Market Overview

The market for anti-ship missile systems in Australia is experiencing significant growth, driven by increasing defense spending and the need to bolster maritime security. Based on a recent historical assessment, the market size is expanding as defense agencies prioritize modernization and strengthening of naval capabilities. Technological advancements, such as the development of hypersonic missiles and precision-guided systems, are also playing a major role in this growth. These trends are supported by increased investment in defense infrastructure and military preparedness, ensuring that missile systems continue to evolve to meet emerging threats. The Australian defense budget continues to see significant investments, contributing to the ongoing expansion of the sector.

Australia’s dominance in the anti-ship missile systems market is primarily driven by the country’s strategic location in the Indo-Pacific region, with its proximity to key maritime trade routes. This geopolitical significance makes Australia a critical player in regional defense. The nation’s emphasis on strengthening its naval forces has led to extensive procurement of advanced missile systems. Key defense partnerships with global powers such as the United States and European nations, as well as local defense initiatives, have cemented Australia’s position as a leader in military technology innovation. Additionally, its commitment to modernizing its naval fleets and investing in defense infrastructure further enhances its dominant role in the market.

Market Segmentation

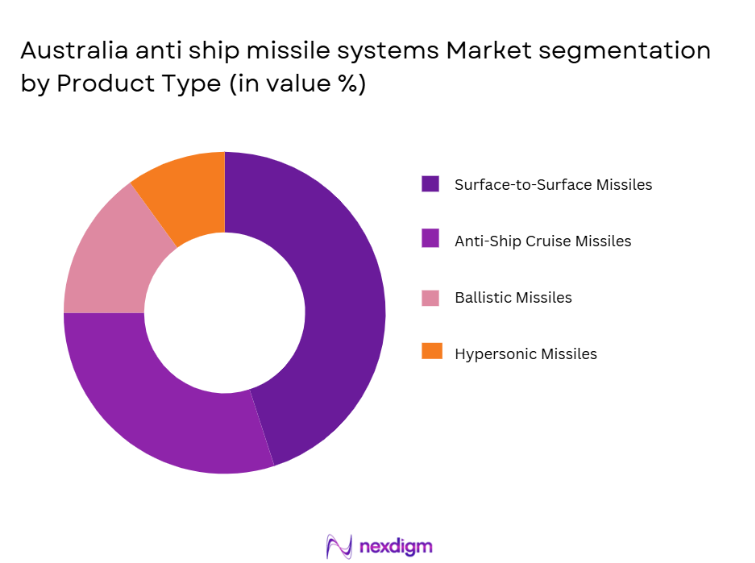

By Product Type

The anti-ship missile systems market is segmented by product type into surface-to-surface missiles, anti-ship cruise missiles, ballistic missiles, and hypersonic missiles. Recently, the surface-to-surface missile sub-segment has dominated the market share due to increased demand for versatile, long-range weaponry suitable for defense against a variety of maritime threats. These systems are favored for their ability to cover large distances with high accuracy, making them a preferred choice for Australia’s defense forces. Technological advancements, cost efficiency, and ease of integration into existing military platforms contribute significantly to their dominance in the market.

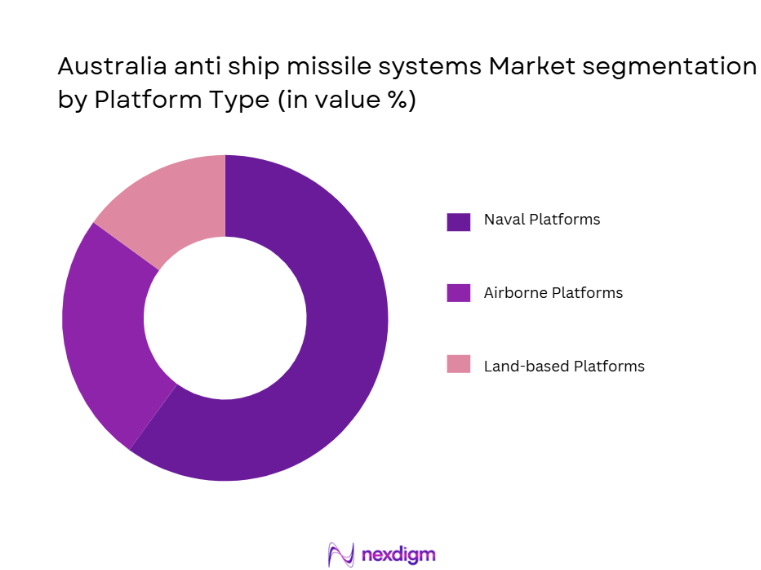

By Platform Type

The market is segmented by platform type into naval platforms, airborne platforms, and land-based platforms. Naval platforms, particularly warships and submarines, dominate this segment, as they provide the necessary mobility and firepower for launching anti-ship missiles effectively. The high demand for naval defense solutions, combined with advanced missile system integration, has solidified naval platforms as the key driver in this market segment. Additionally, the Australian government’s focus on expanding its naval capabilities has directly contributed to the demand for anti-ship missile systems deployed on these platforms.

