Market Overview

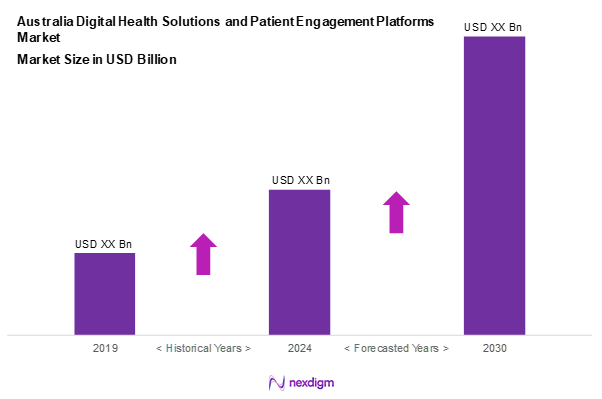

As of 2024, the Australia digital health solutions and patient engagement platforms market is valued at USD 5.7 billion, with a growing CAGR of 12.4% from 2024 to 2030, based on a comprehensive analysis of the industry dynamics and emerging trends. This growth is driven by rising healthcare expenditures, technological innovations, and an increasing preference for remote healthcare solutions. According to credible sources, the annual growth in healthcare spending has accelerated in recent years as governments and private sectors invest in digital transformation across the healthcare ecosystem.

Dominance in the market is exhibited by key cities such as New South Wales and Victoria, primarily due to their robust healthcare infrastructure and significant investments in health technology. These areas benefit from concentrated populations and high demands for healthcare services, leading to a strong adoption of digital health solutions. Furthermore, state-funded initiatives and partnerships with private technology firms bolster this dominance through enhanced patient engagement and improved healthcare delivery systems.

Market Segmentation

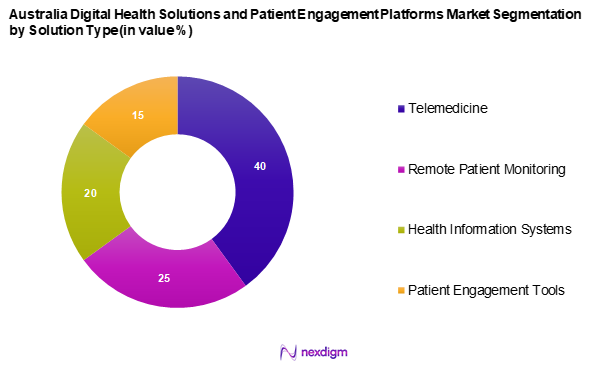

By Solution Type

The Australia digital health solutions and patient engagement platforms market is segmented into telemedicine, remote patient monitoring, health information systems, and patient engagement tools. Telemedicine has emerged as a dominant segment due to its crucial role in expanding access to healthcare services amidst a growing demand for remote consultations and convenience. The COVID-19 pandemic catalysed the rapid adoption of virtual health services as both patients and providers recognized the value of care that transcends geographic barriers. Telehealth platforms have fundamentally changed how care is delivered, allowing for improved patient outcomes and efficiency in service delivery.

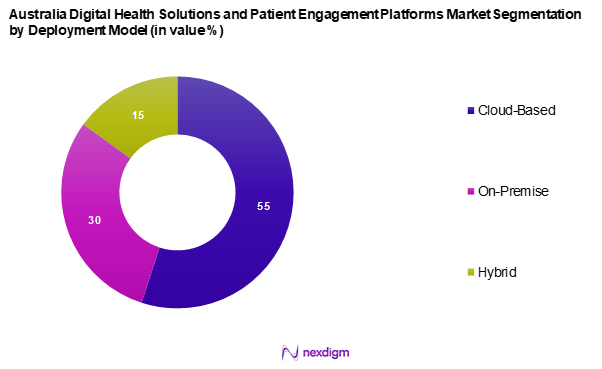

By Deployment Model

The Australia digital health solutions and patient engagement platforms market is segmented into cloud-based, on-premise, and hybrid solutions. The cloud-based deployment model holds the largest market share, primarily due to its flexibility, scalability, and cost-effectiveness. This delivery model allows healthcare providers to easily access patient data from various locations, significantly enhancing the ability to deliver timely care and improve patient engagement. Moreover, as cybersecurity measures continue to evolve, healthcare organizations exhibit an increasing trust in cloud systems to manage sensitive health information securely.

