Market Overview

The Australia BNPL market is valued at USD 268.8 million in 2024. This valuation reflects strong traction driven by near-universal smartphone ownership, surging e‑commerce adoption, and the appetite for flexible, interest‑free financing among digitally native Millennials and Gen Z consumers.

Geographically, dominance is concentrated in Australia’s major metropolitan hubs such as Sydney and Melbourne. These cities lead due to their high e‑commerce penetration, dense internet connectivity, and concentration of early fintech adopters and merchant integrations. Their robust digital infrastructure and substantial consumer bases make them natural epicenters for BNPL uptake.

Market Segmentation

By Channel

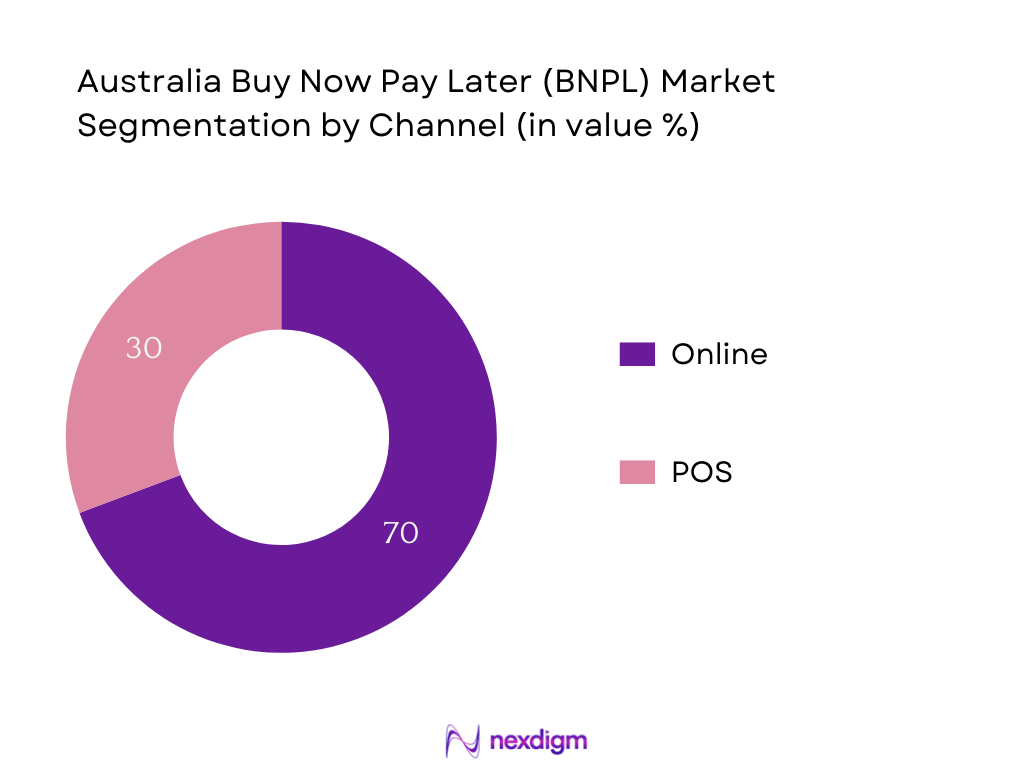

Online BNPL significantly leads, accounting for approximately 69.3% of the market in 2024. This dominance is driven by the seamless digital checkout integration, convenience of use, and heavy reliance on digital transactions. E‑commerce platforms readily embed BNPL options at checkout, significantly boosting user adoption and transaction frequency.

