Market Overview

The Australia ANZ Satellite Communications market is experiencing steady growth driven by increasing demand for connectivity in remote and underserved areas, alongside advancements in satellite technology. As of a recent historical assessment, the market size stands at USD ~ billion, fueled by both government and private sector investments in satellite infrastructure. This expansion is attributed to the growing need for high-quality communication services across rural and maritime regions, in addition to the critical demand from defense and national security sectors. The commercial adoption of satellite-based broadband also continues to gain traction, with a significant rise in satellite capacity being deployed globally, including in the Australia ANZ region.

Countries like Australia and New Zealand lead the region in satellite communications due to their vast geographical expanse and reliance on satellite systems to bridge communication gaps. Australia’s dominance stems from its strategic focus on enhancing satellite broadband access, as well as its efforts to integrate satellite technology with emerging sectors like space-based IoT and 5G. The demand for satellite services is further bolstered by their importance to defense and security sectors, where satellites play an essential role in surveillance, navigation, and communication. New Zealand’s satellite communications sector benefits from its collaboration with global players, positioning the country as a key player in the development of next-generation satellite technologies.

Market Segmentation

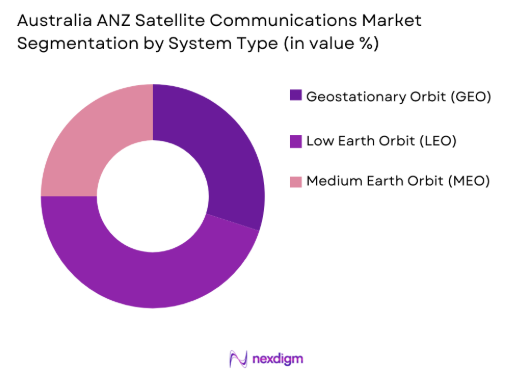

By System Type

The Australia ANZ Satellite Communications market is segmented by system type into geostationary orbit (GEO), low Earth orbit (LEO), and medium Earth orbit (MEO) systems. Recently, the LEO sub-segment has emerged as a dominant force in the market due to its ability to provide low-latency, high-speed internet services, particularly in remote and underserved areas. LEO satellites are favored for their ability to offer continuous coverage with faster data transmission speeds, making them the preferred choice for both commercial and government applications. With several LEO satellite constellations in the pipeline, the demand for LEO-based services is expected to increase substantially, further consolidating its dominance.

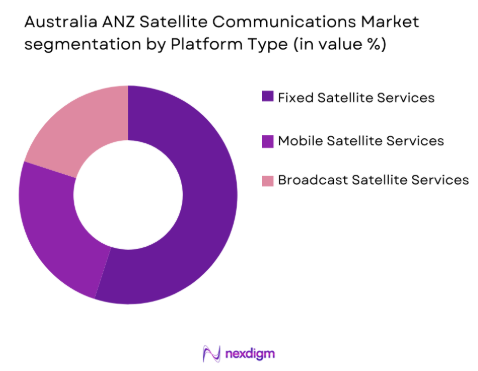

By Platform Type

The market is also segmented by platform type into fixed satellite services, mobile satellite services, and broadcast satellite services. Among these, fixed satellite services dominate the market due to their widespread application in telecommunications and data transmission across large geographical regions. Fixed satellite services offer stable, long-term communication solutions for both private enterprises and government agencies, ensuring reliable communication links for broadband internet, telephony, and television services. This segment benefits from the growing demand for continuous, uninterrupted connectivity in rural and remote locations, especially where terrestrial infrastructure is sparse.

Competitive Landscape

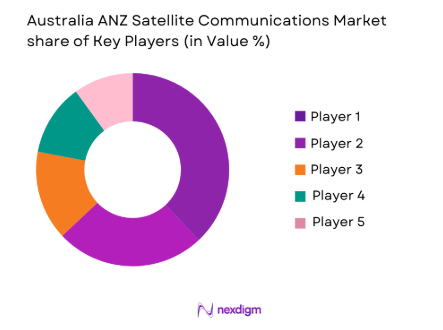

The competitive landscape in the Australia ANZ Satellite Communications market is characterized by a blend of established players and new entrants, all vying for a larger share in the growing satellite communications sector. Consolidation is happening as industry giants increasingly invest in satellite constellations, leading to a more integrated market structure. The influence of major players like SpaceX and Optus continues to reshape the market, driving innovations and creating strategic partnerships that benefit both commercial and government sectors.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| SES S.A. | 1985 | Luxembourg | ~

