Market Overview

Based on a recent historical assessment, the Australia Commercial Airport Radar Systems Market was valued at USD ~ million, supported by sustained public investment in air traffic surveillance, airport capacity expansion, and modernization of civil aviation infrastructure. Spending has been driven by upgrades to secondary surveillance radar, surface movement radar, and integrated air traffic management platforms mandated by national aviation safety requirements. Centralized procurement by Airservices Australia, replacement of aging radar assets, and adoption of solid-state systems have reinforced demand across major commercial airports nationwide.

Based on a recent historical assessment, Sydney, Melbourne, Brisbane, and Perth dominate the Australia Commercial Airport Radar Systems Market due to high aircraft movements, dense terminal airspace, and concentration of international flight operations. These cities require advanced radar coverage to manage congestion, runway safety, and approach sequencing. Australia maintains leadership through centralized air navigation services, strong regulatory enforcement by the Civil Aviation Safety Authority, and consistent government funding for aviation infrastructure, enabling rapid adoption of next-generation radar and digital surveillance technologies.

Market Segmentation

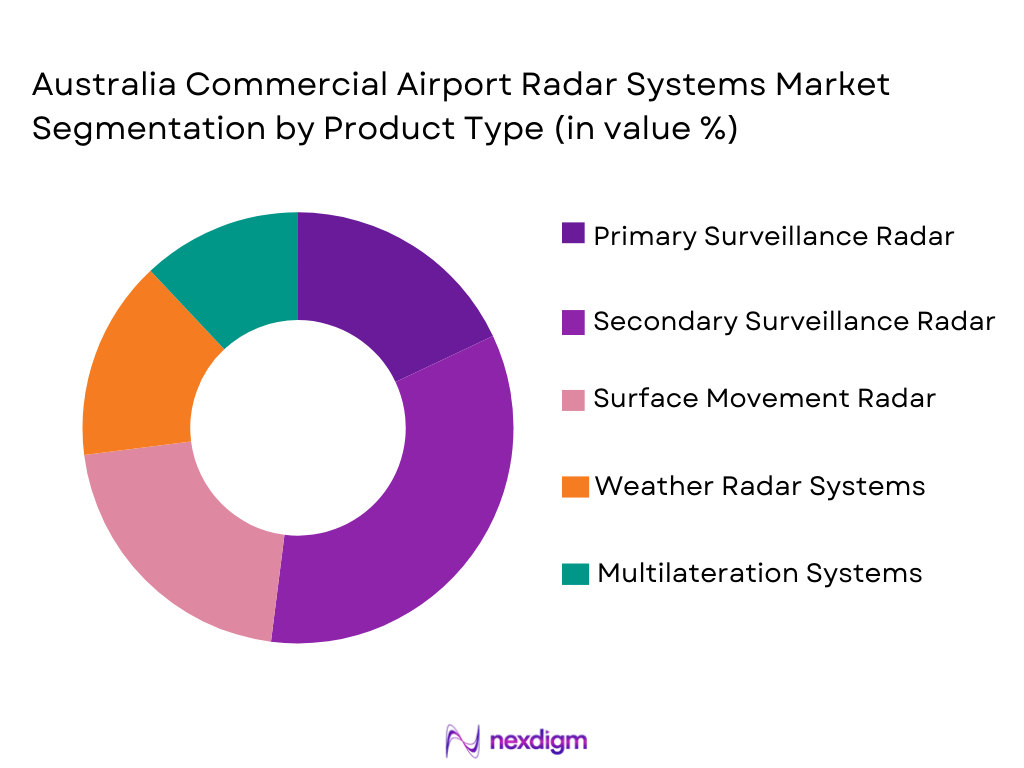

By Product Type

Australia Commercial Airport Radar Systems market is segmented by product type into Primary Surveillance Radar, Secondary Surveillance Radar, Surface Movement Radar, Weather Radar Systems, and Multilateration Systems. Recently, Secondary Surveillance Radar has a dominant market share due to its essential role in aircraft identification, altitude reporting, and seamless integration with modern air traffic control systems. Australian airports prioritize secondary radar to meet surveillance mandates while improving tracking accuracy in congested airspace. Compatibility with Mode S and ADS-B, lower interference risk, and strong regulatory alignment accelerate adoption. Ongoing replacement of legacy systems with solid state secondary radar further reinforces dominance across international and domestic airports.

