Market Overview

The Australia Digital Shipyard market is driven by the increasing adoption of digital technologies in shipbuilding. Based on a recent historical assessment, the market size in 2024 is expected to be valued at approximately USD ~ billion. Factors such as the growing demand for automation in shipyards, advanced robotics, digital twin technology, and increased government investments in naval defense capabilities contribute to market growth. These trends have stimulated the integration of digital solutions to improve shipbuilding efficiency, reduce operational costs, and optimize production timelines.

Australia continues to lead in the digital shipyard space, with major cities like Sydney, Brisbane, and Perth dominating the market. These regions are home to large shipyards, research hubs, and advanced maritime infrastructure, supported by government initiatives aimed at bolstering defense capabilities and maritime innovation. The development of advanced shipbuilding technologies in these cities has positioned Australia as a key player in the digital shipyard industry, especially given the growing focus on sustainable and efficient ship production methods, backed by strategic infrastructure investments.

Market Segmentation

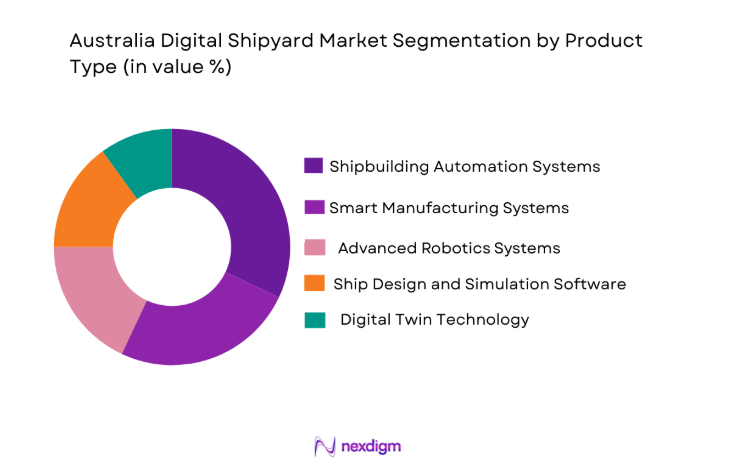

By Product Type

The Australia Digital Shipyard market is segmented by product type into shipbuilding automation systems, smart manufacturing systems, advanced robotics systems, ship design and simulation software, and digital twin technology. Recently, shipbuilding automation systems have dominated the market due to increasing demand for automation to enhance production efficiency, reduce human error, and lower operational costs. This sub-segment benefits from the growing need for faster and more efficient ship construction processes, especially in naval defense and large-scale commercial ship production.

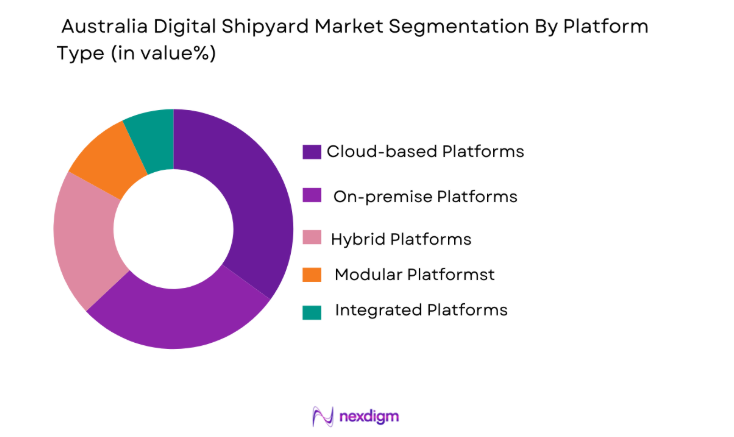

By Platform Type

The Australia Digital Shipyard market is segmented by platform type into on-premises platforms, cloud-based platforms, hybrid platforms, modular platforms, and integrated platforms. Recently, cloud-based platforms have dominated the market share due to their scalability, cost-effectiveness, and ability to enable remote access and collaboration across multiple locations. The growing shift towards cloud solutions is driven by the flexibility they offer in terms of data storage, software integration, and real-time communication, particularly for shipyards seeking to optimize their operational efficiency and reduce infrastructure costs.

