Market Overview

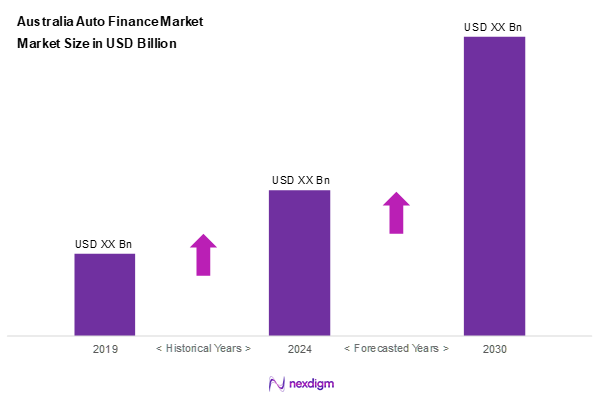

As of 2024, the Australia auto finance market is valued at USD ~ billion, with a growing CAGR of 6.7% from 2024 to 2030, reflecting steady growth driven by increasing vehicle ownership and diverse financing options available to consumers. This growth is supported by favorable economic conditions and a robust automotive industry. The demand for both new and used vehicles is elevating finance uptake, contributing significantly to market expansion.

Dominant cities such as Sydney, Melbourne, and Brisbane are at the forefront of the Australia auto finance market due to their substantial populations and strong economic activity. These urban centers have high vehicle ownership rates, coupled with a variety of financial institutions catering to auto loans. The competitive landscape in these regions is enhanced by the presence of major banks and finance companies, increasing consumers’ access to auto financing solutions.

Market Segmentation

By Vehicle Type

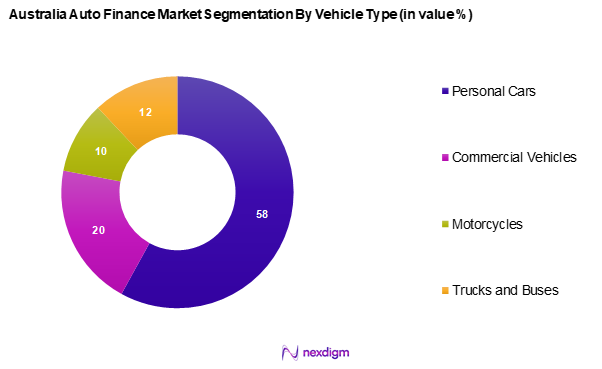

The Australia auto finance market is segmented into personal cars, commercial vehicles, motorcycles, and trucks and buses. Personal cars dominate this segment, capturing a substantial portion of the market share as they remain the preferred choice for individual consumers. The convenience and flexibility offered by personal car financing solutions, coupled with various incentives from manufacturers, drive this preference. Moreover, the increasing disposable income and an overall trend toward vehicle ownership further reinforce the dominance of personal cars in the financing landscape.

