Market Overview

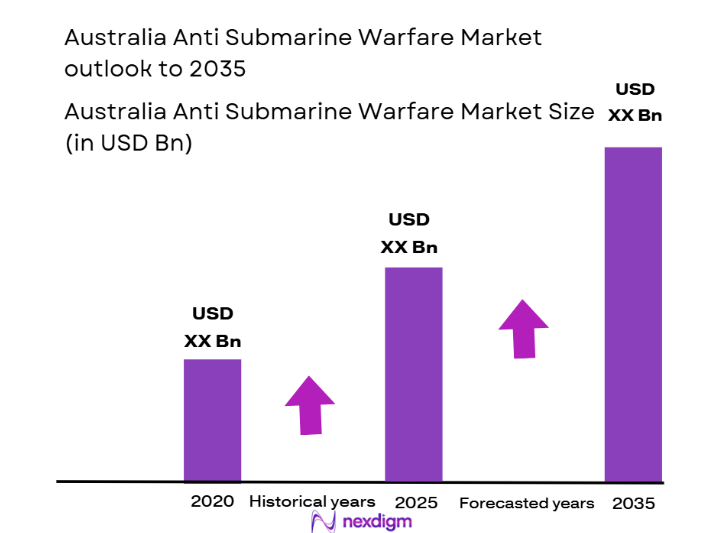

The anti-submarine warfare market is valued at approximately USD ~ billion, driven by significant advancements in defense technology and rising global defense budgets. As military spending increases, governments are investing heavily in next-generation anti-submarine systems such as sonar, torpedoes, and surveillance equipment to enhance maritime security. The growing geopolitical tensions and the need for superior naval capabilities have led to substantial demand for anti-submarine systems. These investments support the market’s expansion by prioritizing the modernization of naval fleets and enhancing defensive capabilities.

Countries such as the United States, Russia, China, and key European nations dominate the market, owing to their large naval forces and considerable defense budgets. Their dominance is driven by the strategic importance of securing maritime routes and the extensive development of anti-submarine technologies. These nations have established strong research and development infrastructure, supporting continuous innovation in sonar and detection systems. Their military strategies and industrial capabilities allow them to lead the way in developing cutting-edge anti-submarine solutions.

Market Segmentation

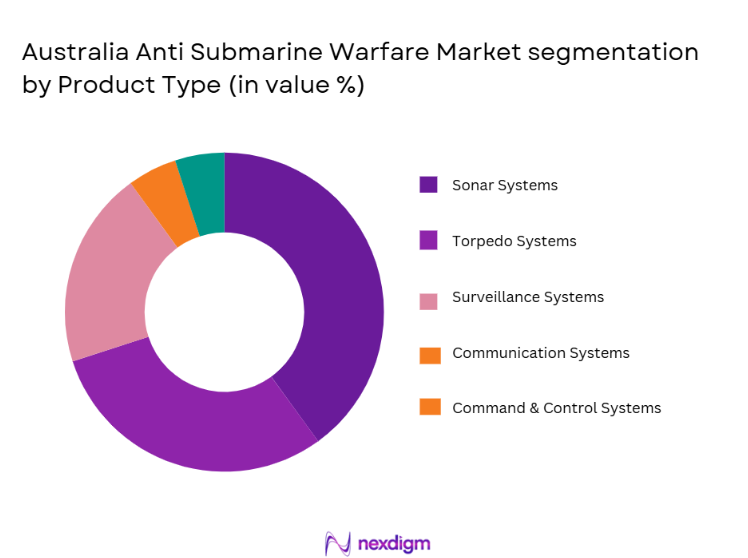

By Product Type

The market is segmented by product type into sonar systems, torpedo systems, and surveillance systems. Sonar systems are currently dominating the market due to their critical role in detecting and tracking submarines, particularly in deep-sea environments. The demand for advanced sonar technologies, such as phased-array sonar and active sonar, has increased as militaries seek more precise and reliable detection methods. Additionally, these systems play a key role in both offensive and defensive naval strategies, further strengthening their market position. Sonar systems are integrated into various platforms, ensuring their leading market share due to their versatility and technological advancements.

