Market Overview

The Australia antenna transducer and radome market is projected to experience substantial growth, with the market size based on recent assessments estimated at approximately USD ~ million. This growth is fueled by the increasing demand for advanced communication systems, particularly in aerospace, telecommunications, and defense sectors. Factors such as technological advancements in antenna and radome design, alongside the expansion of 5G networks, are key drivers of this market. Additionally, rising military expenditure and demand for high-performance communication systems for both commercial and defense applications are anticipated to further propel market growth.

Australia remains a dominant player in this market, largely due to its strong industrial base in the aerospace and defense sectors. The country’s strategic position within the Asia-Pacific region, coupled with significant investments in infrastructure and technology, drives this dominance. Furthermore, Australian cities such as Sydney and Melbourne benefit from robust communication and manufacturing capabilities, ensuring steady market demand. The government’s emphasis on defense modernization and technological innovation also supports Australia’s leadership, making it a hub for antenna, transducer, and radome production.

Market Segmentation

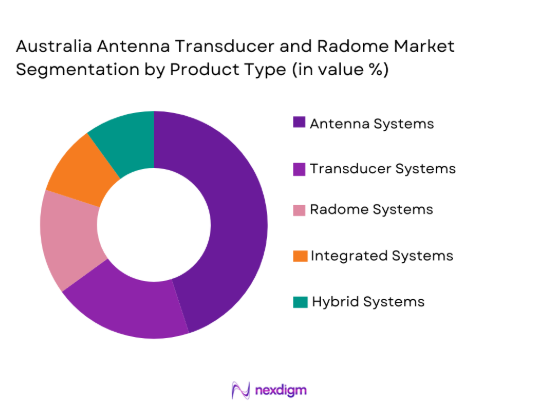

By Product Type

Australia antenna transducer and radome market is segmented by product type into antenna systems, transducer systems, radome systems, integrated systems, and hybrid systems. Recently, the antenna systems sub-segment has a dominant market share due to the growing demand for high-performance communication networks and advanced aerospace technologies. Antennas are critical for ensuring efficient communication in sectors like telecommunications, defense, and aerospace. Their versatility in both military and commercial applications, along with the rising adoption of 5G and satellite communication systems, has made antenna systems the most sought-after segment in the market.

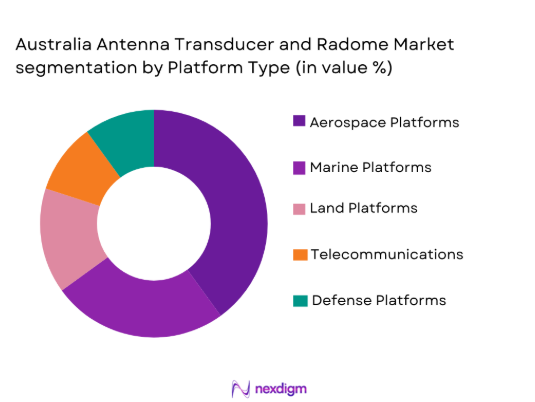

By Platform Type

The Australia antenna transducer and radome market is segmented by platform type into aerospace platforms, marine platforms, land platforms, telecommunications platforms, and defense platforms. The aerospace platforms sub-segment has gained significant traction, largely driven by the increased demand for satellite communication systems and defense applications. The expansion of commercial aerospace, especially with the integration of advanced radomes and antenna systems in aircraft, has propelled the dominance of aerospace platforms. This demand is driven by both the military’s modernization efforts and the commercial sector’s need for robust communication systems for air traffic control and in-flight connectivity.

Competitive Landscape

The competitive landscape of the Australia antenna transducer and radome market is characterized by a few major players who dominate the market through their technological innovations, global reach, and extensive product offerings. Companies in this market focus on continuous research and development to enhance product performance and cater to the growing demand for advanced communication systems in aerospace, defense, and telecommunications sectors. The influence of these major players is further amplified by strategic partnerships and collaborations with government bodies and key industries, driving consolidation in the sector.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1993 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Viasat | 1986 | Carlsbad, USA | ~

|

~

|

~

|

~

|

~

|

| Cobham | 1934 | Dorset, UK | ~

|

~

|

~

|

~

|

~

|

| L3 Technologies | 2018 | New York, USA | ~

|

~

|

~

|

~

|

~

|

Australia Antenna Transducer and Radome Market Analysis

Growth Drivers

Defense Modernization and Technological Advancements

One of the key growth drivers for the Australia antenna transducer and radome market is the ongoing defense modernization initiatives, particularly in the areas of secure communication systems and advanced radar technologies. As part of its strategic defense plans, Australia continues to invest heavily in enhancing its military capabilities, particularly in aerospace and maritime domains. The Australian government has committed significant resources to upgrading its defense infrastructure, which includes state-of-the-art communication systems, radar technologies, and surveillance equipment, all of which heavily rely on high-performance antenna and radome systems. As military operations become more network-centric, the demand for secure and reliable communication systems has surged, driving the need for advanced antennas and radomes that can function seamlessly in demanding environments. Moreover, defense platforms, including fighter jets, naval vessels, and unmanned systems, require cutting-edge, lightweight, and highly durable antenna systems to ensure that they can operate effectively in diverse, extreme conditions.

