Market Overview

The Australian airport terminal operations market is valued at approximately USD ~ in 2025. This market is primarily driven by the resurgence in passenger traffic, increasing airline operations, and expanding terminal infrastructure. The demand for streamlined passenger services, improved security measures, and technological advancements like biometric systems and automated baggage handling systems have played significant roles in market growth. Additionally, strong investments in non-aeronautical revenues, including retail and parking services, are driving overall market expansion. According to the Australian Bureau of Infrastructure and Transport, the country saw a robust growth in passenger throughput, increasing from ~ in 2023 to an expected ~ in 2024.

The cities of Sydney, Melbourne, and Brisbane dominate the Australian airport terminal operations market due to their status as the country’s primary international and domestic gateways. Sydney and Melbourne, being the busiest airports in terms of passenger traffic, account for a large portion of the market share. The expansion of terminals at Sydney Kingsford Smith and Melbourne Tullamarine airports is driven by growing international tourism and the necessity to accommodate higher passenger volumes. Furthermore, Brisbane Airport is emerging as a major hub for both domestic and international flights, benefitting from state-of-the-art terminal operations and technological advancements aimed at improving passenger experience.

Market Segmentation

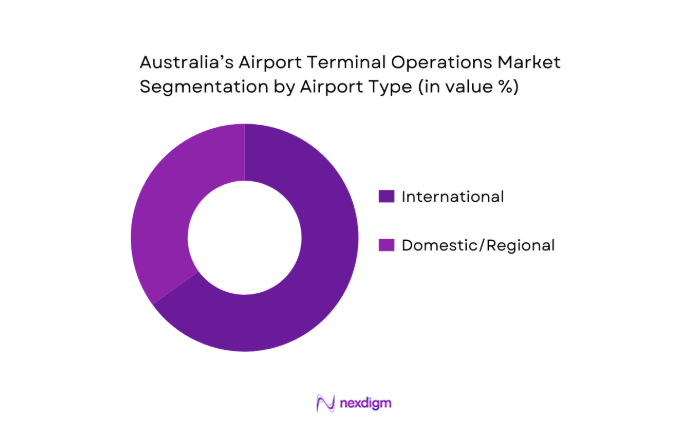

By Airport Type

Australia’s airport terminal operations market is divided into two primary categories: international airports and domestic/regional airports. Among these, international airports dominate the market in terms of revenue generation. International airports such as Sydney and Melbourne handle a significant portion of the passenger traffic and benefit from higher aeronautical revenues due to long-haul flights and international connections. Additionally, international terminals often have more complex and diversified service offerings, including luxury retail, premium lounges, and specialized services for international passengers. The growing number of international tourists and the increase in global air travel are key factors that contribute to the dominance of international airports in the market.

By Service Category

The market is further segmented into aeronautical and non-aeronautical services. Non-aeronautical services, such as retail concessions, parking, and airport lounges, are the dominant segment, accounting for approximately ~ of the total market share in 2024. This dominance is due to the increasing consumer spending at airport retail stores, food and beverage outlets, and the growing demand for premium services like fast track security and lounge access. International travelers, in particular, contribute significantly to this segment. The rise of the duty-free shopping experience, as well as exclusive service offerings for business and first-class passengers, has spurred the growth of non-aeronautical services, which now outpaces traditional aeronautical revenues.

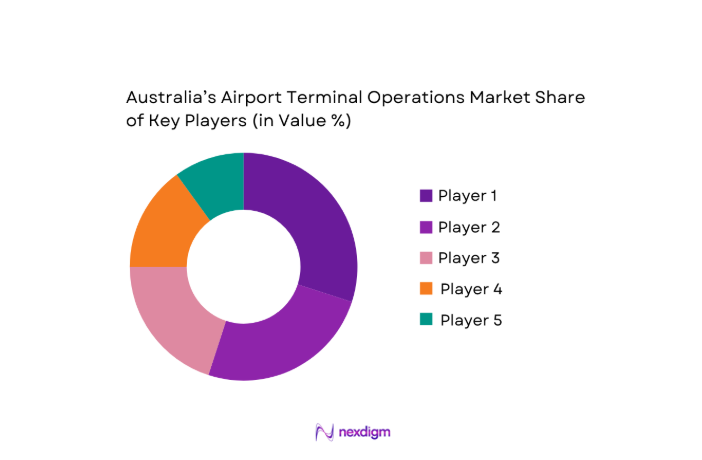

Competitive Landscape

The Australian airport terminal operations market is dominated by a few key players, with major airports like Sydney, Melbourne, and Brisbane setting the tone for industry growth. These players are deeply invested in enhancing operational efficiencies, improving passenger experience, and incorporating cutting-edge technology into terminal operations. Sydney Airport Corporation, Melbourne Airport, and Brisbane Airport Corporation are at the forefront, benefiting from strong regulatory frameworks, substantial investments in infrastructure, and partnerships with global aviation and retail players. The competition primarily revolves around the ability to offer enhanced customer experience, operational efficiency, and diversified revenue streams.

