Market Overview

As of 2024, the Australia car rental and leasing market is valued at USD ~ billion, with a growing CAGR of 5.7% from 2024 to 2030. The market has been driven by factors such as increased tourism and a growing preference for short-term vehicle rentals, particularly in urban areas where public transportation may not suffice. The demand for flexibility in transportation options significantly influences market growth, especially among travelers and business professionals.

Major cities like Sydney, Melbourne, and Brisbane dominate the Australia car rental and leasing market due to their high population density and significant tourism activity. These cities serve as key gateways for international tourists and business travelers, fostering a robust demand for car rental services. Additionally, their well-developed infrastructure and connectivity promote usage, making them central to the industry.

Market Segmentation

By Vehicle Type

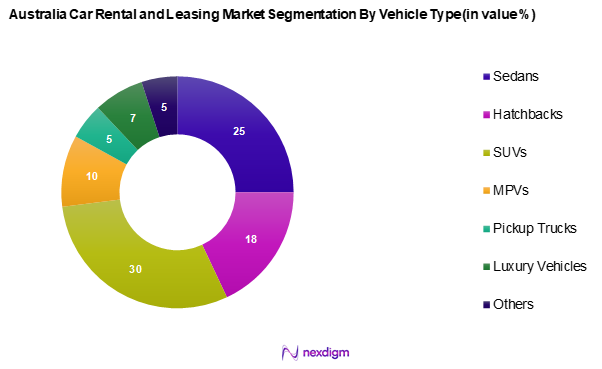

The Australia car rental and leasing market is segmented into Sedans, Hatchbacks, SUVs, MPVs, Pickup Trucks, Luxury Vehicles, and Others. In this market segmentation, SUVs command a dominant market share, primarily due to their versatility, spacious interiors, and increased consumer preference for higher driving positions. As Australians increasingly favor road trips and outdoor activities, the demand for SUVs has surged, making them a top choice for both individual and corporate rentals.

By Rental Duration

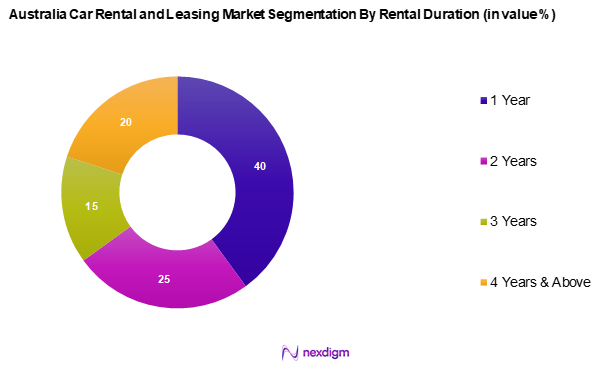

The Australia car rental and leasing market is segmented into 1 Year, 2 Years, 3 Years, and 4 Years & above. The 1 Year rental duration is currently dominating the market share, attributed to its appeal among corporate clients and long-term travellers seeking stable and predictable transportation solutions. Companies favour the flexibility of annual rentals, enabling them to manage operational costs effectively while ensuring reliable transportation for employees.

Competitive Landscape

The competitive landscape of the Australia car rental and leasing market is marked by a limited number of major players for both local and international brands. Prominent companies such as Europcar, Hertz, Avis, and Enterprise dominate the arena, leveraging extensive fleet sizes and geographical coverage to maintain their market position. This concentration among key players underscores the competitive dynamics and highlights the significant influence these companies have on market trends.

| Company Name | Establishment Year | Headquarters | Fleet Size | Market Strategy | Revenue

(USD Mn) |

Market Share

(%) |

| Europcar | 1949 | Paris, France | – | – | – | – |

| Hertz | 1918 | Florida, USA | – | – | – | – |

| Avis | 1946 | New Jersey, USA | – | – | – | – |

| Enterprise | 1957 | Missouri, USA | – | – | – | – |

| Thrifty | 1958 | Oklahoma, USA | – | – | – | – |

Australia Car Rental and Leasing Market Analysis

Growth Drivers

Increasing Tourism

In 2022, Australia welcomed approximately 3.4 million international visitors, marking a significant rebound from the pandemic-induced decline. This resurgence in tourism is expected to bolster local economies, especially in regions heavily reliant on travel-related services. Tourists often seek car rentals for flexibility and convenience, prompting an increase in demand for vehicles in urban and tourist hotspots. The influx of visitors contributes substantially to the economy, with the tourism sector projected to generate over AUD 164 billion in revenue by 2025, reinforcing the growth prospects of the car rental industry.

Rising Disposable Income

The average disposable income in Australia has been on an upward trajectory, with estimates indicating it reached AUD 51,570 in 2022. Increased disposable income allows consumers to prioritize travel and mobility, directly impacting car rental services. With a predicted increase in household consumption expenditure, especially on travel, more Australians will seek car rentals for both leisure and business purposes. The overall economic environment, characterized by income growth, provides a favorable backdrop for the expansion of the car rental market.

Market Challenges

Regulatory Compliance Issues

The car rental industry in Australia faces stringent regulatory compliance requirements, including safety standards and taxation regulations. In 2022, the government implemented new safety measures which increased compliance costs for rental companies significantly. Companies must adhere to the National Heavy Vehicle Regulator’s guidelines while also navigating complex taxation landscapes that vary by state. These regulatory burdens can limit operational flexibility and increase overhead, impacting profitability within a competitive market.