Growth in Aerospace and Space-Enabled Infrastructure

Another significant growth driver for the Australia antenna transducer and radome market is the expanding aerospace and space-enabled infrastructure, spurred by both commercial and governmental investments. Australia’s strategic geographic location in the Asia-Pacific region, with its vast remote areas and oceanic borders, makes it a prime candidate for both space communication and advanced aerospace systems. The increasing demand for satellite communication, both for national defense and commercial use, has directly contributed to the demand for advanced antenna systems and radomes. These components are integral in ensuring efficient communication for satellite systems, which are used in everything from telecommunications to weather forecasting, disaster management, and environmental monitoring. Australia’s growing satellite communication infrastructure supports the booming demand for high-bandwidth, high-frequency antenna systems, especially in regions that are not easily accessible through traditional communication networks. Additionally, the commercial space sector has also seen rapid growth, with several private space exploration and satellite operators increasing their presence in the region. As the country looks to establish itself as a key player in space technology and satellite communication systems, the need for specialized antenna and radome systems is intensifying.

Market Challenges

High Manufacturing Costs and Production Complexity

One of the primary challenges facing the Australia antenna transducer and radome market is the high manufacturing costs and the complexity involved in producing these advanced components. Antennas and radomes, particularly those designed for defense and aerospace applications, require specialized materials and manufacturing processes, which make them costly to produce. The materials used in radomes, such as composites and ceramics, are expensive, and their procurement is subject to fluctuations in global supply chains. Additionally, the production of high-performance antennas requires precise engineering and the integration of advanced technologies, such as phased-array systems and multi-band functionality. These factors drive up production costs, making it difficult for manufacturers to scale production or achieve economies of scale. The complexity of the manufacturing process is compounded by the need to meet strict regulatory and performance standards, particularly for military-grade products. Each component must undergo rigorous testing for electromagnetic compatibility, durability, and environmental resistance, which adds to the time and cost of production.

Regulatory Compliance and Certification Challenges

Another significant challenge in the Australia antenna transducer and radome market is navigating the complex regulatory landscape and ensuring compliance with various certification requirements. Antennas and radomes, particularly those used in defense, aerospace, and telecommunications applications, must meet stringent regulations set by national and international bodies. These regulations ensure that the products are safe, reliable, and capable of functioning in harsh environmental conditions. However, the compliance process for these components is time-consuming and costly. Manufacturers must go through extensive testing procedures, including electromagnetic compatibility (EMC) tests, environmental durability assessments, and certification for specific frequencies and bandwidths. Moreover, as technologies evolve, regulatory standards often change, requiring companies to continuously update their products to remain compliant. For example, the increasing demand for 5G and satellite communication systems requires antennas and radomes to meet specific standards related to high-frequency bands and minimal signal interference. These evolving requirements can delay product development and increase costs, particularly for smaller companies that may lack the resources to stay up-to-date with shifting regulations. Additionally, export controls and international trade agreements can complicate the manufacturing and distribution of these components, especially when dealing with sensitive defense-related products.

Opportunities

Expansion of 5G Infrastructure and Its Impact on Antenna Systems

The ongoing rollout of 5G infrastructure presents a significant opportunity for the Australia antenna transducer and radome market, with an increasing demand for high-performance communication systems across urban and remote regions. As telecommunications companies continue to expand their 5G networks, the need for specialized antenna systems capable of handling high-frequency bands, such as millimeter waves, becomes critical. Antenna systems are fundamental to 5G’s success, ensuring faster data speeds, greater network capacity, and more reliable connections, particularly in densely populated areas where demand for data services is highest. With 5G technology expected to drive advancements in various sectors including healthcare, automotive, and industrial automation, the market for antenna transducers and radomes will see an uptick as these systems become integral to next-generation devices and communication networks. The growing need for small-cell antennas, which are essential for extending coverage and capacity in urban environments, presents a lucrative opportunity for manufacturers. Furthermore, the transition to 5G in both urban and remote areas of Australia requires the development of robust and adaptable radomes to ensure signal integrity and network stability. These radomes must be designed to withstand harsh environmental conditions while maintaining minimal interference, further propelling demand for specialized products.

Growth in Satellite Communication and Space Exploration Initiatives

The expanding satellite communication market and growing interest in space exploration provide a prime opportunity for the Australia antenna transducer and radome market. With Australia’s significant investment in satellite-based communication, particularly for defense, remote sensing, and scientific applications, the demand for advanced antenna systems and radomes is expected to rise sharply. As the country aims to enhance its satellite infrastructure to support everything from telecommunications to national security, companies providing high-performance antenna solutions are poised for growth. The growing reliance on satellite networks for global connectivity, especially in remote and underserved regions, creates an increasing need for robust, reliable communication systems capable of withstanding the challenges of space and extreme environments. Additionally, the increasing use of Low Earth Orbit (LEO) satellites for broadband services presents unique opportunities for specialized antenna designs that can handle the complexities of satellite tracking, beamforming, and high-frequency communications. Australian space agencies, as well as private space exploration ventures, are continuously seeking advanced technologies that can facilitate long-range communication and data transmission. The growing emphasis on space exploration, satellite internet services, and global positioning systems (GPS) creates substantial demand for advanced antennas and radomes that ensure the efficient operation of space communication infrastructure.