By End‑Use Industry Vertical

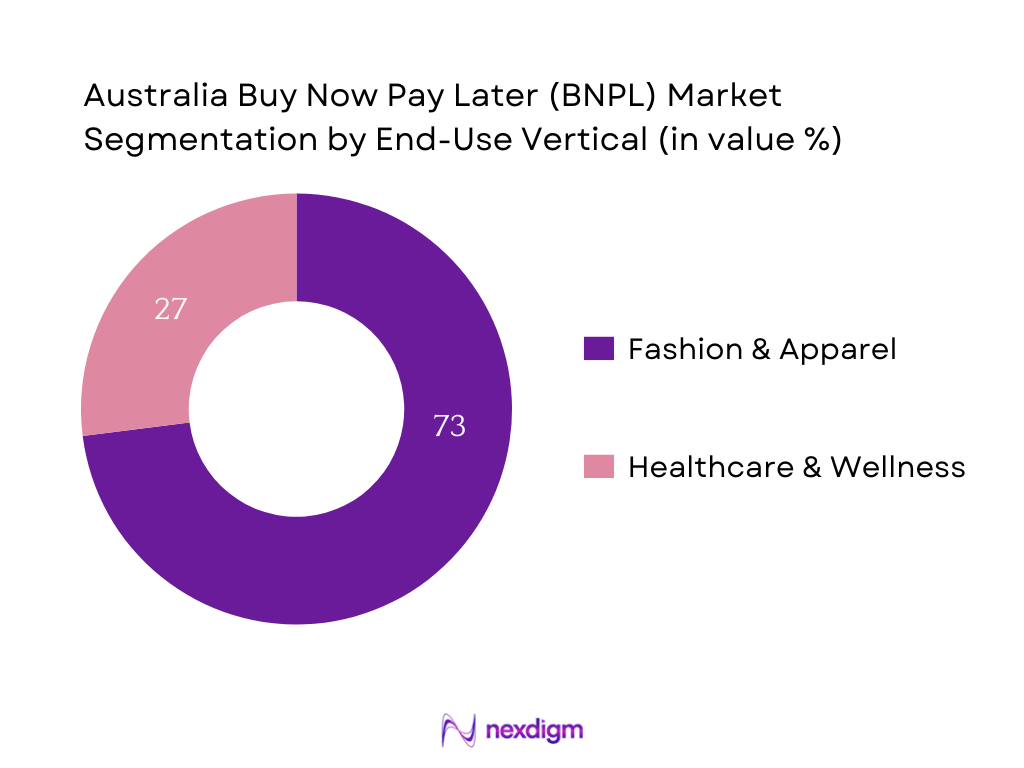

In 2024, Fashion & Apparel led in end-use verticals. Its leadership stems from younger demographics rapidly adopting BNPL for discretionary spending on apparel and footwear. The high-ticket impulse purchases in this category, paired with aggressive marketing and partnerships by BNPL providers with retail brands, have solidified its dominant position.

Competitive Landscape

The Australia BNPL market is shaped by several major players, demonstrating both consolidation and rising competition. Key industry participants such as Afterpay and Zip have capitalized on brand equity, deep merchant networks, and early market entry to maintain leadership. Meanwhile, regulatory shifts, integration with digital wallets, and evolving consumer protections are reshaping the competitive terrain.

| Company | Establishment Year | Headquarters | Active Users (2023/2024) | Annual Payment Volume | Merchant Base | Risk Assessment Model | Regulatory Readiness |

| Afterpay | 2014 | Sydney, Australia | – | – | – | – | – |

| Zip Co | 2013 | Sydney, Australia | – | – | – | – | – |

| Humm Group | 1988 (as FlexiGroup) | Sydney, Australia | – | – | – | – | – |

| Klarna | 2005 | Stockholm, Sweden | – | – | – | – | – |

| PayPal Pay-in-4 | 2020 | San Jose, USA | – | – | – | – | – |

Australia BNPL Market Analysis

Key Growth Drivers

Smartphone and Mobile Wallet Penetration

Australia saw 68.6% smartphone penetration in 2024, equating to approximately 17.0 million smartphone users (out of ~24.8 million population). Mobile wallet adoption is also increasing sharply: during 2023, over 35% of all card transactions were made via mobile wallets, more than triple the share in 2020. This widespread smartphone and mobile wallet adoption underpins BNPL uptake, as consumers find instant credit and installment options more accessible within mobile checkout flows. The convergence of high smartphone ownership and mobile wallet usage creates a robust digital-first environment, enabling BNPL firms to seamlessly integrate their services into everyday payment behavior—supporting frequent and convenient use.

Growing E‑Commerce Spending and Digital Transactions

Online retail spending in Australia reached AU$56.07 billion in 2024, with fashion alone accounting for AU$11.64 billion. Additionally, households spent a record AU$69 billion online in 2024—up from AU$28.5 billion pre-pandemic in 2019—and online purchases made up 16.8% of total retail spend. Weekly engagement remains high: in 2023, 80% of Australian households shopped online, representing 9.5 million households, and one in seven households made weekly online purchases. This surge in e‑commerce volume, transaction frequency, and digital transaction value drives BNPL growth, as both retailers and consumers increasingly favor installment payments at online checkouts.

