Market Overview

The Australia autonomous ships market is valued at approximately USD ~ billion, driven by advancements in AI, marine robotics, and government investments in autonomous technologies. The market is expected to experience sustained growth as the Australian government pushes forward with policies to encourage autonomous maritime innovations, especially to boost its logistics and defense sectors. Technological improvements in navigation systems, fuel efficiency, and safety protocols have also positively impacted the demand for autonomous ships, increasing the market’s overall growth trajectory.

The dominant countries within the Australia autonomous ships market include Australia itself, along with significant interest from neighboring regions such as New Zealand and Southeast Asia. Australia’s prominence in this market is due to its long coastline, major ports, and active role in integrating autonomous technology into its maritime and defense sectors. The country’s favorable regulatory environment, including policies that promote innovation, as well as its focus on sustainability, further strengthens its dominance in the market. Additionally, partnerships with global tech companies and shipbuilders enhance Australia’s competitiveness.

Market Segmentation

By Product Type

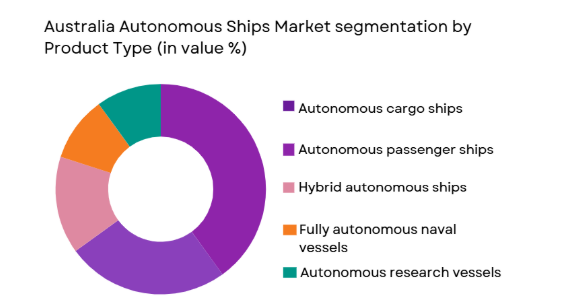

The Australia autonomous ships market is segmented by product type into autonomous cargo ships, autonomous passenger ships, hybrid autonomous ships, fully autonomous naval vessels, and autonomous research vessels. The autonomous cargo ships segment is dominating the market due to increasing demand for more efficient and cost-effective freight transport solutions. The growing need for automation in shipping operations, driven by labor shortages and the desire for fuel efficiency, is making autonomous cargo ships the preferred choice for commercial shipping companies and logistics operators. Autonomous cargo vessels offer reduced operating costs, enhanced safety, and the ability to operate in remote locations, making them ideal for global trade routes.

By Platform Type

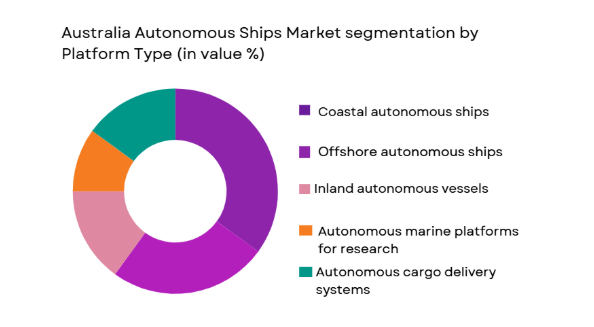

The market for autonomous ships is also segmented by platform type, which includes coastal autonomous ships, offshore autonomous ships, inland autonomous vessels, autonomous marine platforms for research, and autonomous cargo delivery systems. The coastal autonomous ships segment is leading the market due to the rising adoption of autonomous vessels along major trade routes and near port areas. These ships are increasingly being used for short-range logistics, where they can greatly reduce operational costs and improve safety by reducing human error. Coastal areas are ideal for deploying these vessels due to their proximity to existing infrastructure, ease of integration, and the high volume of traffic, making automation a logical solution.

