Market Overview

Based on a recent historical assessment, the Australia Commercial Airport Market was valued at USD ~ million, reflecting revenues generated from airport operations, aeronautical services, non-aeronautical commercial activities, and infrastructure-linked services across major civilian airports. This market size is driven by sustained passenger throughput, strong domestic air travel demand, and steady international route recovery, supported by regulated aeronautical charges and diversified retail income. Additional drivers include infrastructure modernization programs, security system upgrades, and airside capacity investments funded through operator revenues and long-term concession models under national aviation policy oversight.

Based on a recent historical assessment, Sydney, Melbourne, Brisbane, and Perth dominate the Australia Commercial Airport Market due to their role as primary international gateways, dense domestic connectivity, and concentration of airline operations. Sydney and Melbourne benefit from high-capacity terminals, premium retail ecosystems, and strong long-haul traffic, while Brisbane and Perth serve as strategic hubs for Asia-Pacific and resource-driven travel. Australia’s dominance is reinforced by stable regulatory frameworks, strong airport operator governance, and consistent infrastructure investment aligned with national transport priorities and urban population concentration.

Market Segmentation

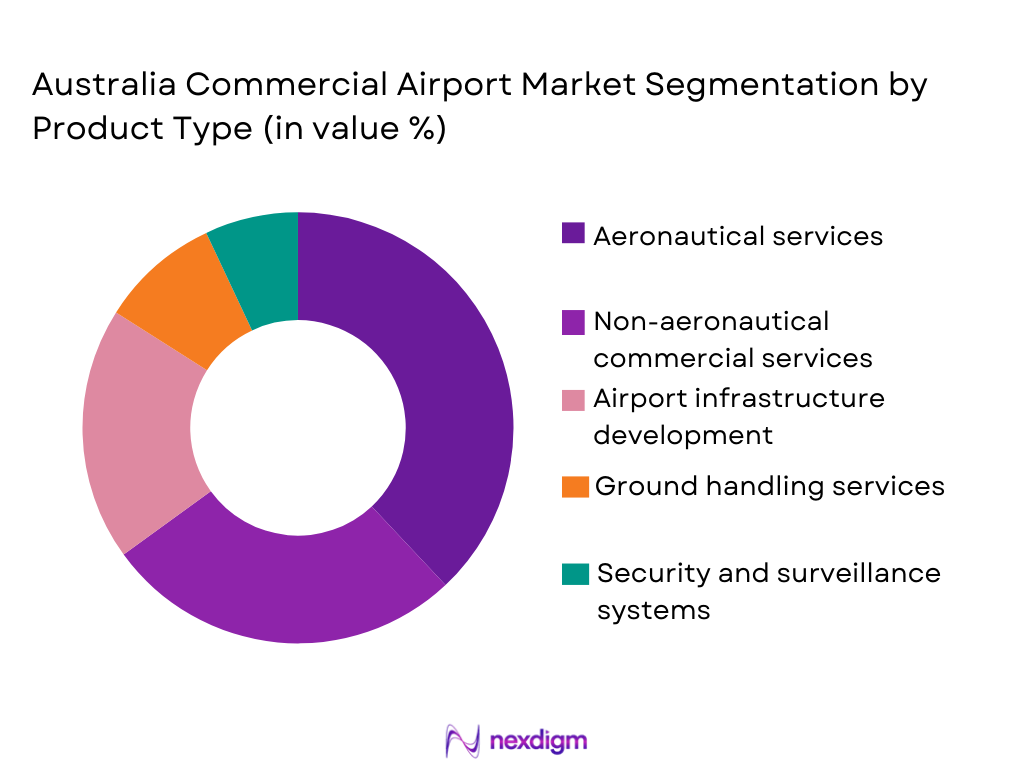

By Product Type

Australia Commercial Airport Market is segmented by product type into aeronautical services, non-aeronautical commercial services, airport infrastructure development, ground handling services, and security and surveillance systems. Recently, aeronautical services have a dominant market share due to consistent passenger volumes, regulated landing and passenger service charges, and long-term airline service agreements. Major airports generate predictable revenues from aircraft movements, terminal usage, and passenger facilitation, which are less exposed to retail volatility. Strong airline presence at hub airports sustains demand for these services, while regulatory certainty ensures stable pricing structures. Continuous investments in runways, taxiways, and navigation systems further reinforce aeronautical revenue dominance across the national airport network.

