Market Overview

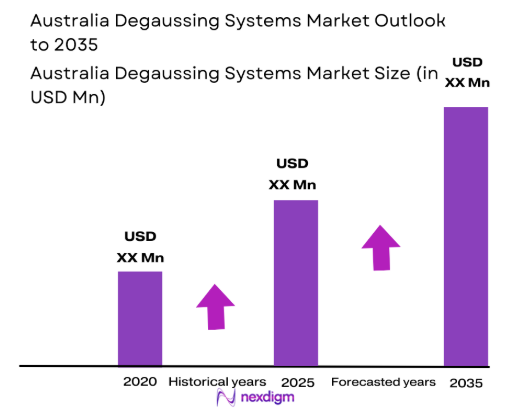

The Australia Degaussing Systems market is experiencing robust growth, with an estimated market size of USD ~ million. The demand for advanced degaussing technology is driven by increasing security concerns surrounding naval vessels, alongside technological advancements in naval defense systems. The growing importance of maritime security, especially in the Indo-Pacific region, has contributed to the expansion of the market. The market is further fueled by the Australian government’s investments in defense modernization and the rising need for advanced technologies to protect naval fleets.

Dominant players in this market are primarily located in key defense hubs such as Sydney and Melbourne, where the Australian Navy is headquartered. The region’s dominance in the sector is attributed to significant government spending on defense, extensive maritime trade routes, and strategic geopolitical positioning in the Asia-Pacific region. Additionally, government incentives for local defense manufacturers and collaborations with international defense contractors are boosting market growth.

Market Segmentation

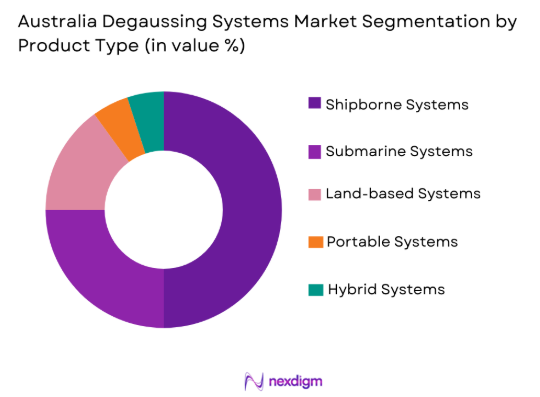

By Product Type

The Australia Degaussing Systems market is segmented by product type into shipborne systems, submarine systems, and land-based systems. Recently, shipborne systems have a dominant market share due to increasing demand from the Australian Navy, driven by rising maritime security threats. The Australian Navy has heavily invested in modernizing its fleet, requiring the integration of advanced degaussing systems on its ships to protect against mines and other underwater threats. This trend is fueled by a strategic emphasis on naval capabilities and defense modernization.

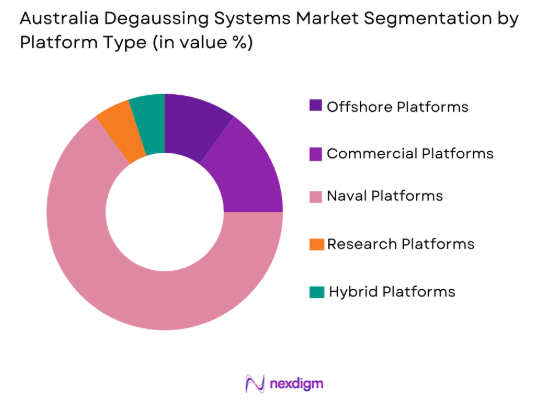

By Platform Type

The Australia Degaussing Systems market is segmented by platform type into naval platforms, commercial platforms, and offshore platforms. Naval platforms dominate the market due to the consistent demand for advanced degaussing systems on naval ships, submarines, and other military vessels. The Australian government has placed a high priority on naval defense, especially with the expansion of the Royal Australian Navy’s fleet and modern naval operations. This focus on strengthening maritime defense capabilities is a key factor driving the demand for degaussing systems on naval platforms.

