Market Overview

The Australia Counter IED market is projected to reach USD ~billion, driven by a combination of rising security threats and increasing government investments in defense. Demand is fueled by technological advancements in detection and neutralization systems that are critical for both military and civilian safety. The market is characterized by growing concerns over the threat posed by improvised explosive devices (IEDs), prompting both the defense and security sectors to allocate resources towards advanced countermeasures and equipment. These efforts are aimed at mitigating the risk of IEDs in both domestic and international operations.

Australia continues to dominate the Counter IED market, with key cities like Canberra and Sydney playing crucial roles in government procurement and defense R&D. The country’s defense policy emphasizes maintaining a strong military presence in the Indo-Pacific, further driving investments in counter IED technologies. Australia’s collaboration with global defense partners enhances its ability to procure cutting-edge countermeasures, solidifying its position as a leader in the market. The country’s well-established defense infrastructure and strategic location contribute significantly to its dominance in counter IED operations.

Market Segmentation

By System Type

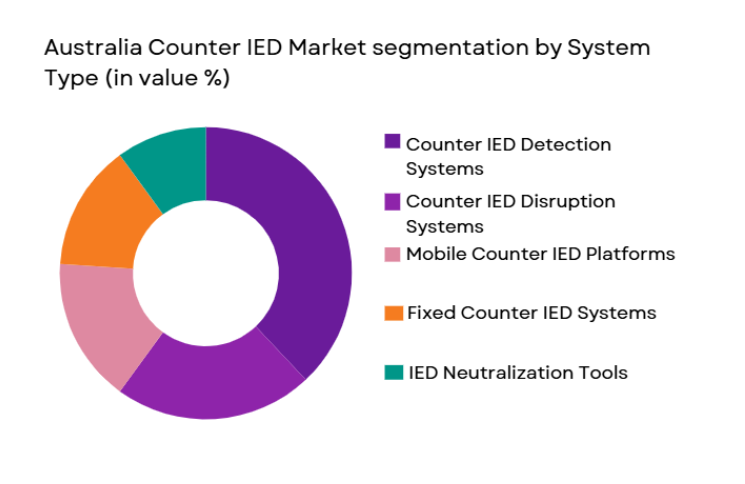

The Australia Counter IED market is segmented by system type into counter IED detection systems, counter IED disruption systems, mobile counter IED platforms, fixed counter IED systems, and IED neutralization tools. Among these, counter IED detection systems hold a dominant market share. The need for rapid identification and detection of IEDs in various operational environments drives the demand for these systems. With advancements in sensor technologies, Australia’s defense forces are increasingly relying on detection systems that offer real-time threat identification. As a result, there is a growing investment in enhancing the capabilities of these detection systems, making them a critical component of military and law enforcement operations.

By Platform Type

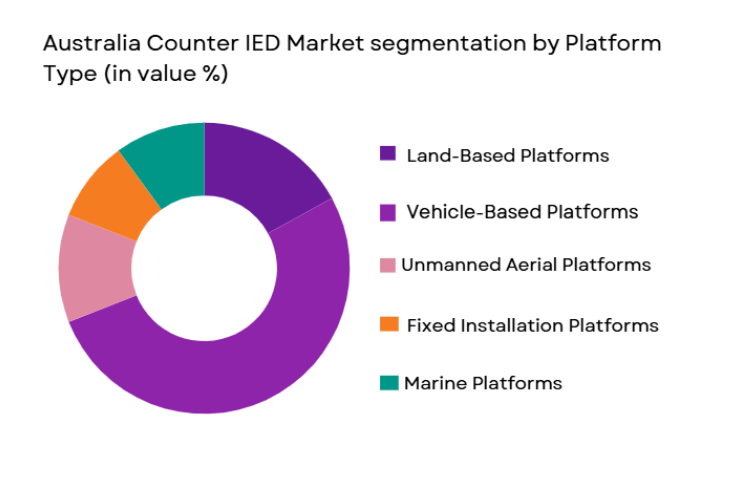

The market is segmented by platform type into land-based platforms, vehicle-based platforms, unmanned aerial platforms, fixed installation platforms, and marine platforms. Vehicle-based platforms dominate the market due to their adaptability and mobility in various operational settings. These platforms are equipped with advanced detection and neutralization systems, which provide flexibility for military units to deploy them across different terrains and situations. The increasing use of vehicle-based platforms is driven by their ability to quickly adapt to shifting operational needs, providing real-time countermeasures against IED threats in both urban and rural areas.

