Market Overview

The Australia Electric Wiring Interconnection Systems market is valued at approximately USD ~ billion based on a recent historical assessment. This growth is driven by the rising demand for efficient and reliable wiring solutions across sectors such as automotive, aerospace, and industrial equipment. Technological advancements and a focus on safety standards are further contributing to market expansion. Increasing urbanization, infrastructural development, and government initiatives to modernize electrical grids also drive demand, promoting growth in this space.

The market’s dominance is largely observed in cities such as Sydney and Melbourne, where industrial activity is significant and infrastructure projects are ongoing. These regions are at the forefront due to their technological advancements, presence of manufacturing facilities, and accessibility to key raw materials. The increasing adoption of electric vehicles and smart technologies in these urban centers further solidifies their leading position in the market.

Market Segmentation

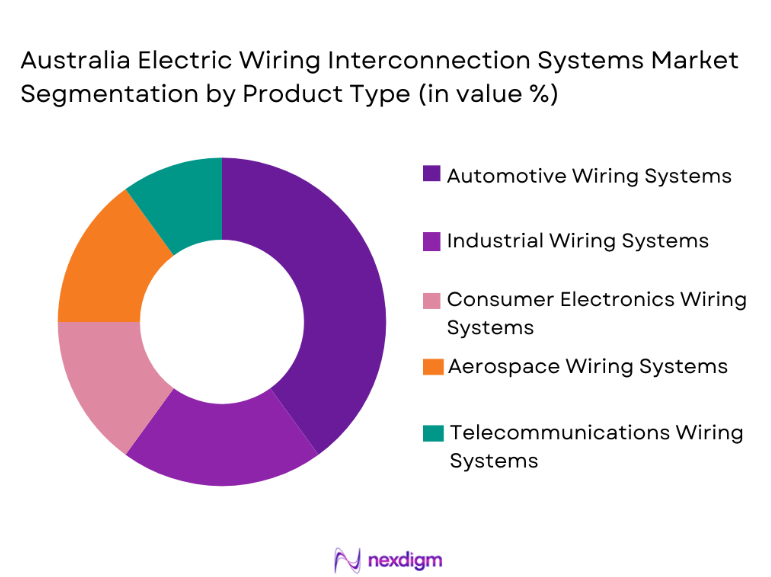

By Product Type

The Australia Electric Wiring Interconnection Systems market is segmented by product type into automotive wiring systems, industrial wiring systems, consumer electronics wiring systems, aerospace wiring systems, and telecommunications wiring systems. Recently, automotive wiring systems have a dominant market share due to the growing adoption of electric vehicles and the push towards vehicle electrification. This is fueled by government incentives and the increasing demand for high-performance and energy-efficient vehicles, alongside technological innovations in wiring materials and designs, which have increased their reliability and efficiency in modern automotive applications.

