Market Overview

The Australia eVTOL (electric Vertical Take-Off and Landing) aircraft market is valued at USD ~ billion in 2024. The market is driven primarily by the increasing demand for urban air mobility (UAM) and intercity air transport. Technological advancements in battery electric propulsion, regulatory frameworks facilitating the certification of eVTOLs, and government investments in air infrastructure are key factors contributing to this growth. Additionally, advancements in autonomous systems and an overall push for sustainable transportation further enhance the sector’s prospects. The eVTOL market is poised for significant growth in the upcoming years as demand for efficient and eco-friendly air transport solutions accelerates.

Dominant cities and countries driving the eVTOL market are primarily concentrated in Australia’s major metropolitan areas, such as Sydney, Melbourne, and Brisbane. These cities are witnessing strong demand for air taxis and short-range flights due to their growing populations and traffic congestion. Australia is well-positioned as a leader in advanced air mobility within the Asia-Pacific region due to government-backed initiatives, favorable regulatory frameworks, and a proactive approach to infrastructure development. Cities such as Brisbane, with its infrastructure investments for the 2032 Olympics, and Sydney, known for its robust air transport network, lead the way.

Market Segmentation

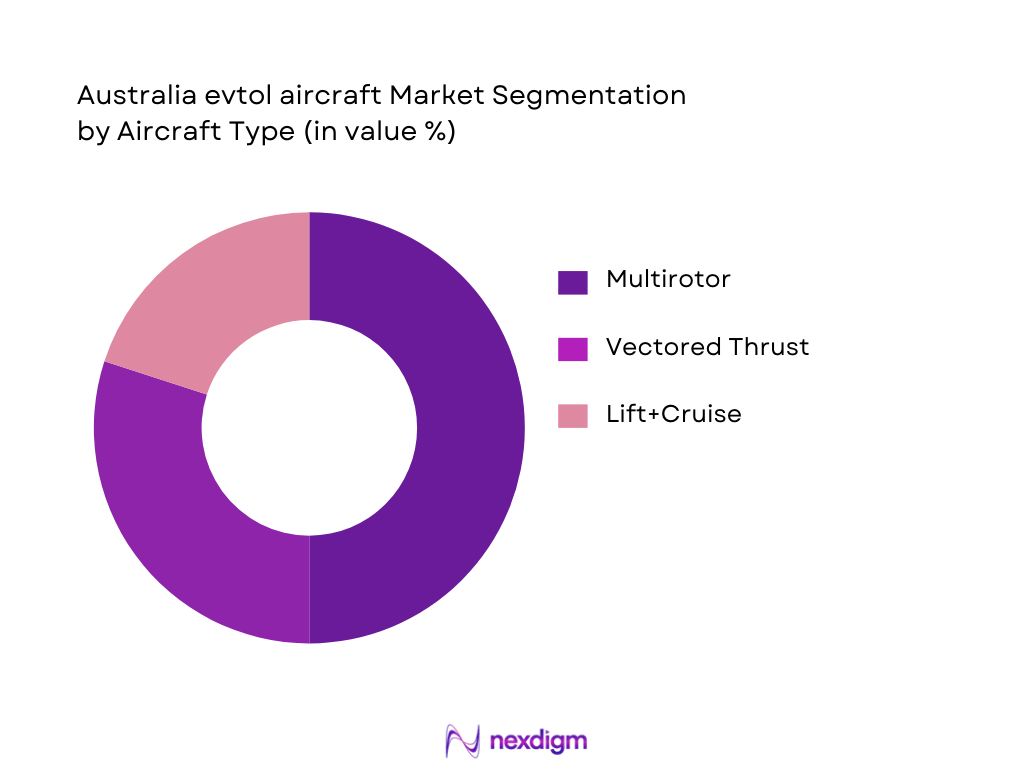

By Aircraft Type

The Australia eVTOL market is segmented by aircraft type into multirotor, vectored thrust, and lift+cruise configurations. Among these, multirotor eVTOLs dominate the market in terms of fleet adoption. This dominance is due to their advanced flight control systems, simple design, and high safety standards, which make them ideal for urban air mobility applications. Their ability to take off and land vertically allows them to navigate urban landscapes with limited infrastructure, making them perfect for short-haul commuter flights and last-mile delivery. The growing interest in air taxis within cities like Sydney and Melbourne further bolsters the demand for multirotor designs.