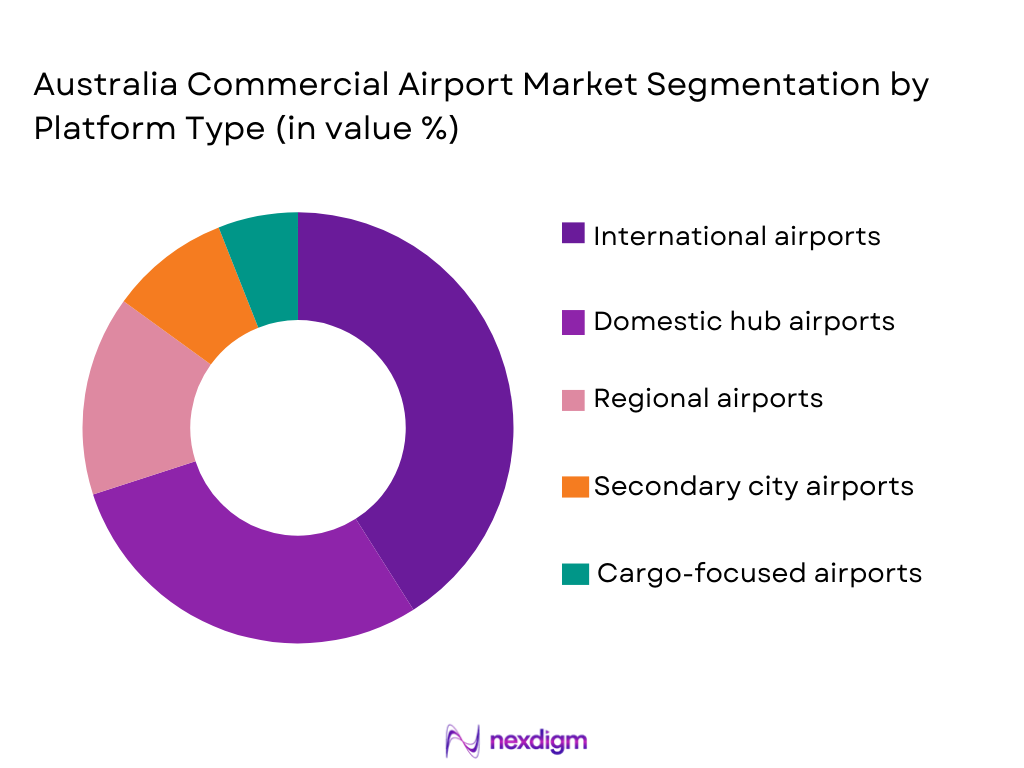

By Platform Type

Australia Commercial Airport Market is segmented by platform type into international airports, domestic hub airports, regional airports, secondary city airports, and cargo-focused airports. Recently, international airports have a dominant market share due to higher passenger spending, diversified airline operations, and premium commercial concessions. These airports benefit from long-haul connectivity, higher aeronautical yields, and strong duty-free and retail revenues. Government-approved capacity expansions and private operator investment enhance operational scale, while tourism and business travel concentration sustains throughput. As a result, international airports continue to command the largest share of overall commercial airport revenues nationwide.

Competitive Landscape

The Australia Commercial Airport Market is moderately consolidated, with major metropolitan airports operated by long-term leaseholders and infrastructure groups exerting strong influence. Competition is shaped by scale, regulatory compliance capability, commercial diversification, and access to capital for expansion projects.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Ownership Model |

| Sydney Airport Corporation | 2002 | Sydney | ~ | ~ | ~ | ~ | ~ |

| Melbourne Airport | 1997 | Melbourne | ~ | ~ | ~ | ~ | ~ |

| Brisbane Airport Corporation | 1997 | Brisbane | ~ | ~ | ~ | ~ | ~ |

| Perth Airport | 1997 | Perth | ~ | ~ | ~ | ~ | ~ |

| Adelaide Airport | 1998 | Adelaide | ~ | ~ | ~ | ~ | ~ |

Australia Commercial Airport Market Analysis

Growth Drivers

Expansion of Passenger Air Traffic and Tourism Demand:

Expansion of passenger air traffic and tourism demand is a core growth driver for the Australia Commercial Airport Market as sustained domestic mobility and inbound travel support consistent airport revenue generation. Rising population concentration in metropolitan regions increases reliance on air transport for business and leisure travel across long distances. Major gateway airports benefit from dense airline networks, higher aircraft movements, and increased passenger service charge collections. Tourism-linked travel strengthens non-aeronautical revenues through retail, food, and duty-free spending within terminals. Government tourism promotion and bilateral air service agreements support route expansion and capacity utilization. Airport operators leverage traffic growth to justify terminal expansions and airside upgrades. Strong connectivity with Asia-Pacific markets reinforces international passenger volumes. The combined effect of mobility needs, tourism flows, and network density continues to underpin long-term demand stability.

