Market Overview

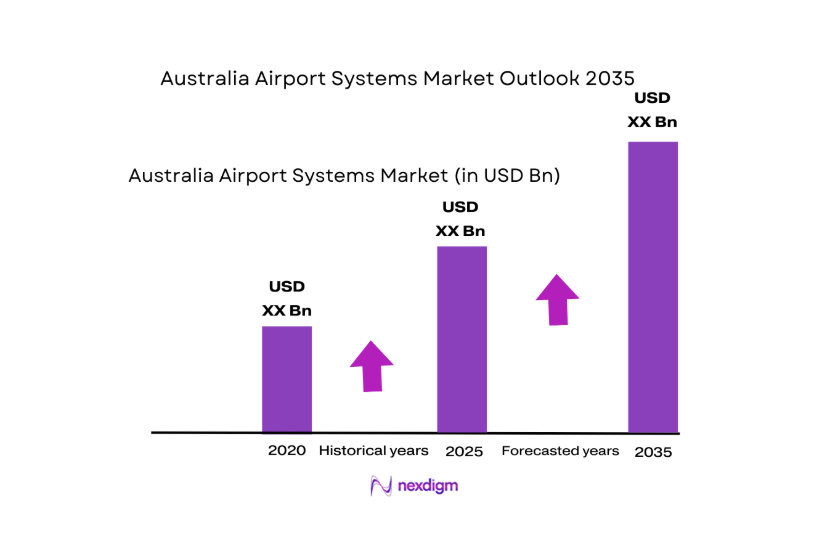

The Australia airport systems market is valued at approximately USD ~. This growth is driven by the increasing passenger traffic and demand for advanced airport technologies, including automation, security screening, and baggage handling systems. Rising passenger throughput, particularly at major airports such as Sydney and Melbourne, is leading to continuous upgrades in infrastructure and technology adoption. Additionally, government initiatives to modernize airport facilities and enhance operational efficiency contribute significantly to market expansion. Technological advancements, including IoT-enabled systems and AI-powered baggage sorting, also play a pivotal role in market growth.

Australia’s major airports, including Sydney Kingsford Smith, Melbourne Tullamarine, and Brisbane Airport, dominate the market due to their higher passenger volumes and global connectivity. Sydney, as the primary international gateway, accounts for a significant share of the market, driven by its large-scale infrastructure projects, such as the automation of baggage handling systems and the introduction of biometric security measures. Melbourne and Brisbane follow closely due to their growing number of international flights, increased demand for advanced passenger screening, and ongoing facility expansions. The government’s focus on improving airport efficiency and ensuring smooth operations further strengthens their dominance.

Market Segmentation

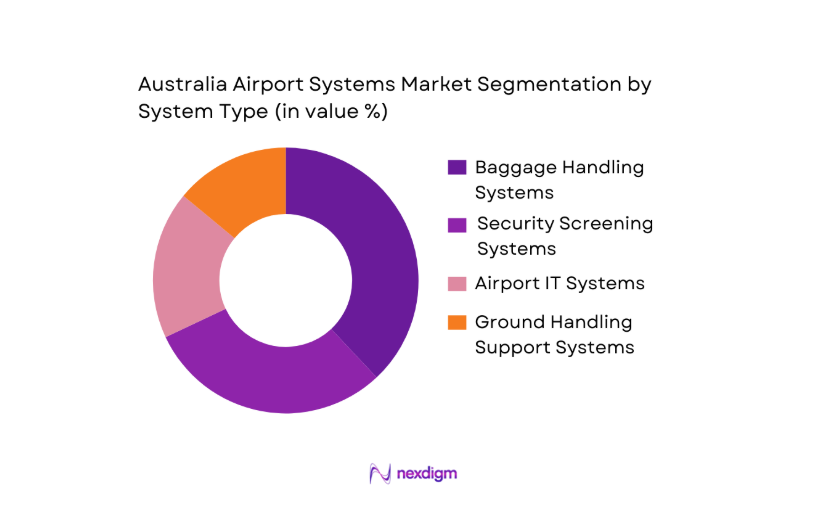

By System Type

The Australian airport systems market is segmented by system type into baggage handling systems, security screening systems, airport IT systems, and ground handling support systems. Baggage handling systems dominate the market due to their critical role in ensuring smooth operations and reducing delays. These systems are becoming increasingly automated, with major airports investing heavily in robotics and AI to handle larger passenger volumes. Automation improves efficiency, reduces the risk of human error, and enhances the passenger experience. Security screening systems are also critical, with heightened safety measures post-9/11 continuing to drive demand for advanced technologies like CT scanners and biometric checks.

