Market Overview

The market size of Australia’s decoys and dispensers market has been growing rapidly, driven by increasing military expenditure and defense modernization programs. With robust defense budgets and ongoing investments in advanced military technologies, the market is projected to reach USD ~ billion. The demand for decoys and dispensers has been fueled by the need to counter sophisticated threats and enhance the defensive capabilities of various military platforms, including airborne and naval systems.

Australia remains a leader in the decoys and dispensers market due to its strategic location in the Asia-Pacific region, where defense spending is on the rise. Key defense hubs like Sydney and Melbourne are home to advanced manufacturing and defense technologies, contributing significantly to market growth. The government’s focus on strengthening its defense sector and fostering partnerships with private contractors also plays a pivotal role in shaping the market’s dynamics. Australia’s proactive stance on defense innovation further solidifies its position in the global market.

Market Segmentation

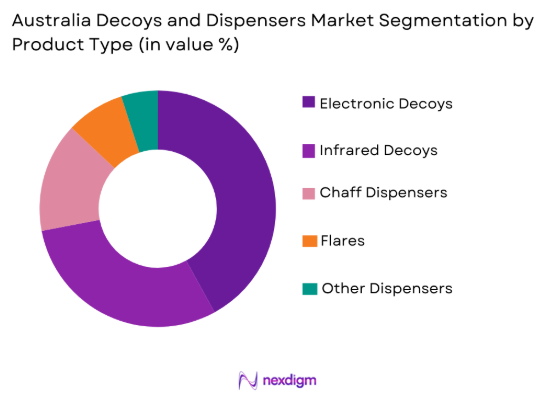

By Product Type

Australia’s decoys and dispensers market is segmented by product type into electronic decoys, infrared decoys, chaff dispensers, flares, and other dispensers. The electronic decoys sub-segment has recently dominated the market due to the increasing demand for advanced electronic warfare capabilities. These decoys are highly effective in diverting enemy radar systems and are widely used in both military and defense platforms. Their adoption has been driven by rising concerns over sophisticated missile and radar threats, along with the desire for enhanced countermeasures. Their superior effectiveness in a wide range of combat situations has further fueled demand, making electronic decoys the most significant sub-segment in Australia’s decoys and dispensers market.

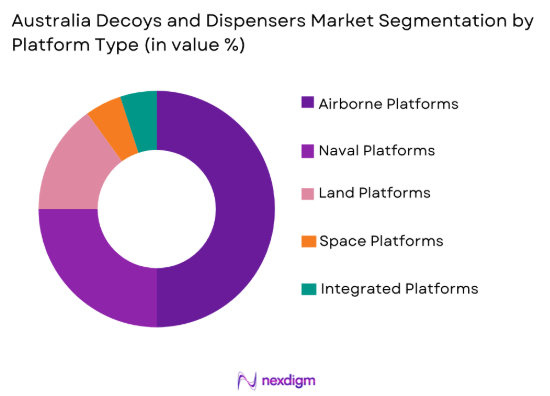

By Platform Type

The market is segmented by platform type into airborne platforms, naval platforms, land platforms, space platforms, and integrated platforms. Airborne platforms have seen the highest demand, primarily due to the growing need for aircraft defense systems. These platforms offer extensive capabilities for decoy deployment and are critical in military air superiority. The growing focus on protecting military aircraft from advanced surface-to-air and air-to-air missiles has driven the adoption of decoys and dispensers in airborne platforms. Furthermore, technological advancements in the development of lightweight and highly effective systems have made airborne decoy systems increasingly vital in defense strategies.

