Market Overview

Based on a recent historical assessment, the Australia corvettes market is valued at USD ~billion, driven by the Australian government’s ongoing investment in modernizing naval defense capabilities. This market is fueled by strategic military objectives, including the enhancement of coastal security, anti-submarine warfare, and multi-role operational support. A robust defense procurement strategy and the push for self-reliance in military assets contribute significantly to this market’s growth, with major investments in naval shipbuilding projects.

Based on a recent historical assessment, Sydney and Adelaide are the dominant cities for corvette construction and deployment in Australia, largely due to their proximity to naval defense infrastructure and shipbuilding facilities. The cities host key defense contractors and specialized manufacturers, supported by a skilled workforce and modern infrastructure. These regions also benefit from significant government funding, ensuring continued investment in the defense sector to maintain a strong naval presence in the Indo-Pacific region.

Market Segmentation

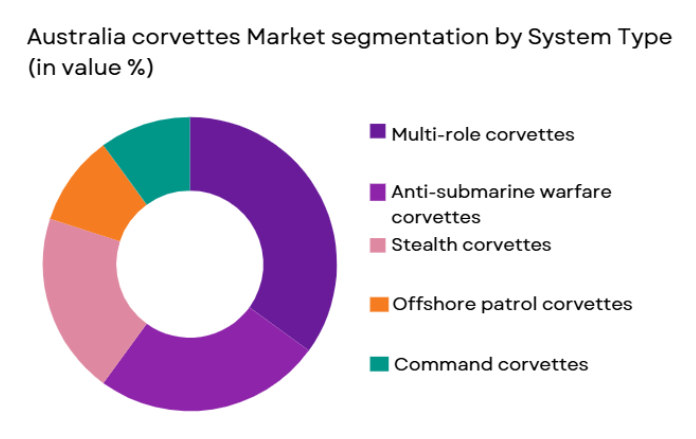

By System Type

Australia corvettes market is segmented by system type into multi-role corvettes, anti-submarine warfare corvettes, stealth corvettes, offshore patrol corvettes, and command corvettes. Recently, multi-role corvettes have a dominant market share due to their flexibility in performing various defense and surveillance tasks. These corvettes are designed to handle anti-surface warfare, anti-air warfare, and intelligence-gathering missions, making them a crucial asset for the Australian Navy. Their versatility and adaptability to a wide range of military operations have been key factors in their increased demand, further supported by international interest in procuring multi-role naval assets for regional defense.

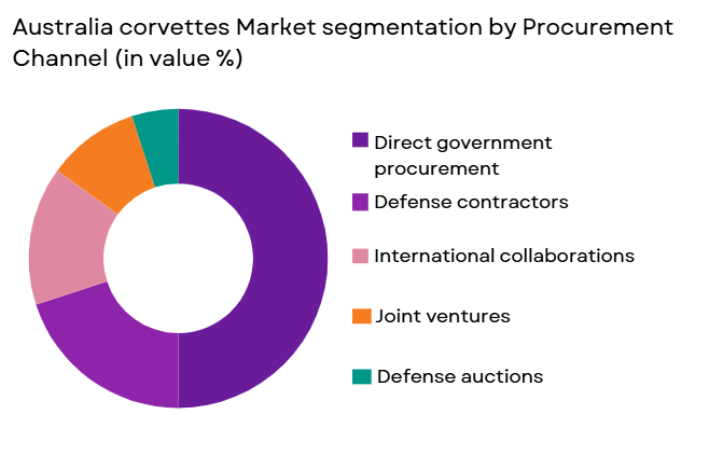

By Procurement Channel

Australia corvettes market is segmented by procurement channel into direct government procurement, defense contractors, international collaborations, joint ventures, and defense auctions. Recently, direct government procurement has held a dominant market share due to the Australian government’s comprehensive defense procurement strategy. The government’s defense policy prioritizes securing long-term contracts with local and international shipbuilders to develop modern naval assets. These procurements are essential for maintaining national security and strengthening defense capabilities, with the Australian Department of Defense managing contracts and driving most acquisitions through direct bids and competitive tendering processes.