Key Market Challenges

Regulatory Pressure from ASIC & Federal Government

Australia’s BNPL providers are under growing oversight from financial regulators. In the most recent Annual Report, the national financial regulator pursued enforcement actions leading to fines of approximately AUD 560,000 across various consumer finance infractions between mid‑2023 and mid‑2024. Meanwhile, legislative consultations are underway to expand unfair trading prohibitions under the primary consumer protection laws, which may extend obligations for BNPL firms into new areas of licensing and conduct. This tightening regulatory environment increases legal compliance overhead and dampens flexible underwriting practices that have previously driven BNPL adoption.

High Default Rates Among Young Consumers

Australian households are highly indebted, with total household liabilities rising to 112.1 percent of GDP by Q4 2024, up from 111.5 in Q3, highlighting continued financial pressure. Among homeowners, approximately one in ten missed a mortgage repayment within a six‑month period—a sign of growing financial fragility in younger borrowers. These indicators of fiscal strain among younger cohorts suggest a higher propensity for BNPL default, as emotionally driven impulse buying combines with stretched disposable income, increasing credit risk for BNPL providers and complicating underwriting models.

Emerging Market Opportunities

BNPL in Healthcare, Utilities, and Education Payments

Australians spent AU$69 billion online in 2024, but category‑specific insights show growing unmet demand: for instance, health & wellness online purchases rose 20.5% year‑on‑year during peak shopping periods. This indicates strong consumer inclination to take digital payment options into non-traditional sectors. Given the comfort with BNPL mechanics in retail, expansion into healthcare out-of-pocket expenses, utility bill smoothing, or education fee installmenting is a logical next step. These domains represent high‑value, necessity-driven purchase flows well suited to BNPL’s flexible payment model.

Cross‑border BNPL for Travel & Luxury Goods

While domestic online spending reached AU$69 billion in 2024, cross-border transactions are emerging trends: 28% of Australians purchased from international sellers in 2022. This behavior suggests customers are comfortable transacting overseas and likely interested in BNPL-enabled offerings for international luxury and travel purchases. Given the high transaction values and unique financing needs—such as currency conversion and global merchant integration—cross-border BNPL presents a sizable opportunity to capture premium spending behavior while extending product reach and user financing flexibility.

Future Outlook

Over the coming years, the Australia BNPL market is poised for strong expansion, fueled by continued digital innovation, regulatory maturation, and evolving consumer preferences. As e‑commerce deepens and in-store BNPL gains traction through integrated point-of-sale solutions and mobile wallets, consumers will increasingly opt for flexible financing options. Regulatory reforms—especially credit licence requirements and mandatory affordability checks—will raise trust and facilitate longer-term adoption among both merchants and households.

Major Players

- Afterpay

- Zip Co

- Humm Group

- Klarna (Australia)

- Sezzle

- PayPal Pay‑in‑4

- Laybuy

- Splitit

- Payright

- Wisr

- LatitudePay (legacy)

- Openpay (legacy)

- Affirm (cross‑border)

- BPay BNPL models

- Scalapay

Key Target Audience

- Institutional Investors

- Private Equity Firms

- Venture Capitalist Firms

- Retail Banking Executives (e.g., Commonwealth Bank, NAB, ANZ)

- Digital Payments Product Heads (e‑commerce platforms)

- CFOs of Retail & Consumer Brands

- Fintech Strategy & Innovation Units within financial institutions

- Government & Regulatory Bodies (e.g., ASIC, Reserve Bank of Australia, Treasury)

Research Methodology

Step 1: Identification of Key Variables

The research commenced with drawing a comprehensive map of the Australia BNPL ecosystem—from consumers and merchants to payment rails and regulators. We utilized both publicly available data and proprietary fintech databases to isolate pivotal metrics influencing market performance.

