Market Overview

The market size for Australia C4ISR systems is estimated to be valued at approximately USD ~ billion, driven by increasing defense budgets and advanced technological adoption. The demand is propelled by the necessity for superior communication, surveillance, and intelligence capabilities in defense operations. The primary drivers include the need for real-time data exchange, enhanced decision-making, and integrated command structures across various military platforms. With constant modernization efforts, demand continues to rise for more sophisticated, interoperable systems in the defense sector, ensuring mission success in complex environments.

Australia is a leading market for C4ISR systems, with major cities like Sydney, Melbourne, and Canberra serving as hubs for defense-related research, development, and procurement. The dominance of these regions can be attributed to government investments in defense infrastructure and strategic alliances with global defense contractors. The Australian government’s strong defense policies and its participation in multilateral defense organizations contribute to the country’s leadership in the development and deployment of C4ISR systems. Moreover, ongoing investments in technological advancements further strengthen Australia’s position in the market.

Market Segmentation

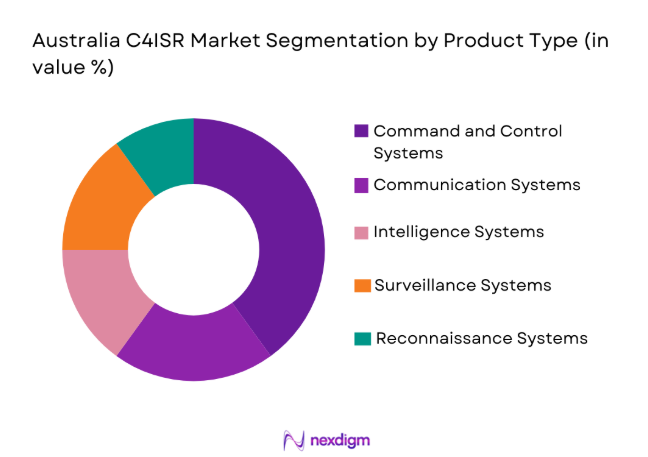

By Product Type:

Australia C4ISR market is segmented by product type into command and control systems, communication systems, intelligence systems, surveillance systems, and reconnaissance systems. Recently, communication systems have a dominant market share due to factors such as increasing reliance on secure, high-speed communication channels in defense operations, which are vital for military coordination. With technological advancements in satellite and radio frequency communication, Australia’s defense forces prioritize these systems for real-time, reliable communications across all platforms. Furthermore, growing partnerships with global defense contractors further enhance the communication systems segment, as these technologies become more integrated and essential for military operations.

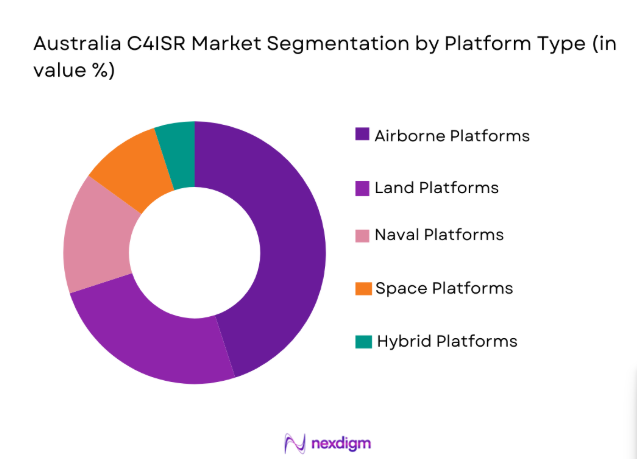

By Platform Type:

Australia C4ISR market is segmented by platform type into airborne platforms, land platforms, naval platforms, space platforms, and hybrid platforms. Recently, airborne platforms have a dominant market share due to factors such as the increasing need for airborne surveillance and reconnaissance, which play a critical role in modern defense strategies. Airborne platforms provide unique advantages, including extensive range and flexibility in monitoring large geographical areas, which are essential for national security and intelligence gathering. With the growing importance of air superiority and surveillance capabilities, these platforms have become a priority investment for Australia’s defense forces.