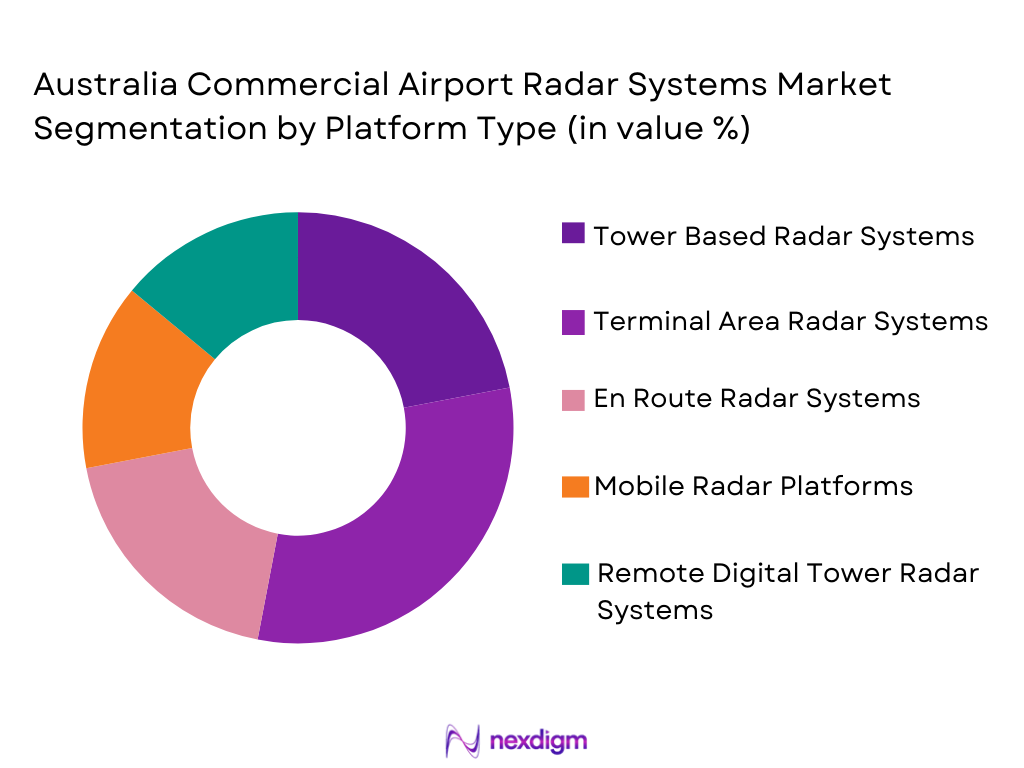

By Platform Type

Australia Commercial Airport Radar Systems market is segmented by platform type into Tower Based Radar Systems, Terminal Area Radar Systems, En Route Radar Systems, Mobile Radar Platforms, and Remote Digital Tower Radar Systems. Recently, Terminal Area Radar Systems hold a dominant market share due to their importance in managing approach and departure traffic at high-density airports. These systems support safe sequencing, reduced separation, and enhanced situational awareness around major hubs. Airspace redesign programs and runway expansions increase reliance on terminal surveillance, while integration with multilateration and ADS-B further strengthens operational preference.

Competitive Landscape

The Australia Commercial Airport Radar Systems Market is moderately consolidated, dominated by global aerospace and defense companies with certified civil aviation radar portfolios. High entry barriers, stringent certification requirements, and long-term government contracts favor established suppliers with strong lifecycle support and proven operational reliability.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| Indra Sistemas | 1993 | Spain | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Italy | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ |

Australia Commercial Airport Radar Systems Market Analysis

Growth Drivers

Air Traffic Growth and Airport Capacity Expansion Programs:

Air Traffic Growth and Airport Capacity Expansion Programs are a primary growth driver for the Australia Commercial Airport Radar Systems Market as increasing passenger demand places sustained pressure on airport and airspace capacity. Major commercial airports are handling higher aircraft movements across domestic and international routes, intensifying congestion in terminal and approach airspace. To safely manage this complexity, airports require high-resolution surveillance systems capable of precise tracking, conflict detection, and sequencing support. Radar systems are critical enablers for runway optimization, reduced separation standards, and efficient air traffic flow management. Ongoing runway additions, terminal redevelopments, and airspace redesign initiatives directly necessitate corresponding upgrades in surveillance infrastructure. Even regional airports experiencing traffic recovery require enhanced radar coverage to support new routes and larger aircraft types. The growth in air traffic also increases operational exposure to weather disruptions, reinforcing the need for integrated surveillance and weather radar systems. As capacity expansion programs progress, radar investment becomes a non-discretionary component of maintaining safety, reliability, and operational continuity across Australia’s commercial aviation network.