Competitive Landscape

The competitive landscape of the Australia Digital Shipyard market is characterized by a blend of global and regional players, with increasing consolidation as companies seek to enhance their technological capabilities and expand market presence. Major players are adopting strategic partnerships and joint ventures to integrate cutting-edge technologies like AI, robotics, and IoT into their offerings. The presence of established players and innovation-driven startups ensures dynamic competition.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| CSIRO | 1926 | Canberra, Australia | ~ | ~ | ~ | ~ | ~ |

| Wärtsilä | 1834 | Helsinki, Finland | ~ | ~ | ~ | ~ | ~ |

| Kongsberg Gruppen | 1814 | Kongsberg, Norway | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | London, UK | ~ | ~ | ~ | ~ | ~ |

Australia Digital Shipyard Market Analysis

Growth Drivers

Government Investments in Naval Defense Capabilities

The Australian government’s increasing focus on strengthening naval defense capabilities has significantly contributed to the growth of the digital shipyard market. The expansion of naval fleets and the modernization of defense infrastructure are vital drivers of market demand. With rising geopolitical tensions and the strategic importance of maritime borders, defense spending has seen a steady increase. These investments include adopting cutting-edge digital technologies to improve operational efficiency and reduce maintenance costs in shipbuilding. Furthermore, such investments are helping build the necessary infrastructure to support digitalization in shipyards. The rise in global defense budgets and Australia’s commitment to enhancing its defense capabilities have made digital shipyard technologies essential in maintaining competitive and modern naval forces. Automation and robotics are increasingly being incorporated into Australian naval shipyards to automate time-consuming processes, while simulation software and digital twin technology ensure that shipyards meet the high standards of quality and precision required by defense contracts.

Technological Advancements in Shipbuilding

Continuous advancements in shipbuilding technologies, such as robotics, 3D printing, and automation systems, are significant drivers of the digital shipyard market. These innovations allow shipyards to increase production speed, improve accuracy, and reduce costs. Automation enables shipyards to operate 24/7 with minimal human intervention, driving higher productivity, and reducing operational delays. The introduction of digital twin technology allows shipbuilders to create virtual replicas of ships to simulate their performance and monitor systems in real time, optimizing the maintenance and construction process. Additionally, advanced manufacturing systems enable the use of smart materials and integrated technologies that enhance shipbuilding precision and sustainability. The automation of routine tasks, along with the growing need for eco-friendly shipbuilding processes, further accelerates market growth, positioning Australia as a leader in the shift towards digital shipyards.

Market Challenges

High Initial Investment in Digital Technologies

One of the major challenges in the Australian digital shipyard market is the high initial investment required for adopting advanced digital technologies. While the long-term benefits of automation, robotics, and digital twin technologies are evident in terms of increased efficiency and reduced operational costs, the upfront costs are significant. This includes the expenses associated with installing complex digital systems, upgrading existing shipyards, and training personnel to operate new technologies. Smaller shipyards may struggle to secure the necessary funding or may be reluctant to invest in such high-cost projects without a guaranteed return on investment. Despite the clear long-term advantages, the cost of transitioning to a digital shipyard is a major obstacle for some companies in the market, and without strong financial backing, many shipyards may find it challenging to modernize their operations. The capital-intensive nature of digital shipyard technologies could slow down adoption in the early phases, especially for companies in regions with less government support for modernization initiatives.

Cybersecurity Threats in Digital Shipyards

As the digital transformation in shipyards increases, so do concerns over cybersecurity risks. Shipyards are becoming more connected, with digital systems integrated into nearly every aspect of shipbuilding, from design and manufacturing to operational management. This increased connectivity introduces vulnerabilities that cybercriminals can exploit, leading to potential data breaches, production downtime, or sabotage of critical systems. In the digital shipyard market, the protection of sensitive naval and defense-related data is paramount, and any cyberattack can have disastrous consequences, particularly defense contracts. Despite efforts to enhance cybersecurity measures, the rapid pace of technological advancements outpaces the development of protective systems, leaving digital shipyards susceptible to increasingly sophisticated threats. The lack of standardized cybersecurity protocols in the maritime industry further complicates the situation, leaving shipyards exposed to potential vulnerabilities. As such, addressing cybersecurity concerns remains one of the major challenges in ensuring the safety and reliability of digital shipyard technologies.

Opportunities

Expansion of Smart Shipbuilding Systems

There is a significant opportunity for growth in the development and expansion of smart shipbuilding systems. The demand for smarter, more efficient ships has never been higher, driven by technological advancements in automation, AI, and digital simulation. This trend is evident in both the defense and commercial sectors, where shipyards are increasingly adopting advanced shipbuilding technologies that incorporate IoT, robotics, and digital twin systems to monitor, analyze, and optimize ship performance. As the need for faster, more efficient ship production grows, so does the demand for integrated smart systems that streamline operations, from design and manufacturing to maintenance and repairs. By implementing smart shipbuilding systems, shipyards can reduce operational costs, improve energy efficiency, and deliver higher-quality vessels with shorter turnaround times. For Australia, this presents an opportunity to establish itself as a leader in smart shipbuilding, leveraging its advanced infrastructure and strong government support for the defense sector.