Competitive Landscape

The Australia decoys and dispensers market is highly competitive, with a few major players holding significant market share. The consolidation of key defense companies has led to a more concentrated market structure. These players are primarily focused on advancing their technological capabilities, ensuring product efficacy, and fostering long-term relationships with government agencies and defense contractors. The influence of companies such as Lockheed Martin, Thales Group, and BAE Systems continues to shape the direction of innovation in the market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Lockheed Martin | 1912 | Bethesda, MD | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, MA | ~ | ~ | ~ | ~ | ~ |

Australia Decoys and Dispensers Market Analysis

Growth Drivers

Technological Advancements in Decoy Systems

The development of advanced decoy systems has been a primary growth driver for the market. These technological advancements have enhanced the efficiency and effectiveness of decoys in countering missile and radar threats. With the integration of AI and machine learning into decoy systems, these products can now adapt in real-time to evolving threats, making them more effective in high-stakes defense situations. The constant demand for modernized defense technologies in military forces has ensured that decoys and dispensers remain a high priority for research and development, contributing significantly to market growth. Manufacturers continue to innovate, focusing on developing lighter, more durable, and more versatile decoy systems that can perform in increasingly complex combat environments. As a result, these innovations are leading to higher market penetration and demand for advanced decoy solutions.

Government Investment in Defense Systems

Australia’s increased government investment in defense is another significant driver for the decoys and dispensers market. In response to rising geopolitical tensions and the need for enhanced military capabilities, the Australian government has committed significant resources to modernize its defense infrastructure. This investment has been particularly focused on expanding defense technologies capable of countering sophisticated threats. The emphasis on strengthening national security by bolstering defense forces has created a conducive environment for the growth of the decoys and dispensers market. As part of the government’s defense strategy, partnerships with key defense contractors and private firms have become more pronounced, leading to an increase in demand for advanced decoy systems for various military applications, from air defense to naval and land defense.

Market Challenges

High Development and Maintenance Costs

One of the key challenges faced by the Australia decoys and dispensers market is the high development and maintenance costs associated with advanced decoy systems. The complexity of developing decoy solutions that meet stringent military standards requires substantial investment in research and development. Moreover, maintaining the operational effectiveness of these systems, particularly for defense forces with limited budgets, presents a significant challenge. The costs involved in upgrading existing systems to incorporate new technologies, such as artificial intelligence and advanced sensors, are substantial, and many defense budgets may not be equipped to handle these financial burdens. As a result, market participants must navigate the trade-off between innovation and cost-effectiveness while ensuring the continuous advancement of decoy systems.

Regulatory and Compliance Challenges

The decoys and dispensers market is also faced with numerous regulatory and compliance challenges. The defense industry is heavily regulated, and the approval process for new systems can be lengthy and complex. Additionally, international regulations governing the export and use of defense technologies have become stricter in recent years, complicating the supply chain for manufacturers. These regulations have led to delays in product development and have hindered the ability of defense contractors to meet growing demand in a timely manner. Furthermore, compliance with safety standards and environmental regulations has added an extra layer of complexity for manufacturers, affecting the overall market dynamics.

Opportunities

Expansion of Defense Capabilities in the Asia-Pacific Region

The Asia-Pacific region has become a key growth area for the decoys and dispensers market due to increasing defense investments. Nations like China, India, Japan, and Australia are significantly modernizing their defense infrastructures, including investments in advanced air defense and electronic warfare systems. Australia, as a strategic player, stands to benefit greatly from this regional expansion. Rising geopolitical tensions, particularly in the South China Sea and the Indo-Pacific region, are prompting countries to bolster their military capabilities, thus driving the demand for advanced decoys and dispensers. Australia’s efforts to strengthen its defense capabilities by upgrading air and naval defense systems are encouraging investments in decoy technologies, which are integral to counteracting aerial and missile threats. Additionally, regional military alliances and growing defense budgets will further increase the demand for effective decoys, creating opportunities for manufacturers and defense contractors to expand their market presence across the region.