Competitive Landscape

The competitive landscape of the Australian anti-ship missile systems market is characterized by strong industry consolidation, with several key global defense contractors actively participating in the sector. Major players include companies with a strong focus on advanced missile technologies, particularly those specializing in hypersonic and cruise missile systems. These companies continue to innovate and develop new solutions to meet the evolving demands of modern warfare. Collaborative efforts between local and international defense firms are also becoming increasingly common, facilitating the development of cutting-edge technology and providing a competitive edge to market leaders.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Key Partnerships |

| Lockheed Martin | 1995 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1995 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| MBDA | 2001 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Saab | 1989 | Gothenburg, Sweden | ~ | ~ | ~ | ~ | ~ |

Australia Anti Ship Missile Systems Market Analysis

Growth Drivers

Rising demand for modernized naval capabilities

The increasing focus on modernizing naval fleets is a key growth driver for the anti-ship missile systems market in Australia. As regional security dynamics evolve, Australia is prioritizing the development and procurement of advanced missile systems to maintain strategic defense superiority. The expansion of military budgets and the shift toward high-tech defense solutions have accelerated the demand for cutting-edge missile technology. Australia’s naval forces are increasingly relying on these advanced systems to strengthen maritime defense against both traditional and emerging threats, including regional power shifts and maritime territorial disputes. Furthermore, international collaborations with countries like the United States and European defense agencies are driving innovations in missile technologies, providing Australian defense forces with access to state-of-the-art equipment. This increasing demand for highly accurate, long-range anti-ship missiles is expected to continue fueling growth in the sector. Additionally, advancements in autonomous and hypersonic technologies are expected to significantly boost demand for next-generation missile systems. Australia’s growing focus on integrating missile systems into naval platforms is also contributing to the rise in procurement and adoption of anti-ship missile systems.

Technological advancements in missile systems

Another significant growth driver for the anti-ship missile systems market is the rapid technological advancements being made in missile development. Innovations in hypersonic missile technology, along with improvements in radar systems, guidance systems, and propulsion technologies, have significantly enhanced the performance of anti-ship missiles. These technological developments allow for greater accuracy, speed, and range, making missile systems more effective against advanced threats. Australia is investing heavily in cutting-edge technologies, positioning itself as a key player in the development of next-generation missile systems. The country’s defense industry is increasingly focused on creating missile systems with improved maneuverability and precision, as well as systems capable of overcoming advanced countermeasures. As technology continues to improve, anti-ship missile systems are becoming more efficient and cost-effective, allowing Australia to expand its military capabilities and better protect its maritime interests. The ongoing focus on innovation in missile technology is thus expected to continue driving growth in the anti-ship missile systems market.

Market Challenges

High operational and maintenance costs

One of the primary challenges facing the anti-ship missile systems market in Australia is the high operational and maintenance costs associated with these advanced systems. Developing, deploying, and maintaining sophisticated missile systems requires significant investments in infrastructure, training, and ongoing support. These costs can place a financial burden on defense budgets, especially as Australia continues to expand its naval defense capabilities. The need for highly trained personnel, advanced technological systems, and ongoing research and development efforts to maintain missile systems adds to the overall operational costs. Moreover, the integration of new technologies into existing defense platforms often requires extensive modifications, further raising the cost of deployment. While the effectiveness of these systems is critical for national defense, the high costs present a significant barrier, limiting the pace at which the Australian defense forces can expand their anti-ship missile capabilities.

Geopolitical tensions and export restrictions

Geopolitical tensions in the Indo-Pacific region also pose a challenge to the Australian anti-ship missile systems market. Increasing territorial disputes and naval confrontations in the region are driving demand for advanced defense technologies. However, these geopolitical dynamics often lead to export restrictions and trade limitations, particularly when it comes to sensitive missile technology. Australia’s defense industry faces the challenge of navigating these restrictions, which can impact the supply chain and limit access to key technologies. Additionally, stringent regulatory environments imposed by international trade agreements and defense treaties make it difficult to maintain a steady flow of missile systems and components. These challenges complicate procurement processes and may delay the deployment of new missile technologies, thereby impacting market growth. With the evolving security landscape, it is essential for Australia to carefully balance its defense needs with its international commitments, which presents an ongoing challenge for the anti-ship missile systems market.

