Market Overview

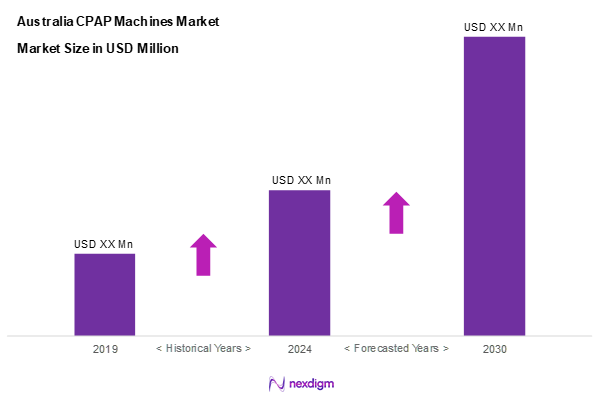

As of 2024, the Australia CPAP machines market is valued at USD 631.2 million, with a growing CAGR of 8.1% from 2024 to 2030. The growth is driven by a growing awareness of sleep apnea and its associated health risks, alongside increasing government initiatives supporting sleep disorder treatments. Enhanced technology in CPAP machines, such as automatic adjustment features and noise reduction, adds to their appeal, encouraging more users to adopt these devices for better sleep quality.

Major cities dominating the market include Sydney, Melbourne, and Brisbane. These regions have a higher prevalence of sleep apnea diagnoses due to their concentrated urban populations, improved healthcare infrastructure, and access to specialized sleep clinics. Additionally, government support in the form of increased healthcare funding for sleep disorders boosts demand for CPAP machines in these metropolitan areas.

Market Segmentation

By Product Type

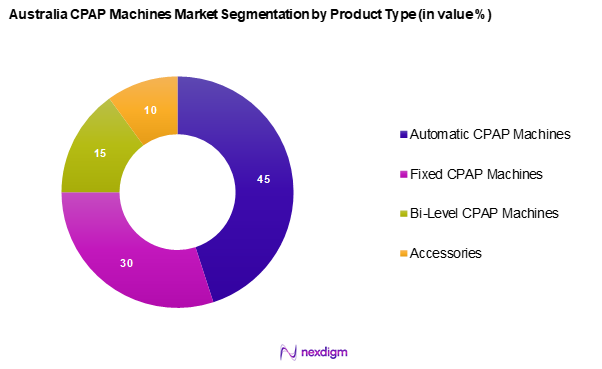

Australia’s CPAP machines market is segmented into automatic CPAP machines, fixed CPAP machines, bi-level CPAP machines, and accessories (masks, tubing, etc.). The automatic CPAP machines currently dominate the market due to their advanced features that offer personalized pressure adjustments, enhancing user comfort and compliance. This technology significantly reduces the complexity associated with fixed machines, allowing users to experience a seamless and effective treatment for Obstructive Sleep Apnea (OSA). Manufacturers are increasingly investing in R&D to integrate smart technology, further driving growth in the automatic CPAP segment.

By End User

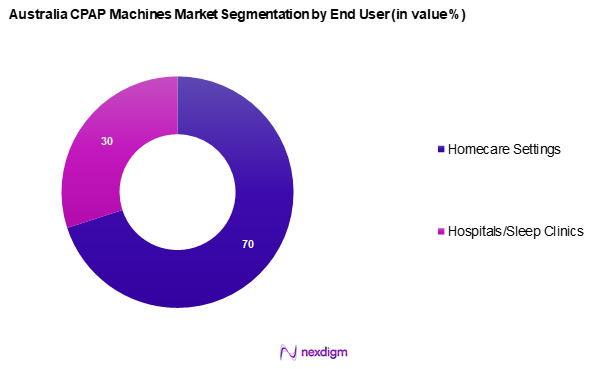

The Australian CPAP machines market is segmented into homecare settings and hospitals/sleep clinics. The homecare settings segment holds the largest market share due to the increasing preference for at-home treatments among patients and the convenience offered by home-based monitoring devices. The shift towards telemedicine and remote healthcare services, especially following the global pandemic, has led to growth in this segment as patients seek to manage their conditions from the comfort of their homes.