Competition from Ride-Sharing Services

The rise of ride-sharing platforms like Uber and Ola has disrupted traditional car rental operations, presenting a significant challenge to market players. In 2022, ride-sharing services accounted for over AUD 7 billion in revenue within Australia’s transport sector, drawing consumers away from conventional rentals. The convenience and appeal of on-demand transportation, combined with competitive pricing, encourage a shift in consumer behaviour, forcing traditional rental companies to adapt their offerings and pricing strategies to retain market share.

Opportunities

Digital Transformation

The rapidly growing trend of digitalization presents significant opportunities for the car rental sector in Australia. As of 2023, nearly 90% of bookings were made online, reflecting a shift in consumer preferences towards digital platforms for car rentals. Revenue from online bookings is projected to grow due to technological advancements, including mobile apps that enhance user experience. Investment in digital solutions allows rental companies to streamline operations, attract tech-savvy consumers, and improve customer service, thus positioning themselves for future growth.

Expansion of Eco-Friendly Fleet

With increasing awareness of environmental issues, the demand for eco-friendly vehicle options is rising. As of 2023, electric vehicles (EVs) made up approximately 8.4% of all new car sales in Australia, indicating a substantial shift towards sustainable transportation solutions. Rental companies expanding their eco-friendly fleets can capitalize on this trend, especially as consumers increasingly seek environmentally responsible travel options. Greater availability of EV infrastructure also supports this transition, enabling rental firms to meet growing demand while contributing positively to ecological sustainability efforts.

Future Outlook

Over the next several years, the Australia car rental and leasing market is expected to experience robust growth, driven by rising tourism rates, advancements in the digital booking landscape, and ongoing shifts toward eco-friendly vehicle options. As more consumers seek sustainable transportation alternatives, the market is poised for transformation, with many companies enhancing their fleets to include electric and hybrid vehicles. Innovations in technology and changing consumer behaviors will also contribute to the evolution of service offerings, making this space particularly dynamic.

Major Players

- Europcar

- Yes Drive

- Hertz

- Avis

- Budget

- Thrifty

- Firefly

- Enterprise

- Dollar

- Alamo

- Bargain Car Rentals

- Alpha Companies

- Routes Car & Truck Rentals

- Fox Rent A Car

- Others

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Infrastructure

- Department of Transport (Australia)

- Local and State Government Agencies

- Automotive Industry Analysts

- Car Rental Associations

- Travel and Tourism Boards

- Fleet Management Companies

- Importers and Distributors of Rental Vehicles

Research Methodology

Step 1: Identification of Key Variables

The research begins by constructing an ecosystem map that includes all major stakeholders within the Australia car rental and leasing market. This process involves extensive desk research, utilizing a combination of secondary data sources such as industry reports, company publications, and market surveys to gather comprehensive insights. The primary objective is to identify and define the key variables that influence the dynamics of the market.

Step 2: Market Analysis and Construction

In this phase, historical data related to the Australia car rental and leasing market is compiled and analyzed. This involves assessing various metrics such as market penetration, revenue generation across different service providers, and the ratios between rentals and leasing services. An evaluation of service quality statistics is also conducted to ensure the accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through direct consultations with industry experts. These consultations involve telephone interviews and surveys with professionals from a diverse array of companies within the sector. Insights gathered from these experts provide operational and financial perspectives which are essential for corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves integrating direct feedback from multiple car rental service providers to enrich the analysis. This step focuses on acquiring detailed insights regarding product segments, sales performance, consumer preferences, and any emerging market trends. This interaction serves to validate and complement the statistics derived from initial research efforts, ensuring a comprehensive and accurate understanding of the Australia car rental and leasing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Tourism

Rising Disposable Income - Market Challenges

Regulatory Compliance Issues

Competition from Ride-Sharing Services - Opportunities

Digital Transformation

Expansion of Eco-Friendly Fleet - Trends

Shift to Subscription Models

Integration of Technology in Operations - Government Regulation

Safety and Emission Standards

Consumer Protection Laws - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Daily Rental Rate, 2019-2024

- By Vehicle Type, (In Value %)

Sedans

Hatchback

SUVs

MPVs

Pickup Trucks

Luxury Vehicles

Others - By Rental Duration, (In Value %)

1 Year

2 Year

3 Year

4 Years & Above - By End-user Type, (In Value %)

Individual Consumers

Corporate Clients

Oil and Gas

Government militaries & ministries

Construction

Logistics and Transportation

Others - By Fuel Type, (In Value %)

Gasoline

Diesel

Electric - By Booking Type, (In Value %)

Offline Booking

Online Booking - By Services Type, (In Value %)

Airport Transfers

Interstate Services

Intrastate Services - By Rental Type, (In Value %)

Business Rental

Chauffeur Drive

Self-Driving

Special Events

- Market Share of Major Players by Value/Volume, 2024

Market Share of Major Players by Type of Vehicle Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Revenue, Distribution Channels, Number of Locations, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Europcar

Yes Drive

Hertz

Avis

Budget

Thrifty

Firefly

Enterprise

Dollar

Alamo

Bargain Car Rentals

Alpha Companies

Routes Car & Truck Rentals

Fox Rent A Car

Others

- Market Demand and Utilization Rate

- Purchasing Power and Behavioural Insights

- Regulatory Compliance and Customer Preferences

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Daily Rental Rate, 2025-2030