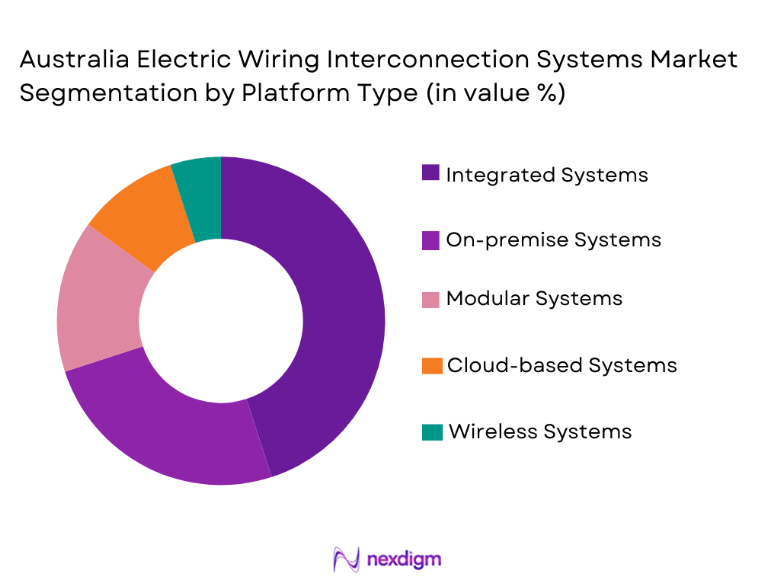

By Platform Type

The market is segmented by platform type into on-premise systems, integrated systems, modular systems, cloud-based systems, and wireless systems. Recently, integrated systems have gained dominance in the market as they combine functionality, flexibility, and scalability. The growth of automation, coupled with the need for seamless integration of electrical systems across various industries, has made integrated systems a preferred choice. Their ability to optimize performance and reduce operational costs has positioned them at the forefront of this segment, appealing to industries ranging from automotive to telecommunications.

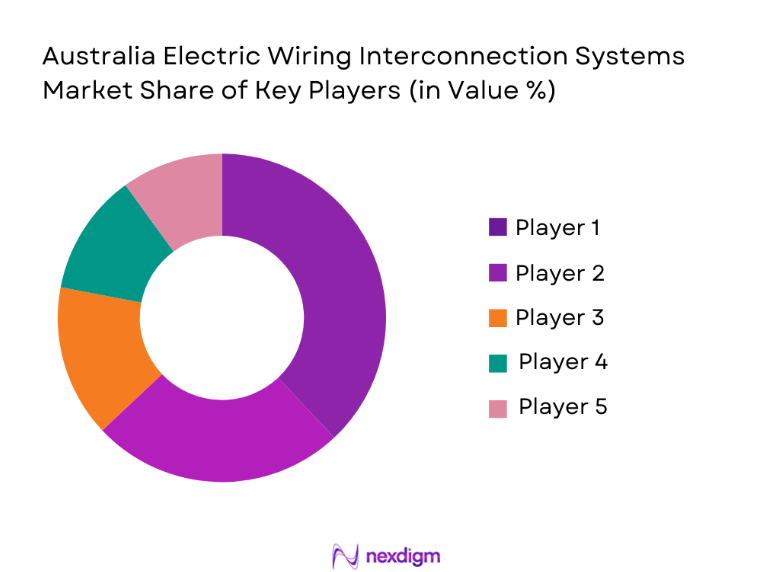

Competitive Landscape

The competitive landscape of the Australia Electric Wiring Interconnection Systems market is marked by a strong presence of global players, consolidating their position through acquisitions and partnerships. Major players dominate the market by investing in advanced technologies such as AI-powered wiring solutions and smart electrical systems, which are increasingly adopted in automotive, industrial, and consumer electronics sectors. Strategic collaborations and technology advancements have further intensified the competitive environment, with companies aiming to improve product quality, reduce operational costs, and expand their customer base.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market-Specific Parameter |

| Prysmian Group | 1975 | Milan, Italy | ~

|

~

|

~

|

~

|

~

|

| Leoni | 1917 | Nuremberg, Germany | ~ | ~

|

~

|

~

|

~

|

| Amphenol | 1932 | Wallingford, USA | ~ | ~

|

~

|

~

|

~

|

| Yazaki | 1941 | Tokyo, Japan | ~ | ~

|

~

|

~

|

~

|

| TE Connectivity | 2007 | Schaffhausen, Switzerland | ~ | ~

|

~

|

~

|

~

|

Australia Electric Wiring Interconnection Systems Market Analysis

Growth Drivers

Government Investments in Infrastructure

One of the key drivers of growth in the Australia Electric Wiring Interconnection Systems market is the government’s substantial investments in infrastructure development. The Australian government has been focusing on modernizing its electrical grid systems and enhancing urban infrastructure. As the country continues to develop smart cities and increase energy efficiency, the demand for reliable and high-performance wiring systems has surged. These government initiatives are not limited to power distribution but extend to public transportation systems, including electric vehicles (EVs), where specialized wiring systems are essential. Additionally, government incentives to promote clean energy, such as solar power, have further augmented the need for more efficient electrical systems. These efforts to establish a robust and sustainable infrastructure are expected to drive long-term market growth, creating significant opportunities for electric wiring systems manufacturers. The rise of smart grids and IoT-connected devices will also play a pivotal role in expanding the market.