Step 2: Market Analysis and Construction

Next, historical transaction volume, value, user counts, and merchant adoption rates were compiled and validated. Market sizing was triangulated from top‑down (aggregate BNPL transaction data) and bottom‑up (provider financials and expenditure data) approaches to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

We validated initial hypotheses via consultations with fintech executives and payments experts using structured interviews. These helped refine assumptions around growth drivers, regulatory impact, and consumer behavior nuances.

Step 4: Research Synthesis and Final Output

The final stage included direct engagement with BNPL providers, retail partners, and regulatory bodies to verify findings. We reconciled qualitative insights with quantitative estimates to produce a cohesive and credible market analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Evolution of BNPL in Australia

- Regulatory Landscape Evolution (ASIC, RBA, Treasury Reviews)

- BNPL in Australia’s Retail Payment Ecosystem

- BNPL Industry Lifecycle and Value Chain Mapping

- Key Growth Drivers

Smartphone and Mobile Wallet Penetration

Growing E-Commerce Spending and Digital Transactions

Youth Demographics Driving Credit Innovation

Cost-of-Living Pressures Shaping Consumer Credit Demand

Demand for Interest-Free and Instant Approval Credit - Key Market Challenges

Regulatory Pressure from ASIC & Federal Government

High Default Rates Among Young Consumers

Consumer Over-Indebtedness & Lack of Transparency

Merchant Skepticism Regarding Margins and Returns - Emerging Market Opportunities

BNPL in Healthcare, Utilities, and Education Payments

Cross-border BNPL for Travel & Luxury Goods

BNPL Integration in Super-Apps and Wallets

Embedded Finance Models for SMEs and Subscription Players - Market Trends

Consolidation Across BNPL Players

Transition to Credit Licence Framework

Integration with Real-Time Payment Systems (NPP)

BNPL as a Loyalty and CRM Tool - Government Regulations

ASIC Design & Distribution Obligations (DDO)

Mandatory Credit Licence Implementation (2024 Draft Bill)

RBA Payments Review Impact

ACCC Guidelines on Consumer Protection - SWOT Analysis

- Stake Ecosystem (Consumers, BNPL Providers, Merchants, Regulators, Payment Gateways, Investors)

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Active User Base, 2019-2024

- By Merchant Adoption, 2019-2024

- By Average Ticket Size, 2019-2024

- By Channel (In Value %)

Online E-Commerce

In-store Point-of-Sale (POS)

Mobile App Transactions - By Consumer Cohort (In Value %)

Generation Z (18–24 years)

Millennials (25–39 years)

Generation X (40–54 years)

Baby Boomers (55+ years) - By Merchant Vertical (In Value %)

Fashion & Apparel

Electronics & Gadgets

Healthcare & Wellness

Travel & Leisure

Home & Living - By BNPL Product Model (In Value %)

Interest-Free Instalments (Pay-in-4, Pay-in-6)

Revolving Credit Model

Subscription-Based BNPL (Recurring Plans) - By Risk Assessment Model (In Value %)

Proprietary Algorithmic Scoring

Open Banking-Enabled Assessment

Credit Bureau Integrated Evaluation

- Market Share by Value & Volume (Transactions, Users, GMV)

- Cross Comparison Parameters (Algorithmic Credit Risk Model (Type & Transparency), BNPL Revenue Mix (Late Fees, Merchant Fees, Subscription), Average Ticket Size per Consumer, Open Banking Integration Capability, Credit Licence Readiness (Regulatory Compliance Status), Number of Active Retailer Integrations, Default Management System (Hardship Programs), Consumer Retention Rate (Loyalty Programs, Return Usage))

- SWOT Analysis of Major Players

- BNPL Pricing & Merchant Commission Fee Benchmarking

- Company Profiles of Major Players

Afterpay (Block Inc.)

Zip Co Ltd

Humm Group

Sezzle

Klarna Australia

PayPal Pay in 4

Laybuy

Splitit

Payright

Wisr

LatitudePay (Legacy Data)

Openpay (Legacy Data)

Affirm (Global Cross-Border Penetration)

BPay BNPL Models

Scalapay

- Usage Frequency and Preferences

- Credit Aversion vs Credit Necessity

- Merchant and Consumer Friction Points

- BNPL and Multichannel Retailing

- Consumer Protection Needs and Trust Indicators

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Ticket Size, 2025-2030

- By Active Consumer Base, 2025-2030

- By Merchant Participation, 2025-2030