Competitive Landscape

The Australia C4ISR market is characterized by a competitive landscape where major players consolidate their market positions through technological innovations and strategic partnerships. Key players continuously enhance their offerings through mergers and acquisitions, expanding their reach in both domestic and international markets. Leading defense companies are focusing on integrated solutions that offer advanced communication, intelligence, and surveillance capabilities. As Australia maintains its strategic defense relationships with international defense organizations, global players also benefit from the country’s defense modernization efforts.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Innovation Index |

| BAE Systems | 1999 | Sydney, AU | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

Australia C4ISR Market Analysis

Growth Drivers

Technological Advancements in Communication Systems:

The increasing reliance on high-speed, secure communication channels is one of the key growth drivers for Australia’s C4ISR market. As global threats evolve, the defense sector has increasingly focused on advanced communication technologies, which are crucial for enhancing operational efficiency and military coordination. Secure communication systems ensure that military personnel can share real-time intelligence and operational data across platforms, significantly improving decision-making. Moreover, innovations in satellite communication, radio frequency technologies, and software-defined radios further accelerate demand. These systems ensure robust data transfer capabilities, even in adverse environments or conflict zones. With significant investments in research and development, companies are continuously improving these systems to meet evolving security needs. Additionally, as Australia strengthens its defense partnerships, demand for advanced communication systems continues to grow, enabling interoperability with allied forces. As defense budgets rise and technological advancements unfold, the communication systems segment remains a major driver of the C4ISR market.

Integration of AI and Automation in Defense Operations:

The integration of AI and automation into defense operations is another key driver for the C4ISR market in Australia. AI technologies enhance surveillance, reconnaissance, and intelligence gathering by automating data analysis, reducing human error, and accelerating decision-making processes. The implementation of AI algorithms allows for predictive analytics and autonomous operations, leading to more efficient and responsive defense capabilities. These technologies are also essential for handling vast amounts of data generated by C4ISR systems, enabling defense agencies to quickly assess and act upon critical intelligence. As Australia increasingly adopts these cutting-edge technologies, AI-driven solutions continue to enhance military preparedness and operational efficiency. Automation technologies also streamline command and control operations, ensuring seamless integration across multiple platforms. The convergence of AI and C4ISR systems allows for more effective deployment of defense resources, positioning AI as a major growth driver in the sector.

Market Challenges

High Cost of C4ISR System Implementation:

One of the significant challenges facing Australia’s C4ISR market is the high cost of system implementation. The initial investment required for deploying these complex systems, which involve advanced technologies like communication satellites, radar systems, and data analytics, can be prohibitive. These systems also require extensive maintenance, upgrades, and integration, adding to the financial burden. Smaller defense budgets or resource constraints can delay or limit the adoption of state-of-the-art C4ISR systems. The reliance on cutting-edge technology and the need for specialized personnel further increases operational costs, making it difficult for defense contractors and government bodies to fully equip their forces with the most advanced solutions. Additionally, the ongoing need to stay ahead of cyber threats and technological obsolescence makes cost management a constant concern. As defense spending priorities shift, there is a growing need for cost-effective solutions that provide similar levels of capability without compromising on security or efficiency.

Interoperability Issues Across Platforms:

Another challenge facing the Australia C4ISR market is the interoperability of systems across various platforms. The integration of different military platforms, such as air, land, naval, and space systems, often presents technical challenges in ensuring seamless communication and data exchange. These systems must be compatible with multiple international defense systems, as Australia is involved in several multinational defense collaborations. However, different platforms may use varying communication protocols, software versions, or hardware, making integration difficult. The complexity of aligning these systems without compromising performance or security is a significant hurdle. Moreover, legacy systems, which may not be designed to communicate with newer platforms, can create additional barriers to effective C4ISR deployment. Addressing interoperability issues requires substantial investments in software upgrades, testing, and training, all of which are time-consuming and costly. As Australia seeks to enhance its defense capabilities, overcoming these integration issues remains a challenge.

Opportunities

Expansion of Space-based C4ISR Systems:

The expansion of space-based C4ISR systems presents a significant opportunity for the Australian market. With the increasing reliance on satellite communications for real-time intelligence and surveillance, space-based systems offer a unique advantage in terms of coverage and flexibility. These systems can support a wide range of defense operations, from global communications to reconnaissance and navigation. As the cost of satellite technology decreases and Australia invests in expanding its space capabilities, there is a growing potential for integrating satellite-based solutions into its C4ISR infrastructure. Additionally, space-based C4ISR systems enhance Australia’s ability to coordinate with allied forces, as many defense partners are also upgrading their space-based capabilities. This opportunity allows Australia to improve its operational capabilities, monitor vast areas, and maintain communication even in remote locations. The rising demand for satellite technologies provides an opportunity to drive the growth of space-based C4ISR systems in the Australian defense sector.