Technological Advancements in Wiring Solutions

Technological advancements have been instrumental in the rapid development of electric wiring interconnection systems. Innovations such as AI-powered components, lightweight materials, and multi-functional wiring have elevated the performance and reliability of electrical systems across various industries. In particular, the automotive sector, driven by the growing popularity of electric vehicles, has significantly influenced the demand for sophisticated wiring solutions. Wiring systems are required to support the high electrical demands of EVs, which include large battery packs, high voltage systems, and advanced electronics. The integration of smart technologies, such as sensors and IoT connectivity, has also spurred demand for advanced wiring systems, especially in industries like aerospace and telecommunications. As these industries adopt more complex systems, the need for efficient and durable wiring solutions will continue to grow. Technological innovations will drive the market by offering increased system efficiency and lower energy consumption, aligning with the global shift towards sustainability.

Market Challenges

High Costs of Raw Materials

One of the significant challenges facing the Australia Electric Wiring Interconnection Systems market is the high cost of raw materials, such as copper, aluminum, and other conductive materials, which are essential for producing wiring systems. Fluctuating prices of these raw materials, influenced by global supply chain disruptions, geopolitical tensions, and rising demand from multiple industries, are putting pressure on manufacturers. As raw material costs increase, manufacturers must adjust their pricing strategies or absorb the increased costs, which can reduce their profit margins. This situation can be especially challenging for smaller companies that lack the financial flexibility to cope with such fluctuations. Furthermore, rising raw material costs could also hinder innovation and product development, as companies may focus more on cost-cutting rather than investing in new technologies or more sustainable practices. The instability in raw material pricing poses a risk to the growth and sustainability of the electric wiring systems market.

Supply Chain Disruptions

Supply chain disruptions have become a significant challenge for industries worldwide, and the electric wiring interconnection systems market in Australia is no exception. Geopolitical tensions, natural disasters, and the lingering effects of the COVID-19 pandemic have created delays in the manufacturing and delivery of key components for wiring systems. These disruptions affect both the availability of raw materials and the timely distribution of finished products, causing delays in production schedules and increasing lead times for customers. As the demand for electrical systems grows, particularly in the automotive and energy sectors, the pressure on supply chains intensifies. Manufacturers are struggling to meet the growing needs of their customers, which can lead to missed opportunities and reduced competitiveness. Additionally, disruptions in logistics can result in higher transportation costs, further adding to the financial strain on companies. Addressing these supply chain challenges will require greater collaboration among industry players, alternative sourcing strategies, and more resilient operational models.

Opportunities

Expanding Electric Vehicle Market

The growing adoption of electric vehicles (EVs) presents a significant opportunity for the Australia Electric Wiring Interconnection Systems market. With the Australian government offering various incentives for EV adoption and the global push for cleaner transportation solutions, the demand for advanced wiring systems is expected to surge. EVs require high-performance wiring solutions to support large battery packs, powertrain systems, and advanced electronic components. This opens up opportunities for manufacturers to develop specialized wiring systems that cater to the unique needs of EVs. Moreover, as automotive manufacturers focus on reducing weight and improving energy efficiency, lightweight and flexible wiring systems are becoming more essential. Additionally, the rapid expansion of charging infrastructure for EVs across Australia further drives the need for high-quality wiring solutions. The electric vehicle market’s growth will continue to fuel innovation in wiring technologies, making it one of the key opportunities for industry players to capitalize on.

Emerging Demand for Smart Infrastructure

Another key opportunity for the Australia Electric Wiring Interconnection Systems market lies in the increasing demand for smart infrastructure. As Australian cities move towards becoming smart cities, the need for advanced electrical systems that can support IoT devices, smart grids, and energy-efficient systems has intensified. These technologies require reliable and high-performance wiring systems to ensure seamless integration across various sectors, including transportation, energy management, and public services. Smart grids, which enable more efficient energy distribution, and the integration of renewable energy sources, such as solar and wind, will further increase the demand for specialized wiring solutions. Additionally, the rise of automation in industries like manufacturing and logistics will require advanced wiring systems to handle complex operations. The push for energy efficiency, sustainability, and connectivity is transforming infrastructure, creating vast opportunities for companies that provide wiring interconnection systems capable of supporting these new technologies. As these trends grow, manufacturers will be well-positioned to offer solutions that cater to the evolving needs of smart cities and connected systems.