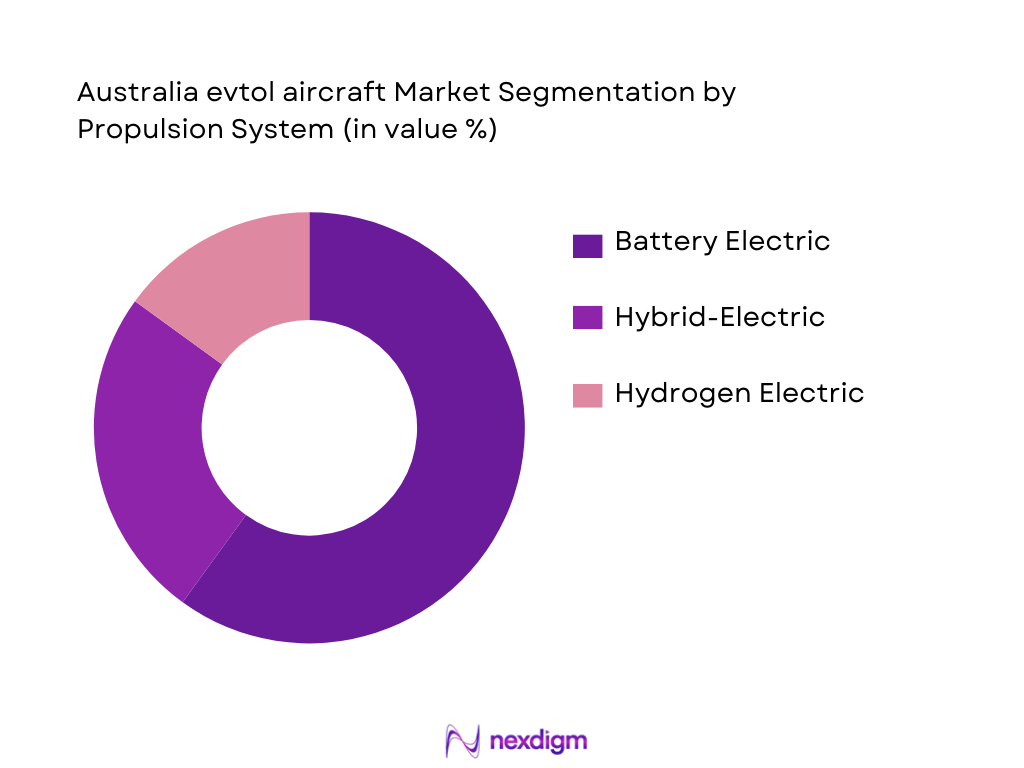

By Propulsion System

In the propulsion system segment, battery electric eVTOLs take the lead in the Australian market. This is largely due to the growing demand for sustainable transportation solutions, which align with Australia’s renewable energy goals. Battery-electric systems offer the advantage of zero emissions, making them an ideal choice for urban air mobility. The Australian government’s commitment to reducing its carbon footprint and enhancing the sustainability of its transportation sector makes the battery electric propulsion system the dominant choice. Additionally, technological advancements in battery life and energy efficiency have driven adoption in air taxi services, especially in cities like Sydney and Melbourne.

Competitive Landscape

The Australia eVTOL market is dominated by several key players in the aerospace and aviation industries, along with emerging local manufacturers. Major global companies like Joby Aviation, Wisk Aero, and Lilium GmbH have established a strong presence in Australia, while Australian startups like AMSL Aero (Vertiia) and SkyDrive are carving out a niche. These players are focused on meeting the demand for urban air mobility solutions through innovations in aircraft design, propulsion technology, and autonomous systems. Additionally, partnerships with government bodies and infrastructure developers are instrumental in driving market expansion.

| Company | Establishment Year | Headquarters | Aircraft Type | Propulsion System | Mode of Operation | Region |

| Joby Aviation | 2009 | USA | ~ | ~ | ~ | ~ |

| Wisk Aero | 2019 | USA | ~ | ~ | ~ | ~ |

| Lilium GmbH | 2015 | Germany | ~ | ~ | ~ | ~ |

| AMSL Aero (Vertiia) | 2018 | Australia | ~ | ~ | ~ | ~ |

| SkyDrive | 2018 | Japan | ~ | ~ | ~ | ~ |

Australia Evtol Aircraft Market Analysis

Growth Drivers

Urban Traffic Congestion and Need for UAM

Increasing urbanization in Australian cities like Sydney and Melbourne has led to severe traffic congestion, driving the demand for Urban Air Mobility (UAM) solutions like eVTOLs. These aircraft offer a faster, more efficient mode of transport, bypassing road traffic and reducing commute times. With more people living in metropolitan areas, the need for alternative transportation solutions such as eVTOLs will continue to grow, helping to ease the pressure on traditional transport networks.