Competitive Landscape

The Australia digital health solutions and patient engagement platforms market is highly competitive, characterized by a mix of established players and innovative start-ups. The presence of major players such as Telstra Health, Epic Systems Corporation, and Vodafone Group signifies the consolidation and competitive dynamics within the industry. These companies leverage advanced technologies and extensive networks, enhancing their market positions and driving industry growth.

| Company | Establishment Year | Headquarters | Market Share (%) | Revenue (USD Mn) | Key Solutions | Customer Base |

| Telstra Health | 2013 | Victoria, Australia | – | – | – | – |

| Epic Systems Corporation | 1979 | Wisconsin, USA | – | – | – | – |

| Vodafone Group | 1984 | Newbury, UK | – | – | – | – |

| Qualcomm Technologies, Inc. | 1985 | California, USA | – | – | – | – |

| MCKESSON CORPORATION | 1833 | Texas, USA | – | – | – | – |

Australia Digital Health Solutions and Patient Engagement Platforms Market Analysis

Growth Drivers

Increasing Healthcare Expenditure

Healthcare expenditure in Australia is steadily increasing and reached AUD 147,679 million (USD 93,067.3 million) in the fourth quarter of 2024. Reflecting the government’s commitment to strengthening public health services. This trend aligns with a growing population, highlighting the rising demand for efficient healthcare solutions. As financial investments in healthcare expand, digital health platforms gain more traction, facilitating the adoption of remote monitoring, telehealth services, and electronic health records. These advancements contribute to improved patient outcomes while supporting innovation in healthcare technology.

Growing Demand for Remote Care Solutions

The demand for remote care solutions is on the rise, driven by an aging population and the necessity for continuous healthcare access. Older adults increasingly prefer managing their health from home rather than making frequent visits to healthcare facilities. This shift underscores the importance of telehealth and remote patient monitoring in managing chronic conditions efficiently. Digital health solutions not only enhance convenience but also ensure consistent monitoring and better quality of care.

Market Challenges

Regulatory Compliance Issues

Regulatory compliance poses a significant challenge for the digital health sector, particularly in the areas of data protection and patient privacy. Authorities continue to enforce stringent regulations that require organizations to invest heavily in compliance frameworks and security protocols. Navigating the complex legal landscape can be particularly challenging for new entrants, potentially limiting innovation and market growth.

Data Security Concerns

Data security remains a critical concern within the digital health landscape. Cyber incidents affecting sensitive health information have become more frequent, raising concerns about patient confidentiality and organizational reputation. The financial impact of data breaches can be substantial, discouraging healthcare providers from transitioning to digital platforms due to fears of security vulnerabilities.

Opportunities

Expansion of Digital Health Networks

The expansion of digital health networks presents significant growth opportunities. Many hospitals have integrated at least one form of digital health technology, signalling a shift toward healthcare digitalization. Government initiatives continue to support infrastructure projects aimed at enhancing telehealth services. This increasing accessibility fosters innovation, enabling new players to enter the market and address specific healthcare challenges while driving competition and service improvements.

Rising Consumer Adoption of Telehealth

The adoption of telehealth services has accelerated, particularly in response to healthcare emergencies. Consumers have grown accustomed to the convenience of remote consultations, leading to a sustained preference for digital healthcare solutions. This behavioural shift presents an opportunity for both established providers and new entrants to refine their offerings, catering to a population that increasingly embraces digital-first healthcare options.

Future Outlook

The Australia digital health solutions and patient engagement platforms market is poised for substantial growth in the coming years, driven by advancements in technology, increasing health awareness, and ongoing government support for digital healthcare initiatives. Factors such as the rise of artificial intelligence in healthcare solutions and the growing demand for personalized patient care are anticipated to further boost market expansion. As digital health continues to integrate into healthcare delivery, the focus will shift towards enhancing patient outcomes and reducing costs, ensuring a healthier population overall.

Major Players

- Stryker

- TruBridge

- Quantum-Si Incorporated

- Hims & Hers Health Inc.

- Telefonica SA

- AirStrip Technologies, Inc.

- AT&T

- Vodafone Group

- SoftServe Inc.

- Orange

- Epic Systems Corporation

- Cisco Systems Inc.

- Qualcomm Technologies, Inc.

- MCKESSON CORPORATION

- Samsung Electronics Co Ltd

- International Business Machines Corp

- HotDoc Online Pty Ltd

- Five Faces

- Fortunesoft

- Orion Health group of companies

- IQVIA Inc.

