Market Overview

The assured PNT market in Australia is poised for growth as defense and commercial sectors require increasingly sophisticated positioning, navigation, and timing solutions. Market expansion is largely driven by the rising demand for enhanced GPS systems and solutions to support military and civil operations. The market size is largely fueled by government-backed initiatives and defense budget allocations, pushing technological advancements in GPS, communications, and network infrastructure. These drivers reinforce Australia’s strategic defense and commercial requirements, estimated to reach USD ~million based on a recent historical assessment. The market’s dominance in Australia is concentrated in key urban centers and regional hubs that are critical for defense and technological development. Cities such as Canberra, Sydney, and Melbourne lead the charge, driven by government investments and high-tech infrastructure in aerospace, defense, and telecommunication sectors. Australia’s favorable regulations and robust defense partnerships with global players also support the growth of the assured PNT market. As the nation’s defense and aerospace sectors continue to evolve, these regions will maintain their competitive edge, positioning the country as a leader in the Asia-Pacific PNT domain.

Market Segmentation

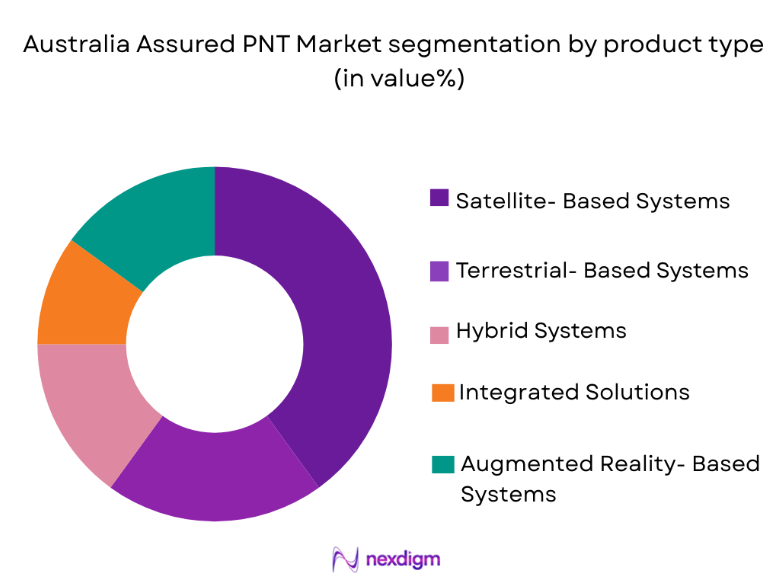

By Product Type

The Australia Assured PNT market is segmented by product type into satellite-based systems, terrestrial-based systems, hybrid systems, integrated solutions, and augmented reality (AR)-based systems. Satellite-based systems dominate the market due to their widespread use in military and commercial applications, providing precise navigation and timing. Terrestrial-based systems cater to environments where satellite signals may not be available or reliable, making them suitable for specific defense and industrial sectors. Hybrid systems combine both satellite and terrestrial technologies, providing enhanced reliability and flexibility. Integrated solutions, which combine PNT systems with other technologies like communication and surveillance systems, are gaining traction in complex operations. Lastly, AR-based systems are emerging as an innovative segment, combining real-time navigation with augmented visual data for defense and aviation applications.

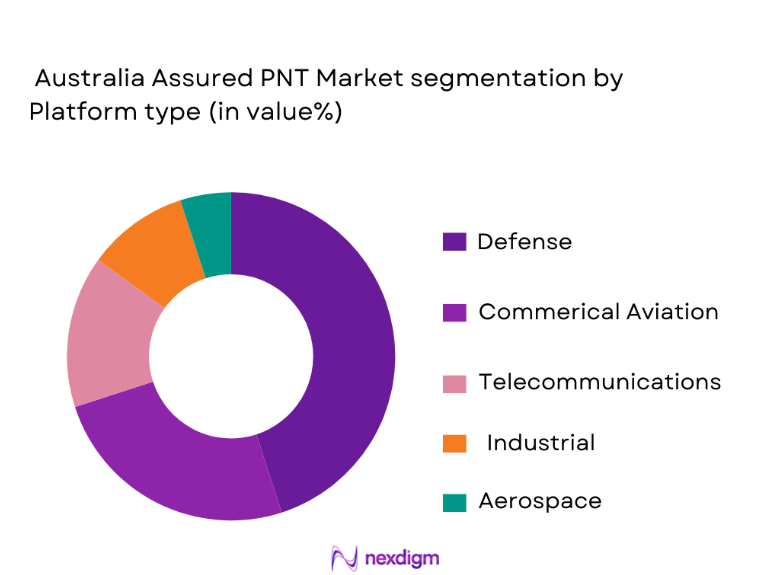

By Platform Type

The market is segmented by market platform type into defense, commercial aviation, telecommunications, industrial, and aerospace. The defense sector holds the largest market share, driven by the need for highly accurate and secure positioning systems for military operations, surveillance, and national security. The commercial aviation sector is also a significant contributor, with airlines and airports adopting advanced PNT systems to ensure operational efficiency and safety. Telecommunications, which requires precise timing for network synchronization, follow closely behind. Industrial applications, including logistics and transportation, benefit from PNT systems for fleet management and geolocation. Lastly, the aerospace sector continues to drive demand for advanced navigation systems in both manned and unmanned spacecraft.