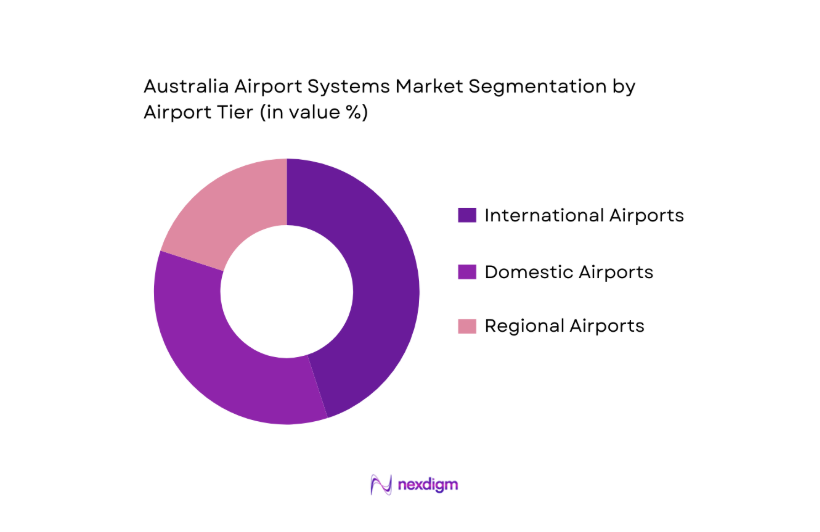

By Airport Tier

The Australian airport systems market is segmented by airport tier into international airports, domestic airports, and regional airports. International airports, such as Sydney and Melbourne, dominate the market due to the scale of their operations and higher investment in advanced technologies. These airports face significant demand for modern baggage systems, security infrastructure, and IT solutions to handle the large volumes of passengers and cargo. Domestic airports and regional airports also contribute to market growth but at a smaller scale, focusing on enhancing efficiency and improving customer experience through smaller, cost-effective solutions.

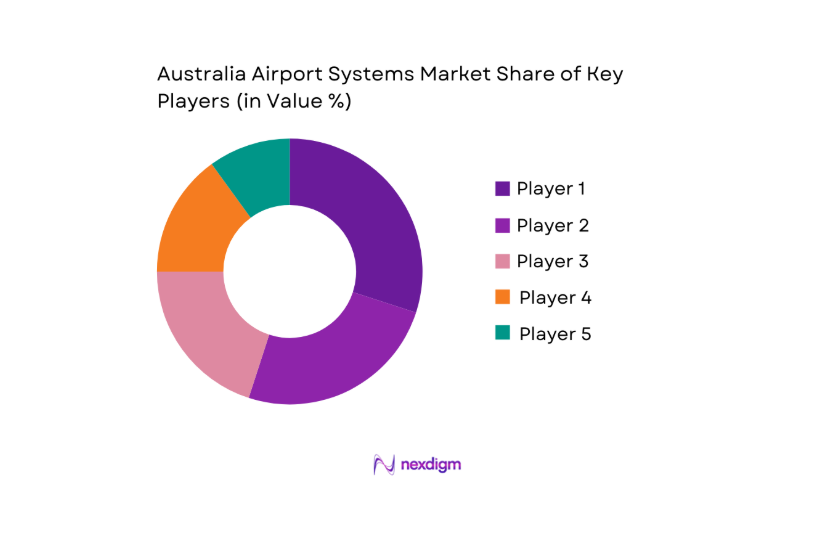

Competitive Landscape

The Australian airport systems market is highly competitive, with several key players operating in different segments of the market. The market is dominated by a few major international players such as Honeywell, Siemens, and Vanderlande, which offer comprehensive solutions ranging from baggage handling systems to airport security technologies. These companies lead the market by leveraging strong brand presence, technological innovation, and extensive distribution networks.