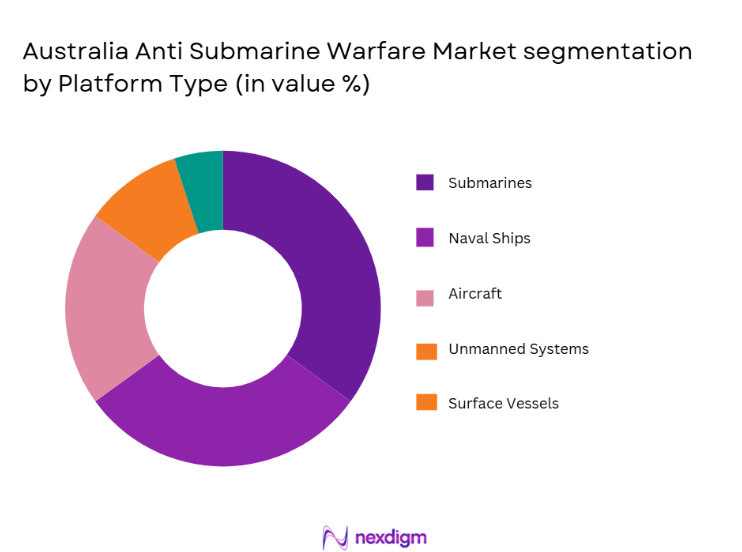

By Platform Type

The market is segmented by platform type into naval ships, submarines, aircraft, unmanned systems, and surface vessels. Submarines dominate this segment due to their stealth and offensive capabilities in anti-submarine warfare. As the most effective platform for executing submerged operations, submarines are a crucial component of naval defense strategies. They are equipped with the latest sonar and weaponry to detect and neutralize threats, ensuring their leading role in the market. The increasing investments in modern submarine fleets and their strategic importance to national security further solidify their dominance in this segment.

Competitive Landscape

The anti-submarine warfare market is highly competitive, with major defense contractors and technology providers leading the market. Consolidation is a key trend, as companies continue to merge or form strategic alliances to enhance their technological capabilities and expand their market reach. The dominance of large defense firms is supported by substantial R&D investments, ensuring a continuous flow of advanced products and systems. These companies play a critical role in shaping the market by driving innovation in detection, surveillance, and weaponry technologies.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market-Specific Parameter |

| Lockheed Martin | 1912 | Bethesda, MD, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, MA, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | Farnborough, UK | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A | 1948 | Rome, Italy | ~ | ~ | ~ | ~ | ~ |

Australia Anti Submarine Warfare Market Analysis

Growth Drivers

Increased Military Spending

Increased global military spending is one of the primary growth drivers for the anti-submarine warfare market. As geopolitical tensions rise, many nations are prioritizing defense investments to ensure the security of their maritime territories. Countries such as the United States, Russia, and China are allocating larger portions of their defense budgets to enhance naval defense capabilities, with a particular focus on anti-submarine technologies. This includes investments in new submarines, advanced sonar systems, and torpedo development. With rising defense budgets, military fleets are being modernized, which increases the demand for new anti-submarine systems. Furthermore, the rise of international threats, including piracy and naval conflicts, has led to an increased focus on securing maritime routes, further boosting military spending on advanced anti-submarine warfare systems. The growth in military spending directly translates into sustained demand for advanced anti-submarine technologies, driving the market’s expansion.

Technological Advancements in Detection Systems

Another key growth driver for the anti-submarine warfare market is the rapid technological advancements in detection systems. The development of cutting-edge sonar technologies, such as phased-array sonar and AI-driven detection systems, has revolutionized the market. These advanced systems provide real-time, accurate data, enabling naval forces to detect and track submarines at greater distances and with more precision. The integration of AI and machine learning into sonar systems enhances detection capabilities and reduces false positives, making these systems more reliable in complex underwater environments. Additionally, advancements in autonomous underwater vehicles (AUVs) and unmanned systems have expanded the operational range and effectiveness of anti-submarine systems. As these technologies continue to evolve, they play an increasingly critical role in ensuring naval security, driving demand for innovative anti-submarine warfare solutions across global markets.

Market Challenges

High Development and Maintenance Costs

One of the primary challenges facing the anti-submarine warfare market is the high cost of developing and maintaining advanced systems. Anti-submarine technologies such as sonar systems, torpedoes, and surveillance systems require significant financial investment, both in terms of research and development and in the procurement of high-quality materials. The ongoing costs of maintaining these systems, including software updates, hardware replacements, and operational expenses, further strain the budgets of defense organizations. As a result, many smaller nations with limited defense budgets may struggle to afford the latest technologies, leading to disparities in capabilities. This challenge can limit market growth, especially in regions where military spending is constrained. Additionally, the complexity of these systems means that long-term costs can exceed initial investments, making it difficult for some players to compete in the market without significant government support or partnerships.

Regulatory Compliance and Certification Challenges

Navigating the complex regulatory landscape for defense technologies is another significant challenge. Anti-submarine warfare systems, due to their military applications, are subject to stringent export controls, certification processes, and international regulations. Manufacturers must ensure their products meet the specifications and standards set by various governing bodies, which can delay product development and market entry. Additionally, compliance with national security regulations, especially in countries with strict arms export laws, further complicates the process. This regulatory burden increases the time and costs involved in bringing new products to market, and non-compliance can result in heavy penalties or loss of contracts. As a result, companies must invest heavily in legal and compliance expertise to navigate these regulatory challenges, which may deter some smaller firms from entering the market.