National Aviation Safety Regulations and Digital Airspace Modernization:

National Aviation Safety Regulations and Digital Airspace Modernization initiatives strongly drive demand in the Australia Commercial Airport Radar Systems Market by mandating higher surveillance performance and system reliability. Australian aviation authorities enforce strict compliance with international civil aviation standards covering aircraft identification, tracking accuracy, and redundancy. These requirements compel airports and air navigation service providers to replace aging primary and secondary radar installations with modern solid-state and digital systems. Modernization programs emphasize integration of radar with ADS-B, multilateration, and automated air traffic management platforms to enhance situational awareness. Regulatory expectations around runway safety, surface movement monitoring, and low-visibility operations further increase reliance on advanced radar solutions. Centralized air navigation management encourages standardized technology adoption across airports, supporting scale deployment. Digital transformation strategies in aviation prioritize data-driven decision-making, where radar acts as a foundational sensor. As compliance thresholds continue to tighten, radar system upgrades are essential not only for operational efficiency but also for maintaining certification and uninterrupted airport operations.

Market Challenges

High Capital Intensity and Budget Allocation Constraints:

High Capital Intensity and Budget Allocation Constraints represent a critical challenge in the Australia Commercial Airport Radar Systems Market because radar deployment requires substantial upfront investment combined with long-term financial commitment. Commercial airport radar systems involve not only the procurement cost of hardware but also expenses related to site preparation, civil works, system integration, calibration, certification, and controller training. These costs are further compounded by ongoing maintenance, software upgrades, and lifecycle support obligations that extend over decades. Publicly owned airports and air navigation service providers operate under fixed capital budgets, where radar upgrades must compete with terminal expansion, runway construction, and sustainability initiatives. Budget prioritization often delays radar modernization even when operational risk is recognized. Regional and secondary airports face greater constraints due to lower traffic volumes and limited revenue bases, making return justification more difficult. Inflationary pressure on specialized electronic components and skilled labor adds to cost uncertainty. Procurement processes require multi-year approvals, which slow response to emerging safety or capacity requirements. As a result, capital intensity directly limits the speed and scale of radar technology adoption across the national airport network.

Complex Integration, Certification, and Operational Continuity Risks:

Complex Integration, Certification, and Operational Continuity Risks pose another major challenge in the Australia Commercial Airport Radar Systems Market due to the critical safety role radar plays in air traffic management. Australian airports operate a mix of legacy and modern air traffic control systems sourced from different vendors, creating technical complexity during upgrades. Integrating new radar systems with existing automation platforms, communication networks, and surveillance data feeds requires extensive customization and testing. Certification by aviation regulators demands rigorous validation under live operational conditions, increasing project timelines and risk exposure. Any integration-related disruption can directly affect airport operations, making stakeholders risk-averse to system changes. Migration from legacy radar to modern solid-state or digital systems must often be performed in parallel, increasing operational costs. Limited availability of highly specialized radar engineers and air traffic system integrators further constrains project execution. Cybersecurity assurance has become an additional layer of complexity as radar systems are increasingly networked and software-driven. These integration and certification challenges elevate implementation risk, discourage rapid innovation adoption, and reinforce dependence on incumbent suppliers with proven operational track records.

Opportunities

Adoption of Digital and Remote Tower Radar Solutions:

Adoption of Digital and Remote Tower Radar Solutions represents a significant opportunity in the Australia Commercial Airport Radar Systems Market as airport operators seek cost efficiency, scalability, and operational resilience. Digital tower concepts rely heavily on high-performance radar systems combined with sensor fusion to deliver comprehensive situational awareness without traditional physical tower infrastructure. This approach is particularly attractive for regional and secondary airports where traffic volumes do not justify full-scale control towers but still require certified surveillance. Centralized remote operations allow multiple airports to be managed from a single facility, reducing staffing and infrastructure costs while maintaining safety compliance. Australia’s geographically dispersed airport network makes it well suited for remote tower deployment supported by robust radar coverage. Regulatory bodies have shown increasing openness to digital tower certification, creating a favorable policy environment. Radar vendors that can integrate seamlessly with video, multilateration, and ADS-B sensors gain a competitive edge. The opportunity extends to lifecycle services, software upgrades, and long-term maintenance contracts. As air traffic grows unevenly across regions, flexible digital radar-enabled towers offer airports a scalable solution aligned with future demand patterns.

Integration of AI and Advanced Data Analytics into Radar Systems:

Integration of AI and Advanced Data Analytics into Radar Systems offers a high-impact opportunity for differentiation and value creation in the Australia Commercial Airport Radar Systems Market. AI-enabled radar enhances target detection accuracy, clutter suppression, and anomaly identification, improving overall airspace safety. Advanced analytics allow predictive monitoring of runway incursions, aircraft conflicts, and weather-related disruptions, supporting proactive decision-making by air traffic controllers. Airports increasingly seek systems that reduce cognitive workload and support human operators rather than relying solely on manual interpretation. AI-driven automation also enables more efficient traffic sequencing and reduced delays during peak operations. From a procurement perspective, airports favor solutions that deliver operational efficiency gains alongside compliance. Integration of analytics platforms opens opportunities for recurring software revenues beyond initial hardware sales. Vendors can offer modular upgrades that extend system lifespan and adaptability. As Australia advances its digital aviation strategy, AI-enabled radar aligns with broader smart infrastructure initiatives. This opportunity encourages collaboration between radar manufacturers, software developers, and air navigation service providers to deliver next-generation surveillance ecosystems.

