Market Overview

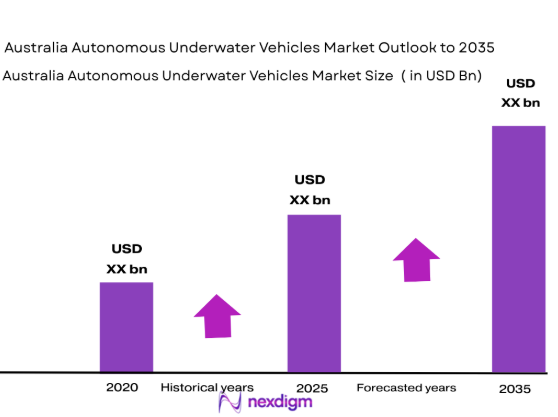

The Australia Autonomous Underwater Vehicles market is valued at approximately USD ~ million, driven by the increasing need for advanced technologies in defense, marine research, and offshore industries. The market’s growth is fueled by the demand for autonomous solutions in underwater exploration, particularly in sectors such as oil and gas, defense, and environmental monitoring. These industries are seeking cost-effective, efficient, and safe alternatives to traditional manual methods, contributing to the rise of autonomous systems capable of operating in deep-sea environments with minimal human intervention.

Australia’s dominance in the autonomous underwater vehicle market is attributed to its strategic location and its extensive marine resources, which make it a hub for maritime technology and research. The nation’s robust defense initiatives, coupled with government investments in marine science and oceanography, have driven the development of advanced AUV technologies. The large number of research programs and exploration activities within Australia, along with strong collaborations between government and private sector players, positions the country as a leading market for autonomous underwater vehicles.

Market Segmentation

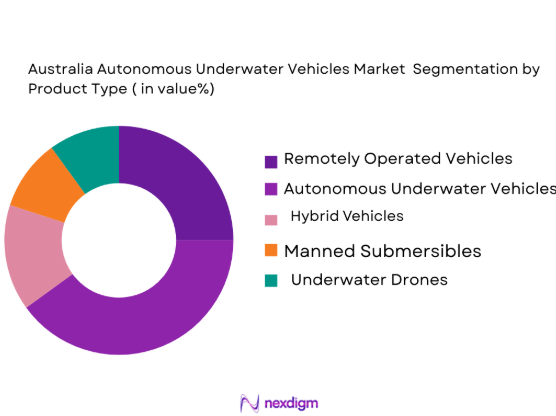

By Product Type

Australia Autonomous Underwater Vehicles market is segmented by product type into remotely operated vehicles (ROVs), autonomous underwater vehicles (AUVs), hybrid vehicles, manned submersibles, and underwater drones. Recently, autonomous underwater vehicles have a dominant market share due to the growing demand for high-efficiency systems that require less manual intervention, thereby providing cost savings and enhancing safety in deep-sea explorations and military applications. These vehicles are preferred for both long-duration missions and tasks in hazardous or hard-to-reach environments.

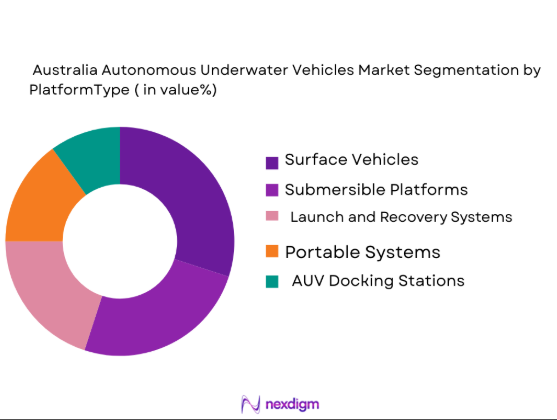

By Platform Type

The market is segmented by platform type into surface vehicles, submersible platforms, launch and recovery systems, portable systems, and AUV docking stations. Surface vehicles have a significant market share due to their high utility in launching and recovering autonomous vehicles in a variety of marine environments. These platforms facilitate the ease of operation for AUVs and ROVs, particularly for long-term or high-value offshore operations, thus making them indispensable in both defense and industrial applications.

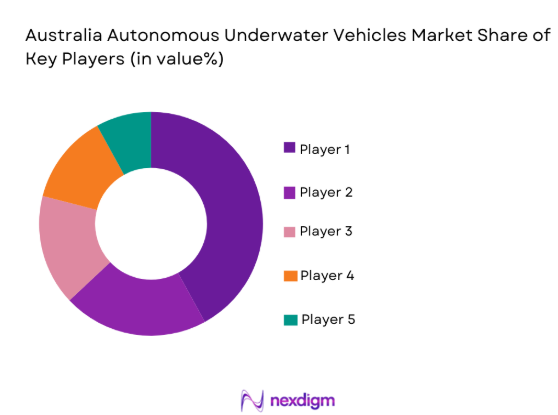

Competitive Landscape

The competitive landscape in the Australian autonomous underwater vehicle market is characterized by strong consolidation, with major players leading the market through technological innovations, strategic partnerships, and an expanding portfolio of products. The influence of established players with extensive experience in underwater robotics and marine exploration technologies shapes the competitive environment, as they continue to lead the push toward advanced autonomous systems. The market sees a combination of private and government investments, particularly in defense and environmental monitoring sectors.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Technology Integration |