|

~ | ~ | ~ | ~ |

| Optus | 1992 | Australia | ~

|

~

|

~

|

~

|

~

|

| SpaceX | 2002 | USA | ~ | ~ | ~ | ~ | ~ |

| Inmarsat | 1979 | UK | ~

|

~

|

~

|

~

|

~

|

| Viasat | 1986 | USA | ~

|

~

|

~

|

~

|

~

|

Australia ANZ Satellite Communications Market Analysis

Growth Drivers

Technological Advancements in Satellite Systems

The market for satellite communications in Australia and New Zealand is heavily driven by the rapid advancements in satellite technology. Satellite systems have evolved significantly, with LEO constellations gaining traction for their ability to provide low-latency, high-speed internet connections. The increasing need for faster and more reliable communication, particularly in remote and rural areas, has propelled the adoption of these newer systems. The deployment of advanced satellite technologies is expected to facilitate better coverage and data transmission capabilities, fueling market growth. Government initiatives aimed at enhancing connectivity in underserved regions are further bolstering the demand for next-generation satellite services. The growth of broadband internet services powered by satellites is making it a key tool in enhancing communication infrastructure. With the integration of 5G, IoT, and satellite services, the demand for satellite communication systems is expected to continue its upward trajectory.

Increasing Demand for Rural and Remote Connectivity

A major driver of growth in the Australia ANZ Satellite Communications market is the increasing demand for reliable communication services in rural and remote regions. These areas often lack the necessary infrastructure for terrestrial broadband networks, making satellite communication systems an essential solution. With Australia’s vast and rugged geography, satellite communications are the most viable means of bridging the connectivity gap. In addition, the maritime industry in Australia relies on satellite communications for tracking and navigation services, making it a key driver for continued market expansion. The integration of satellite communication with emerging technologies, such as IoT and 5G, is expected to further stimulate demand for high-speed, low-latency connectivity solutions in underserved areas. Government programs, such as the National Broadband Network (NBN), are also helping to drive demand for satellite-based solutions, especially in regions that are not economically viable for terrestrial broadband.

Market Challenges

High Initial Capital Expenditure

One of the primary challenges facing the Australia ANZ Satellite Communications market is the high initial capital expenditure required to deploy and maintain satellite systems. Establishing satellite infrastructure, particularly for LEO constellations, involves significant investment in both hardware and technology development. The cost of launching satellites and maintaining operational systems can be a barrier for many companies, particularly smaller players. Additionally, satellite services require continual upgrades to remain competitive, which increases the financial burden on operators. While demand for satellite services is growing, the substantial upfront investment required poses a challenge for companies looking to expand their operations. Regulatory hurdles and limited access to launch facilities in the region can further complicate the financial dynamics of entering the market. As competition intensifies, companies will need to ensure that they can manage the financial requirements of satellite deployment effectively.

Geographical Coverage Limitations

Despite the technological advancements, one of the ongoing challenges for satellite communications in Australia and New Zealand is the geographical coverage limitations of current systems. Although LEO satellites provide better coverage and lower latency than traditional GEO satellites, they still face challenges in offering continuous, global coverage. The high cost of launching and maintaining satellite constellations that cover vast territories can result in uneven service availability, particularly in certain remote or isolated regions. This is especially problematic for applications that require uninterrupted connectivity, such as emergency services or real-time communications. Furthermore, satellite signal degradation due to environmental factors, such as storms or atmospheric disturbances, remains a challenge for satellite communications in these regions. While ongoing technological advancements aim to address these issues, they still pose significant hurdles for the market.

Opportunities

Expanding Demand for Satellite-Based Internet

One of the key opportunities for the Australia ANZ Satellite Communications market is the expanding demand for satellite-based internet, particularly in rural and underserved regions. With terrestrial broadband networks often inaccessible or costly to deploy in these areas, satellite internet offers a practical solution for connecting remote communities. Government initiatives and private investments aimed at expanding broadband access are expected to increase the adoption of satellite internet. The deployment of LEO satellite constellations is further driving this demand by providing more affordable and reliable high-speed internet services. As more consumers and businesses rely on the internet for daily activities, including telemedicine, online education, and remote work, the need for robust satellite internet connectivity will continue to grow. This presents a significant opportunity for satellite operators to capture a larger share of the market and expand their service offerings.

Government Contracts and Defense Sector Growth

Another significant opportunity lies in securing government contracts for satellite communication systems, particularly in the defense and security sectors. The Australian government has increasingly invested in satellite technologies to enhance national security, improve disaster management capabilities, and support defense operations. As Australia focuses on strengthening its defense and intelligence capabilities, satellite communication systems will play a crucial role in providing secure, real-time communication for military operations. The growing interest in space-based defense infrastructure presents a lucrative opportunity for satellite operators to partner with government agencies. The demand for secure, high-capacity communication systems for defense and national security will continue to drive growth in the satellite communications market. Furthermore, as geopolitical tensions rise, governments are investing more in autonomous satellite systems to maintain secure and reliable communications across various sectors.