By Financing Type

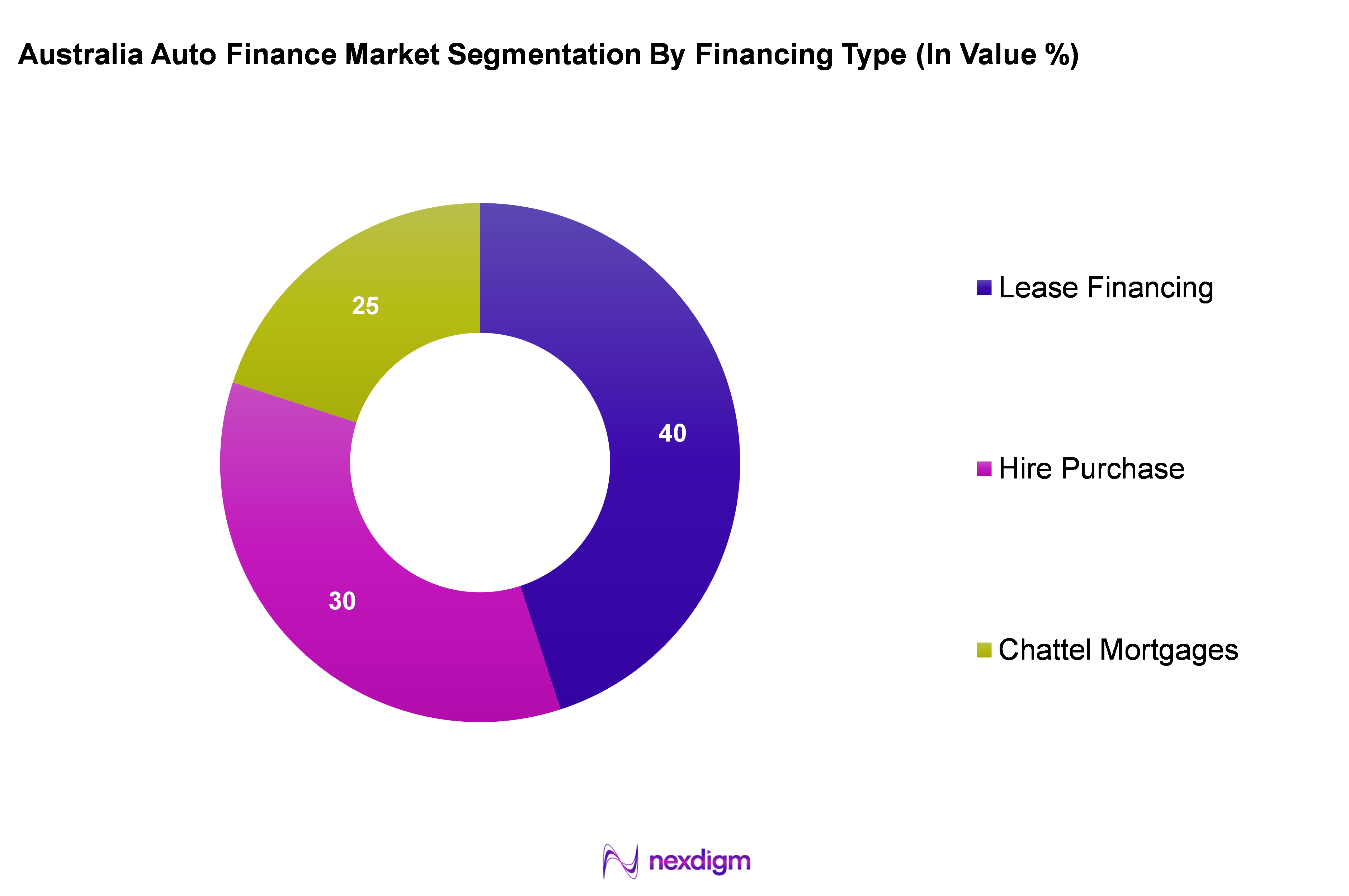

The Australia auto finance market is segmented into lease financing, hire purchase, and chattel mortgages. Lease financing is leading this segment due to its attractiveness for consumers seeking lower monthly payments and flexible terms. Businesses often prefer lease financing as it allows them to maintain cash flow while driving newer vehicles without the burdensome costs of ownership. The trend towards corporate leasing solutions, especially in urban areas, highlights the growing preference for lease financing in auto-related financial products.

Competitive Landscape

The Australia auto finance market is characterized by significant competition, dominated by key players such as ANZ, National Australia Bank, and Toyota Finance Australia. The consolidation of major banks and finance firms within the sector emphasizes the influence they wield over consumer choices and financial offerings.

| Major Players | Establishment Year | Headquarters | Financial Products Offered | Market Strategies | Customer Segments | Recent Developments |

| Australia and New Zealand Banking Group Limited (ANZ) | 1835 | Melbourne, Australia | – | – | – | – |

| National Australia Bank Limited | 1858 | Victoria, Australia | – | – | – | – |

| Toyota Finance Australia Limited | 1982 | Sydney, Australia | – | – | – | – |

| Hyundai Motor Company, Australia Pty Limited | 1986 | Sydney, Australia | – | – | – | – |

| Westpac Banking Corporation | 1817 | Sydney, Australia | – | – | – | – |

Australia Auto Finance Market Analysis

Growth Drivers

Increasing Vehicle Ownership

Australia’s vehicle ownership has been on a steady rise, reaching approximately 21.2 million registered motor vehicles in 2023. The increasing population, which is expected to be 26 million in 2024, along with rising disposable incomes, has contributed positively to vehicle ownership rates. The Commonwealth Government provides incentives for electric vehicle purchases, which foster growth in auto financing as consumers look to acquire new vehicles. This growing trend reflects a changing landscape in transportation preferences, with consumers increasingly opting for personal ownership over public transport. The stronger demand pushes the auto finance market forward, highlighting the correlation between vehicle ownership and finance uptake.

Technological Advancements in Finance Solutions

Technological advancements are central to the evolution of the auto finance market in Australia. With more than 80% of banks and financial institutions investing in digital transformation initiatives, the adoption of fintech solutions has increased access to auto financing. Innovations such as mobile applications for loan management, AI-based credit scoring, and real-time vehicle valuations have enhanced customer experiences. By 2023, over 60% of auto loan applications were made digitally, providing convenience and efficiency that appeal to tech-savvy consumers. These advancements are crucial in attracting younger buyers who prioritize seamless transactions and personalized financial products.

Market Challenges

Regulatory Hurdles

The auto finance sector in Australia faces numerous regulatory challenges that can impede growth. The Australian Consumer Law (ACL) mandates strict guidelines for credit provision, requiring transparency in terms and conditions and protecting consumers from predatory lending practices. Additionally, compliance with the National Consumer Credit Protection Act requires extensive documentation and verification processes, which can slow down loan approvals. The regulatory environment demands significant resources from financial institutions, which could otherwise be used to enhance service offerings and customer engagement. The ongoing adjustments to compliance requirements challenge market players to innovate continually while ensuring adherence to regulations.

Rising Interest Rates

Rising interest rates present significant challenges to the auto finance market in Australia. The Reserve Bank of Australia (RBA) has increased the cash rate, which rose to 4.10% due to efforts to control inflation, which has reached 6.8% as of early 2024. Higher interest rates lead to increased borrowing costs for consumers, decreasing demand for auto loans. Many potential buyers may delay their purchases, causing a ripple effect throughout the auto finance sector. Consequently, financial institutions must adjust their lending strategies, which may impact their profitability and operational capacity in a competing market.