Competitive Landscape

The assured PNT market in Australia is characterized by a competitive landscape with several global and regional players consolidating their positions through technological advancements and strategic partnerships. Companies in this market are focused on improving product offerings to cater to defense, commercial aviation, and telecommunication needs. Consolidation is taking place through mergers and acquisitions, with major players expanding their technological capabilities and geographic reach. This competitive intensity, coupled with the market’s strategic importance, ensures that the industry remains dynamic and innovation driven.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | La Défense, France | ~ | ~ | ~ | ~ |

| Harris Corporation | 1895 | Melbourne, Australia | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | Phoenix, USA | ~ | ~ | ~ | ~ |

Australia Assured PNT Market Analysis

Growth Drivers

Advancements in GPS and Communication Technology

The growing demand for precise navigation and timing solutions has fueled the advancements in GPS and communication technologies within the assured PNT market. Modern military and commercial sectors require these technologies for applications such as surveillance, tracking, and geolocation in both civilian and defense operations. As new GPS technologies improve signal accuracy and reliability, industries such as aviation, defense, and telecommunications are investing heavily in these systems, ensuring the growth of the assured PNT market. In addition, integration with other systems, such as 5G and autonomous technologies, is expanding the potential applications of assured PNT solutions. The continuous development in satellite-based navigation, coupled with government-backed projects and innovations in secure communication networks, is further propelling the market’s growth trajectory. The convergence of these factors has led to increased demand for assured PNT solutions, solidifying this growth drive as crucial for the future expansion of the market.

Government Investment in Defense and Aerospace

Australia’s robust defense spending and government investment in aerospace infrastructure have significantly driven the growth of the assured PNT market. The Australian government has been consistently increasing its defense budget, supporting the development of advanced technologies for military and defense applications. This includes the procurement of advanced positioning and navigation systems, particularly defense forces, air forces, and maritime operations. The government’s focus on enhancing national security and defense readiness is leading to higher demand for reliable PNT systems across all military platforms. These investments are not limited to defense; they extend to the civilian aviation sector as well, where advanced PNT systems are critical for safe and efficient operations. The Australian government’s continuous commitment to technological advancement in defense and aerospace has created a stable environment for the assured PNT market to thrive.

Market Challenges

High Initial Investment Costs

One of the key challenges facing the assured PNT market in Australia is the high initial investment required for the deployment of advanced systems. Both military and commercial sectors need to make significant capital expenditures to adopt these sophisticated technologies. The cost of infrastructure development, including satellites, communication networks, and specialized equipment, is a major barrier for many potential market players. For the defense sector, the high investment costs are often coupled with long procurement cycles and stringent budget constraints. Additionally, as global competition intensifies, organizations are under pressure to deliver cost-effective solutions, making it harder for smaller players to compete in this high-cost environment. Despite these challenges, the market remains attractive due to its strategic importance for national security and economic growth. Overcoming these high upfront costs remains a critical hurdle for future market expansion.

Regulatory and Compliance Hurdles

The assured PNT market in Australia faces significant regulatory and compliance challenges, particularly in the defense and telecommunications sectors. Strict government regulations regarding the use of positioning, navigation, and timing systems, as well as the integration of these systems with other critical infrastructure, pose a challenge for market players. Adhering to national and international standards, including those related to cybersecurity and data privacy, is increasingly becoming a priority for both commercial and military stakeholders. Compliance with these complex regulations requires continuous investments in technology upgrades and infrastructure improvements, increasing operational costs for companies. Navigating these regulatory complexities can delay product deployments, creating bottlenecks in the market, and limiting the potential for rapid expansion. Ensuring compliance without compromising system performance remains a challenge for industry.

Opportunities

Expansion of Autonomous Systems in Military and Commercial Sectors

The rising demand for autonomous systems in both the military and commercial sectors presents a significant opportunity for the assured PNT market in Australia. Autonomous systems, such as drones, unmanned vehicles, and autonomous ships, rely heavily on assured PNT systems for navigation and timing. As defense forces and commercial industries, including logistics and transportation, increase their reliance on autonomous technologies, the need for advanced PNT solutions will grow. This presents an opportunity for market players to develop integrated PNT systems that cater specifically to autonomous applications, offering solutions that ensure safe, efficient, and accurate operations in complex environments. The continuous development of AI and machine learning technologies further enhances the capability of these systems, creating new avenues for growth in the assured PNT market.