| Company Name | Establishment Year | Headquarters | Passenger Throughput | Annual Revenue (2024) | Terminal Size (m²) | Technological Advancements | Customer Satisfaction Rating | Sustainability Score |

| Sydney Airport Corporation | 1936 | Sydney, Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Melbourne Airport | 1970 | Melbourne, Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Brisbane Airport Corporation | 1988 | Brisbane, Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Adelaide Airport | 1955 | Adelaide, Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Perth Airport | 1997 | Perth, Australia | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Airport Terminal Operations Market Analysis

Growth Drivers

Passenger Traffic Recovery & Growth

Passenger traffic in Australian airports is on the rise, fueled by the recovery from the COVID-19 pandemic. Australia experienced a resurgence in air travel, with total passenger numbers expected to hit ~ by 2024. According to the Australian Bureau of Infrastructure and Transport, domestic passenger traffic in Australia was up by ~ in 2023 compared to the previous year. International traffic also grew substantially, with an increase of over ~ in 2023. The return of international tourism, alongside government efforts to boost aviation capacity, is expected to drive steady growth in passenger traffic, particularly in major hubs like Sydney, Melbourne, and Brisbane.

Terminal Modernization & Biometric Adoption

As passenger volumes rise, Australian airports are investing heavily in modernization efforts. One notable trend is the widespread adoption of biometric technologies. In 2023, the Australian Government allocated ~ for infrastructure upgrades across key airports. For instance, Sydney and Melbourne airports have integrated biometric technologies for enhanced security and faster processing times. These upgrades help airports to manage the increasing flow of passengers, reduce queues, and enhance the overall passenger experience. In 2024, Melbourne Airport announced the completion of its biometric check-in system, which now processes over 10,000 passengers daily, boosting operational efficiency.

Market Challenges

Capacity Constraints & Peak Congestion

Australia’s airports are experiencing growing congestion during peak travel periods, especially at major hubs like Sydney and Melbourne. The Sydney Kingsford Smith Airport, for example, has reported that during peak hours, the terminal is operating at ~ of its optimal capacity, causing delays and longer wait times for passengers. This congestion is exacerbated by rising passenger numbers and limited physical infrastructure. The Australian Government has committed to addressing these challenges through various expansion projects, but in the short term, capacity constraints are expected to continue affecting operational efficiency and customer satisfaction.

Capital Intensity & Funding Models

Infrastructure expansion in Australian airports requires significant capital investment. The cost of upgrading and modernizing terminal facilities, including baggage handling systems, check-in kiosks, and biometric security systems, has been a major challenge. In 2023, the Australian Government reported that the aviation sector requires an estimated $~ in investment by 2030 to meet growing demand. This high capital intensity, coupled with fluctuating demand for air travel, has created challenges for airports in securing funding. Public-private partnerships and innovative funding models are being explored to address these financial constraints.

Market Opportunities

Contactless Journeys & AI‑Based Terminal Management

With the rising demand for contactless travel, AI-based terminal management systems are gaining momentum in Australian airports. The adoption of contactless technologies, such as mobile check-ins and self-service kiosks, is becoming essential in minimizing physical contact while improving operational efficiency. Sydney Airport, for example, has invested in AI-driven passenger flow management systems that help forecast and manage the movement of passengers. By 2024, over ~ of international travelers at major airports will be using contactless technologies. This shift towards seamless, contactless travel offers a significant growth opportunity for airport operators, allowing them to reduce operational costs and improve the passenger experience.

Premium Passenger Services & Loyalty‑Linked Revenue

Premium services, including business class lounges, priority security checks, and concierge services, are becoming a key revenue driver for Australian airports. With international tourism on the rise, the demand for high-end passenger services is also growing. Melbourne and Sydney airports have increasingly focused on upgrading their premium lounges, with investments aimed at offering personalized services and comfort. In 2023, Sydney Airport expanded its premium services, resulting in a ~ increase in loyalty-linked revenue. As global air travel continues to grow, the premium services segment is expected to become a significant contributor to the revenue mix of Australian airports.