| Company Name | Year Established | Headquarters | Product Portfolio | Market Focus | Technological Innovation | Service Support | Regional Presence |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| Siemens Mobility | 1847 | Germany | ~ | ~ | ~ | ~ | ~ |

| Vanderlande Industries | 1955 | Netherlands | ~ | ~ | ~ | ~ | ~ |

| SITA | 1949 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Amadeus IT Group | 1987 | Spain | ~ | ~ | ~ | ~ | ~ |

Australia Airport Systems Market Analysis

Growth Drivers

Rising Passenger & Cargo Throughput

The Australian airport system market is heavily driven by the consistent rise in passenger and cargo throughput across major airports. According to the Australian Government Department of Infrastructure, Transport, Regional Development, and Communications, Australia’s airports experienced a ~ increase in total passenger traffic in 2024, with over ~ domestic and international passengers handled across major hubs like Sydney and Melbourne. Moreover, Australia’s freight traffic is forecast to reach ~ tons by 2025, marking a steady recovery and growth post-pandemic. These increases in both passenger and cargo throughput significantly fuel the demand for enhanced airport systems and technological upgrades to manage higher volumes.

Modernization & Digital Transformation Mandates

The Australian Government’s push for modernization through digital transformation is a key growth driver for the market. The country’s aviation sector, valued at over AUD~ in 2024, is witnessing major investment in digital infrastructures such as automated security systems and self-check-in kiosks. This growth is in line with the government’s 2024 mandate to improve airport efficiency through technology integration. The Australian Infrastructure Audit indicates that the government has allocated an estimated AUD ~ for the modernization of airport infrastructure by 2026, which includes investments in AI-powered security systems, baggage handling automation, and IoT-driven operational solutions.

Market Challenges

Legacy Infrastructure Integration Costs

One of the major challenges in the Australian airport systems market is the high costs associated with integrating new technology into legacy airport infrastructure. According to a 2024 report from the Australian Airports Association, ~ of airports still rely on outdated baggage handling systems and legacy check-in technology. The cost to upgrade these systems is substantial, with integration efforts often requiring airport operators to bear millions of dollars in capital expenditure. Additionally, outdated IT infrastructure limits the ability to integrate new technologies seamlessly, further raising costs and extending timelines for modernizing airport operations.

Skilled Talent Constraints & Operational Disruption Risks

The shortage of skilled talent in airport operations and systems integration is another major challenge faced by the Australian airport systems market. As per the Australian Bureau of Statistics (ABS), the unemployment rate for the ICT sector remained at ~ in 2023, indicating a shortage of qualified personnel to support the growing technological advancements in the aviation sector. With airports looking to adopt AI-driven baggage systems, biometric screenings, and advanced security solutions, there is a growing need for specialized engineers and IT professionals. The lack of talent can lead to operational disruptions and delays in the implementation of critical systems, further affecting market growth.

Market Opportunities

Smart & Biometric Airport Solutions

Smart and biometric technologies present significant growth opportunities in the Australian airport systems market. Australia’s push for contactless and seamless travel experiences, especially in major airports like Sydney and Melbourne, is driving demand for biometric solutions. With over ~ passengers in Australia opting for biometric screening in 2024, the market for biometric gates and facial recognition systems is expected to expand rapidly. These technologies not only enhance security but also improve operational efficiency. Airports are increasingly investing in AI-powered systems that can process passenger data in real-time, reducing wait times and enhancing the customer experience.

Predictive Analytics & Operational Optimization

Predictive analytics and operational optimization are pivotal opportunities for growth within the Australian airport systems market. According to the Australian Airports Association, airports have begun to invest heavily in data analytics to optimize baggage handling and ground operations. In 2025, Sydney Airport implemented an AI-based predictive analytics tool to forecast peak travel times, enabling better resource allocation and staff scheduling. This investment is expected to boost operational efficiency and significantly reduce delays. With airport systems generating more data than ever, there is a massive opportunity to leverage predictive analytics for proactive decision-making, further enhancing airport performance and reducing costs.