Competitive Landscape

The Australia CPAP machines market is dominated by a few major players that maintain significant influence in shaping market trends and innovation. Key companies include ResMed, Fisher & Paykel Healthcare, and Philips Respironics. Their leading positions are characterized by strong brand recognition, extensive R&D investments, and a broad distribution network catering to both retail and hospital channels.

| Company | Establishment Year | Headquarters | Product Range | Annual Revenue | Market Share | Notable Innovations |

| ResMed | 1989 | Sydney, Australia | – | – | – | – |

| Fisher & Paykel Healthcare | 1969 | Auckland, New Zealand | – | – | – | – |

| Koninklijke Philips N.V. | 1891 | Amsterdam, Netherlands | – | – | – | – |

| BMC | 2001 | Beijing, China | – | – | – | – |

| Invacare Corporation | 1885 | Ohio, USA | – | – | – | – |

Australia CPAP Machines Market Analysis

Growth Drivers

Increasing Prevalence of Sleep Disorders

In Australia, the prevalence of sleep disorders, particularly sleep apnea, is rising significantly, affecting roughly 1 in 10 adults. This growth can be attributed to lifestyle factors, including obesity and sedentary behaviour, both of which are on the rise. According to the Australian Institute of Health and Welfare, approximately 64% of adults are classified as overweight or obese, raising the risk of developing Obstructive Sleep Apnea (OSA). As awareness of these issues proliferates, more individuals seek diagnosis and treatment, leading to increased demand for CPAP machines across the healthcare spectrum.

Rise in Elderly Population

The Australian Bureau of Statistics reports that the number of Australians aged 65 and over is projected to reach 8.8 million by 2030, which corroborates the growing demand for healthcare services tailored to older adults. As age is a significant risk factor for sleep disorders, this increasing elderly demographic is likely to contribute to greater utilization of CPAP devices. Additionally, older adults are often more prone to comorbid conditions such as cardiovascular diseases and diabetes, which further elevates the likelihood of experiencing sleep apnea and needing effective treatment solutions.

Market Challenges

Device Adherence Issues

One of the primary challenges facing the CPAP market is adherence to therapy among users. It is reported that adherence rates to CPAP therapy fall between 30% to 50%, according to a study published in the Australian Journal of General Practice. Poor adherence often stems from discomfort associated with wearing masks, noise levels from the devices, or inadequate patient education about the importance of usage. Stricter guidelines and improved patient education could address these issues, but until such measures are normalized, maintaining high adherence rates remains challenging for healthcare providers across Australia.

Regulatory Hurdles

Regulatory challenges represent another significant obstacle for the CPAP market. Devices are subject to rigorous regulatory scrutiny by the Therapeutic Goods Administration (TGA) to ensure safety and effectiveness. The TGA has been known to take time in evaluating new technological innovations or changes to existing products, which can delay the entry of new solutions into the market. Additionally, regulatory barriers can also deter smaller manufacturers from competing effectively, ultimately impacting the overall diversity and innovation within the CPAP market in Australia.

Opportunities

Enhanced Consumer Awareness Campaigns

There is a significant opportunity for growth through enhanced consumer awareness regarding the issues surrounding sleep disorders and available treatment options. Government initiatives, such as public health campaigns emphasizing the importance of sleep health, are gaining traction and have been linked to heightened diagnosis rates. The Australian Government’s Sleep Health Foundation emphasizes the need for education on identifying the symptoms of sleep apnea, which can catalyse growth in CPAP machine utilization as patients proactively seek treatment options.

Expansion of Distribution Channels

The expansion of distribution channels distinctly represents a market opportunity for CPAP manufacturers. Increased penetration of e-commerce and telehealth has altered consumer purchasing behaviour, especially since the COVID-19 pandemic. As more patients turn to online platforms for medical supplies, CPAP manufacturers can leverage this trend to reach broader markets. According to the Australia Post, e-commerce sales have surged, with online spending increasing by approximately AUD 40 billion from 2020 to 2021. Establishing partnerships with telehealth providers could further streamline the process, enabling patients to receive prescriptions and consult healthcare professionals while purchasing CPAP devices directly from online retailers. This trend could significantly enhance market access and visibility for various CPAP brands.

Future Outlook

Over the next five years, the Australia CPAP machines market is expected to show significant growth driven by continuous advancements in product technology, increasing healthcare expenditure, and a heightened focus on sleep health awareness. As more patients are diagnosed with sleep apnea and related disorders, the market will benefit from innovations aimed at improving user experience. Furthermore, trends toward remote patient monitoring and telehealth solutions will enhance market penetration and patient engagement.

Major Players in the Market

- Resmed

- Fisher & Paykel Healthcare Limited.

- Koninklijke Philips N.V.

- BMC

- Medical Depot, Inc.

- APEX MEDICAL DEVICES

- Som Imaging Informatics Pvt. Ltd.

- Koala Health

- Invacare Holdings Corporation

- Medtronic

- Circadiance

- SleepMed Solutions

- Agilent Technologies, Inc.