| Ocean Infinity | 2017 | UK | ~ | ~ | ~ | ~ | ~ |

| Teledyne Technologies | 1960 | USA | ~ | ~ | ~ | ~ | ~ |

| L3 Technologies | 1997 | USA | ~ | ~ | ~ | ~ | ~ |

| Kongsberg Gruppen | 1814 | Norway | ~ | ~ | ~ | ~ | ~ |

|

Saab Group |

1984 | Sweden | ~ | ~ | ~ | ~ | ~ |

Australia Autonomous Underwater Vehicles Market Analysis

Growth Drivers

Technological Advancements in Underwater Robotics

Technological advancements in autonomous underwater vehicle systems are driving market growth by enhancing operational capabilities and reducing the need for manual intervention. The integration of cutting-edge technologies, such as AI, deep learning algorithms, and more efficient battery systems, has enabled AUVs to perform long-duration underwater missions with enhanced autonomy and precision. This has been particularly beneficial in applications such as deep-sea exploration, where manual operations are both risky and costly. Furthermore, the continuous improvement of sensors and communication systems is allowing AUVs to navigate more complex underwater environments, providing real-time data collection for scientific and commercial purposes. The demand for AUVs that can operate in extreme depths with minimal human oversight is expected to continue to increase as industries such as offshore oil and gas exploration, military surveillance, and marine research demand more sophisticated solutions to their underwater operational needs.

Government and Defense Investments in Marine Technologies

Governments worldwide, especially in Australia, are significantly investing in autonomous underwater vehicle technologies due to their military and research applications. The growing importance of national security and the need for advanced surveillance capabilities in maritime domains are key drivers of market expansion. Australian defense initiatives, focused on enhancing surveillance and reconnaissance capabilities in both national waters and international territorial zones, have led to significant government expenditure on AUVs. These vehicles are becoming vital tools for defense forces to monitor vast oceanic territories and conduct underwater intelligence gathering with greater efficiency and precision. Additionally, with increasing pressure to protect marine ecosystems, governments are allocating more resources to using autonomous underwater vehicles for environmental monitoring, enabling researchers and policymakers to assess ocean health and biodiversity effectively.

Market Challenges

High Development and Operational Costs

One of the most significant challenges facing the Australian autonomous underwater vehicle market is the high cost of development and operational maintenance. The complexity of designing AUVs that can withstand harsh underwater environments requires advanced materials, cutting-edge technology, and extensive testing, all of which contribute to high initial investment costs. Furthermore, the operational expenses associated with running these vehicles, including battery life, sensor calibration, and data analysis, can be prohibitive for smaller companies and research organizations. This makes it difficult for many potential adopters to enter the market, limiting growth potential, particularly in regions or sectors that do not have significant government or institutional backing. The need for highly skilled technicians to maintain and repair these vehicles also adds to operational costs, making widespread deployment a financial hurdle for some organizations.

Regulatory and Environmental Compliance Issues

Autonomous underwater vehicles are subject to a complex web of regulations and environmental standards, especially in commercial applications like offshore exploration and military use. These regulations aim to ensure the vehicles’ safety, reliability, and minimal environmental impact. However, navigating these standards can be a challenge for companies, as they often vary by region and are subject to frequent updates and revisions. The approval process for new systems can be lengthy, involving extensive testing and certification procedures before AUVs can be deployed in certain regions. Additionally, environmental monitoring regulations necessitate vehicles to meet strict emissions and operational safety standards, which can increase both development and operational costs for manufacturers and end-users.

Opportunities

Expanding Offshore Energy Exploration and Mining Markets

As global energy demand continues to grow, offshore energy exploration, including oil, gas, and renewable energy sources like tidal and wave power, presents a significant opportunity for autonomous underwater vehicle manufacturers. These vehicles are essential in offshore drilling and exploration, where traditional methods are not feasible due to the hazardous nature of deep-sea operations. In addition, mining activities, such as seabed mining for rare earth elements, are gaining traction, requiring highly efficient underwater exploration systems. Australia, with its vast coastlines and marine resources, is positioned to capitalize on these opportunities as both commercial and defense sectors seek to enhance operational capabilities in these areas. Autonomous underwater vehicles can help streamline exploration, reduce operational risks, and enhance environmental safety, thus driving market growth.