Opportunities

Expansion of Naval Fleet Capabilities

One of the major opportunities in the anti-submarine warfare market is the expansion of naval fleet capabilities, especially in emerging markets. Many nations, particularly in Asia and the Middle East, are rapidly modernizing their naval forces to enhance security and project power in their respective regions. This modernization involves the acquisition of new submarines, surface vessels, and anti-submarine technologies, which creates significant demand for advanced sonar systems and torpedoes. The strategic importance of maintaining a powerful naval fleet, particularly in regions with contested maritime borders, has driven governments to invest heavily in anti-submarine warfare capabilities. As nations expand their naval fleets, the market for anti-submarine technologies is expected to experience strong growth. This offers opportunities for both established defense contractors and new players to capitalize on the increasing demand for state-of-the-art systems and solutions.

Integration of AI and Autonomous Systems

The integration of artificial intelligence (AI) and autonomous systems into anti-submarine warfare technologies presents another significant opportunity for market growth. AI is being increasingly incorporated into sonar systems, surveillance technologies, and torpedo guidance systems to improve their efficiency and accuracy. Autonomous underwater vehicles (AUVs) and unmanned aerial systems (UAS) are also gaining traction in the market, offering a cost-effective and highly flexible solution for anti-submarine operations. These technologies allow for the automation of routine surveillance tasks and the deployment of unmanned platforms that can operate in dangerous or hard-to-reach areas, reducing the risk to human life and improving operational efficiency. As AI and autonomous technologies evolve, they will play a crucial role in shaping the future of anti-submarine warfare, presenting significant growth opportunities for companies that lead in these areas.

Future Outlook

The anti-submarine warfare market is poised for significant growth in the coming years, driven by advancements in technology and increasing investments in military defense. The next five years are expected to witness a continued focus on modernization, with nations expanding their naval fleets and investing in cutting-edge technologies such as AI-driven sonar systems and autonomous underwater vehicles. Technological developments, coupled with rising geopolitical tensions and maritime security concerns, will provide sustained demand for anti-submarine warfare solutions. Regulatory support, particularly in key defense markets, will further enhance opportunities for industry players to capitalize on this expanding market.

Major Players

- Lockheed Martin

- Raytheon Technologies

- BAE Systems

- Thales Group

- Leonardo S.p.A

- Northrop Grumman

- General Dynamics

- L3 Technologies

- Kongsberg Gruppen

- Naval Group

- Saab Group

- Mitsubishi Heavy Industries

- Fincantieri

- Huntington Ingalls Industries

- ST Engineering

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Naval forces

- Defense contractors

- Military equipment suppliers

- Aerospace and defense analysts

- Research institutions specializing in defense technologies

- Security agencies and military strategists

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying critical variables influencing market dynamics, including technological advancements, regulatory factors, and global defense budgets.

Step 2: Market Analysis and Construction

In this step, historical data and current market trends are analyzed to understand market size, segmentation, and growth projections.

Step 3: Hypothesis Validation and Expert Consultation

Expert insights and industry consultations are conducted to validate hypotheses and refine market assumptions, ensuring the accuracy of findings.

Step 4: Research Synthesis and Final Output

The final analysis is synthesized, producing a comprehensive market report that includes detailed forecasts, key findings, and actionable insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense spending

Rising maritime security threats

Technological advancements in sonar systems - Market Challenges

High development and maintenance costs

Stringent regulatory compliance

Limited interoperability with legacy systems - Market Opportunities

Expansion of naval fleet capabilities

Development of autonomous anti-submarine warfare technologies

Integration of AI and machine learning for enhanced detection - Trends

Advancements in unmanned underwater vehicles

Shift towards modular and scalable systems

Increased adoption of integrated defense platforms - Government Regulations

Defense Export Controls

Regulatory Standards for Underwater Systems

Compliance with International Maritime Laws

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Sonar Systems

Torpedo Systems

Communication Systems

Surveillance Systems

Command & Control Systems - By Platform Type (In Value%)

Naval Ships

Submarines

Aircraft

Unmanned Systems

Surface Vessels - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Upgrade - By EndUser Segment (In Value%)

Military

Government Defense Agencies

Naval Forces

Commercial Shipping Operators

Private Defense Contractors - By Procurement Channel (In Value%)

Direct Procurement

Indirect Procurement

OEM Procurement

Government Contracts

Private Sector Procurement

- Market Share Analysis

- CrossComparison Parameters (Sonar Systems, Torpedo Systems, Submarine Platforms, Surveillance Systems, Military Procurement)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Boeing

Lockheed Martin

Raytheon Technologies

Thales Group

Navantia

L3 Technologies

Leonardo S.p.A

Northrop Grumman

General Dynamics

BAE Systems

Kongsberg Gruppen

Naval Group

Huntington Ingalls Industries

Fincantieri

ST Engineering

- Government Defense Agencies’ Role

- Naval Forces’ Strategic Importance

- Commercial Shipping Operators’ Demand

- Private Sector Contractors’ Involvement

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035