Future Outlook

Over the next five years, the Australia ANZ Satellite Communications market is expected to continue its growth trajectory, driven by advancements in satellite technology and the increasing demand for reliable communications in remote areas. Key developments such as the expansion of LEO satellite constellations and their integration with 5G networks are expected to enhance connectivity across the region. The government’s focus on bridging the digital divide through satellite broadband initiatives will further stimulate market growth. With the rise of IoT and satellite-based 5G technologies, demand for high-speed, low-latency satellite services will continue to increase, positioning the market for sustained expansion.

Major Players

- SES S.A.

- Optus

- SpaceX

- Inmarsat

- Viasat

- Telesat

- Intelsat

- Hughes Network Systems

- OneWeb

- Gilat Satellite Networks

- Iridium Communications

- Globalstar

- Eutelsat

- Speedcast

- Thaicom

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite communication service providers

- Aerospace and defense contractors

- Telecommunications operators

- Maritime service providers

- Remote area infrastructure developers

- Internet service providers

Research Methodology

Step 1: Identification of Key Variables

Key variables influencing the satellite communications market include technological advancements, demand for connectivity in remote regions, and government policies. Identifying these variables helps in understanding the factors driving market dynamics. These variables guide the market sizing and segmentation process. They provide a framework for analyzing current trends and forecasting future growth.

Step 2: Market Analysis and Construction

Market analysis involves segmenting the satellite communications market by system type, platform type, and customer needs. This step involves collecting data from both primary and secondary sources to construct an accurate market model. The data is analyzed to identify key growth drivers and constraints. The market model is then used to predict future trends based on current dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted to validate the hypotheses derived from initial research. These experts include industry leaders, satellite service providers, and government agencies. Their input helps refine the market model and provides insights into market-specific challenges and opportunities. The consultations ensure that the research findings align with industry expectations and ground realities.

Step 4: Research Synthesis and Final Output

After validating hypotheses, the data is synthesized into comprehensive market reports. These reports cover market size, trends, and forecasts, providing a detailed analysis for stakeholders. The final output is structured in a way that highlights critical insights and actionable strategies. This ensures that decision-makers have the necessary information to drive growth and innovation.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government investment in satellite infrastructure

Rising demand for satellite-based broadband

Technological advancements in satellite communications

Increasing adoption in the defense sector

Expanding satellite communication services in remote areas - Market Challenges

High initial costs of satellite infrastructure

Geographical limitations of satellite coverage

Interference and congestion in satellite bands

Regulatory and licensing challenges

Dependency on weather and environmental conditions - Market Opportunities

Growth in demand for satellite-based Internet in rural areas

Strategic collaborations between public and private sectors

Expansion of satellite services in aviation - Trends

Rise in satellite constellation networks

Integration of satellite services with 5G networks

Growing popularity of LEO satellite deployments

Increased focus on satellite cybersecurity

Development of small satellite technologies - Government Regulations & Defense Policy

National Space Policy Impact

Satellite Licensing and Frequency Regulations

Export Control Policies on Satellite Technology

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fixed Satellite Services

Mobile Satellite Services

Broadcast Satellite Services

Satellite Internet Services

Satellite Communications for Defense - By Platform Type (In Value%)

Geostationary Orbit (GEO)

Low Earth Orbit (LEO)

Medium Earth Orbit (MEO)

Hybrid Satellite Systems

On-Demand Satellite Systems - By Fitment Type (In Value%)

Fixed

Portable

Mobile

Transportable

Wearable - By EndUser Segment (In Value%)

Telecommunications

Defense

Broadcasting

Maritime

Aerospace - By Procurement Channel (In Value%)

Direct Procurement

Third-party Procurement

Online Platforms

Distributors

OEMs - By Material / Technology (in Value%)

High-Throughput Satellites (HTS)

Spot Beam Technology

Frequency Reuse Technology

Adaptive Coding and Modulation

Ka-Band Technology

- Market share snapshot of major players

- Cross Comparison Parameters (Technology Adoption, Market Reach, Service Offerings, Infrastructure Investment, Strategic Partnerships)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

SES S.A.

Optus

Australia Broadcasting Corporation (ABC)

OneWeb

Hughes Network Systems

Inmarsat

Viasat

Thales Group

SpaceX

ViaSat, Inc.

IntelSat

Telesat

Eutelsat Communications

Sky Muster

Australian Space Agency

- Rising government demand for defense communications

- Increasing use of satellite broadband in remote regions

- Adoption of satellite TV and broadcasting services

- Growth of satellite applications in the maritime industry

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035