke GmbH

Wausau Equipment Company

Boschung Group

Kodiak America LLC

M‑B Companies Inc.

Multihog Limited

Oshkosh Corporation

Team Eagle Ltd.

- Operational uptime requirements

- Total Cost of Ownership

- Airport procurement cycles & budgeting

- Safety & compliance factors

- By value, 2026-2035

- By volume, 2026-2035

- By average selling price, 2026-2035