Opportunities

Expansion of international defense partnerships

A significant opportunity for the Australian anti-ship missile systems market lies in the expansion of international defense partnerships. As Australia seeks to enhance its naval defense capabilities, it is increasingly engaging in collaborative defense programs with key international partners, such as the United States, the United Kingdom, and regional allies in the Indo-Pacific. These partnerships provide access to advanced missile technology, enhance operational capabilities, and improve integration with allied forces. By participating in joint defense initiatives, Australia can benefit from shared knowledge, cost-effective production, and the development of next-generation missile systems. These collaborations are also vital in addressing emerging threats in the region, including anti-access/area denial (A2/AD) strategies, ensuring that Australia remains competitive in the global defense landscape. Expanding these defense collaborations also opens opportunities for Australian manufacturers to contribute to international missile systems projects, driving innovation and providing a competitive advantage in global markets.

Growing focus on hypersonic missile technology

The growing focus on hypersonic missile technology presents a unique opportunity for the Australian anti-ship missile systems market. Hypersonic missiles, known for their high speed and maneuverability, offer a significant strategic advantage in countering emerging threats. Australia is actively investing in the research and development of hypersonic technologies to enhance its missile defense systems. These missiles, capable of traveling at speeds greater than five times the speed of sound, can penetrate even the most advanced defense systems. As global demand for hypersonic missile technologies rises, Australia’s defense industry has an opportunity to lead in the development and deployment of these advanced systems. By advancing hypersonic missile capabilities, Australia can bolster its defense position in the region and gain a technological edge over potential adversaries. The ability to deploy hypersonic anti-ship missiles will also significantly improve Australia’s naval capabilities, ensuring that it remains a formidable force in the Indo-Pacific.

Future Outlook

The future outlook for the Australian anti-ship missile systems market is promising, with growth expected to continue over the next five years. The increasing focus on enhancing defense capabilities, particularly in response to growing geopolitical tensions in the Indo-Pacific region, will drive demand for advanced missile technologies. Technological developments in hypersonic and cruise missile systems will play a crucial role in shaping the future of the market. Additionally, growing international collaborations and defense partnerships will provide access to cutting-edge technologies, facilitating innovation and strengthening Australia’s naval forces. As the demand for more sophisticated and versatile missile systems increases, Australia is well-positioned to remain a key player in the global anti-ship missile systems market.

Major Players

- Lockheed Martin

- BAE Systems

- Raytheon Technologies

- MBDA

- Saab

- Northrop Grumman

- Kongsberg Gruppen

- Leonardo

- Thales Group

- Rafael Advanced Defense Systems

- General Dynamics

- Boeing Defense

- L3 Technologies

- Harris Corporation

- Huntington Ingalls Industries

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military forces

- Defense contractors

- National defense ministries

- Defense equipment manufacturers

- Research and development organizations

- Aerospace and defense investors

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the critical variables that drive the market, such as technological advancements, defense budgets, and geopolitical factors. This includes understanding the factors that influence market size and growth trends.

Step 2: Market Analysis and Construction

This step involves analyzing data from multiple sources to build a comprehensive picture of the current market landscape. Market segmentation and trend analysis are conducted to identify the main drivers and challenges in the anti-ship missile systems market.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations with industry specialists and defense analysts are conducted to validate assumptions and hypotheses regarding market trends, challenges, and growth drivers. This includes discussions with key players in the defense industry.

Step 4: Research Synthesis and Final Output

After collecting data and consulting experts, the final report is synthesized, drawing conclusions based on the research findings. The output includes detailed analysis and recommendations tailored to the Australian anti-ship missile systems market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense spending

Rising maritime security concerns

Technological advancements in missile systems - Market Challenges

High operational costs

Regulatory constraints on defense exports

Complex integration requirements - Market Opportunities

Growing demand for modernized missile defense systems

Advancements in missile precision targeting

Collaborative defense programs with allied nations - Trends

Shift toward autonomous and AI-powered systems

Increased investment in hypersonic missile technology

Adoption of multi-role and flexible missile systems - Government Regulations

Export control regulations on missile technologies

Compliance with international defense agreements

Domestic defense industry standards

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Surface-to-Surface Missiles

Surface-to-Air Missiles

Anti-Ship Cruise Missiles

Ballistic Missiles

Hypersonic Missiles - By Platform Type (In Value%)

Naval Platforms

Land-based Platforms

Airborne Platforms

Hybrid Platforms

Submarine Platforms - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Upgrade Fitment - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Research Institutions

Private Contractors - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Purchases

International Sales

Defense Collaborations

- Market Share Analysis

- CrossComparison Parameters (Cost of Development, Technological Advancements, Government Support, International Trade Policies, Competitive Pressure)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

BAE Systems

Raytheon Technologies

Northrop Grumman

Thales Group

Rafael Advanced Defense Systems

Navantia

Leonardo

Saab

Kongsberg Gruppen

Boeing Defense

General Dynamics

MBDA

L3 Technologies

Huntington Ingalls Industries

- Government and Defense Agencies

- Military Forces

- Defense Contractors

- Research and Development Organizations

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035