Market Overview

The Australia decoys and dispensers market is valued at approximately USD ~ million, driven by increasing demand from defense agencies and military organizations focusing on advanced countermeasures. The market’s growth is further fueled by the rise in technological innovations in electronic warfare and missile defense systems. With the rising security concerns in the Asia-Pacific region, Australia is investing heavily in defense technologies, including decoys and dispensers, to enhance its national defense capabilities and to support regional security initiatives.

Australia’s dominance in the decoys and dispensers market is driven by its strategic defense priorities and the country’s significant defense expenditure. Key Australian defense manufacturers, along with international collaborations, have bolstered the nation’s position as a major player in the development and deployment of decoy systems. The need for advanced countermeasure systems to protect national infrastructure and defense assets against airborne, missile, and radar threats continues to push the growth of this market. Australia’s continued investment in next-generation defense technologies strengthens its global position in the defense sector.

Market Segmentation

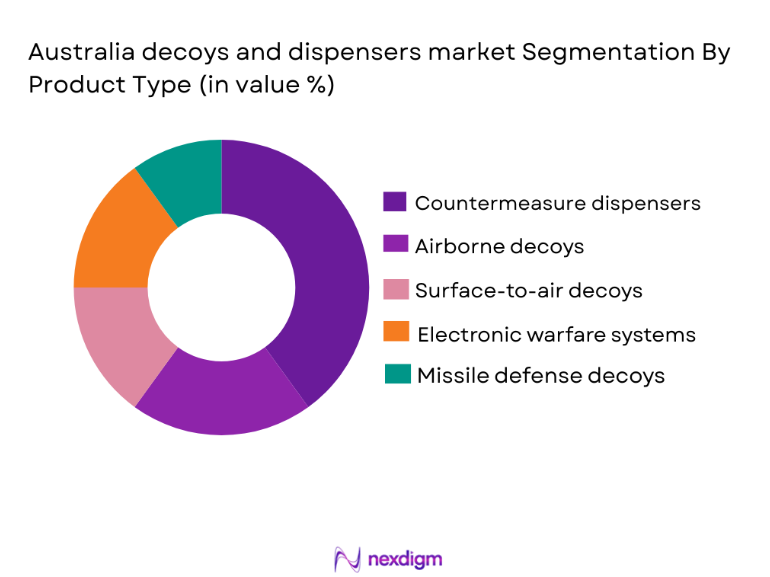

By Product Type

Australia decoys and dispensers market is segmented by product type into countermeasure dispensers, airborne decoys, surface-to-air decoys, electronic warfare systems, and missile defense decoys. The countermeasure dispensers segment holds a dominant market share due to their versatility and effectiveness in offering protection against various airborne threats. These systems are increasingly in demand by defense agencies for both military and strategic defense applications, ensuring the protection of critical assets. The growing importance of electronic warfare and the need to defend against evolving missile technologies have significantly driven this sub-segment’s market growth.

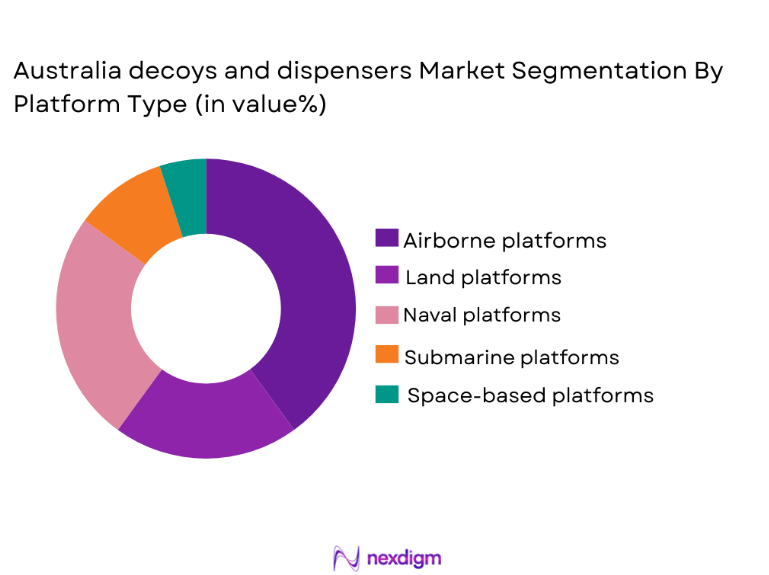

By Platform Type

The market is also segmented by platform type into airborne platforms, land platforms, naval platforms, submarine platforms, and space-based platforms. Airborne platforms dominate the market due to their widespread use in military defense strategies. These platforms provide crucial tactical advantages in deploying decoys and countermeasures to protect aircraft from missile threats. The high demand for these systems, along with ongoing technological advancements in aerospace defense, ensures that airborne platforms continue to lead the market. The emphasis on defense in airspace, combined with Australia’s investment in next-gen fighter jets and UAVs, strengthens the dominance of this segment.