Competitive Landscape

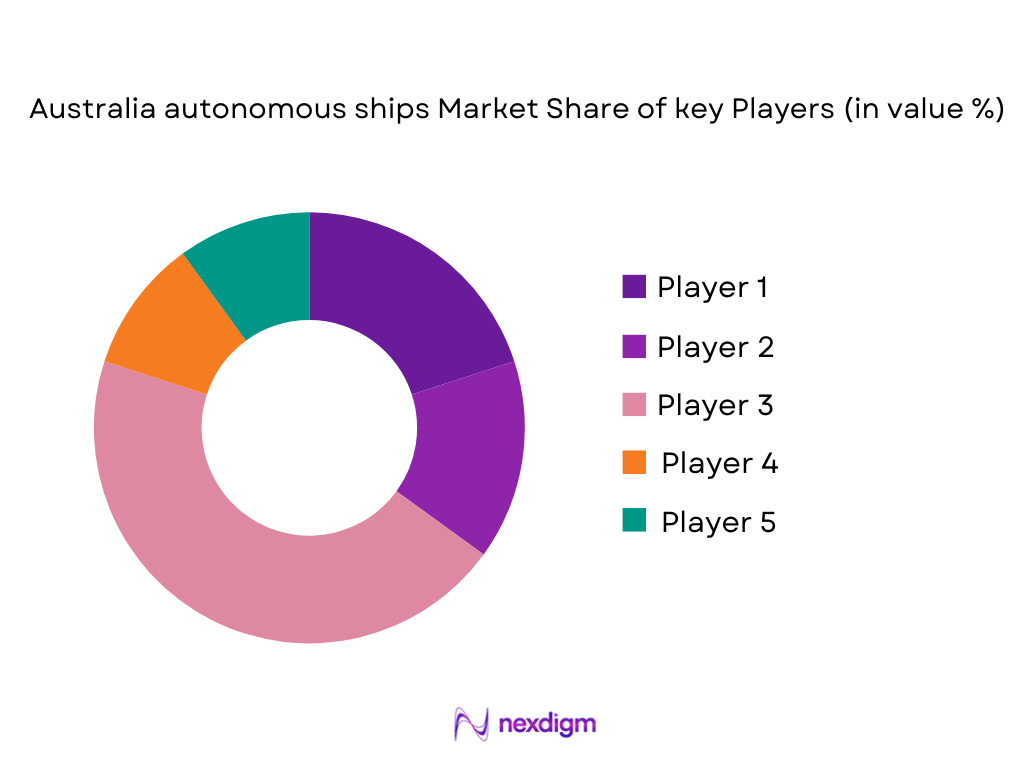

The Australia autonomous ships market is characterized by a high level of competition among both established players and emerging tech firms. The market is experiencing consolidation as major global players such as Wärtsilä Corporation and Kongsberg Gruppen ASA work to expand their offerings in autonomous maritime technologies. Collaborations between traditional shipbuilders and tech companies are shaping the competitive landscape, allowing for the rapid development of new autonomous vessel solutions. Increased funding from both private and public sectors is driving innovation, particularly in the areas of AI-based navigation systems, fuel-efficient propulsion technologies, and cybersecurity.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Autonomous Ship Type Focus |

| Wärtsilä Corporation | 1834 | Finland | ~ | ~ | ~ | ~ | ~ |

| Kongsberg Gruppen ASA | 1814 | Norway | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| ABB Ltd. | 1883 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Hyundai Heavy Industries | 1972 | South Korea | ~ | ~ | ~ | ~ | ~ |

Australia Autonomous Ships Market Analysis

Growth Drivers

Technological Advancements in Autonomous Navigation

The integration of cutting-edge technologies such as AI, machine learning, and machine vision in autonomous navigation systems is a major driver of the Australia autonomous ships market. The development of highly advanced AI systems has made it possible for autonomous vessels to navigate safely, avoid collisions, and operate without human intervention. These systems enhance the efficiency and safety of operations, reducing reliance on skilled crew members and significantly lowering operational costs. Furthermore, autonomous systems are equipped with sensors and GPS technologies, making them capable of operating even in harsh maritime conditions. As the technology continues to evolve, it is expected that autonomous navigation will become the standard in the shipping industry, which will further boost the market’s growth. The increasing demand for seamless and error-free operations in shipping, driven by growing trade volumes, is also contributing to the widespread adoption of autonomous vessels.

