Market Overview

The Australia airport thermal camera market is valued at approximately USD ~ million in 2025. The growth of this market is primarily driven by the increasing demand for security and monitoring solutions in Australia’s airports, especially with the rise in passenger traffic and evolving security standards. Thermal cameras are critical in enhancing security protocols, particularly for non-intrusive temperature screening and surveillance. Government investments in upgrading airport infrastructure and enhancing public safety further fuel the adoption of advanced surveillance systems such as thermal cameras in airports across the country.

Australia is a dominant player in the thermal camera market within the Asia-Pacific region due to its well-established aviation sector and robust airport infrastructure. Cities like Sydney, Melbourne, and Brisbane are key centers for the adoption of advanced security technologies. As major international airports, they have the infrastructure and regulatory support to implement thermal camera systems for passenger screening, particularly after the pandemic heightened the need for health monitoring solutions. The Australian government’s commitment to enhancing airport security and public health safety ensures continued market growth in the region.

Market Segmentation

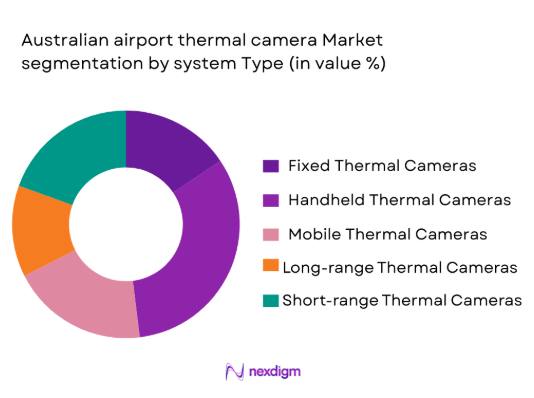

By System Type

The Australian airport thermal camera market is segmented by system type, including handheld thermal cameras, fixed thermal cameras, mobile thermal cameras, long-range thermal cameras, and short-range thermal cameras. Among these, fixed thermal cameras dominate the market due to their widespread use in airport terminals for continuous monitoring. These cameras provide real-time surveillance and temperature detection, making them ideal for screening large crowds at critical points, such as entrances and security checkpoints. The increasing emphasis on maintaining constant surveillance for safety and health checks, especially post-pandemic, has cemented the dominance of fixed thermal cameras in the market.

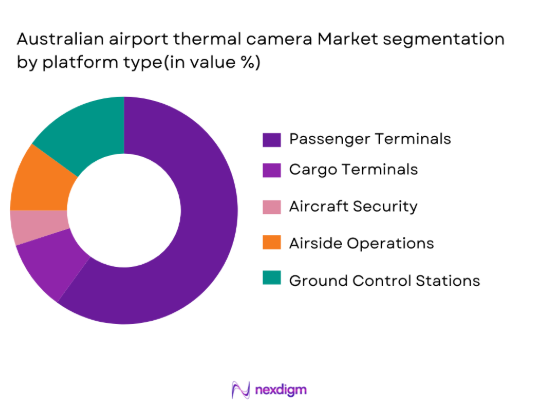

By Platform Type

The market is also segmented by platform type, which includes passenger terminals, cargo terminals, aircraft security, airside operations, and ground control stations. Passenger terminals account for the largest market share due to the heightened focus on safety and security in public spaces. The growing number of passengers traveling through Australian airports and the need for non-invasive, efficient security measures have driven the demand for thermal camera systems in these terminals. Thermal cameras are crucial for detecting elevated body temperatures, ensuring that passengers are screened for potential health risks before boarding or entering terminals.

Competitive Landscape

The Australia airport thermal camera market is dominated by a few key players who provide cutting-edge thermal imaging solutions tailored to airport security needs. Companies like FLIR Systems, Axis Communications, Bosch Security Systems, and Honeywell International are at the forefront of the market. These companies offer advanced thermal camera solutions that cater to a wide range of airport security requirements, from passenger screening to perimeter surveillance. Their strong market presence, along with continuous product innovation, gives them a competitive edge in Australia’s rapidly evolving airport security landscape.