Increased Cybersecurity Integration in C4ISR Systems:

The increasing need for robust cybersecurity measures presents another opportunity in the Australia C4ISR market. As cyber threats continue to grow in sophistication, protecting sensitive military data and communications becomes crucial. C4ISR systems are prime targets for cyberattacks, and integrating advanced cybersecurity technologies into these systems enhances their resilience. The Australian defense sector has placed a high priority on improving its cybersecurity frameworks, ensuring that its C4ISR systems remain secure against evolving threats. Moreover, collaboration with cybersecurity firms and defense contractors offers opportunities for developing cutting-edge security technologies that can be integrated into C4ISR platforms. The need for secure and reliable communication across defense platforms makes cybersecurity an essential component of future C4ISR solutions. With the rising incidence of cyber threats, the demand for cybersecurity solutions in the C4ISR market is expected to increase, providing a growth avenue for market participants.

Future Outlook

The Australia C4ISR market is expected to experience robust growth over the next five years. Technological advancements in communication, surveillance, and intelligence systems will drive demand for more integrated and secure C4ISR solutions. Increasing defense budgets, coupled with Australia’s strategic focus on modernizing its military capabilities, will further accelerate market expansion. Technological developments, particularly in AI and satellite communications, will enhance operational efficiencies. Additionally, ongoing regulatory support for defense modernization will play a crucial role in sustaining growth, while demand-side factors such as heightened security concerns and multinational collaborations will drive continuous innovation in C4ISR technologies.

Major Players

• Lockheed Martin

• Northrop Grumman

• Thales Group

• Raytheon Technologies

• General Dynamics

• L3 Technologies

• Leonardo

• Saab AB

• Harris Corporation

• Elbit Systems

• Honeywell Aerospace

• Rockwell Collins

• Airbus Defence and Space

• Hewlett Packard Enterprise

Key Target Audience

• Government and regulatory bodies

• Military and defense contractors

• Aerospace manufacturers

• Space agencies

• Security firms

• Telecommunications companies

• Military research agencies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying critical variables influencing the market, including technological trends, defense budgets, and geopolitical factors.

Step 2: Market Analysis and Construction

In this step, comprehensive data is gathered and analyzed to build a robust market model, considering various demand drivers, challenges, and opportunities.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions and hypotheses are validated through expert interviews and consultations with industry leaders and stakeholders in the defense sector.

Step 4: Research Synthesis and Final Output

The final research synthesis incorporates all findings into a comprehensive report that offers actionable insights, backed by solid data and expert validation.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Defense Budgets in Australia

Technological Advancements in Communications

Increase in Cross-Border Security Threats

Upgrades in Military Capabilities

Strategic Defense Partnerships and Alliances - Market Challenges

High Cost of Integration and Maintenance

Evolving Cybersecurity Threats

Interoperability Issues

Regulatory and Policy Constraints

Lack of Skilled Workforce - Market Opportunities

Integration of AI in C4ISR Systems

Expansion of Space-based Communication Systems

Growth in Defense Export Markets - Trends

Adoption of Autonomous Platforms in Defense

Increased Use of Satellite Communication

AI-Driven Decision-Making Systems

Development of Next-Gen Radar Technologies

Demand for Cybersecurity in Military Systems - Government Regulations & Defense Policy

Tighter Regulations on Export of Defense Technology

Increasing Focus on Cybersecurity Protocols

Adoption of NATO Standards in C4ISR Systems - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and Control Systems

Communication Systems

Intelligence Systems

Surveillance Systems

Reconnaissance Systems - By Platform Type (In Value%)

Airborne Platforms

Land Platforms

Naval Platforms

Space Platforms

Hybrid Platforms - By Fitment Type (In Value%)

Retrofit

New Installation

Field Upgrade

Modular System Integration

Reconfiguration - By EndUser Segment (In Value%)

Defense and Security

Government and Intelligence Agencies

Aerospace and Aviation

Public Safety Organizations

Private Sector Contractors - By Procurement Channel (In Value%)

Direct Government Procurement

OEM Partnerships

System Integrators

Third-Party Distributors

Online Marketplaces - By Material / Technology (In Value%)

RF Communication Technology

Advanced Data Analytics

AI and Machine Learning

Electromagnetic Spectrum Technology

Cybersecurity and Data Protection

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Market Share, Revenue, Technology Adoption, Product Range, Price Competitiveness, Customer Base, Distribution Channels, Regional Presence, Innovation, Financial Stability) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

BAE Systems

Lockheed Martin

Northrop Grumman

Thales Group

Raytheon Technologies

General Dynamics

L3 Technologies

Leonardo

Saab AB

Harris Corporation

Elbit Systems

Honeywell Aerospace

Rockwell Collins

Airbus Defence and Space

Hewlett Packard Enterprise

- Increased Collaboration Between Defense and Intelligence Agencies

- Growing Focus on Maritime Security

- Demand for Integrated Defense Solutions

- Need for Enhanced Airborne Surveillance Systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035