Collaborations with Tech Startups for Innovation

Another exciting opportunity in the Australia Digital Shipyard market lies in collaborations with tech startups that specialize in emerging technologies like AI, machine learning, and 3D printing. These startups bring innovative solutions that can drive the next wave of efficiency and cost savings in shipbuilding. By partnering with startups, established shipyards can gain access to cutting-edge technologies that enhance their production capabilities and foster a culture of innovation. Additionally, these collaborations enable the rapid development and deployment of new systems that may otherwise take years to evolve within traditional shipbuilding practices. For Australia’s digital shipyard industry, this represents a chance to integrate the latest advancements into its operations, ensuring that it remains competitive in a rapidly evolving global market. Collaboration also helps foster a vibrant ecosystem of technology providers, further solidifying the country’s position as a leader in the digital transformation of shipbuilding.

Future Outlook

The future outlook for the Australia Digital Shipyard market over the next five years is optimistic, with continued growth expected in line with advancements in automation, robotics, and digital technologies. The demand for digital solutions will increase as shipyards look to enhance operational efficiency, reduce costs, and meet the requirements of modern naval defense programs. Technological innovations such as AI-powered automation, digital twins, and sustainable shipbuilding methods are anticipated to lead the way. Furthermore, government policies and strategic initiatives will likely provide additional regulatory support and funding for the adoption of digital technologies. With these factors in play, the digital shipyard market is poised for significant growth, making Australia a key player in the global shipbuilding industry.

Major Players

- CSIRO

- Wärtsilä

- Kongsberg Gruppen

- BAE Systems

- Rolls-Royce

- Saab Group

- Thales Group

- Navantia

- Lockheed Martin

- Huntington Ingalls Industries

- General Dynamics

- Northrop Grumman

- Harris Corporation

- Leidos

- L3 Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Shipbuilding companies

- Maritime operators

- Defense contractors

- Engineering firms

- Technology integrators

- Supply chain management firms

Research Methodology

Step 1: Identification of Key Variables

Identification of the key variables influencing the market, including economic factors, technological trends, and industry regulations.

Step 2: Market Analysis and Construction

In-depth market analysis using both primary and secondary research sources to assess current trends, technologies, and key market players.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with industry experts and stakeholders to validate market hypotheses and ensure accuracy.

Step 4: Research Synthesis and Final Output

Synthesizing the collected data into comprehensive market insights, preparing the final output for reporting.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government Investments in Naval Defense Capabilities

Technological Advancements in Automation and Robotics

Increased Demand for Efficient Shipbuilding Processes

Growing Need for Sustainable and Green Shipbuilding Technologies

Rising Adoption of Digital Twin and Simulation Technologies - Market Challenges

High Initial Investment in Digital Technologies

Integration of New Technologies with Legacy Systems

Cybersecurity Risks in Digital Shipyards

Skills Shortage and Training in Advanced Technologies

Regulatory Hurdles in Maritime Industry Innovation - Market Opportunities

Expansion of Smart Shipbuilding Systems

Collaborations with Tech Startups for Innovation

Adoption of IoT for Real-time Ship Monitoring - Trends

Increase in Use of Digital Twin Technology

Growth of Artificial Intelligence and Machine Learning in Shipbuilding

Integration of Automation and Robotics in Shipbuilding

Surge in Interest for Sustainable Shipbuilding Solutions

Digitization of Maintenance and Repair Operations - Government Regulations & Defense Policy

Strict Environmental Regulations for Shipbuilding

Government Funding for Naval Defense Modernization

Defense Technology Export Controls - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Shipbuilding Automation Systems

Smart Manufacturing Systems

Advanced Robotics Systems

Ship Design and Simulation Software

Digital Twin Technology - By Platform Type (In Value%)

On-premise Platforms

Cloud-based Platforms

Hybrid Platforms

Modular Platforms

Integrated Platform - By Fitment Type (In Value%)

Standalone Solutions

Integrated Solutions

Cloud-based Fitments

On-premises Fitments

Hybrid Fitments - By End User Segment (In Value%)

Shipbuilding Companies

Maritime Operators

Government Agencies

Engineering Firms

Defense Contractors - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Automation Technology

AI and Machine Learning Systems

Advanced Robotics Materials

3D Printing Technology

Cybersecurity Technology

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

CSIRO

Kongsberg Gruppen

Wärtsilä

Navantia

Lockheed Martin

BAE Systems

Lloyd’s Register

Rolls-Royce

Saab Group

Thales Group

Huntington Ingalls Industries

General Dynamics

Northrop Grumman

Harris Corporation

Leidos

- Shipbuilding Companies’ Shift Towards Automation

- Government Agencies’ Push for Digital Transformation in Defense

- Maritime Operators Seeking Cost-Effective Ship Maintenance Solutions

- Engineering Firms’ Growing Role in Digital Design and Simulation

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035