Energy Cost Efficiency and Decarbonization Imperatives

Australia’s commitment to reducing carbon emissions is promoting the use of electric propulsion systems. eVTOLs, powered by battery-electric technology, align with decarbonization goals by offering cleaner, cost-effective transportation options for urban areas, particularly as energy costs continue to rise globally. As more industries seek to reduce their environmental impact, the demand for sustainable air mobility solutions like eVTOLs is expected to increase, helping Australia meet its renewable energy and emission reduction targets.

Challenges

Regulatory Complexity (Type Certification, Airspace Integration)

EVTOLs face significant regulatory hurdles, including obtaining type certification from authorities like CASA. The integration of these aircraft into existing airspace systems requires extensive coordination between regulators, infrastructure developers, and operators to ensure safety and efficiency. Given the newness of eVTOL technology, regulators are cautious about implementing airspace integration and certification protocols, which could delay widespread adoption and limit market growth in the short term.

Battery Energy Density & Lifecycle Limitations

The current limitations in battery energy density restrict the range and payload of eVTOLs, which is crucial for commercial viability. With battery performance still evolving, eVTOLs may face challenges in meeting operational requirements for longer flights and heavier payloads. Additionally, the lifespan and degradation of batteries over time can impact operational costs and the long-term sustainability of eVTOL fleets. Manufacturers need to address these challenges to ensure the economic and environmental benefits of eVTOLs are fully realized.

Opportunities

Autonomous Evtol Services

The development of autonomous eVTOL technology presents a major opportunity to reduce operating costs, as pilot fees would be eliminated. Autonomous systems can increase fleet availability and create scalable on-demand air mobility solutions, enhancing urban transport systems and reducing human error in operations. As autonomous flight technology matures, it will become more attractive for eVTOL operators looking to streamline operations, reduce human intervention, and improve safety.

Olympic and Mega-Event Readiness

Major events, such as the Brisbane 2032 Olympics, provide a unique opportunity to showcase eVTOL technology in action. The large-scale transportation needs associated with these events will likely push the development of the necessary infrastructure, such as vertiports and air traffic management systems, accelerating market adoption and investment. As Australia prepares for the influx of visitors and the need for efficient mobility solutions during these events, eVTOLs will play a significant role in providing sustainable and high-capacity transportation services.

Future Outlook

Over the next five years, the Australian eVTOL market is expected to experience significant growth driven by continued advancements in battery technology, regulatory support, and increased demand for urban air mobility solutions. Government initiatives aimed at enhancing transportation infrastructure, coupled with private sector investments in fleet development, will be key to market expansion. As autonomous systems mature and regulatory hurdles are cleared, the market will see increased fleet deployment in cities like Sydney and Melbourne. Additionally, growing awareness of sustainable transportation options will further accelerate the adoption of eVTOLs across Australia.

Major Players

- Joby Aviation

- Wisk Aero

- Lilium GmbH

- AMSL Aero (Vertiia)

- SkyDrive

- Vertical Aerospace

- Overair

- Eve Air Mobility

- Hyundai Supernal

- Toyota AAT

- Beta Technologies

- Aurora Flight Sciences

- Jaunt Air Mobility

- Volocopter

- Urban Aeronautics

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., CASA, Australian Department of Infrastructure, Transport, Regional Development, and Communications)

- eVTOL OEMs

- Air Mobility Service Providers

- Infrastructure Developers and Vertiport Operators

- Energy and Battery Manufacturers

- Urban Transport Planners and Policy Makers

- Airport Operators and Aviation Stakeholders

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying and defining the key variables that influence the eVTOL market in Australia. This process includes comprehensive desk research and interviews with aviation experts, regulatory bodies, and industry stakeholders. The goal is to understand the driving forces behind the market, including technological advancements, infrastructure readiness, and consumer demand.

Step 2: Market Analysis and Construction

In this phase, historical and current market data is analyzed, including market penetration rates, revenue generation, and service offerings. Key performance indicators (KPIs) are reviewed to gauge the market’s trajectory and provide actionable insights on fleet development, operational capacity, and customer adoption.