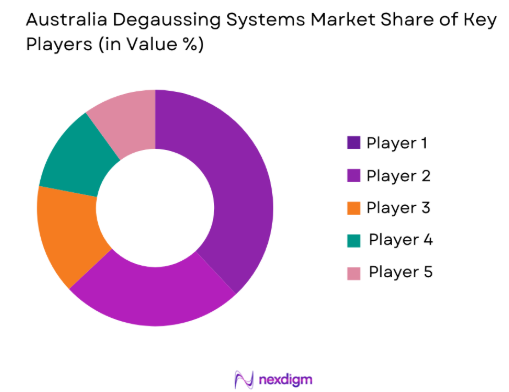

Competitive Landscape

The competitive landscape in the Australia Degaussing Systems market is characterized by consolidation, with key players such as Lockheed Martin, Thales Australia, and BAE Systems dominating the market. These major companies have established strong partnerships with the Australian government and defense forces, enabling them to secure large contracts for the supply of degaussing systems. The market is highly competitive, with companies constantly innovating and improving their technologies to meet the stringent requirements of naval defense.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Australia | 2000 | Sydney, Australia | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Saab | 1981 | Stockholm, Sweden | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

Australia Degaussing Systems Market Analysis

Growth Drivers

Rising Maritime Security Concerns

The growing emphasis on securing maritime borders has been a key growth driver for the Australia Degaussing Systems market. As global maritime security risks increase, nations are focusing on enhancing their naval fleets to address underwater threats, such as mines and submarines. In Australia, this is reflected in the Australian Government’s defense modernization efforts, which prioritize the strengthening of naval capabilities. With a strategic location in the Indo-Pacific region, Australia faces growing security challenges, including territorial disputes and international tensions. As a result, there is a strong demand for advanced degaussing systems, particularly in naval fleets. The Australian Navy has continued to upgrade its assets, integrating cutting-edge degaussing technologies to enhance the protection of its vessels. This ongoing demand is further supported by the Australian Government’s commitment to boosting defense spending, making the protection of naval fleets and maritime trade routes a priority.

Technological Advancements in Naval Defense Systems

Technological advancements in degaussing systems are one of the primary growth drivers in the Australia Degaussing Systems market. The rapid development of next-generation degaussing technologies, such as the integration of AI, machine learning, and automation, has greatly enhanced the effectiveness of these systems. These innovations provide more accurate detection and neutralization of underwater threats, which are crucial for modern naval operations. As defense strategies evolve, there is an increasing shift toward more advanced, reliable, and cost-effective solutions. In particular, autonomous and AI-powered degaussing systems offer enhanced capabilities, allowing for real-time analysis and adjustments during naval operations. The Australian Navy’s push toward modernization and its adoption of cutting-edge technology for naval defense systems has contributed to the strong demand for advanced degaussing solutions. This technological evolution not only strengthens the Australian fleet’s defenses but also aligns with global trends toward more automated and technologically driven military systems.

Market Challenges

High Initial Investment Costs

One of the primary challenges in the Australia Degaussing Systems market is the high initial cost of degaussing systems. These systems are complex and require significant capital for development, procurement, and integration with existing naval fleets. The advanced technology used in degaussing systems, including sensors, power sources, and control systems, adds to the overall cost. For smaller defense contractors or countries with limited defense budgets, this represents a considerable hurdle. Additionally, the customization required for specific naval platforms further drives up the cost, making it a significant barrier for organizations that are trying to modernize their fleets. Although the long-term benefits, such as increased fleet protection and operational efficiency, are clear, the upfront investment required for degaussing systems can deter potential buyers. This challenge is compounded by economic constraints and the increasing need to balance spending on multiple areas of defense.

Maintenance and Operational Costs

Maintenance and operational costs associated with degaussing systems present another challenge to market growth. Degaussing systems require continuous monitoring, calibration, and repairs to ensure optimal performance throughout their lifespan. The high level of expertise required for maintaining these systems also leads to increased operational costs, especially as the complexity of degaussing technologies increases. Skilled personnel are necessary for installation, maintenance, and troubleshooting, contributing to the overall cost of ownership. This is particularly difficult for defense organizations that face budget constraints and are looking to streamline their spending. The ongoing maintenance and the replacement of components also add a layer of financial burden. For example, as degaussing systems are integrated into naval vessels, they must be regularly updated to adapt to evolving underwater threats. These operational expenses can become a significant concern, particularly for smaller organizations or fleets operating under financial pressure.

Opportunities

Emerging Demand for Hybrid Systems

One of the emerging opportunities in the Australia Degaussing Systems market lies in the demand for hybrid degaussing systems. These systems combine both traditional and modern degaussing technologies, offering a flexible solution for a wide range of naval platforms. As the Australian Navy continues its fleet modernization efforts, hybrid systems present an attractive option that allows for a smoother integration of newer technologies into existing infrastructure. The ability to incorporate both legacy systems and the latest technological advancements allows for a cost-effective solution, particularly for older vessels that may not be compatible with fully modern systems. Additionally, hybrid systems are highly adaptable, providing protection across various maritime environments and platform types. This versatility makes hybrid systems particularly valuable for Australia, which needs to balance the modernization of its naval assets with the operational costs of upgrading older fleets. As a result, there is an increasing interest in hybrid systems across both defense and private maritime sectors.