Future Outlook

Over the next five years, the Australia antenna transducer and radome market is expected to continue its growth trajectory, driven by advancements in communication technologies, particularly 5G and satellite networks. The increasing demand for secure and high-performance communication systems across aerospace, defense, and telecommunications sectors will fuel market expansion. Regulatory support and government investments in infrastructure and defense modernization will further strengthen the market’s position. Technological innovations in antenna materials and radome design are anticipated to play a key role in driving the adoption of these systems, making them more efficient and cost-effective for a wide range of applications.

Major Players

- Thales Group

- Raytheon Technologies

- Viasat

- Cobham

- L3 Technologies

- Lockheed Martin

- BAE Systems

- Northrop Grumman

- Honeywell

- Harris Corporation

- Rockwell Collins

- Airbus

- General Electric

- Rohde & Schwarz

- ViaSat

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Aerospace and telecommunications companies

- Satellite service providers

- Commercial airlines

- Research and development institutions

- Antenna and radome manufacturers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the primary variables that influence the market, such as technological advancements, consumer demand patterns, and regulatory changes. These variables are critical in understanding market dynamics and predicting future trends. Industry reports, government publications, and expert consultations are used to gather data. Key market segments and their drivers are also mapped during this stage to ensure comprehensive market analysis.

Step 2: Market Analysis and Construction

In this step, extensive market data from both primary and secondary sources is analyzed. This involves assessing historical market trends, current performance, and future projections. Data is collected through surveys, interviews, and market intelligence reports, providing a solid foundation for constructing market models. These models are used to project the market size, growth, and segmentation patterns based on real-world factors.

Step 3: Hypothesis Validation and Expert Consultation

Once initial hypotheses regarding market drivers and trends are formed, they are validated through expert consultations and industry feedback. This validation process involves discussions with market experts, key stakeholders, and thought leaders to refine assumptions. The insights gathered help in fine-tuning the market models and ensure the research reflects the most accurate and up-to-date industry perspectives.

Step 4: Research Synthesis and Final Output

After data collection, analysis, and validation, the research findings are synthesized into a comprehensive report. This includes actionable insights, market forecasts, and a detailed examination of the market’s dynamics. The final output is structured to provide a clear understanding of the market’s current state and future outlook. The research is presented with clarity, highlighting key findings that can inform strategic decision-making for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Radome Design

Increased Military Expenditure

Rising Demand for High-Speed Data Networks

Growth of Aerospace and Defense Sectors

Surge in IoT and Connected Devices - Market Challenges

High Manufacturing Costs

Complexity of System Integration

Lack of Skilled Workforce

Supply Chain Disruptions

Government Regulations & Trade Barriers - Market Opportunities

Expansion of 5G Networks

Emerging Markets for Aerospace Platforms

Collaborations for Smart Antenna Technologies - Trends

Rise in Lightweight Antenna Materials

Advancements in Antenna Miniaturization

Integration of Antennas with Smart Technologies

Growth in Autonomous Vehicles and Their Antenna Needs

Adoption of C-band and Ka-band Systems - Government Regulations & Defense Policy

National Defense Policy Reforms

Aerospace and Defense Industry Subsidies

Environmental Regulations for Materials - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Antenna Systems

Transducer Systems

Radome Systems

Integrated Systems

Hybrid Systems - By Platform Type (In Value%)

Aerospace Platforms

Marine Platforms

Land Platforms

Telecommunications Platforms

Defense Platforms - By Fitment Type (In Value%)

Original Equipment Manufacturer (OEM)

Aftermarket Fitment

Upgraded Fitment

Retrofit Fitment

Modular Fitment - By EndUser Segment (In Value%)

Commercial Aviation

Military & Defense

Telecommunications

Maritime

Automotive - By Procurement Channel (In Value%)

Direct Procurement

Distributors & Retailers

Online Platforms

Government Procurement

OEM Partnerships - By Material / Technology (In Value %)

Composite Materials

Metallic Materials

Smart Materials

Ceramic Materials

Advanced Plastics

- Market share snapshot of major players

- Cross Comparison Parameters (Price, Quality, System Complexity, Customer Service, Innovation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Thales Group

General Electric

L3 Technologies

Raytheon Technologies

Cobham

Viasat

Hexagon AB

Harris Corporation

Rohde & Schwarz

Antenna Products Corporation

AeroVironment

MTU Aero Engines

Northrop Grumman

Honeywell

Elbit Systems

- Increased Adoption in Commercial Aviation

- Military & Defense Sector Expansion

- Telecom Sector Demand for Advanced Antenna Systems

- Automotive Sector Emphasis on Connectivity

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035