Infrastructure Modernization and Private Capital Investment:

Infrastructure modernization and private capital investment drive market growth by enabling airports to expand capacity, improve efficiency, and enhance commercial offerings. Long-term lease structures incentivize operators to invest in terminals, runways, and digital systems to maximize asset value. Private funding supports large-scale redevelopment without direct fiscal burden on public budgets. Modernized infrastructure improves passenger experience, attracting airlines and increasing dwell time spending. Advanced security and automation systems reduce operational bottlenecks and improve throughput. Sustainability-linked investments align with regulatory expectations and investor priorities. Access to global infrastructure capital markets strengthens funding resilience. These dynamics collectively accelerate modernization-led growth across major airports.

Market Challenges

Regulatory Approval Complexity and Community Opposition Risks:

Regulatory approval complexity and community opposition risks represent a major challenge for the Australia Commercial Airport Market as infrastructure expansion is closely scrutinized under environmental, planning, and social impact frameworks. Airport operators must navigate federal aviation regulations, state planning laws, and local community consultations before progressing runway, terminal, or landside development projects. These multi-layered approval processes often extend project timelines and increase compliance costs, creating uncertainty around capital deployment and return realization. Community concerns related to aircraft noise, land acquisition, traffic congestion, and environmental impact intensify resistance to airport expansion, particularly near densely populated urban areas. Legal challenges and public inquiries further delay project execution and constrain capacity growth at already congested airports. As passenger demand continues to rise, the inability to expand infrastructure at the required pace can lead to operational bottlenecks, service quality deterioration, and strained airline relationships. Balancing national connectivity needs with local stakeholder interests remains a persistent structural challenge across major Australian airports.

Rising Operating Costs and Skilled Workforce Constraints:

Rising operating costs and skilled workforce constraints pose ongoing challenges for the Australia Commercial Airport Market by exerting pressure on margins and operational reliability. Airports face increasing expenditure related to energy consumption, security compliance, technology maintenance, and sustainability initiatives mandated by regulators. Inflationary pressures affect contractor services, construction materials, and specialized equipment procurement, raising overall cost bases. At the same time, shortages of skilled personnel in areas such as airside engineering, cybersecurity, digital systems management, and aviation security screening limit operational flexibility. Airports must invest heavily in training, automation, and retention programs to maintain service standards, further increasing expenditure. Smaller and regional airports are particularly exposed, as they lack the scale efficiencies and financial buffers available to major hubs. Regulated aeronautical pricing frameworks restrict the ability of operators to fully pass on rising costs to airlines and passengers. These combined factors complicate long-term financial planning and challenge the sustainability of airport operations in a cost-intensive operating environment.

Opportunities

Smart Airport Automation and Data-Driven Operations Expansion:

Smart airport automation and data-driven operations expansion represents a significant opportunity for the Australia Commercial Airport Market as operators seek to improve efficiency, capacity utilization, and passenger experience without proportionate increases in physical infrastructure. Advanced passenger processing systems, including biometric identity verification and automated boarding, enable faster throughput while reducing dependency on manual labor. Integrated airport operations control centers allow real-time coordination of airside, terminal, and landside activities, minimizing delays and improving asset utilization. Data analytics platforms support predictive maintenance of runways, baggage systems, and terminal equipment, lowering lifecycle costs and improving reliability. Retail analytics and passenger flow data help optimize commercial layouts, increasing non-aeronautical revenue potential. Airlines benefit from improved turnaround times and operational predictability, strengthening airport attractiveness. Regulatory authorities increasingly support digital security and screening technologies, accelerating approvals. These factors collectively create a favorable environment for technology vendors and airport operators to scale smart infrastructure adoption nationwide.

Sustainable Infrastructure Development and Green Financing Alignment:

Sustainable infrastructure development and green financing alignment offer a strong opportunity for the Australia Commercial Airport Market as environmental performance becomes central to regulatory compliance, investor expectations, and airline partnerships. Airports are well positioned to deploy renewable energy systems, energy-efficient terminals, electrified ground support equipment, and low-emission construction materials. Sustainability-linked investments reduce long-term operating costs and exposure to carbon pricing risks while improving resilience against energy price volatility. Access to green bonds and sustainability-linked loans expands capital availability for large-scale expansion projects. Airlines increasingly prioritize environmentally efficient hubs to meet their own emission targets, reinforcing demand-side alignment. Community acceptance of airport expansion improves when environmental impacts are mitigated through transparent sustainability strategies. National infrastructure and climate policies further reinforce this direction. Together, these dynamics position sustainability not only as a compliance requirement but as a competitive differentiator and long-term growth catalyst.