International Defense and Aerospace Collaborations

Australia’s growing partnerships with international defense and aerospace organizations offer a unique opportunity for the assured PNT market to expand. As Australia strengthens its defense alliances with countries like the United States, the United Kingdom, and regional partners in the Asia-Pacific region, there is an increasing demand for standardized PNT systems that can be seamlessly integrated into multinational operations. This collaborative environment opens new markets for assured PNT technologies, particularly in joint military operations, multinational aerospace projects, and international defense contracts. These collaborations offer opportunities for Australian companies to expand their market reach and develop technologies that are aligned with global defense standards and operational requirements.

Future Outlook

The assured PNT market in Australia is expected to continue its upward trajectory over the next five years, driven by growing defense and commercial sector demand. With advancements in satellite technology, increased focus on autonomous systems, and rising investments in defense infrastructure, the market is set for substantial growth. The Australian government’s strong support for defense and aerospace initiatives further boosts market prospects. However, challenges such as high initial investments and regulatory complexities will require careful management. Technological advancements and global partnerships are likely to play a key role in shaping the market’s future.

Major Players

- Lockheed Martin

- Thales Group

- Harris Corporation

- BAE Systems

- Honeywell Aerospace

- Raytheon Technologies

- Rockwell Collins (Collins Aerospace)

- Northrop Grumman

- Airbus Defence and Space

- General Dynamics Mission Systems

- Leonardo S.p.A.

- L3 Technologies

- Garmin Ltd.

- Raytheon Technologies

- Hexagon AB

- Navtec Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Aerospace technology providers

- Telecommunications firms

- Military agencies

- Aviation authorities

- National security agencies

Research Methodology

Step 1: Identification of Key Variables

The primary variables influencing the market are identified, including technological advancements, regulatory changes, and government investments. These variables form the foundation of market analysis and are validated through primary and secondary research.

Step 2: Market Analysis and Construction

A comprehensive analysis of the market size, growth drivers, and trends is conducted using both quantitative and qualitative research methods. This analysis forms the basis of the market forecast and future projections.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses derived from initial analysis are validated through consultations with industry experts, government officials, and key market players. These insights help refine the market model and ensure accuracy.

Step 4: Research Synthesis and Final Output

The collected data is synthesized into a final report, which includes all relevant market segments, key drivers, challenges, and opportunities. This report is then verified for accuracy and market relevance.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Satellite Navigation

Increasing Military and Defense Budgets

Growing Adoption of Autonomous Systems

Rising Demand for Reliable Positioning in Commercial Aviation

Australia’s Strategic Partnerships in the Asia-Pacific Region - Market Challenges

High Initial Investment Costs for PNT Systems

Regulatory and Compliance Barriers

Integration of New Technologies into Legacy Systems

Limited Availability of Skilled Workforce

Security and Cyber Threats - Market Opportunities

Expansion of Autonomous Vehicle Market

Growing Demand in Commercial Aviation for Safety Systems

Government Investments in Next-Generation Defense Systems - Trends

Integration of AI and Machine Learning in Navigation Systems

Growing Use of Hybrid Systems in Military Applications

Increased Focus on Secure Communication Networks

Shift Toward Real-Time PNT Systems in Industrial Applications

Development of AR Solutions for Enhanced Navigation - Government Regulations & Defense Policy

Strict Cybersecurity Standards for PNT Systems

Increased Regulatory Oversight in Telecommunications

Government Support for Innovation in Defense Technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Satellite-based Systems

Terrestrial-based Systems

Hybrid Systems

Integrated Systems

Augmented Reality-based Systems - By Platform Type (In Value%)

Airborne Platforms

Terrestrial Platforms

Space-based Platforms

Marine Platforms

Autonomous Systems - By Fitment Type (In Value%)

Standalone Fitment

Integrated Fitment

Embedded Fitment

Custom Fitment

Modular Fitment - By End User Segment (In Value%)

Military

Commercial Aviation

Telecommunications

Industrial Applications

Aerospace - By Procurement Channel (In Value%)

Direct Procurement

Distributor Channel

Online Sales

Government Contracts

Commercial Contracts - By Material / Technology (In Value%)

Satellite Technology

Ground-based Technology

Hybrid Navigation Technology

AR-based Technology

Communication Network Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Market Share, Innovation, Pricing, Technological Advancements, Product Portfolio)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Thales Group

Harris Corporation

BAE Systems

Honeywell Aerospace

Raytheon Technologies

Airbus Defence and Space

General Dynamics Mission Systems

Leonardo S.p.A.

L3 Technologies

Garmin Ltd.

Hexagon AB

Northrop Grumman

Collins Aerospace

Rockwell Collins

- Military’s Increasing Reliance on GPS and PNT Systems

- Aviation Sector’s Demand for Accurate Navigation

- Telecommunications’ Dependence on Precise Timing

- Industrial Sector’s Use of PNT for Geolocation and Logistics

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035