Emerging Demand for Multi-functional Decoy Systems

There is a growing demand for multi-functional decoy systems that combine multiple capabilities into one compact solution. Traditional decoy systems, often focused on a single function, are increasingly being replaced by advanced, multi-purpose systems capable of performing various roles, such as countering radar, infrared, and missile threats simultaneously. These systems offer better versatility, cost-effectiveness, and adaptability in modern warfare. As military forces look to integrate decoys into complex, multi-role defense platforms, the need for such innovative systems has intensified. This trend is not only driven by the desire for enhanced protection but also by budget constraints, as multi-functional decoys reduce the need for multiple separate systems. Manufacturers are increasingly investing in developing these next-generation decoy technologies, which are expected to dominate the market. The opportunity lies in offering more advanced and scalable solutions that meet the evolving requirements of modern defense applications, from fighter jets to naval vessels.

Future Outlook

The future outlook for the Australia decoys and dispensers market is highly positive, with significant growth expected over the next five years. Technological advancements, particularly in artificial intelligence and machine learning, will continue to drive innovation in decoy systems. Increased government investment in defense modernization programs and the rising demand for more advanced countermeasures will further contribute to market expansion. Regulatory support, especially in terms of defense innovation and strategic partnerships, will also play a key role in enabling market growth. With growing geopolitical tensions, the need for advanced defense solutions will remain a primary factor in shaping the future trajectory of the market.

Major Players

- Lockheed Martin

- Thales Group

- BAE Systems

- Northrop Grumman

- Raytheon Technologies

- L3 Technologies

- Saab Group

- Elbit Systems

- Leonardo

- Harris Corporation

- General Dynamics

- Rheinmetall AG

- Boeing

- Sikorsky Aircraft

- Harris Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Aerospace & defense firms

- Military forces

- Commercial defense systems integrators

- Technology firms specializing in defense solutions

- Manufacturers of military hardware and software

Research Methodology

Step 1: Identification of Key Variables

The first step involved identifying the key market variables, including product types, platform types, and end-user segments, which are critical in understanding the market structure.

Step 2: Market Analysis and Construction

A detailed market analysis was conducted to understand the drivers, challenges, and dynamics affecting the decoys and dispensers market, along with future trends.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts and key stakeholders helped validate hypotheses regarding market growth patterns and technological advancements.

Step 4: Research Synthesis and Final Output

All collected data, insights, and expert consultations were synthesized to produce a comprehensive market report, which was used to forecast future market trends.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Military Modernization Programs

Technological Advancements in Electronic Warfare

Rising Geopolitical Tensions - Market Challenges

High Costs of Advanced Systems

Integration Issues with Existing Military Infrastructure

Regulatory and Compliance Barriers - Market Opportunities

Expansion in Emerging Markets

Increasing Demand for Multi-functional Dispensers

Partnerships with Private Tech Firms for Enhanced Capabilities - Trends

Integration of AI and Machine Learning in Defense Systems

Use of Autonomous Systems for Decoy Deployment

Surge in Cybersecurity Investments for Defense Technologies - Government Regulations

Export Control and Compliance Policies

Government Funding and Grants for Defense Technologies

Data Protection and Privacy Regulations

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electronic Decoys

Infrared Decoys

Chaff Dispensers

Flares

Other Dispensers - By Platform Type (In Value%)

Airborne Platforms

Naval Platforms

Land Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

Fixed Solutions

Portable Solutions

Modular Solutions

Integrated Solutions

Hybrid Solutions - By End User Segment (In Value%)

Military Forces

Defense Contractors

Aerospace & Defense Organizations

Government Agencies

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributon

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Technology Type, Region, Price Range, Product Lifecycle, Material Composition)

SWOT Analysis of Key Competitors

Pricing & Procurement Analysis

Porter’s Five Forces

Key Players

Rheinmetall AG

BAE Systems

Thales Group

Lockheed Martin

General Dynamics

Northrop Grumman

Saab Group

L3 Technologies

Elbit Systems

Leonardo

Harris Corporation

Raytheon Technologies

Hewlett Packard Enterprise

- Military Forces’ Increasing Demand for Decoy Systems

- Aerospace and Defense Contractors’ Shift Towards Innovation

- Government Agencies’ Role in Regulating and Procuring Systems

- Private Sector’s Growing Interest in Advanced Dispensers

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035