Future Outlook

The Australia Commercial Airport Market is expected to experience steady growth over the next five years, supported by passenger traffic expansion, infrastructure modernization, and digital transformation. Regulatory stability and private investment frameworks will continue to underpin capacity development. Technological advancements in automation and security will enhance operational efficiency. Demand-side momentum from tourism, business travel, and regional connectivity will remain strong.

Major Players

- Sydney Airport Corporation

- Melbourne Airport

- Brisbane Airport Corporation

- Perth Airport

- Adelaide Airport

- Canberra Airport

- Gold Coast Airport

- Cairns Airport

- Darwin International Airport

- Hobart Airport

- Sunshine Coast Airport

- Newcastle Airport

- Townsville Airport

- Launceston Airport

- Avalon Airport

Key Target Audience

- Airport operators

- Airlines and aviation service providers

- Infrastructure investors

- Investments and venture capitalist firms

- Government and regulatory bodies

- Construction and EPC companies

- Aviation technology and systems providers

- Logistics and air cargo operators

Research Methodology

Step 1: Identification of Key Variables

Key variables related to traffic volumes, revenue streams, regulatory structures, and infrastructure assets were identified. These variables defined the commercial scope of airports. Data relevance and consistency were evaluated. Only validated indicators were retained.

Step 2: Market Analysis and Construction

Market structure was constructed using airport revenue models and operational frameworks. Segment relationships were mapped. Historical performance data supported analysis. Cross-validation ensured robustness.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through industry expert consultation and secondary literature review. Assumptions were stress-tested. Feedback refined market logic. Conflicting views were reconciled.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a coherent market narrative. Quantitative and qualitative insights were aligned. Consistency checks were applied. Final outputs reflect validated market conditions.

- Executive Summary

- Australia Commercial Airport Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising domestic and international air passenger traffic

Government investment in airport capacity expansion

Growth of low cost carriers and regional connectivity

Adoption of smart airport and automation technologies

Expansion of air cargo and logistics infrastructure - Market Challenges

High capital expenditure requirements for airport projects

Lengthy regulatory and environmental approval processes

Operational disruptions during modernization activities

Skilled workforce shortages in advanced airport systems

Cost pressures from sustainability and emission mandates - Market Opportunities

Development of green and sustainable airport infrastructure

Digital transformation through smart airport platforms

Expansion of regional and secondary airports - Trends

Increased adoption of biometric passenger processing

Integration of AI driven airport operations management

Focus on net zero and energy efficient airport designs

Growth of contactless and self service technologies

Rising role of private operators in airport development - Government Regulations & Defense Policy

Civil aviation safety and airport certification frameworks

National aviation security and border control policies

Infrastructure investment and regional connectivity programs - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Passenger terminal infrastructure

Airside operations systems

Airport security and screening systems

Baggage handling and sorting systems

Air traffic support and ground control systems - By Platform Type (In Value%)

Domestic airports

International airports

Regional airports

Low cost carrier focused airports

Cargo and logistics airports - By Fitment Type (In Value%)

New airport development projects

Terminal expansion projects

Airside modernization retrofits

Technology system upgrades

Maintenance and refurbishment fitments - By EndUser Segment (In Value%)

Airport operators

Government and aviation authorities

Airlines and aviation service providers

Ground handling companies

Cargo and logistics operators - By Procurement Channel (In Value%)

Government tenders

Public private partnership contracts

Direct OEM procurement

System integrator contracts

EPC and infrastructure consortiums - By Material / Technology (in Value %)

Smart airport digital platforms

Biometric and identity management systems

Advanced surveillance and security technologies

Sustainable construction materials

Automation and robotics systems

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Infrastructure capability, Technology integration, Project scale, Regulatory compliance expertise, Financial strength, Sustainability focus, Geographic presence, Partnership model, Service portfolio) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Sydney Airport Corporation

Melbourne Airport

Brisbane Airport Corporation

Perth Airport

Adelaide Airport

Canberra Airport Group

Gold Coast Airport

Auckland Airport Australia Operations

Qantas Airport Services

Lendlease Infrastructure

CPB Contractors

Downer Group

Ventia

Honeywell Australia Airports

Siemens Mobility Australia

- Airport operators prioritizing capacity optimization and efficiency

- Airlines seeking faster turnaround and improved passenger flow

- Government agencies focusing on safety, security, and compliance

- Logistics operators demanding integrated cargo handling facilities

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035