Market Overview

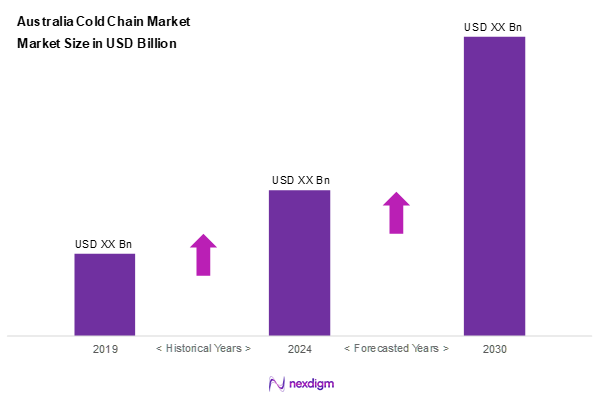

As of 2024, the Australia cold chain market is valued at USD ~ billion, with a growing CAGR of 4.1% from 2024 to 2030, driven significantly by the increasing demand for frozen foods and expanding e-commerce in the food sector, demonstrating a robust growth trajectory supported by innovations in logistics and storage solutions. The rising consumer focus on food safety and quality is a crucial factor propelling this market.

The dominant cities in the Australia cold chain market include New South Wales, Victoria, and Queensland. These regions are prominent due to their large urban populations, which create a high demand for perishable goods. Additionally, well-developed cold chain infrastructure and logistics networks in these areas enhance operational efficiency, making them critical hubs for cold chain activities.

Market Segmentation

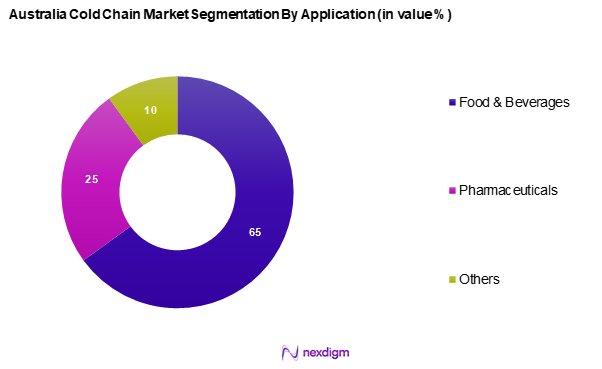

By Application

The Australia cold chain market is segmented into food & beverages, pharmaceuticals, and others. Within this segmentation, food & beverages represent a significant portion of the market due to the increasing consumption of processed and frozen foods. In 2024, food & beverages are expected to hold a market share of 65%, driven by the rising demand for ready-to-eat meals and frozen products, which are supported by consumer trends leaning towards convenience and shelf-life extension.

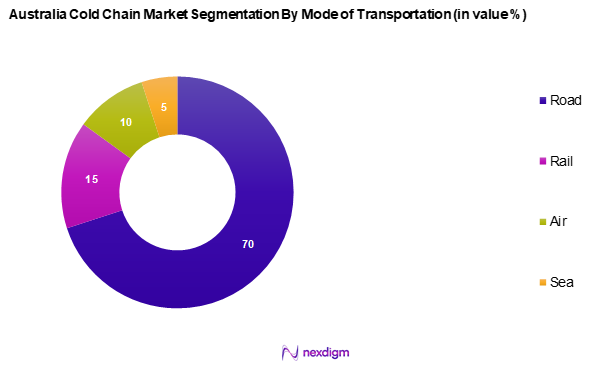

By Mode of Transportation

The Australia cold chain market is segmented into road, rail, air, and sea. The road transportation segment is expected to dominate in 2024, capturing a market share of 70%. This is primarily due to its flexibility and efficiency in delivering perishable goods to various locations, combined with the infrastructure improvements that facilitate faster transit times. The proximity of production facilities to urban centers also supports the reliance on road logistics.

Competitive Landscape

The Australia cold chain market is characterized by a competitive landscape featuring major players like Americold, DP World, QMC Logistics, Laverton Cold Storage, and Pakwal Business Logistics. The market’s consolidation among these key players is attributed to their extensive service offerings and strong supply chain capabilities, which enhance their market positioning.

| Company Name | Establishment Year | Headquarters | Market Position | Transportation Mode | Service Type | Technology Utilized |

| Americold | 1997 | Sydney, Australia | – | – | – | – |

| DP World | 1972 | Dubai, UAE | – | – | – | – |

| QMC Logistics | 2004 | Brisbane, Australia | – | – | – | – |

| Laverton Cold Storage | 1998 | Melbourne, Australia | – | – | – | – |

| Pakwal Business Logistics | 2010 | Sydney, Australia | – | – | – | – |

Australia Cold Chain Market Analysis

Growth Drivers

Rising Demand for Frozen Foods

The Australian cold chain market is experiencing strong growth, primarily fueled by the rising popularity of frozen food products. This trend reflects shifting consumer lifestyles, where convenience, time-efficiency, and longer shelf life are becoming top priorities. A growing number of dual-income households is also contributing to this demand, as busy schedules drive reliance on quick and easy meal solutions. The broader global movement towards frozen food consumption further reinforces this trend within the country, positioning frozen goods as a key contributor to cold chain expansion.

