Market Overview

Based on a recent historical assessment, the Australia Ballistic Protection Market was valued at approximately USD ~ million, driven primarily by sustained defense procurement programs, modernization of personal protection equipment, and upgrades to armored vehicle fleets. Government-funded acquisitions for body armor, vehicle armor kits, and infrastructure protection formed the core demand base, supported by homeland security requirements and regional threat preparedness. Additional demand was generated through lifecycle replacement of legacy systems and increased emphasis on survivability standards aligned with allied defense frameworks, resulting in stable institutional spending across multiple ballistic protection categories.

Based on a recent historical assessment, Australia emerged as the dominant national market due to centralized defense procurement managed by federal authorities and concentrated manufacturing and integration capabilities in regions such as Victoria, South Australia, and New South Wales. These areas host major defense primes, testing facilities, and certified suppliers supporting ballistic armor production and integration. Strong collaboration with allied countries, access to advanced materials supply chains, and proximity to defense research institutions further reinforced national dominance, while smaller contributions originated from exports and specialized protection programs supporting regional security partnerships.

Market Segmentation

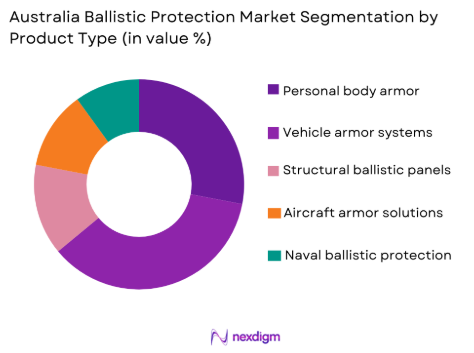

By Product Type

Australia Ballistic Protection Market market is segmented by product type into personal body armor, vehicle armor systems, structural ballistic panels, aircraft armor solutions, and naval ballistic protection. Recently, vehicle armor systems have held a dominant market share due to sustained investment in protected mobility platforms, armored patrol vehicles, and fleet survivability upgrades. Ongoing replacement of aging armored vehicles, combined with evolving threat environments, has driven demand for modular and scalable vehicle protection solutions. Vehicle armor benefits from higher unit values, longer program durations, and integrated procurement contracts compared to individual protection equipment. Additionally, interoperability requirements with allied forces and multi-role deployment needs have reinforced adoption, positioning vehicle armor as the most commercially significant product segment within national ballistic protection programs.

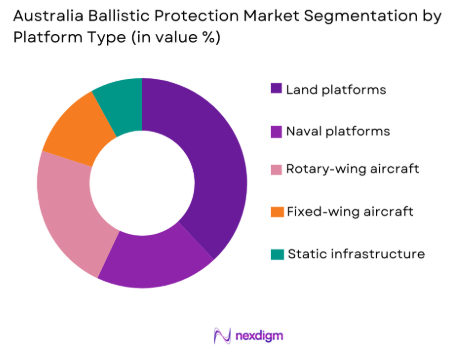

By Platform Type

Australia Ballistic Protection Market market is segmented by platform type into land platforms, naval platforms, rotary-wing aircraft, fixed-wing aircraft, and static infrastructure. Recently, land platforms have dominated the market due to continuous upgrades of armored vehicles, troop carriers, and land-based defense assets supporting expeditionary and domestic operations. Land platforms require layered ballistic solutions tailored to mobility, payload, and mission profiles, leading to higher procurement volumes and system complexity. The concentration of land-based programs within national defense planning, combined with standardized protection requirements, has ensured consistent funding allocation. These factors collectively position land platforms as the leading platform segment within the overall ballistic protection market.

Competitive Landscape

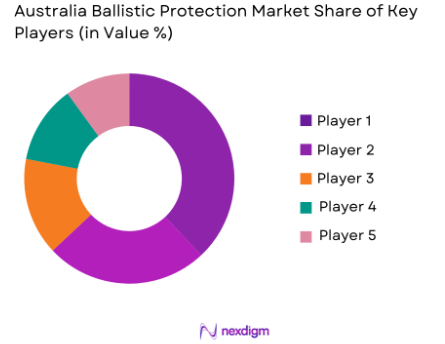

The competitive landscape of the Australia Ballistic Protection Market is characterized by a concentrated group of defense primes and specialized armor manufacturers that collectively shape procurement outcomes and technology adoption. Market competition is primarily driven by long-term government contracts, platform integration capabilities, and compliance with stringent defense certification standards. Established players benefit from deep relationships with national defense authorities, allowing them to participate in multi-year modernization and sustainment programs. Barriers to entry remain high due to capital-intensive manufacturing requirements, extensive testing protocols, and the need for proven operational performance. As a result, smaller firms typically operate in niche segments such as lightweight materials or modular add-on solutions rather than full-system delivery. Collaboration through joint ventures, technology partnerships, and licensed production arrangements is common, particularly to meet domestic manufacturing and sovereign capability objectives. Overall, competition is shaped less by price volatility and more by reliability, integration expertise, and long-term program alignment with defense priorities.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Defense Integration Capability |