| Company Name | Establishment Year | Headquarters | Product Offering | Market Reach | Innovation Focus | Major Partnerships | Revenue | Product Quality | R&D Investment | Certifications |

| FLIR Systems | 1978 | United States | – | – | – | – | – | – | – | – |

| Axis Communications | 1984 | Sweden | – | – | – | – | – | – | – | – |

| Bosch Security Systems | 1886 | Germany | – | – | – | – | – | – | – | – |

| Honeywell International | 1906 | United States | – | – | – | – | – | – | – | – |

| Vivotek | 2000 | Taiwan | – | – | – | – | – | – | – | – |

Australia Airport Thermal Camera Market Dynamics

Growth Drivers

Increasing Focus on Passenger Safety and Security Driving Demand for Thermal Camera Systems at Airports

Passenger safety and security have been key priorities for Australian airports, particularly post-pandemic. In response, Australian airports, including Sydney, Melbourne, and Brisbane, have increasingly adopted advanced surveillance technologies, such as thermal cameras, to monitor passenger flow and detect potential health risks like elevated body temperature. As the Australian Government focuses on safeguarding public health and safety, the demand for thermal camera systems has escalated, reflecting broader trends in global aviation security enhancements. In 2023, the Australian government allocated AUD 8 billion for improving airport infrastructure and security systems, increasing the demand for sophisticated monitoring solutions.

Expansion of Airport Infrastructure and Modernization Initiatives Increasing the Need for Surveillance Systems

Australia’s airports are undergoing significant infrastructure expansions and modernization initiatives, further driving the demand for advanced security systems, including thermal cameras. The Australian Government’s 2023-2024 budget includes an allocation of AUD 2.1 billion for modernizing airport terminals and upgrading airside security operations across major airports. This expansion, particularly at Melbourne and Sydney airports, is expected to handle growing passenger volumes, necessitating the deployment of modern surveillance systems to ensure safety and efficiency. The push for smart airports in Australia directly boosts the demand for advanced thermal imaging systems, integral to modern airport security operations.

Market Challenges

High Initial Investment Cost of Thermal Camera Systems for Smaller Airports

One of the primary challenges in the Australian airport thermal camera market is the high initial investment required for advanced thermal camera systems, particularly for smaller regional airports. Smaller airports in Australia often face budget constraints when it comes to implementing advanced security technologies. Thermal cameras, which can cost up to AUD 50,000 per unit depending on the system, may be considered too costly for airports with limited funds or low passenger traffic. Despite the long-term benefits of improved safety and compliance with international regulations, the upfront cost remains a significant barrier for many smaller operators, limiting widespread adoption across all Australian airports.

Integration Complexities with Existing Airport Surveillance Infrastructure

The integration of thermal camera systems with existing airport surveillance infrastructure can be a complex and costly process. Many Australian airports, particularly those built decades ago, utilize legacy systems that were not designed to accommodate modern thermal imaging technology. In 2023, Sydney and Melbourne airports faced significant challenges in upgrading their infrastructure to integrate thermal cameras with their current security systems. These integration issues often lead to delays in the deployment of new technologies and can increase the total cost of installation and maintenance. Airports must ensure that their existing surveillance infrastructure is compatible with modern thermal camera systems to maximize operational efficiency and maintain security standards.

Market Opportunities

Growing Adoption of Smart Airports in Australia, Creating Demand for Advanced Surveillance Systems

The push towards smart airports in Australia presents a significant growth opportunity for the airport thermal camera market. With an increasing number of airports implementing smart technologies to improve efficiency and passenger experience, the demand for advanced surveillance systems is expected to grow. In 2023, the Australian government allocated funding for the development of smart technologies at major airports, including automatic security checkpoints and advanced screening solutions, which incorporate thermal camera systems. The growing adoption of smart airports will further fuel the demand for high-quality surveillance systems that can support automated security and passenger monitoring systems, positioning the market for continued growth.

Increased Passenger Flow Post-Pandemic, Necessitating More Advanced Safety and Monitoring Equipment

The return of increased passenger traffic post-pandemic is creating greater demand for advanced monitoring and safety systems, such as thermal cameras, at Australian airports. According to the International Air Transport Association (IATA), the number of international passengers traveling through Australian airports is expected to surpass pre-pandemic levels in 2024, with growth driven by both domestic and international travel. This surge in passenger volume presents an opportunity for thermal camera manufacturers to provide solutions that can handle larger flows of people while maintaining high levels of security and health safety. With elevated temperature screening becoming a standard health check, demand for thermal cameras is expected to grow.