Growth of E-commerce in the Food Sector

The rapid expansion of online grocery shopping in Australia is significantly influencing cold chain logistics. More consumers are turning to digital platforms for their food purchases, driven by the convenience and efficiency of doorstep delivery. This shift was accelerated by changes in shopping behavior during the pandemic, leading to a sustained increase in online food orders. As e-commerce becomes an integral part of food retail, there is a growing need for reliable cold chain infrastructure to maintain product freshness and quality during last-mile delivery.

Market Challenges

Regulatory and Compliance Complexity

Cold chain operators in Australia face an increasingly complex regulatory landscape. Strict food safety regulations imposed by national authorities demand continuous compliance, often requiring substantial investments in technology upgrades and staff training. Navigating different regulatory standards across states adds to the operational burden. Many businesses express concerns about the difficulty of meeting these stringent requirements, which can limit flexibility and increase costs.

Inadequate Infrastructure

Infrastructure shortfalls remain a significant barrier to growth in the Australian cold chain sector. While there is an existing network of refrigerated transport and storage solutions, certain areas—particularly remote and regional locations—lack sufficient cold storage capacity. This limitation restricts the ability of producers and distributors to manage perishable goods effectively. The gap in infrastructure development continues to impact food safety, product shelf life, and overall supply chain efficiency.

Opportunities

Innovation in Refrigeration Technologies

The ongoing shift toward energy-efficient and environmentally friendly refrigeration technologies presents promising opportunities for market expansion. Operators are increasingly adopting advanced systems that optimize energy usage and reduce operational costs. Smart refrigeration solutions, equipped with real-time monitoring and automated controls, are gaining popularity. These innovations not only improve temperature control and safety but also support the industry’s broader sustainability goals.

Expanding Cold Storage Capacity

Growing investments in cold storage infrastructure signal a positive outlook for the market. To meet rising demand for fresh and frozen goods, companies are scaling up storage facilities across the country. Government-backed initiatives are also supporting the development of modern cold storage units, aimed at strengthening the resilience and efficiency of the supply chain. These developments are expected to enhance the reach and reliability of cold chain operations, especially in underserved areas.

Future Outlook

Over the next five years, the Australia cold chain market is expected to experience significant growth, driven by continuous advancements in logistics technology, a rising preference for online grocery shopping, and increased consumer awareness regarding food safety. Additionally, investment in cold storage facilities and the integration of IoT in temperature monitoring are anticipated to bolster operational efficiencies.

Major Players

- Americold

- DP World

- QMC Logistics

- Laverton Cold Storage

- Pakwal Business Logistics

- Sands Fridge Lines

- New Cold Advanced Cold Logistics

- The Mid Field Group

- Karras Cold Logistics

- Global Cold Chain Solutions

- MFR Cool Logistics

- AGRO Merchants Group, LLC

- Kerry Logistics

- Auscold Logistics PTY Ltd.

- Others

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Food Standards Australia New Zealand, Australian Competition and Consumer Commission)

- Large Retail Chains

- Food and Beverage Manufacturers

- Pharmaceutical Companies

- Logistics Service Providers

- Cold Storage Operators

- Importers and Exporters

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Australia cold chain market. This step employs extensive desk research, utilizing secondary sources such as industry reports, government publications, and market surveys to gather comprehensive information. The primary aim is to identify and define critical variables that impact market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the Australia cold chain market. This includes assessment of market penetration rates, an evaluation of the ratio of distributors to service providers, and resultant revenue generation. Additionally, a thorough examination of service quality metrics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts from a diverse range of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the quantitative data.

Step 4: Research Synthesis and Final Output

The final phase entails direct engagement with multiple cold chain service providers and clients to acquire detailed insights into product segments, operational performance, consumer preferences, and other relevant factors. This interaction will serve to verify and complement the statistics derived from earlier phases, ensuring a comprehensive and validated analysis of the Australia cold chain market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Growing Demand for Frozen Foods

Expansion of E-commerce in Food Sector - Market Challenges

Regulatory and Compliance Hurdles

Infrastructure Limitations - Opportunities

Technological Advancements in Refrigeration

Investment in Cold Storage Facilities - Trends

Adoption of IoT in Temperature Monitoring

Sustainability Practices - Government Regulation

Food Safety Standards

Environmental Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Application, (In Value %)

Food & Beverages

Dairy Products

Fish, Meat, and Seafood

Pharmaceuticals

Others - By Temperature Range, (In Value %)

Chilled

Frozen

Ambient - By Mode of Transportation, (In Value %)

Road

Rail

Air

Sea - By Market Structure, (In Value %)

Organized

Unorganized - By Service, (In Value %)

Storage

Transportation

Value-added Services - By Technology, (In Value %)

Blast Freezing

Evaporative Cooling

Vapor Compression

Cryogenic Systems

Programmable Logic Controller

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Application Segment, 2024 - Cross-Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Market Share, Technological Capabilities, Customer Base, Revenue, Distribution Networks, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Profiles of Major Companies

Americold

DP World

QMC Logistics

Laverton Cold Storage

Pakwal Business Logistics

Sands Fridge Lines

New Cold Advanced Cold Logistics

The Mid Field Group

Karras Cold Logistics

NewCold Advanced Cold Logistics

Global Cold Chain Solutions

MFR Cool Logistics

AGRO Merchants Group, LLC

Kerry Logistics

Auscold Logistics PTY Ltd.

Others

- Consumer Demand and Behaviour

- Industry-Specific Requirements and Budget Allocations

- Needs Assessment of Key Stakeholders

- Decision-Making Processes in Procurement

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030