Future Outlook

The Australia Electric Wiring Interconnection Systems market is expected to experience substantial growth over the next five years, driven by technological innovations, increasing infrastructure investments, and the rising adoption of electric vehicles. As Australia continues to modernize its electrical infrastructure and urban development initiatives, the demand for more efficient and reliable wiring systems will grow. The next phase of market growth will be characterized by the widespread use of smart technologies, improved sustainability practices, and stronger government support for clean energy, offering new opportunities for market participants.

Major Players

- Prysmian Group

- Leoni

- Amphenol

- Yazaki

- TE Connectivity

- Sumitomo Electric

- Molex

- Lapp Group

- Southwire

- Hubbell Incorporated

- Belden Inc.

- General Cable

- Kongsberg Gruppen

- Huber+Suhner

- Nexans

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Automotive manufacturers

- Consumer electronics companies

- Aerospace & defense contractors

- Industrial equipment manufacturers

- Telecom service providers

- Energy sector organizations

Research Methodology

Step 1: Identification of Key Variables

In this step, the primary factors influencing market trends are identified through a review of industry reports, interviews with experts, and analysis of regulatory frameworks. Key variables such as market drivers, consumer preferences, and technological advancements are outlined.

Step 2: Market Analysis and Construction

Data from primary and secondary sources are collected, structured, and analyzed to create a comprehensive market framework. This includes an examination of the competitive landscape, market sizing, and growth projections based on current trends and historical performance.

Step 3: Hypothesis Validation and Expert Consultation

Insights gained from the previous steps are validated through consultations with industry experts and stakeholders. This helps refine market assumptions, ensuring that conclusions are based on reliable, expert-driven insights.

Step 4: Research Synthesis and Final Output

The final report synthesizes all research findings, offering actionable insights, conclusions, and recommendations for market participants. The report is tailored to meet the needs of industry stakeholders, investors, and decision-makers.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growth in automotive industry demands

Rising demand for smart consumer electronics

Expansion of the aerospace & defense sector - Market Challenges

High cost of raw materials

Complexity in system integration

Supply chain disruptions - Market Opportunities

Technological advancements in materials

Government investment in infrastructure

Growing focus on electric vehicles - Trends

Increasing shift towards automation and IoT

Rising demand for lightweight and high-efficiency wiring

Advancement in green and sustainable technologies - Government Regulations

Compliance with safety and environmental standards

Regulations on raw material sourcing

Standards for wireless communication systems

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Automotive Wiring Systems

Industrial Wiring Systems

Consumer Electronics Wiring Systems

Aerospace Wiring Systems

Telecommunications Wiring Systems - By Platform Type (In Value%)

On-premise Systems

Integrated Systems

Modular Systems

Cloud-based Systems

Wireless Systems - By Fitment Type (In Value%)

Original Equipment Manufacturer (OEM)

Aftermarket

Hybrid Fitment

Integrated Solutions

Upgraded Systems - By EndUser Segment (In Value%)

Automotive Manufacturers

Consumer Electronics Producers

Aerospace & Defense

Industrial Equipment Manufacturers

Telecom Service Providers - By Procurement Channel (In Value%)

Direct Procurement

Distributors and Resellers

Online Platforms

OEM Partnerships

Retail Chains

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, End-user Segment, Procurement Channel, Material/Technology, Price Sensitivity, Technological Innovation, Sustainability Initiatives, Customer Service, Brand Reputation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Prysmian Group

Leoni

Sumitomo Electric

Molex

Amphenol

Yazaki

TE Connectivity

ABB

Furukawa Electric

Kongsberg Gruppen

Hitachi Metals

SAB Bröckskes

Würth Elektronik

Lapp Group

Southwire

- Automotive manufacturers investing in advanced wiring

- Electronics sector’s demand for reliable connectivity

- Aerospace manufacturers adopting lightweight solutions

- Telecom companies focusing on upgraded wiring systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035