Competitive Landscape

The Australia corvettes market is highly competitive, with both local and international players vying for defense contracts. The market is characterized by a mix of global defense contractors and local firms focused on shipbuilding and defense solutions. Government-backed naval defense initiatives, such as the SEA 1180 program, have provided substantial opportunities for both existing players and new entrants. As the Australian government invests in domestic naval shipbuilding capabilities, local players benefit from strategic partnerships and joint ventures.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Naval Defense Focus |

| BAE Systems Australia | 1954 | Melbourne, Australia | ~ | ~ | ~ | ~ | ~ |

| Austal Limited | 1988 | Perth, Australia | ~ | ~ | ~ | ~ | ~ |

| Navantia Australia | 2001 | Sydney, Australia | ~ | ~ | ~ | ~ | ~ |

| Fincantieri Australia | 2009 | Sydney, Australia | ~ | ~ | ~ | ~ | ~ |

| Huntington Ingalls Industries | 1886 | Newport News, USA | ~ | ~ | ~ | ~ | ~ |

Australia Corvettes Market Analysis

Growth Drivers

Increase in National Defense Spending

The increase in national defense spending is a key growth driver for the Australia corvettes market. As global geopolitical tensions rise, particularly in the Indo-Pacific region, Australia has prioritized strengthening its naval forces. The Australian government has committed to significant investments in modernizing its fleet of naval vessels, including corvettes, to enhance its defense capabilities. The country’s defense budget, which includes funding for naval shipbuilding, is expected to continue growing over the next decade, ensuring that corvette construction remains a high priority. The Australian Navy’s goal to develop a more versatile, multi-role fleet further accelerates the demand for advanced corvette designs, especially those that can address multiple defense needs, from coastal protection to anti-submarine warfare.

Strategic Defense Partnerships

Strategic defense partnerships are another crucial growth driver for the Australia corvettes market. Australia has formed several international collaborations with defense industry leaders, such as the United States, United Kingdom, and European Union nations. These partnerships enable access to advanced naval technologies and shipbuilding capabilities, facilitating the joint development of modern corvettes. Additionally, these collaborations create opportunities for co-production agreements and the sharing of resources, which allows Australia to enhance its naval fleet while managing costs and improving the performance of its naval assets. The demand for corvettes is also driven by Australia’s involvement in regional defense alliances, further strengthening its military presence in the Indo-Pacific region.

Market Challenges

High Production and Maintenance Costs

High production and maintenance costs present significant challenges in the Australia corvettes market. The cost of building advanced naval vessels, especially those with multi-role capabilities, remains high due to the specialized materials, technologies, and skilled labor required. In addition, ongoing maintenance and upgrades of corvettes require significant investment. These high costs can strain national defense budgets, potentially limiting the frequency of corvette acquisitions. Furthermore, the complexity of modern corvette systems, including advanced radar, sonar, and weapon systems, means that maintaining operational readiness requires continuous investments in training, parts, and repairs. These financial burdens can slow down the rate of fleet modernization, posing challenges to military planners and policymakers.

Regulatory and Compliance Issues

Regulatory and compliance issues in the defense sector also challenge the Australia corvettes market. As corvettes are critical assets for national security, their design, procurement, and operation are subject to strict government regulations and defense policies. These regulations are meant to ensure the safety, effectiveness, and integration of corvettes within the broader naval fleet, but they can also slow down the procurement process. Compliance with environmental regulations, particularly regarding emissions and waste management from naval vessels, further complicates production. Additionally, international regulations on military exports, particularly regarding corvette technologies, create obstacles for defense manufacturers seeking to expand their customer base beyond Australia.

Opportunities

Expansion of Export Markets

The expansion of export markets presents a significant opportunity for the Australia corvettes market. As global demand for advanced naval defense assets rises, especially in emerging markets in Asia, the Middle East, and Africa, Australian corvette manufacturers are well-positioned to meet these needs. Australia’s defense industry is highly regarded for its cutting-edge technology, and the country’s strong naval defense capabilities make it an attractive partner for nations looking to modernize their fleets. By leveraging its expertise and international partnerships, Australia can increase its presence in global defense markets, particularly in the Indo-Pacific region, where naval defense spending is expected to grow significantly over the next decade.

Rising Demand for Multi-role Corvettes

Rising demand for multi-role corvettes provides a growth opportunity in the Australia corvettes market. As naval forces around the world increasingly require vessels that can perform a variety of functions, including anti-submarine warfare, surveillance, and surface combat, the market for multi-role corvettes has expanded. Australia’s focus on acquiring multi-role corvettes capable of operating in both peaceful and conflict scenarios enhances the country’s naval flexibility. These corvettes can be deployed across various defense missions, making them versatile assets for the Australian Navy and other international buyers. The growing need for adaptable, cost-effective naval platforms is expected to drive the demand for multi-role corvettes over the next decade.