Competitive Landscape

The Australia decoys and dispensers market is shaped by competition among several global and regional defense companies. Leading players in the market are involved in collaborations with the Australian government to enhance defense capabilities, particularly in electronic warfare and missile defense systems. Consolidation in the industry is increasing, as companies merge to bring innovative solutions to the market. Major players in the market continue to develop next-generation decoys and dispensers to stay competitive, focusing on improved performance and cost-effectiveness for defense applications.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ |

Australia Decoys and Dispensors Market Analysis

Growth Drivers

Increased Military Expenditure

The growth of the Australia decoys and dispensers market is significantly driven by the ongoing increase in military expenditure. Australia’s defense budget has been on the rise, focused on upgrading its defense systems to address new threats. The government’s commitment to improving national security through the procurement of advanced defense technologies, including decoys and dispensers, plays a key role in driving market growth. As geopolitical tensions and security concerns in the Asia-Pacific region intensify, the Australian government is expected to continue investing in its defense capabilities. The growing reliance on advanced countermeasure systems to protect military assets and national infrastructure from missile and radar threats ensures sustained demand for decoys and dispensers. Furthermore, the integration of these systems with next-generation fighter jets, UAVs, and naval vessels continues to fuel the growth of this segment, making it a critical aspect of Australia’s defense strategy. As defense priorities shift towards more advanced systems, the decoys and dispensers market will expand further, bolstered by government funding and global defense partnerships.

Technological Advancements in Electronic Warfare Systems

Another key growth driver is the continuous advancement in electronic warfare (EW) systems. As missile defense systems evolve, the need for countermeasures and dispensers to protect military assets against evolving threats becomes even more critical. EW systems, including decoys that simulate radar signatures, have gained prominence in defense strategies across the globe. Australia’s push to remain at the forefront of technological innovations in EW has directly impacted the demand for decoys and dispensers. With increasing investments in the development of sophisticated electronic warfare technologies, Australia is strengthening its defense systems with more advanced countermeasures that enhance the effectiveness of military operations. These advancements are not only improving the performance of decoys but are also reducing the cost of deployment, ensuring their integration in various defense applications, including naval, airborne, and land platforms. As technological advancements continue to shape the future of electronic warfare, the Australia decoys and dispensers market will benefit from sustained growth.

Market Challenges

High Research and Development Costs

A major challenge for the Australia decoys and dispensers market is the high cost associated with research and development (R&D). Developing new, advanced decoy systems requires significant investment in cutting-edge technologies and materials. The complexity of designing countermeasure dispensers and integrating them with various platforms such as fighter jets, naval ships, and ground vehicles makes R&D efforts resource intensive. For smaller players in the market, these costs can be a barrier to entry, limiting competition, and slowing down the introduction of new products. Additionally, the lengthy development cycles for advanced defense technologies, along with the need for rigorous testing and validation, increase the time-to-market for new decoy systems. As a result, high R&D costs not only limit the availability of new products but also affect the affordability of decoy systems for defense agencies. For the market to grow, stakeholders must find ways to balance innovation with cost-efficiency, ensuring that these systems remain accessible for both local and international buyers.

Geopolitical Instability in the Asia-Pacific Region

The ongoing geopolitical instability in the Asia-Pacific region poses another challenge for the decoys and dispenser’s market. Tensions between neighboring countries, territorial disputes, and the growing military presence in the region have led to an uncertain security environment. For Australia, the need for robust defense measures, including decoys and dispensers, is crucial to ensuring national security. However, the unpredictability of geopolitical developments often results in shifting defense priorities, affecting defense procurement plans. Additionally, international relations and defense alliances influence the availability of foreign technology and materials used in the production of decoy systems. The volatile political situation can also impact the timing of defense contracts and delay the delivery of critical defense systems. The challenge of adapting to changing security dynamics in the region requires constant reassessment of defense strategies and the technologies employed, which can be costly and resource-draining.

Opportunities

Indigenous Defense Manufacturing Growth

One significant opportunity for the Australia decoys and dispensers market lies in the growth of indigenous defense manufacturing. The Australian government’s commitment to developing a self-sufficient defense sector is pushing for the local production of critical defense systems, including decoys and dispensers. By investing in local defense capabilities and supporting Australian manufacturers, the country is reducing its reliance on foreign suppliers and creating a more resilient defense infrastructure. This opportunity is further reinforced by the government’s vision to enhance the competitiveness of local defense companies in the global market. The move toward indigenous manufacturing is expected to lower production costs, shorten lead times, and boost innovation within the local defense industry. It also opens doors for greater collaboration between defense agencies and local manufacturers, ensuring that decoys and dispensers are tailored to the specific needs of the Australian military. This push for domestic production will contribute to the overall growth of the decoys and dispensers market in Australia.