Step 3: Hypothesis Validation and Expert Consultation

To validate hypotheses derived from the initial market analysis, in-depth expert consultations will be conducted with professionals from key sectors such as aircraft manufacturing, airspace management, and urban transport. These insights will help refine assumptions and improve the accuracy of market projections.

Step 4: Research Synthesis and Final Output

In the final stage, the research findings are synthesized, ensuring that all segments—aircraft type, propulsion system, region, and application—are appropriately analyzed. Feedback from industry experts and stakeholders will be integrated into the final report to enhance the quality and reliability of the market forecast.

- Executive Summary

- Research Methodology (Market Definitions and Scope, Industry Assumptions and AAM Definitions, Abbreviations and Standards (CAASA, ICAO, UAM/AAM acronyms), Data Sources: Primary (Regulators, OEMs, Operators) and Secondary (Industry, Aviation Bodies), Market Sizing Methodology (Value and Unit Projections), Forecast Confidence & Bias Mitigation, Limitations and Future Research Enhancements)

- Definition and Scope of eVTOL (Passenger, Cargo & Specialized Variants)

- Market Genesis and Evolution in Australia

- Advanced Air Mobility Ecosystem (Urban Air Mobility, Regional Connectivity)

- Market Value Chain and Supply Chain Architecture

- Infrastructure Enablers

- Regulatory Framework and Certification Landscape

- Public Acceptance and Safety Perception Dynamics

- Growth Drivers

Urban Traffic Congestion and Need for UAM (Metropolitan Demand)

Energy Cost Efficiency and Decarbonization Imperatives

Battery & Propulsion Technology Improvements

Public & Private Infrastructure Investments - Challenges

Regulatory Complexity (Type Certification, Airspace Integration)

Battery Energy Density & Lifecycle Limitations

Operational Reliability & Safety Certification Bottlenecks - Opportunities

Autonomous eVTOL Services

Olympic and Mega‑Event Readiness (Brisbane 2032)

Regional and Remote Healthcare Connectivity

Defense and Critical Logistics Use Cases - Market Trends

Vertiport Network Expansion

UAM Route Economics and Ticketing Platforms

Battery Swapping and Hydrogen Fuel Innovation - Government Policies and Incentives

- SWOT Analysis

- Porter’s Five Forces (OEMs, Suppliers, Operators, Regulators, Substitutes)

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Aircraft Type (In Value %)

Multirotor

Vectored

Lift+Cruise

Hybrid - By Propulsion System (In Value %)

Battery

Hybrid-Electric

Hydrogen - By Mode of Operation (In Value %)

Piloted

Autonomous - By Range Band (In Value %)

Urban

Regional

Long-Range - By End-Use Application (In Value %)

Air Taxi

Last Mile

Air Ambulance

Cargo - By Service Model (In Value %)

On-Demand

Scheduled

- Market Share by Value and Units (Leading OEMs & Operators)

- Cross‑Comparison Parameters (Company Overview (Global & Local), Business Strategy and Market Entry Models, Certification Status and Regulatory Approvals (CASA / FAA / EASA Recognition), Recent Developments (Orders, Partnerships, Pilots), Strengths (Tech, IP, Network), Weaknesses (Production, Certification Delays), Product Differentiators (Range, Payload, Noise Footprint), Manufacturing Footprint and Assembly Capacity, Distribution &, After‑Sales Support, Pricing and Revenue Models, Battery & Propulsion Tech Partnerships, Ground Infrastructure Partnerships, Service Contracts & MoUs)

- Detailed Profiles of Key Competitors

Joby Aviation

Wisk Aero

Lilium GmbH

Archer Aviation

Vertical Aerospace

Overair

Eve Air Mobility (Embraer)

Hyundai UAM / Supernal

Toyota AAT / eVTOL Ventures

Beta Technologies

AMSL Aero (Vertiia)

Volocopter

Airbus / A³ Vahana

Boeing / Aurora Flight Sciences

Jaunt Air Mobility

SkyDrive (if Australian initiatives exist)

H55 (Swiss eVTOL partner)

- Urban Commuter Profile and Affordability Thresholds

- Regional Uptake Patterns (Tourism & Intercity Commuter Demand)

- Fleet Utilization Scenarios and Operating Hours

- Operator Budgeting and Cost Structures

- Acceptance, Trust, and Safety Indices

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035