Future Outlook

The Australian airport terminal operations market is poised for substantial growth in the next decade, driven by technological advancements, improved infrastructure, and the ongoing recovery in air travel demand. Over the next five years, the market is expected to expand further with continued investments in automation, self-service systems, and enhanced security measures. These innovations will streamline passenger processing, reduce operational costs, and increase revenue generation through advanced non-aeronautical services. Additionally, the increasing adoption of biometric systems, AI, and IoT technology in airport operations will significantly improve the customer experience and operational efficiency, making Australian airports more competitive on a global scale.

Major Players

- Sydney Airport Corporation

- Melbourne Airport

- Brisbane Airport Corporation

- Adelaide Airport

- Perth Airport

- Qantas Airways Limited

- Virgin Australia Airlines

- Menzies Aviation

- dnata Australia

- Swissport Australia

- Collins Aerospace

- SITA

- Vanderlande Industries

- Amadeus IT Group

- Aeroports de Paris Group

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airport Operations Managers

- Airport Ground Handling Services Providers

- Airline Operations Executives

- Retail and Concessions Providers

- Technology Providers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the core drivers and metrics that shape the airport terminal operations market, such as passenger throughput, revenue segmentation, terminal size, and service category growth. Comprehensive desk research helps in gathering insights from secondary sources like government reports, industry publications, and proprietary databases.

Step 2: Market Analysis and Construction

The second phase compiles historical data from multiple airports across Australia, evaluating variables such as aeronautical vs non-aeronautical revenue, passenger satisfaction scores, technological adoption, and capacity constraints. This information is then structured into clear market insights.

Step 3: Hypothesis Validation and Expert Consultation

To refine market models, we consult with industry experts, including airport management, regulatory bodies, and technology providers. These expert interviews validate hypotheses and provide granular insights into operational practices and market trends.

Step 4: Research Synthesis and Final Output

The final research output involves synthesizing all collected data, including insights from airports, airlines, and technology firms. Detailed financial analyses are conducted to estimate market sizes and growth rates, ensuring that the final report delivers a comprehensive overview of the Australian airport terminal operations market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Industry Context

- Timeline

- Growth Drivers

Passenger Traffic Recovery & Growth

Terminal Modernization & Biometric Adoption

Digital Queueing & Real‑Time Ops Platforms - Market Challenges

Capacity Constraints & Peak Congestion

Capital Intensity & Funding Models

Integration of Legacy Systems - Opportunities

Contactless Journeys & AI‑Based Terminal Management

Premium Passenger Services & Loyalty‑Linked Revenue

Aerotropolis & Intermodal Access Enhancements - Trends

Smart Terminals & Predictive Analytics

Green Terminals & Sustainability KPIs

Private Sector Terminal Management Models - Government & Regulatory Framework

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By Terminal Throughput, 2020-2025

- By Average Yield, 2020-2025

- By Airport Type (In Value %)

Primary International Gateways

Secondary & Regional Airports - By Service Category (In Value %)

Passenger Handling

Baggage Handling & Screening

Retail & F&B Terminal Concessions - By Revenue Stream (In Value %)

Aeronautical

Non‑Aeronautical - By Terminal Technology Adoption (In Value %)

Biometric & Self‑Service Systems

Real‑Time Operations Control - By Passenger Category (In Value %)

Domestic

International

Transit / Transfer

- Market Share by Revenue

- Cross‑Comparison Parameters (Passenger Throughput, Aeronautical Yield, Retail Revenue per Pax, Terminal Service Level, Technology Adoption Index)

- SWOT Analysis of Key Players

- Pricing & Fee Structure Analysis

- Major Players

Sydney Airport Corporation

Melbourne Airport

Brisbane Airport Corporation

Perth Airport Pty Ltd

Adelaide Airport Ltd

Qantas Airport Services

Virgin Australia Ground Operations

Swissport Australia

Menzies Aviation

Aeroports de la Cote d’Azur Operations

Amadeus Airport IT Solutions

SITA Airport Management Systems

Collins Aerospace Terminal Systems

Vanderlande Airport Logistics

- Impact of Pax Experience Scores on Choice of Airline/Terminal

- Terminal Delay & Dwell Time Sensitivity

- Influence of Ancillary Offerings on Spend per Passenger

- Role of Intermodal Access Quality

- By Value, 2026-2035

- By Terminal Throughput, 2026-2035

- By Average Yield, 2026-2035