Future Outlook

The future outlook for the Australia corvettes market is positive, with expected growth in the next five years driven by continued defense spending, technological advancements, and international collaborations. The Australian government’s commitment to modernizing its naval assets, particularly through corvette procurement and upgrades, will help maintain the nation’s military readiness. Additionally, expanding international defense partnerships and increasing demand for versatile, multi-role vessels will further boost the market. Technological innovations, such as the integration of AI and advanced propulsion systems, will improve operational efficiency and extend the service life of these vessels.

Major Players

- BAE Systems Australia

- Austal Limited

- Navantia Australia

- Fincantieri Australia

- Huntington Ingalls Industries

- Lockheed Martin Australia

- Lürssen Australia

- DCN International

- Thales Australia

- Raytheon Australia

- General Dynamics Marine Systems

- Navantia

- Saab Australia

- Rheinmetall Defence Australia

- Elbit Systems

Key Target Audience

- Government and defense procurement agencies

- Military and defense contractors

- Naval defense research and development bodies

- International defense forces

- Investors in the defense sector

- Aerospace and defense manufacturers

- Strategic defense partners

- Military training and operational agencies

Research Methodology

Step 1: Identification of Key Variables

Key market variables were identified through extensive secondary research, including government defense budgets, naval procurement data, and defense policy documents.

Step 2: Market Analysis and Construction

Market analysis was based on both primary and secondary data sources, including interviews with industry experts, naval officers, and defense contractors.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions regarding market trends, growth drivers, and challenges were validated through expert consultations with industry stakeholders and defense analysts.

Step 4: Research Synthesis and Final Output

The synthesized data was presented in a structured report, providing insights into the Australia corvettes market, its dynamics, and future potential.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of naval defense budgets in the Asia-Pacific region

Technological advancements in corvette design and capabilities

Increasing demand for multi-role combat and surveillance capabilities - Market Challenges

High manufacturing and operational costs of advanced corvette systems

Limited local production capacity for high-tech naval systems

Intense competition from global defense suppliers - Market Opportunities

Collaborations for co-development with allied nations

Increase in naval modernization programs across the Indo-Pacific region

Rising demand for corvettes in peacekeeping and counter-piracy missions - Trends

Advancements in stealth and low-signature technology

Growing integration of AI and autonomous systems in naval operations

Increasing use of hybrid propulsion for reduced operational costs

Enhanced multi-role capabilities and modular configurations

Shift towards environmentally friendly naval technologies - Government Regulations & Defense Policy

National defense policies promoting domestic naval procurement

Regional defense agreements supporting multi-national naval capabilities

Government incentives for private-sector involvement in defense contracting - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Multi-role corvettes

Offshore patrol corvettes

Anti-submarine warfare corvettes

Stealth corvettes

Command corvettes - By Platform Type (In Value%)

Surface combatants

Hybrid propulsion corvettes

Autonomous corvettes

Large fast attack corvettes

Coastal defense corvettes - By Fitment Type (In Value%)

Factory-fitted weapon systems

Retrofit systems

Custom-built corvettes

Modular component systems

Enhanced propulsion systems - By EndUser Segment (In Value%)

Australian Navy

Asia-Pacific defense organizations

Exporting nations

Private military contractors

Research and development agencies - By Procurement Channel (In Value%)

Direct government procurement

Defense contractors

Military auctions

International partnerships

Joint ventures with foreign entities - By Material / Technology (in Value %)

Stealth materials

Advanced radar and sonar systems

Hybrid propulsion technology

Integrated weapons systems

AI-driven operational control systems

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Design innovation, Weapon system integration, Production scalability, Defense partnerships, Cost efficiency, Technological superiority, After-sales support, Customization flexibility, Export capabilities, Environmental sustainability)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

BAE Systems Australia

Navantia Australia

Thales Australia

Austal Limited

Lockheed Martin Australia

Huntington Ingalls Industries

Lürssen Australia

DCN International

Fincantieri Australia

General Dynamics Marine Systems

Naval Group

Elbit Systems

Kongsberg Gruppen

Harris Corporation

Raytheon Australia

- The Australian Navy’s strategic focus on near-sea defense and rapid deployment capabilities

- Increasing focus on regional defense collaborations with neighboring nations

- Emerging interest from private contractors in smaller, more versatile corvettes

- Upgrades to existing naval assets to maintain modern capabilities in a dynamic security environment

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035