| BAE Systems Australia | 1953 | Australia | ~ | ~ | ~ | ~ | ~ |

| Thales Australia | 1976 | Australia | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall Defence Australia | 2006 | Australia | ~ | ~ | ~ | ~ | ~ |

| Craig International Ballistics | 1993 | Australia | ~ | ~ | ~ | ~ | ~ |

| Plasan Australia | 2008 | Australia | ~ | ~ | ~ | ~ | ~ |

Australia Ballistic Protection Market Analysis

Growth Drivers

Defense Modernization and Force Protection Prioritization

Defense modernization and force protection prioritization remain central growth drivers for the Australia Ballistic Protection Market as national security planning increasingly emphasizes survivability across personnel, vehicles, and infrastructure. The defense establishment has consistently allocated funding toward upgrading protective equipment to meet evolving threat profiles, including ballistic, blast, and fragmentation risks. This driver is reinforced by operational requirements aligned with allied defense forces, necessitating standardized protection levels and interoperability. Modernization programs often bundle ballistic protection upgrades with platform life extension initiatives, expanding procurement scope and value. Increased deployment readiness expectations further elevate demand for advanced armor solutions across land, air, and naval assets. Domestic manufacturing participation requirements strengthen local supply chains, sustaining recurring investment. Continuous replacement cycles for worn or obsolete protection systems ensure baseline demand stability. Collectively, modernization and protection priorities create a structurally resilient demand environment for ballistic protection suppliers operating within Australia.

Regional Security Commitments and Allied Interoperability Requirements

Regional security commitments and allied interoperability requirements significantly drive growth within the Australia Ballistic Protection Market by shaping procurement specifications and long-term capability planning. Australia’s defense posture emphasizes close operational alignment with allied forces, requiring compliance with internationally recognized ballistic protection standards. These commitments translate into regular upgrades of protection systems to maintain compatibility across joint operations and exercises. Interoperability also increases demand for modular armor solutions adaptable to multiple platforms and mission profiles. Participation in multinational defense programs exposes domestic forces to emerging protection technologies, accelerating adoption cycles. Additionally, regional security responsibilities necessitate readiness across diverse operational environments, reinforcing the need for scalable and adaptable ballistic solutions. This driver supports sustained procurement activity beyond baseline domestic requirements. As a result, interoperability-driven demand remains a consistent and influential growth catalyst.

Market Challenges

High Cost and Material Supply Constraints

High cost and material supply constraints represent a major challenge for the Australia Ballistic Protection Market, particularly as advanced armor systems increasingly rely on specialized composites and ceramics. These materials involve complex manufacturing processes, limited global suppliers, and stringent quality controls, all of which elevate production costs. Budgetary pressures within defense procurement can constrain acquisition volumes or delay program timelines. Dependence on imported raw materials further exposes suppliers to geopolitical and logistics risks. Cost escalation can also limit adoption of next-generation lightweight solutions despite operational advantages. Smaller domestic manufacturers may face barriers to scaling production due to capital intensity. Additionally, certification and testing requirements add further expense before systems reach operational deployment. Together, cost and supply challenges place downward pressure on margins and complicate long-term planning.

Weight, Mobility, and Integration Trade-Offs

Weight, mobility, and integration trade-offs pose persistent challenges within the Australia Ballistic Protection Market, as increasing protection levels often conflict with platform performance requirements. Heavier armor solutions can reduce vehicle mobility, payload capacity, and fuel efficiency, affecting operational effectiveness. Integration of ballistic systems must account for platform-specific constraints, requiring customized engineering and testing. These complexities extend development timelines and increase costs for both suppliers and end users. Balancing survivability with operational agility remains a critical design challenge. Retrofit programs for legacy platforms are particularly affected, as structural limitations restrict armor upgrades. This challenge necessitates ongoing innovation but also introduces technical and financial risks. Consequently, integration trade-offs remain a limiting factor for rapid adoption of enhanced protection solutions.

Opportunities

Development of Lightweight and Advanced Composite Armor

Development of lightweight and advanced composite armor presents a significant opportunity for the Australia Ballistic Protection Market as defense users seek improved survivability without compromising mobility. Advances in material science enable thinner, lighter armor offering equivalent or superior protection compared to traditional solutions. These innovations support applications across personnel protection, vehicles, and aircraft. Domestic research and development initiatives can accelerate commercialization while strengthening sovereign capability objectives. Lightweight solutions also reduce lifecycle costs through improved fuel efficiency and reduced structural stress. Adoption potential is further enhanced by compatibility with modular armor architectures. Export opportunities may arise as allied forces pursue similar performance improvements. Overall, advanced composite development represents a high-value growth avenue.