Environmental Sustainability and Regulations

The growing emphasis on environmental sustainability is another key driver of the autonomous ships market. With increasing global awareness regarding the environmental impact of shipping activities, particularly in terms of fuel consumption and emissions, the push for cleaner and more sustainable maritime solutions has intensified. Autonomous ships are seen as a solution to this issue, as they can be designed to operate more efficiently, using cleaner energy sources, reducing emissions, and optimizing fuel consumption. In addition, governments and international organizations have imposed stricter environmental regulations on the maritime industry, pushing for the adoption of greener technologies. Australia, with its vast coastline and commitment to environmental sustainability, is leading the charge in adopting these technologies, which has, in turn, driven the market for autonomous ships.

Market Challenges

High Initial Capital Investment

One of the primary challenges faced by the autonomous ships market in Australia is the high initial capital investment required for research, development, and manufacturing of autonomous vessels. Although the operational costs of autonomous ships are significantly lower than traditional manned vessels, the upfront cost of integrating advanced technologies such as AI, sensors, and autonomous navigation systems can be prohibitively expensive for many shipping companies. This high cost is a significant barrier to the widespread adoption of autonomous vessels, particularly for smaller companies that are unable to afford these investments. Furthermore, the infrastructure needed to support these ships, such as autonomous port facilities and charging stations for electric vessels, further increases the overall investment required. These financial constraints are limiting the rate at which autonomous ships are being adopted in Australia and globally.

Regulatory and Certification Hurdles

Another significant challenge facing the Australia autonomous ships market is the complex regulatory environment surrounding the certification and operation of autonomous vessels. The maritime industry is highly regulated, with stringent safety, environmental, and operational standards that must be met for ships to be certified and allowed to operate. The introduction of autonomous vessels presents new challenges for regulators, who must ensure that these vessels meet the same safety and operational standards as traditional manned ships. The lack of clear and standardized regulations for autonomous vessels in many regions, including Australia, has created uncertainty for shipbuilders and operators. This regulatory uncertainty is hindering the pace of innovation and slowing the deployment of autonomous vessels, as companies are reluctant to invest in new technologies without a clear regulatory framework in place.

Opportunities

Expansion of Autonomous Shipping in Defense and Security

One of the most significant opportunities for the Australia autonomous ships market lies in the defense and security sectors. Autonomous vessels offer several advantages in military and security operations, including the ability to perform high-risk missions without endangering human lives. These vessels can be used for a variety of purposes, including reconnaissance, surveillance, and resupply missions, as well as for border patrol and anti-piracy operations. Given Australia’s strategic location and its increasing investment in defense technologies, there is significant potential for autonomous vessels to play a critical role in the country’s defense infrastructure. Additionally, the global defense sector is increasingly adopting autonomous technologies, which presents an opportunity for Australia to lead in the development of military-grade autonomous ships. This growing interest in defense applications will contribute significantly to the overall market growth.

Integration with Smart Ports and Logistics Network

The integration of autonomous vessels with smart port and logistics networks represents a major opportunity for the Australia autonomous ships market. Smart ports use advanced technologies such as the Internet of Things (IoT), AI, and automation to streamline port operations, improve efficiency, and reduce costs. By connecting autonomous vessels with these smart port systems, shipping companies can further optimize their operations, reduce waiting times, and minimize human error in port procedures. Autonomous ships can be seamlessly integrated into these systems, improving the overall efficiency of global supply chains. Australia’s strong focus on infrastructure development, particularly in its port cities, positions the country well to capitalize on this opportunity. The growth of smart ports globally will drive the demand for autonomous vessels and create a favorable environment for their widespread adoption.

Future Outlook

The future outlook for the Australia autonomous ships market is highly promising, with expected advancements in AI and automation technologies. Over the next five years, the market is poised for significant growth as both the shipping and defense sectors continue to embrace autonomous solutions. Technological developments, particularly in navigation and energy-efficient systems, are expected to enhance the capabilities of autonomous vessels, while increasing regulatory support will streamline certification processes. With rising demand for autonomous solutions and strong investments in infrastructure, Australia is set to become a global leader in autonomous shipping.

Major Players

- WärtsiläCorporation

- Kongsberg Gruppen ASA

- Rolls-Royce

- ABB Ltd.