- WeGuide

- Global Health Limited

- Upvio

- Solutionreach, Inc.

- Opticomm Pty Ltd. (a Subsidiary of Uniti Group Pty Ltd.)

- Telstra Health UK

- Harris

- Pro Medicus, Ltd.

- Fujitsu

Key Target Audience

- Healthcare Providers

- Payers

- Patients

- Government Agencies (Department of Health, Australian Digital Health Agency)

- Technology Vendors

- Investors and Venture Capitalist Firms

- Pharmaceutical Companies

- Health Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Australia Digital health solutions and patient engagement platforms market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Australia digital health solutions and patient engagement platforms market. This includes assessing market penetration, the ratio of digital health services to traditional healthcare pathways, and resultant revenue generation. Furthermore, an evaluation of service quality metrics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple technology providers and healthcare organizations to acquire detailed insights into product segments, regulatory compliance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Australia digital health solutions and patient engagement platforms market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Healthcare Expenditure

Growing Demand for Remote Care Solutions - Market Challenges

Regulatory Compliance Issues

Data Security Concerns - Opportunities

Expansion of Digital Health Networks

Rising Consumer Adoption of Telehealth - Trends

Integration of AI and Machine Learning in Health Solutions

Increased Focus on Patient-Centric Health Systems - Government Regulation

Data Protection Laws

Telehealth Regulation Framework - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Number of Users, 2019-2024

- By Average Revenue per User (ARPU), 2019-2024

- By Solution Type (In Value %)

Telemedicine

– Video Consultations

– Virtual Follow-Ups

– e-Prescriptions

Remote Patient Monitoring

– Wearables & Smart Devices

– Chronic Disease Monitoring

– Real-Time Alert Systems

Health Information Systems

– Electronic Health Records (EHR)

– Hospital Information Systems (HIS)

– Laboratory Information Systems (LIS)

Patient Engagement Tools

– Appointment Scheduling Platforms

– Mobile Health Apps

– Medication Reminders

Other Emerging Solutions

– AI-Driven Diagnostics

– Digital Therapeutics

– Chatbot-Based Support - By End-User Segment (In Value %)

Provider

– Hospitals

– Clinics

– Diagnostic Centres

Payers

– Private Insurance Companies

– Public Health Insurance Systems

Patient

– Urban Tech-Savvy Consumers

– Elderly and Chronic Disease Patients

Others

– Government Agencies

– Health IT Companies - By Deployment Model (In Value %)

Cloud-Based

– Public Cloud

– Private Cloud

On-Premise

– Large Hospitals

– Integrated Health Networks

Hybrid

– Mixed-Environment Integrations

– Gradual Migration Models - By Region (In Value %)

New South Wales

Victoria

Queensland

Western Australia

South Australia

Tasmania

Northern Territory

Australian Capital Territory - By Application (In Value %)

Obesity

– Weight Management Programs

– Digital Diet Coaching

Diabetes

– Glucose Monitoring Integration

– Lifestyle Management Tools

Cardiovascular

– Blood Pressure Tracking

– Rehabilitation Monitoring

Respiratory Diseases

– COPD and Asthma Monitoring

– Breathing Pattern Analytics

Neurology

– Epilepsy Management Tools

– Cognitive Health Monitoring

Others

– Oncology

– Mental Health

– Women’s Health

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Solution Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Solution Type, Number of Customers, Average Revenue per User, Distribution Channels, User Retention Rate, Technology Stack Used, Integration with EHR/EMR Platforms, Data Security and Compliance, Platform Scalability, Customer Support Infrastructure, AI/ML Capabilities, Patient Engagement Features, Partnerships with Healthcare Providers, Mobile App Ratings, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Stryker

TruBridge

Quantum-Si Incorporated

Hims & Hers Health Inc.

Telefonica SA

AirStrip Technologies, Inc.

AT&T

Vodafone Group

SoftServe Inc.

Orange

Epic Systems Corporation

Cisco Systems Inc.

Qualcomm Technologies, Inc.

MCKESSON CORPORATION

Samsung Electronics Co Ltd

International Business Machines Corp

HotDoc Online Pty Ltd

Five Faces

Fortunesoft

Orion Health group of companies

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Number of Users, 2025-2030

- By Average Revenue per User (ARPU), 2025-2030