Expansion of Domestic Manufacturing and Export Capability

Expansion of domestic manufacturing and export capability offers another key opportunity for the Australia Ballistic Protection Market by aligning with national defense industrial strategies. Government policies encouraging local production create favorable conditions for capacity expansion and technology transfer. Enhanced domestic capability reduces reliance on foreign suppliers and improves supply chain resilience. Export-oriented production can leverage Australia’s reputation for quality and compliance with allied standards. Participation in multinational programs further supports export growth. Investment in local facilities also stimulates skilled employment and innovation ecosystems. Over time, expanded manufacturing capability can improve cost competitiveness. This opportunity positions Australia as both a consumer and supplier within the global ballistic protection landscape.

Future Outlook

The Australia Ballistic Protection Market is expected to maintain steady momentum over the next five years, supported by continued defense modernization initiatives, regional security commitments, and structured replacement cycles for legacy protection systems. Increasing emphasis on force survivability across land, air, and maritime domains will sustain demand for both personnel and platform-level ballistic solutions. Technological developments in lightweight composites, modular armor architectures, and multi-threat protection systems are likely to influence procurement preferences. Regulatory support for sovereign defense manufacturing will further encourage domestic production and capability development. Demand-side factors such as interoperability with allied forces and readiness for diverse operational environments will remain central to acquisition strategies, shaping a stable and institutionally driven market outlook.

Major Players

- BAE Systems Australia

- Thales Australia

- Rheinmetall Defence Australia

- Craig International Ballistics

- Plasan Australia

- CEA Technologies

- Electro Optic Systems

- Marand Defence Solutions

- Ferra Engineering

- Supacat Australia

- DefendTex

- Armor Australia

- Varley Defence

- Honeywell Australia

- DuPont Australia

Key Target Audience

- Defense ministries and armed forces

- Law enforcement agencies

- Border security organizations

- Critical infrastructure operators

- Private security companies

- Defense manufacturers

- System integrators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables such as protection levels, material types, platform applications, and procurement volumes were identified through defense documentation review. Data points were categorized by product and platform relevance. Variable interdependencies were mapped to ensure consistency. This step established the analytical foundation.

Step 2: Market Analysis and Construction

Market structure was constructed using defense spending disclosures and procurement programs. Segmentation logic was applied to align products and platforms. Data normalization ensured comparability across sources. Analytical models were then developed.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through expert consultations and industry commentary. Assumptions were tested against operational requirements. Feedback loops refined segmentation and driver analysis. This enhanced accuracy and relevance.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a cohesive narrative. Quantitative and qualitative findings were integrated. Consistency checks ensured alignment across sections. Final outputs were structured for decision-making utility.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense modernization programs

Increased focus on soldier survivability

Expansion of armored vehicle fleets

Growing emphasis on infrastructure protection

Regional security and threat preparedness - Market Challenges

High cost of advanced ballistic materials

Complex certification and testing requirements

Weight and mobility trade-offs

Supply chain dependence on specialized materials

Integration challenges across platforms - Market Opportunities

Development of lightweight composite armor

Domestic manufacturing and localization initiatives

Upgrades of legacy protection systems - Trends

Adoption of modular scalable armor solutions

Integration of ballistic and blast protection

Use of smart materials and layered systems

Increased collaboration with allied defense suppliers

Focus on lifecycle cost optimization

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Personal body armor systems

Vehicle-mounted armor kits

Structural ballistic panels

Helicopter and aircraft armor

Naval ballistic shielding systems - By Platform Type (In Value%)

Land-based defense platforms

Naval vessels and patrol boats

Rotary-wing aircraft

Fixed-wing military aircraft

Static infrastructure installations - By Fitment Type (In Value%)

OEM-integrated protection systems

Retrofit armor solutions

Modular add-on protection kits

Mission-specific removable armor

Hybrid integrated and modular fitments - By End User Segment (In Value%)

National defense forces

Law enforcement agencies

Border security and customs

Critical infrastructure operators

Private security contractors - By Procurement Channel (In Value%)

Direct government contracts

Defense procurement agencies

International defense partnerships

System integrator agreements

Authorized defense distributors - By Material / Technology (in Value %)

Advanced ceramic composites

Aramid fiber-based armor

Ultra-high-molecular-weight polyethylene

Metallic alloy armor systems

Hybrid multi-material ballistic solutions

- Market share snapshot of major players

- Cross Comparison Parameters (Protection level standards, Material composition, Weight efficiency, Platform compatibility, Modular scalability, Certification compliance, Lifecycle cost, Local manufacturing capability)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

BAE Systems Australia

Thales Australia

Rheinmetall Defence Australia

CEA Technologies

Electro Optic Systems

Plasan Australia

DuPont Protection Solutions

Honeywell Advanced Materials Australia

Craig International Ballistics

Marand Defence Solutions

Ferra Engineering

Supacat Australia

DefendTex

Armor Australia

Varley Defence

- Defense forces prioritizing multi-threat protection

- Law enforcement demand for lightweight wearable armor

- Infrastructure operators focusing on fixed ballistic shielding

- Private security adopting modular protection solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035