Future Outlook

Over the next decade, the Australia airport systems market is expected to show significant growth, driven by the continuous expansion of major airports, rising passenger demand, and the ongoing push for automation and digital transformation. Advancements in AI, machine learning, and IoT technology will lead to smarter, more efficient airports. Government investment in infrastructure and sustainability initiatives, such as the electrification of airport ground support equipment, will further fuel market growth. The demand for seamless, frictionless passenger experiences, including biometric and facial recognition systems, is expected to significantly boost technology adoption across airports.

Major Players

- Honeywell International Inc.

- Siemens Mobility

- Vanderlande Industries B.V.

- SITA

- Amadeus IT Group

- NEC Corporation

- Thales Group

- Collins Aerospace

- Rockwell Collins

- Swissport International AG

- TAV Airports / Groupe ADP

- Qantas Engineering

- dnata

- Frequentis AG

Key Target Audience

- Airport Operators

- Airlines

- Airport Technology Providers

- Government Agencies

- Aviation Regulatory Bodies

- Investment and Venture Capital Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Australian airport systems market. This includes airport operators, technology providers, system integrators, and regulatory bodies. The research will focus on identifying and defining the critical variables, such as technology adoption, market growth drivers, and infrastructure development.

Step 2: Market Analysis and Construction

This phase will include compiling historical data on airport operations, passenger throughput, and technology investments. Market penetration analysis will be conducted to assess the rate of technology adoption across various system types, including baggage handling and security systems.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about the market’s growth and key drivers will be validated through interviews with industry experts, such as airport operators, OEMs, and regulatory authorities. These consultations will help refine market assumptions and improve the accuracy of forecasts.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with major players in the airport systems market to verify and complement findings gathered through previous phases. This engagement will provide insights into product segments, technological innovations, and market strategies, ensuring the accuracy of the overall market analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Rising passenger & cargo throughput

Modernization & digital transformation mandates

Security & compliance mandates - Market Challenges

Legacy infrastructure integration costs

Skilled talent constraints & operational disruption risks

Regulatory complexity in safety certification - Market Opportunities

Smart & biometric airport solutions

Predictive analytics & operational optimization

Electrification of support fleets

System integration with national airspace management - Trends

AI‑driven predictive baggage sorting

Smart gates & frictionless travel adoption - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By value, 2020-2025

- By installed systems volume, 2020-2025

- By average pricing, 2020-2025

- By System Type (In Value %)

Baggage Handling Systems

Security & Passenger Screening Systems

Airport IT & Management Systems

Ground Handling & Support Systems - By Deployment Mode (In Value %)

Greenfield airports

Brownfield enhancements - By Airport Infrastructure Tier (In Value %)

Major international hubs

Domestic connectors

Regional airports - By Technology Adoption (In Value %)

AI & Machine Learning‑Enabled

IoT & sensors‑based

Legacy systems - By Procurement Channel (In Value %)

Direct OEM Contracts

System Integrators / Consortiums

- Market Share of Major Players

- Cross Comparison Parameters (Market Focus, Regional Footprint, Installed Base, Tech Innovation Score, After‑Sales Service & Support, Compliance Certification, Sustainability Solutions)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Players

Honeywell International Inc.

Smiths Detection Ltd.

Vanderlande Industries B.V.

SITA

Amadeus IT Group

NEC Corporation

Thales Group

Rockwell Collins

Siemens Mobility

CGI Inc.

Qantas Engineering

Swissport International AG

dnata

TAV Airports / Groupe ADP

Frequentis AG

- Total Cost of Ownership of airport systems

- Lifecycle support & maintenance cost expectations

- SLA / performance benchmarks

- Regulatory compliance & interoperability requirements

- By value, 2026-2035

- By volume, 2026-2035

- By average pricing, 2026-2035