Increasing Adoption in Marine Conservation and Environmental Monitoring

Autonomous underwater vehicles are increasingly being adopted for marine conservation and environmental monitoring, creating opportunities in research and environmental sectors. These vehicles can conduct detailed surveys of marine ecosystems, monitor biodiversity, and track the health of coral reefs and other critical habitats. As climate change accelerates, there is growing pressure on governments and environmental organizations to understand the impacts of environmental degradation on ocean life. AUVs offer an efficient, cost-effective, and safe way to collect data on oceanic health, providing critical insights into pollution levels, temperature changes, and the condition of marine species. With rising global awareness of ocean conservation, the demand for these vehicles in research and monitoring initiatives is expected to increase, providing an exciting growth opportunity for manufacturers and stakeholders.

Future Outlook

The future outlook for the Australia Autonomous Underwater Vehicles market over the next five years is poised for substantial growth, driven by technological advancements, increasing demand for offshore exploration, and government investments in marine defense and research. As technological innovations continue to improve the efficiency, durability, and capabilities of AUVs, they will become indispensable tools across a range of sectors, including defense, energy exploration, and environmental monitoring. Additionally, regulatory support and greater awareness of ocean health will fuel the adoption of autonomous vehicles in scientific research. This expansion will be accompanied by further developments in AI and sensor technologies, enhancing the performance and autonomy of AUVs in complex underwater environments.

Major Players

- Ocean Infinity

- Teledyne Technologies

- L3 Technologies

- Kongsberg Gruppen

- Saab Group

- Bluefin Robotics

- ECA Group

- Subsea 7

- Fugro

- International Submarine Engineering

- Hydroid Inc.

- FMC Technologies

- Reef Subsea

- Riviera Maritime Media

- Innospection Ltd

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Energy companies

- Marine research institutions

- Defense contractors

- Environmental organizations

- Offshore exploration firms

- OEMs

Research Methodology

Step 1: Identification of Key Variables

Identification of key market variables, including system types, platform types, end-user segments, and regulatory frameworks.

Step 2: Market Analysis and Construction

Construction of market size models, incorporating historical data, current trends, and competitive dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with industry experts and validation of assumptions with stakeholders from key market sectors.

Step 4: Research Synthesis and Final Output

Synthesis of research findings into a final report, presenting actionable insights and strategic recommendations for stakeholders.

- Executive Summary

- Australia Autonomous Underwater Vehicles Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Demand in Offshore Exploration

Increased Military & Defense Applications

Advancements in Battery and Sensor Technologies

Growing Investments in Marine Research

Rising Demand for Environmental Monitoring - Market Challenges

High Initial Investment Costs

Technological Limitations in Harsh Environments

Regulatory Compliance and Certification Challenges

Complexity in Data Processing and Integration

Dependence on Skilled Operators and Technicians - Market Opportunities

Expansion of Underwater Exploration

Growth in Renewable Energy and Marine Mining

Enhanced Research Capabilities for Environmental Preservation - Trends

Miniaturization of Autonomous Systems

Improved AI Integration in Autonomous Vehicles

Shift Towards Hybrid System Designs

Increased Collaboration Between Government and Private Sectors

Emergence of Autonomous Underwater Drone Swarms - Government Regulations & Defense Policy

Government Incentives for Marine Technology

New Environmental Standards for Marine Vehicles

Defense Spending on Autonomous Marine Vehicles - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Remotely Operated Vehicles

Autonomous Underwater Vehicles

Hybrid Underwater Vehicles

Lightweight Underwater Vehicles

Heavy Duty Underwater Vehicles - By Platform Type (In Value%)

Surface Vehicles

Submersible Platforms

Launch and Recovery Systems

AUV Docking Stations

Portable Systems - By Fitment Type (In Value%)

Military Fitments

Commercial Fitments

Research Fitments

Scientific Fitments

Government Fitments - By End User Segment (In Value%)

Defense & Military

Oil & Gas Industry

Marine Research Institutes

Environmental Agencies

Commercial Exploration - By Procurement Channel (In Value%)

Direct Sales

Distributors

OEMs

Online Marketplaces

Government Procurement - By Material / Technology (In Value%)

Carbon Fiber Materials

Metal Alloys

Composites

Electronics and Sensors

Battery Technologies

- Market share snapshot of major players

- Cross Comparison Parameters (Price, Technology, Operational Efficiency, R&D Investment, Market Presence)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Ocean Infinity

Teledyne Technologies

L3 Technologies

Kongsberg Gruppen

Saab Group

Bluefin Robotics

ECA Group

Subsea 7

Fugro

International Submarine Engineering

Hydroid Inc.

FMC Technologies

Reef Subsea

Riviera Maritime Media

Innospection Ltd.

- Rising Use in Scientific Research and Oceanography

- Demand for Underwater Vehicles in Offshore Oil & Gas Exploration

- Military Demand for Surveillance and Reconnaissance Missions

- Expansion of Environmental Monitoring Projects

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035