Competitive Landscape

The competitive landscape of the Australia Counter IED market is shaped by both local and international defense contractors. Key players, including Rheinmetall Defence, Thales Group, and BAE Systems, dominate the space through their advanced countermeasure technologies and extensive defense collaborations. These companies are continually innovating, introducing new products that enhance the capabilities of counter IED systems. The market is witnessing consolidation as defense contractors partner with governments to provide comprehensive solutions that meet growing security challenges. The competition is expected to intensify as emerging players enter the market with cutting-edge technologies and specialized systems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market-Specific Parameter |

| Rheinmetall Defence | 1889 | Düsseldorf, Germany | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

Australia Counter IED Market Analysis

Growth Drivers

Increasing Terrorism and Security Threats

The rising global threat of terrorism and asymmetric warfare has been a significant driver for the growth of the Australia Counter IED market. As terrorist organizations increasingly resort to the use of IEDs to carry out attacks, both military and law enforcement agencies are prioritizing investments in technologies designed to neutralize these threats. With conflicts in regions like the Middle East and increasing threats in the Indo-Pacific, Australia’s defense forces are ramping up their efforts to secure borders and protect civilian infrastructure. This rising security threat has spurred demand for advanced counter IED systems, driving growth in the market. As terrorism tactics evolve, there is also a need for adaptable and scalable solutions that can be deployed across a variety of operational environments.

Technological Advancements in Detection and Neutralization

The Australia Counter IED market is also being driven by continuous advancements in technology. The development of more sophisticated detection systems, including the integration of sensors, artificial intelligence, and robotics, has significantly enhanced the ability to identify and neutralize IEDs. Modern detection systems are now faster, more accurate, and capable of handling a wide range of threats, including both traditional and emerging IED types. In addition, innovations in neutralization technologies, such as robotic systems and electronic jamming devices, have contributed to more efficient and effective countermeasures. These technological advancements have expanded the range of counter IED solutions available to both the military and law enforcement sectors, helping to improve security and safety.

Market Challenges

High Cost of Counter IED Systems

A major challenge facing the Australia Counter IED market is the high cost of advanced detection and neutralization systems. The complex technology and specialized materials required to develop these systems result in high production and maintenance costs. This issue is further compounded by the need for continuous upgrades and system integration, as evolving threats require new technologies. For defense organizations with limited budgets, the high costs of counter IED solutions can pose significant barriers to adoption. While there are budget allocations for defense and security, maintaining a balance between investing in advanced counter IED technologies and managing overall defense spending remains a challenge.

Integration and Compatibility of Systems

The complexity of integrating counter IED systems into existing defense infrastructures is another significant challenge. Many of these systems must work seamlessly with other military and law enforcement technologies, including surveillance equipment, communication networks, and vehicle platforms. Ensuring compatibility and interoperability among various systems remains a complex task, particularly as new technologies emerge. In some cases, the lack of standardized protocols or open systems has led to integration challenges, hindering the effectiveness of counter IED efforts. As a result, defense contractors and government agencies are working to standardize systems, but achieving complete interoperability across all platforms remains an ongoing challenge.

Opportunities

Autonomous Counter IED Systems

One of the key opportunities in the Australia Counter IED market is the development and deployment of autonomous systems. With advancements in robotics and artificial intelligence, autonomous vehicles and drones are becoming increasingly capable of detecting and neutralizing IEDs without human intervention. These systems can operate in environments that are too dangerous for humans, improving operational efficiency and safety. The Australian defense forces have already begun investing in these technologies, with the potential for further expansion into various applications such as border security, military operations, and counter-terrorism. As autonomous technologies mature, they offer significant opportunities to enhance counter IED capabilities and reduce the risks associated with human involvement.