Collaboration with Private Maritime Sector

Another significant opportunity lies in the potential for collaboration between defense contractors and the private maritime sector. The growing global demand for secure and efficient degaussing systems extends beyond military vessels, with increasing interest from offshore platforms, commercial shipping companies, and energy infrastructure. The private maritime sector, particularly in industries like oil and gas exploration, requires robust degaussing systems to protect against underwater threats such as mines and enemy submarines. By collaborating with commercial maritime companies, defense contractors can expand their reach and drive adoption of advanced degaussing systems beyond naval defense applications. In Australia, the growing importance of offshore infrastructure, such as oil rigs and cargo shipping routes, has created a market for degaussing systems that address these needs. Such collaborations can drive innovation and provide a strong revenue stream, while also ensuring greater protection for commercial and defense assets operating in sensitive maritime environments.

Future Outlook

Over the next five years, the Australia Degaussing Systems market is poised for continued growth, driven by ongoing advancements in technology and increasing security concerns. The Australian government’s focus on bolstering naval defense capabilities, especially in the Indo-Pacific region, is expected to provide steady demand for degaussing systems. The market will also benefit from the integration of artificial intelligence and automation in naval defense technologies. Furthermore, regulatory support for defense modernization initiatives and the growing emphasis on secure maritime borders are likely to drive adoption of advanced degaussing systems across various naval platforms.

Major Players

- Lockheed Martin

- Thales Australia

- BAE Systems

- Saab

- General Dynamics

- Northrop Grumman

- Leonardo

- Rolls-Royce

- Kongsberg Gruppen

- Harris Corporation

- L3 Technologies

- Raytheon Technologies

- Rheinmetall Defence

- Navantia

- Huntington Ingalls Industries

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Naval defense contractors

- Offshore defense companies

- Maritime security agencies

- Commercial shipping companies

- Energy and offshore oil platforms

- Naval fleet operators

Research Methodology

Step 1: Identification of Key Variables

We identify the critical factors driving the market, such as technological advancements, regulatory changes, and consumer demand, using primary and secondary data sources.

Step 2: Market Analysis and Construction

We analyze current market trends, historical data, and government reports to build an accurate model for the market size and future growth.

Step 3: Hypothesis Validation and Expert Consultation

We consult industry experts, including defense contractors and naval officials, to validate the initial hypotheses and ensure the reliability of our data.

Step 4: Research Synthesis and Final Output

Finally, we compile the findings into a comprehensive report that outlines market drivers, challenges, and opportunities, providing actionable insights for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Degaussing Systems

Rising Demand for Maritime Security

Government Investment in Naval Defense - Market Challenges

High Initial Investment Costs

Maintenance and Operational Costs

Regulatory Compliance and Certification - Market Opportunities

Development of Autonomous and AI-Powered Systems

Expansion in Offshore Defense and Research

Collaboration with Commercial Maritime Sector - Trends

Increasing Focus on Green and Energy-Efficient Systems

Integration of AI and Machine Learning for Degaussing

Rise in International Naval Partnerships - Government Regulations

Environmental Protection Regulations

Naval Defense and Security Standards

Maritime Technology Development Policies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Shipborne Degaussing Systems

Submarine Degaussing Systems

Land-Based Degaussing Systems

Portable Degaussing Systems

Hybrid Degaussing Systems - By Platform Type (In Value%)

Naval Platforms

Military Platforms

Commercial Platforms

Offshore Platforms

Research and Development Platforms - By Fitment Type (In Value%)

Onboard Fitment

Offboard Fitment

Hybrid Fitment

Modular Fitment

Integrated Fitment - By End User Segment (In Value%)

Naval Defense

Coastal Defense

Marine Research Institutes

Offshore Industry

Commercial Maritime - By Procurement Channel (In Value%)

Government Procurement

Private Sector Procurement

Direct Purchases

Third-Party Distributors

Online Bidding Platforms

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, End-user Segment, Procurement Channel, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

BAE Systems

Lockheed Martin

Thales Australia

Leonardo

Northrop Grumman

General Dynamics

Saab

Navantia

Harris Corporation

L3 Technologies

Kongsberg Gruppen

Huntington Ingalls Industries

Oceaneering International

Rolls-Royce

Rheinmetall Defence

- Increasing Demand from Naval Defense Forces

- Growing Focus on Offshore Defense Infrastructure

- Expansion of Commercial Maritime Sector

- Naval and Defense Industry Collaborations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035