Expansion of Defense Alliances in the Indo-Pacific Region

Australia’s strategic defense alliances in the Indo-Pacific region present significant opportunities for the decoys and dispenser’s market. As security concerns in the region grow, defense partnerships with neighboring countries and global powers are becoming increasingly important. These collaborations not only enhance Australia’s military readiness but also open opportunities for joint defense programs, including the procurement of advanced decoy systems. By aligning with countries like the United States, Japan, and India, Australia can leverage shared resources and technologies to improve defense capabilities. Additionally, the growing focus on joint military exercises, cooperative defense strategies, and arms sales further drives demand for high-performance decoys and dispensers. These regional alliances create a platform for innovation and cross-border defense collaborations, accelerating the adoption of cutting-edge defense technologies in Australia. As the country continues to strengthen its defense ties, the decoys and dispensers’ market is expected to benefit from these expanding international relationships.

Future Outlook

The Australia decoys and dispensers’ market is expected to see continued growth over the next five years, driven by technological advancements in electronic warfare and the increasing demand for countermeasure systems. Australia’s focus on defense modernization and expanding regional defense alliances will support market growth, while indigenous defense manufacturing will provide further opportunities for cost-effective solutions. The integration of next-generation decoys with evolving military platforms and defense strategies will shape the future of the market, ensuring the country’s defense readiness in the face of evolving security threats.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- BAE Systems

- Thales Group

- Leonardo

- L3 Technologies

- General Dynamics

- Saab Group

- Rafael Advanced Defense Systems

- MBDA

- Elbit Systems

- Kongsberg Gruppen

- Harris Corporation

- Kratos Defense & Security Solutions

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors and integrators

- Military procurement departments

- Aerospace and defense manufacturers

- Regional defense ministries

- International defense agencies

- Security research organizations

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying the key drivers, technologies, and market trends influencing the Australia decoys and dispensers’ market. This helps define the scope of the study and pinpoint the critical variables.

Step 2: Market Analysis and Construction

Market segmentation is conducted based on system type, platform type, and procurement channels. The analysis incorporates market data from primary and secondary sources to build a comprehensive market structure.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts and defense analysts are consulted to validate the market assumptions, ensuring the research reflects the most accurate and up-to-date information.

Step 4: Research Synthesis and Final Output

The final research output synthesizes all findings, presenting actionable insights for stakeholders. This includes an in-depth analysis of the market, growth drivers, challenges, and opportunities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Military Expenditure

Growing Demand for Electronic Warfare Systems

Technological Advancements in Countermeasure Systems

Heightened Security Concerns in the Pacific Region

Collaboration with Global Defense Suppliers - Market Challenges

High R&D and Production Costs

Geopolitical Instability in the Asia-Pacific Region

Complex Integration of New Decoy Systems

Dependency on Foreign Suppliers

Environmental and Regulatory Constraints - Market Opportunities

Expansion of Indigenous Defense Manufacturing

Increased Demand for Naval and Aerospace Decoy Systems

Technological Innovations in Stealth and Countermeasures - Trends

Adoption of AI in Electronic Warfare

Focus on Autonomous Decoy Systems

Increasing Use of Multi-Role Platforms

Development of Advanced Stealth Technologies

Growing Interest in Cyber-Resilient Defense Systems - Government Regulations & Defense Policy

Increased Investment in Domestic Defense R&D

Stricter Export Control on Defense Technologies

Strengthening of Defense Alliances with the US and Regional Partners - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Countermeasure Dispensers

Airborne Decoys

Surface-to-Air Decoys

Electronic Warfare Systems

Missile Defense Decoys - By Platform Type (In Value%)

Airborne Platforms

Land Platforms

Naval Platforms

Submarine Platforms

Space-based Platforms - By Fitment Type (In Value%)

OEM Systems

Retrofit Systems

Upgrades

Customization and Tailored Fitments

Modular Fitments - By EndUser Segment (In Value%)

Defense Contractors

Military Organizations

Government Defense Agencies

Commercial Aerospace

Research and Development Institutes - By Procurement Channel (In Value%)

Direct Purchases from Manufacturers

Government Contracts

Through Defense Agencies

Regional and International Alliances

Distributors and Resellers - By Material / Technology (in Value%)

Composite Materials

High-Temperature Alloys

Thermal Protection Materials

Radar-Absorbing Materials

Advanced Electronic Components

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Technology Focus, Market Reach, Key Products, Revenue, Innovation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Raytheon Technologies

Northrop Grumman

BAE Systems

Thales Group

Leonardo

L3 Technologies

General Dynamics

Saab Group

Rafael Advanced Defense Systems

MBDA

Elbit Systems

Kongsberg Gruppen

Honeywell International

Kratos Defense & Security Solutions

- Defense Ministries and Military Procurement Divisions

- Aerospace Manufacturers

- Defense and Security Contractors

- Military Alliances and Partnerships

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035