- Hyundai Heavy Industries

- Navantia

- Damen Shipyards Group

- L3 Technologies

- General Electric Company

- Lockheed Martin

- Bae Systems

- Mitsubishi Heavy Industries

- Saipem

- Thales Group

- Kawasaki Heavy Industries

Key Target Audience

- Investments and venture capitalist firm

- Government and regulatory bodies

- Commercial shipping companies

- Military and defense contractors

- Environmental protection agencies

- Smart port developers

- Logistics and supply chain firms

- Research and development organizations

Research Methodology

Step 1: Identification of Key Variables

Identifying key drivers, challenges, and trends in the market for autonomous ships, as well as recognizing market barriers and emerging opportunities.

Step 2: Market Analysis and Construction

Data analysis of existing market trends, competitor performance, and regulatory landscape, followed by segmentation of the market based on key factors such as technology and product type.

Step 3: Hypothesis Validation and Expert Consultation

Conducting interviews with industry experts, stakeholders, and market leaders to validate market hypotheses and gain insights into the current and future market dynamics.

Step 4: Research Synthesis and Final Output

Integrating primary and secondary data, including expert interviews and market reports, to synthesize a comprehensive report with market insights and recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological advancements in autonomous navigation

Rising demand for cost-effective and efficient shipping

Government investments in maritime infrastructure

Increasing focus on sustainability and emissions reduction

Growing interest in autonomous vessels for defense applications - Market Challenges

High initial capital investment

Regulatory hurdles and certification processes

Cybersecurity risks in autonomous ship operations

Integration complexities with existing maritime infrastructure

Limited public acceptance of autonomous vessels - Market Opportunities

Expansion of autonomous ships in the defense sector

Development of hybrid propulsion systems for long-distance voyages

Collaborations between public and private sectors for infrastructure development - Trends

Adoption of 5G and IoT in autonomous ships

Increased use of machine learning for predictive maintenance

Collaborative navigation systems with unmanned aerial vehicles

Integration of autonomous vessels in smart ports

Rising focus on reducing carbon emissions in maritime shipping - Government Regulations & Defense Policy

National maritime safety regulations for autonomous ships

Government policies promoting automation in shipping

International maritime treaties and standards for autonomous vessels - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Autonomous cargo ships

Autonomous passenger ships

Hybrid autonomous ships

Fully autonomous naval vessels

Autonomous research vessels - By Platform Type (In Value%)

Coastal autonomous ships

Offshore autonomous ships

Inland autonomous vessels

Autonomous marine platforms for research

Autonomous cargo delivery systems - By Fitment Type (In Value%)

OEM autonomous ships

Aftermarket autonomous retrofitting

Integrated autonomous systems

Modular autonomous ship systems

Custom-built autonomous vessels - By EndUser Segment (In Value%)

Commercial shipping companies

Research organizations

Naval defense sectors

Logistics and cargo transport companies

Public sector transportation agencies - By Procurement Channel (In Value%)

Direct purchase from manufacturers

Third-party resellers

Government defense contracts

Integrated procurement from shipbuilders

Through public tenders and government bids - By Material / Technology (In Value%)

Battery-powered autonomous ships

Diesel-electric hybrid propulsion systems

Advanced navigation systems

AI-driven ship control systems

Remote control operation systems

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Technology, System Complexity, Platform Type, Procurement Channel, Market Value, Installed Units, Average System Price, End User, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Wärtsilä Corporation

Kongsberg Gruppen ASA

Rolls-Royce

ABB Ltd.

L3 Technologies Inc.

General Electric Company

Hyundai Heavy Industries

Naval Group

Yara International ASA

Cargill, Incorporated

Bae Systems

Samsung Heavy Industries

Subsea 7

Fincantieri

Crowley Maritime Corporation

- Adoption of autonomous vessels in commercial shipping

- Growing interest from defense and security sectors

- Deployment of autonomous research vessels in marine science

- Partnerships between government and private firms for maritime projects

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035