Opportunities

Adoption of Telematics and IoT

The adoption of telematics and Internet of Things (IoT) technology in vehicles presents significant growth opportunities for the auto finance market. Data from the Australian Bureau of Statistics indicates that more than 65% of new cars sold are equipped with connected technology. This trend has increased consumer awareness regarding vehicle performance data and financing options tailored to user behavior. Financial institutions can leverage this data to offer personalized financing solutions and create insurance products that reward safe driving, aligning financial products closely with consumer needs. As telematics becomes ubiquitous in the auto industry, its integration into financing solutions will enable market expansion and innovation.

Expansion of Digital Lending Platforms

The rise of digital lending platforms represents a remarkable opportunity for market growth in the auto finance sector. As of 2024, over 70% of Australian consumers prefer online lending platforms due to their efficiency and user-friendly interfaces. This shift has led to the emergence of numerous fintech companies that provide quick and accessible auto loan options. Traditional banks are increasingly collaborating with these fintechs to remain competitive, enhancing their service offerings. The ability to provide immediate credit decisions and streamline the application and approval processes significantly improves overall customer satisfaction, driving further adoption of auto financing.

Future Outlook

Over the next five years, the Australia auto finance market is expected to witness robust growth, propelled by advancements in digital lending platforms, increasing consumer preferences for vehicle ownership, and a shift towards eco-friendly transportation. Key drivers such as government incentives supporting electric vehicles and enhancements in financing solutions tailored to individual needs will further contribute to this growth trajectory.

Major Players

- Australia and New Zealand Banking Group Limited (ANZ)

- National Australia Bank Limited

- Toyota Finance Australia Limited

- Hyundai Motor Company, Australia Pty Limited

- Westpac

- Bendigo and Adelaide Bank

- Fair Go Finance

- Great Southern Bank

- Heritage Bank

- Stratton Finance Pty Ltd

- George Bank

- People’s Choice Credit Union

- SUNCORP

- HSBC Bank Australia Limited

- National Roads and Motorists’ Association Limited (NRMA)

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (Australian Competition and Consumer Commission)

- Financial institutions and banks

- Automotive manufacturers

- Dealerships and automotive retailers

- Fleet management companies

- Telecommunication companies (for connectivity solutions)

- Insurance companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Australia Auto Finance market. This step employs extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as regulatory frameworks, consumer preferences, and financing options.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Australia Auto Finance market. This includes assessing market penetration, the ratio of financing options available to consumers, and resultant revenue generation. Additionally, an evaluation of market demand and service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates derived from the collected data.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through targeted interviews with industry experts representing a diverse array of companies in the auto finance sector. These consultations yield valuable insights into operational and financial aspects of the market, which are instrumental in refining and corroborating the market data collected in earlier steps.

Step 4: Research Synthesis and Final Output

The final phase entails direct engagement with multiple automotive finance providers to acquire detailed insights into financing segments, sales performance, consumer preferences, and other pertinent factors. This interaction is essential to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Australia Auto Finance market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Vehicle Ownership

Technological Advancements in Finance Solutions - Market Challenges

Regulatory Hurdles

Rising Interest Rates - Opportunities

Adoption of Telematics and IoT

Expansion of Digital Lending Platforms - Trends

Shift to Electric Vehicles

Increasing Popularity of Subscription Models - Government Regulation

Consumer Credit Protection Laws

Vehicle Emission Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Interest Rate, 2019-2024

- By Vehicle Type, (In Value %)

Personal Cars

Commercial Vehicles

Motorcycles

Trucks and Buses - By Financing Type, (In Value %)

Lease Financing

Hire Purchase

Chattel Mortgages - By Customer Type, (In Value %)

Individual Consumers

Businesses/Corporate Entities

Governmental Entities - By Region, (In Value %)

New South Wales

Victoria

Queensland

Western Australia

South Australia

Others - By Duration of Finance, (In Value %)

Short-term (1-4 years)

Medium-term (5-7 years)

Long-term (8+ years) - By Loan Provider, (In Value %)

Banks

Captives

Credit Unions

NBFCs

Others - By Purpose, (In Value %)

Loan

Leasing - By Vehicle Age, (In Value %)

New Vehicles

Used Vehicles

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Vehicle Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Revenues, Revenue by Vehicle Type, Number of Branches/Offices, Distribution Channels)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Australia and New Zealand Banking Group Limited (ANZ)

National Australia Bank Limited

Toyota Finance Australia Limited

Hyundai Motor Company, Australia Pty Limited

Mahindra Automotive Australia Pty Ltd

Bendigo and Adelaide Bank

Beyond Bank Australia Limited

Fair Go Finance

Great Southern Bank

Heritage Bank

Stratton Finance Pty Ltd

St.George Bank

Westpac

People’s Choice Credit Union

SUNCORP

National Roads and Motorists’ Association Limited

HSBC Bank Australia Limited

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Interest Rate, 2025-2030