Future Outlook

Over the next decade, the Australian airport thermal camera market is expected to experience robust growth. The demand for advanced security systems, particularly thermal cameras, is driven by the increasing need for non-contact temperature screening and enhanced surveillance in public areas. As Australia’s airports continue to modernize their infrastructure and implement advanced technology to comply with global safety standards, the adoption of thermal cameras is likely to increase. In addition, the growing focus on health safety in light of global health challenges presents a significant opportunity for continued growth in the thermal camera market in Australia.

Major Players

- FLIR Systems

- Axis Communications

- Bosch Security Systems

- Honeywell International

- Vivotek

- Dahua Technology

- Hikvision

- Thermoteknix Systems

- L3Harris Technologies

- Seek Thermal

- Teledyne FLIR

- Raytheon Technologies

- Unify

- InfraTec GmbH

- Panasonic Corporation

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airport Authorities

- Airlines

- Airport Security Services

- Ground Handling Services

- Military and Defense Contractors

- System Integrators and MRO Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key stakeholders within the Australia airport thermal camera market. This includes manufacturers, airport authorities, and government bodies responsible for airport security standards. Research will focus on defining the variables that influence market demand, particularly in the context of evolving security and health screening requirements.

Step 2: Market Analysis and Construction

In this phase, historical data will be compiled to assess the current market dynamics. We will analyze data on thermal camera adoption rates in Australian airports, security needs, and government initiatives driving technology investments. This phase aims to create a foundational understanding of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested through consultations with key industry experts. These experts will include representatives from airport authorities, manufacturers, and security services, providing insights into the operational and technological challenges in airport security.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the gathered data and producing a comprehensive market report on the Australian airport thermal camera market. This will include analysis of key growth drivers, market segmentation, competitive dynamics, and future trends, ensuring a complete and accurate representation of the market’s potential.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing focus on passenger safety and security driving demand for thermal camera systems at airports.

Expansion of airport infrastructure and modernization initiatives increasing the need for surveillance

systems.

Government policies and investments in smart airport technology to improve security systems. - Market Challenges

High initial investment cost of thermal camera systems for smaller airports.

Integration complexities with existing airport surveillance infrastructure.

Regulatory hurdles related to the certification of thermal camera systems for airport security use. - Market Opportunities

Growing adoption of smart airports in Australia, creating demand for advanced surveillance systems.

Increased passenger flow post-pandemic, necessitating more advanced safety and monitoring equipment.

Technological advancements in thermal cameras offering opportunities for enhanced capabilities in security. - Trends

Integration of AI and machine learning with thermal camera systems to enhance security monitoring.

Rising use of non-contact temperature screening solutions at airports due to health safety concerns.

Development of more compact and cost-effective thermal camera solutions for broader airport deployment.

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Handheld Thermal Cameras

Fixed Thermal Cameras

Mobile Thermal Cameras

Long-range Thermal Cameras

Short-range Thermal Cameras - By Platform Type (In Value%)

Passenger Terminals

Cargo Terminals

Aircraft Security

Airside Operations

Ground Control Stations - By Fitment Type (In Value%)

Linefit

Retrofit

Aftermarket

OEM Channels

Maintenance and Overhaul - By End User Segment (In Value%)

Airlines

Airport Authorities

Airport Security Services

Customs and Border Protection

Ground Handling Services - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Aftermarket Suppliers

Government Procurement

Airport Tendering Process

Online Retail

- Market Share Analysis

- Cross Comparison Parameters (Product Innovation, Market Reach, Supply Chain Efficiency, Regulatory Compliance, Technological Leadership)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

FLIR Systems

Axis Communications

Bosch Security Systems

Honeywell International

Vivotek

InfraTec GmbH

Dahua Technology

Uniview

L3Harris Technologies

Zebra Technologies

Hikvision

Thermoteknix Systems

Irisity AB

Bosh Security and Safety Systems

Seek Thermal

- Airports seeking advanced monitoring and security solutions to manage increasing passenger traffic.

- Airlines investing in cutting-edge security technologies for better passenger experience and safety.

- Government bodies focusing on modernizing airport security infrastructure.

- Ground service providers seeking efficient, accurate, and non-invasive security equipment.

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035