Future Outlook

The market is expected to grow steadily over the next five years supported by airport modernization programs and airspace management reforms. Advances in digital radar, AI integration, and remote tower technologies will shape procurement strategies. Regulatory emphasis on safety and efficiency will remain a key demand driver. Increasing aircraft movements and infrastructure expansion will continue to support long-term market growth.

Major Players

- Thales Group

- Indra Sistemas

- Leonardo S.p.A.

- Raytheon Technologies

- Saab AB

- Northrop Grumman

- Lockheed Martin

- Hensoldt

- Terma Group

- Honeywell Aerospace

- NEC Corporation

- Rohde & Schwarz

- KongsbergDefence& Aerospace

- Aselsan

- Furuno Electric

Key Target Audience

- Airport authorities

- Air navigation service providers

- Civil aviation regulators

- Government and regulatory bodies

- Infrastructure developers

- Defense and aerospace manufacturers

- Systems integrators

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

Key variables including radar types, deployment platforms, regulatory requirements, and procurement structures were identified. Data was sourced from aviation authorities and industry disclosures. Variables were screened for relevance and reliability. Only commercially applicable indicators were retained.

Step 2: Market Analysis and Construction

Collected data was structured to reflect segmentation and competitive dynamics. Cross-validation ensured consistency. Market sizing logic aligned with infrastructure investment flows. Assumptions were standardized.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through expert interviews and technical reviews. Industry professionals provided operational insights. Feedback refined assumptions. Outliers were reassessed.

Step 4: Research Synthesis and Final Output

Validated data was synthesized into a structured framework. Insights were aligned with market structure. Outputs were reviewed for accuracy. Conclusions were objectively derived.

- Executive Summary

- Australia Commercial Airport Radar Systems Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of airport infrastructure and runway capacity

Rising air passenger traffic across domestic and international routes

Modernization of air traffic management systems

Increasing safety and surveillance regulations

Integration of advanced digital airspace management technologies - Market Challenges

High capital expenditure for radar system deployment

Complex regulatory certification and compliance requirements

Integration challenges with legacy air traffic systems

Skilled workforce shortages for radar system operation

Long procurement and approval cycles - Market Opportunities

Adoption of digital tower and remote surveillance solutions

Upgrades to multilateration and surface movement systems

Integration of AI and automation in air traffic surveillance - Trends

Shift toward solid state and phased array radar systems

Increasing use of remote and virtual air traffic control towers

Deployment of AI based radar analytics

Focus on cybersecurity for air traffic surveillance systems

Growth of integrated weather and surveillance radar solutions - Government Regulations & Defense Policy

Civil aviation safety compliance mandates

National airspace modernization programs

Infrastructure investment policies supporting aviation safety - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Primary Surveillance Radar

Secondary Surveillance Radar

Surface Movement Radar

Weather Radar Systems

Multilateration Systems - By Platform Type (In Value%)

Tower Based Radar Systems

Terminal Area Radar Systems

En Route Radar Systems

Mobile Radar Platforms

Remote Digital Tower Radar Systems - By Fitment Type (In Value%)

New Airport Installations

Runway Expansion Fitments

Terminal Modernization Retrofits

Air Traffic Control Upgrades

System Replacement Programs - By EndUser Segment (In Value%)

International Commercial Airports

Domestic Commercial Airports

Regional Airports

Airport Authorities

Air Navigation Service Providers - By Procurement Channel (In Value%)

Direct Government Procurement

Airport Authority Contracts

System Integrator Led Procurement

Public Private Partnership Projects

Technology Upgrade Tenders - By Material / Technology (in Value %)

Solid State Radar Technology

Phased Array Radar Systems

Digital Signal Processing Based Radar

AI Enabled Radar Systems

Software Defined Radar Architecture

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (System Range, Detection Accuracy, System Reliability, Integration Capability, Lifecycle Cost, Maintenance Support, Compliance Standards, Deployment Time, Technology Maturity) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Thales Group

Indra Sistemas

Leonardo S.p.A.

Raytheon Technologies

Hensoldt

Saab AB

Northrop Grumman

Lockheed Martin

NEC Corporation

Furuno Electric

Terma Group

Honeywell Aerospace

Aselsan

Rohde & Schwarz

Kongsberg Defence & Aerospace

- International airports prioritizing high capacity surveillance systems

- Regional airports adopting cost efficient radar upgrades

- Airport authorities focusing on safety compliance and modernization

- Air navigation service providers investing in digital airspace management

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035