- Embletta

- Other

Key Target Audience

- Healthcare Providers

- Hospitals and Sleep Clinics

- Insurance Companies

- Homecare Service Providers

- Medical Supply Distributors

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Australian Medical Association, Therapeutic Goods Administration)

- Orthopedic and Respiratory Clinics

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Australia CPAP machines market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as pricing trends, customer preferences, and regulatory impacts on sales.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Australia CPAP machines market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Additionally, evaluating service quality statistics ensures the reliability and accuracy of the revenue estimates. The purpose is to refine our understanding of the market landscape and to derive actionable insights.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through expert consultations. These consultations involve computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. The invaluable operational and financial insights gained from these discussions will play a critical role in refining and corroborating the data used in our market analysis.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with key players in the CPAP market to acquire detailed insights regarding product segments, sales performance, consumer preferences, and overarching market trends. This interaction is essential for verifying and complementing the statistics derived from the comprehensive market analysis, thereby ensuring a thorough and validated assessment of the Australia CPAP machines market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Evolution and Historical Overview

- Regulatory Environment

- Pricing Strategies

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Prevalence of Sleep Disorders

Rise in Elderly Population - Market Challenges

Device Adherence Issues

Regulatory Hurdles - Opportunities

Enhanced Consumer Awareness Campaigns

Expansion of Distribution Channels - Trends

Integration of Smart Technology

Shift Towards Home Healthcare Solutions - Government Regulations

Health Guidelines and Standards

Reimbursement Policies - SWOT Analysis

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Selling Price, 2019-2024

- By Product Type (In Value %)

Automatic CPAP Machines (Auto-CPAP)

– Premium Auto-CPAP Devices (with Wi-Fi/Bluetooth, app integration)

– Mid-Range Auto-CPAP Devices

– Travel-Friendly Auto-CPAP Machines

Fixed CPAP Machines

– Entry-Level Fixed Pressure CPAP Devices

– Fixed CPAP Machines with Built-in Humidifier

– CPAP Machines with Minimal Interface (for elderly use)

Bi-Level CP / Bi-Level CPAP Machines (Merge for consistency)

– BiPAP S (Spontaneous mode)

– BiPAP ST (Spontaneous/Timed mode)

– BiPAP Auto

– BiPAP AVAPS (Average Volume Assured Pressure Support)

Accessories (Masks, Tubing, etc.)

– Nasal Masks

– Full Face Masks

– Nasal Pillow Masks

– Heated Tubing

– Non-Heated Tubing

– Filters & Humidifiers

– Headgear and Chin Straps - By End User (In Value %)

Homecare Settings

– Self-Pay/Home-Based Sleep Apnea Patients

– Insurance-Covered Home Users

– Elderly Population with Chronic Respiratory Conditions

– Telemonitoring-Compatible Users

Hospitals and Sleep Clinics

– Public Hospitals (ICU, Respiratory Therapy Units)

– Private Hospitals

– Accredited Sleep Disorder Clinics

– Rehabilitative/Respiratory Wellness Centers - By Distribution Channel (In Value %)

Direct Sales

– B2B Institutional Sales (Hospitals, Clinics)

– CPAP Rental Programs (via sleep centers)

– Direct Corporate Accounts (e.g., aged care homes)

E-commerce Platforms

– Company-Owned Webstores (e.g., ResMed Australia)

– Third-Party Online Retailers (e.g., Amazon AU, eBay AU)

– Healthcare E-Commerce Sites (e.g., CPAP Australia, MyCPAP)

Medical Supply Stores

– Brick-and-Mortar CPAP Specialty Stores

– Pharmacy Chains Selling CPAP Devices

– Independent DME Retailers (Durable Medical Equipment) - By Region (In Value %)

New South Wales (NSW)

Victoria

Queensland

Western Australia

South Australia

- Market Share of Major Players by Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Product Portfolio, Market Positioning, Recent Innovations, Distribution Channels, Strengths, Weaknesses, Customer Base, Revenue (Company-Level), Product Revenue (CPAP Segment), Cost Structure (Refine/Replace), Strategic Partnerships)

- SWOT Analysis of Major Players

- Detailed Profiles of Major Competitors

Resmed

Fisher & Paykel Healthcare Limited.

Koninklijke Philips N.V.

BMC

Medical Depot, Inc.

APEX MEDICAL DEVICES

Som Imaging Informatics Pvt. Ltd.

Koala Health

Invacare Holdings Corporation

Medtronic

Circadiance

SleepMed Solutions

Agilent Technologies, Inc.

Embletta

- Consumer Demand and Preferences

- Budget Allocations for CPAP Devices

- Decisions Influencing Purchase Behavior

- Needs and Pain Points of Users

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030