Increased Demand for Mobile Counter IED Solutions

The growing need for rapid-response countermeasures in dynamic and unpredictable environments has created an opportunity for mobile counter IED solutions. These systems, which can be deployed quickly and relocated as needed, are crucial for responding to threats in both urban and rural settings. Mobile platforms, including vehicles and drones, provide flexibility for military and law enforcement agencies to adapt to changing situations. This trend is expected to continue as defense agencies prioritize mobility and agility in their counter IED efforts. The growing demand for mobile counter IED solutions presents a significant growth opportunity for companies that specialize in the development and production of these systems.

Future Outlook

The future of the Australia Counter IED market is expected to be characterized by the continued adoption of advanced technologies, particularly autonomous systems and mobile countermeasures. Increasing security concerns, coupled with ongoing investments in defense, will continue to drive demand for sophisticated detection and neutralization systems. Over the next five years, technological innovations in AI, robotics, and sensors will enhance the capabilities of counter IED systems, ensuring they remain effective against emerging threats. Additionally, collaboration between defense forces and international partners will help drive the market forward, as the need for effective countermeasures grows.

Major Players

- Rheinmetall Defence

- Thales Group

- BAE Systems

- Lockheed Martin

- Northrop Grumman

- General Dynamics

- L3 Technologies

- Leonardo

- Saab AB

- Elbit Systems

- Israel Aerospace Industries

- QinetiQ

- FLIR Systems

- Textron Systems

- Harris Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Private security firms

- Military and law enforcement agencies

- Defense equipment manufacturers

- Border security agencies

- Counter-terrorism units

Research Methodology

Step 1: Identification of Key Variables

Identification of key factors influencing the Australia Counter IED market, including technological trends, security threats, and procurement patterns.

Step 2: Market Analysis and Construction

Analysis of current market trends, competitor landscape, and consumer needs, utilizing primary and secondary research sources.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with defense experts, industry professionals, and key stakeholders to validate assumptions and market forecasts.

Step 4: Research Synthesis and Final Output

Consolidation of research findings into a comprehensive report, presenting market insights, forecasts, and strategic recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Terrorism and Security Threats

Advancements in Detection and Neutralization Technologies

Government Investment in Defense and Security - Market Challenges

High Cost of Advanced Counter IED Systems

Technological Integration Complexities

Limited Interoperability Among Systems - Market Opportunities

Expansion of Defense Partnerships and Alliances

Advancements in Autonomous Counter IED Systems

Growing Demand for Mobile Counter IED Solutions - Trends

Deployment of AI and Robotics for IED Detection

Increased Use of Drones for Counter IED Operations

Growth in Demand for Portable Counter IED Devices

Advancements in Automated Neutralization Technologies

Government Regulations Supporting Counter IED Technologies - Government Regulations & Defense Policy

Implementation of National Counter IED Standards

Strengthening International Defense Cooperation

New Regulations for IED Detection and Neutralization - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Counter IED Detection Systems

Counter IED Disruption Systems

Mobile Counter IED Platforms

Fixed Counter IED Systems

IED Neutralization Tools - By Platform Type (In Value%)

Land-Based Platforms

Vehicle-Based Platforms

Unmanned Aerial Platforms

Fixed Installation Platforms

Marine Platforms - By Fitment Type (In Value%)

Integrated Systems

Modular Systems

Standalone Devices

Mobile Systems

Portable Systems - By EndUser Segment (In Value%)

National Defense Forces

Law Enforcement Agencies

Private Security Contractors

International Organizations

Government Bodies - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Contractors

International Defense Alliances

Private Sector Procurement

Custom Shipbuilders - By Material / Technology (In Value%)

Advanced Sensors

Electronic Countermeasure Technologies

Robotics and AI Integration

Explosive Detection Systems

Wireless Communication Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Technology Integration, Deployment Capabilities, Cost-effectiveness, Range of Operation, System Flexibility, Maintenance and Support, User Training, Customization Capabilities, After-sales Service)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Rheinmetall Defence

Thales Group

BAE Systems

Lockheed Martin

Northrop Grumman

General Dynamics

L3 Technologies

Leonardo

Saab AB

Elbit Systems

Israel Aerospace Industries

QinetiQ

FLIR Systems

Textron Systems

Harris Corporation

- Integration of AI in IED Detection

- Collaborative Counter IED Programs with Allies

- Increased Procurement from Defense Contractors

- Technological Upgrades in Existing IED Systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035