Market Overview

The Australia Explosive Ordnance Disposal (EOD) market has experienced substantial growth due to rising security threats, legacy ordnance management needs, and the Australian Defence Force’s (ADF) modernization efforts. The market size in 2025 was valued at USD ~ million, with expected further growth driven by technological advancements in robotics, AI-enabled detection systems, and government defense spending on counterterrorism and mine clearance operations. The market is largely driven by government contracts, which have surged with the growing demand for safe disposal of unexploded ordnance (UXO), especially in defense and civil sectors.

Australia’s EOD market is dominated by cities with strong defense infrastructure and operational hubs. Canberra, the nation’s capital, serves as the strategic defense center, hosting key government departments and defense agencies like the Department of Defence and the Australian Defence Force. Other dominant regions include Sydney and Melbourne, which have both military and commercial EOD operations. Additionally, coastal cities such as Brisbane and Perth are vital due to their strategic ports and growing focus on maritime EOD operations for safeguarding national security.

Market Segmentation

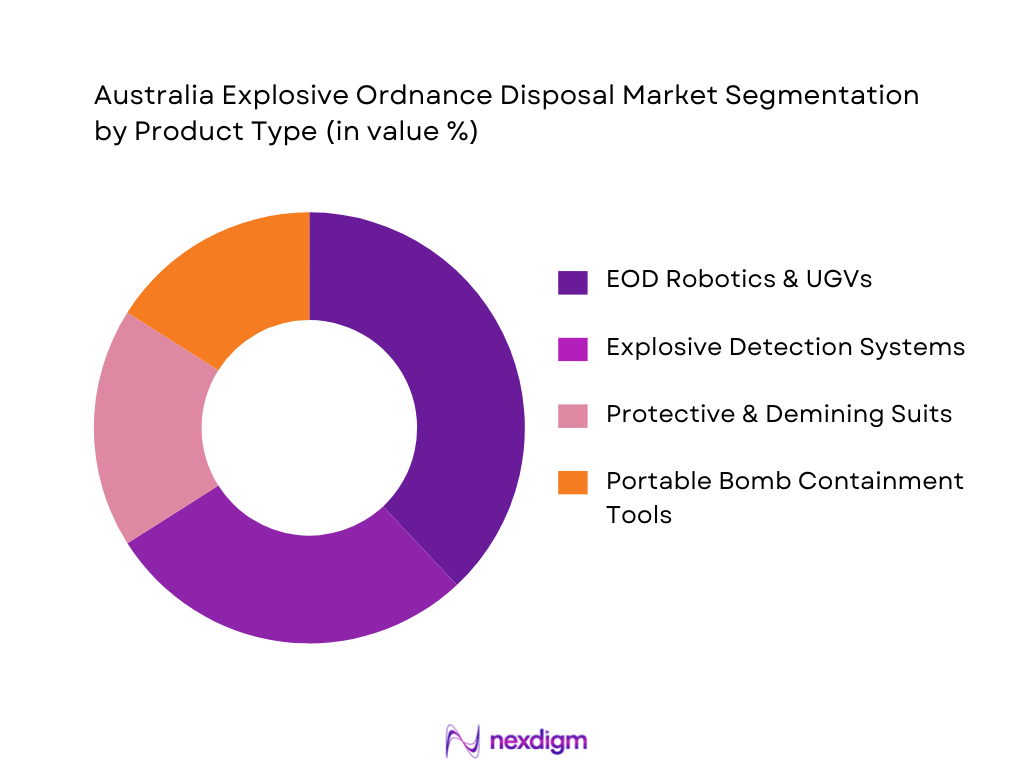

By Product Type

The Australia Explosive Ordnance Disposal market is segmented by product type into various categories such as EOD robotics, explosive detection systems, bomb suits, and containment devices. Among these, EOD robotics have taken a significant share due to the increasing demand for remote-controlled and autonomous systems that minimize human risk in hazardous environments. These technologies are gaining traction due to their effectiveness in dealing with IEDs and UXOs in high-risk zones. Robotics solutions allow for safer, more efficient operations, positioning them as the dominant product type.

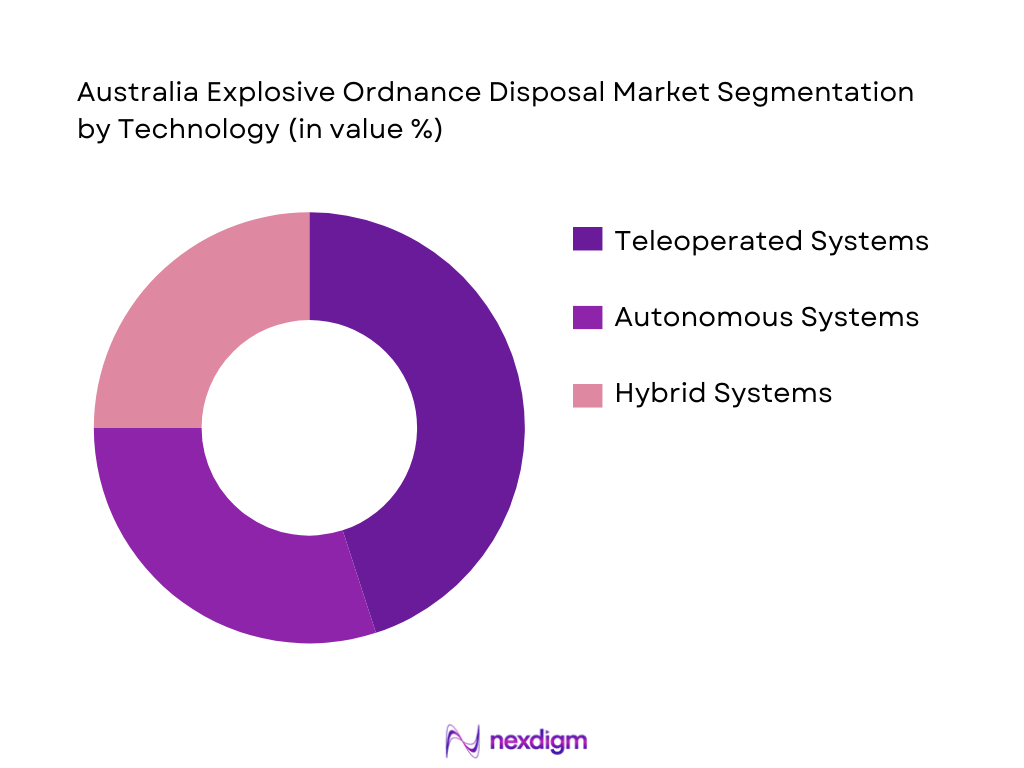

By Technology Type

The technology segment within the Australian EOD market is characterized by teleoperated systems, autonomous systems, and hybrid solutions. Teleoperated systems dominate due to their established presence in defense and law enforcement, as these systems provide the necessary control while offering precise operational capabilities. Teleoperated EOD tools are preferred by military and police bomb disposal units because of their adaptability and reduced risk during UXO disposal and bomb neutralization operations. These systems also have significant room for advancement with the integration of AI for improved real-time analysis.

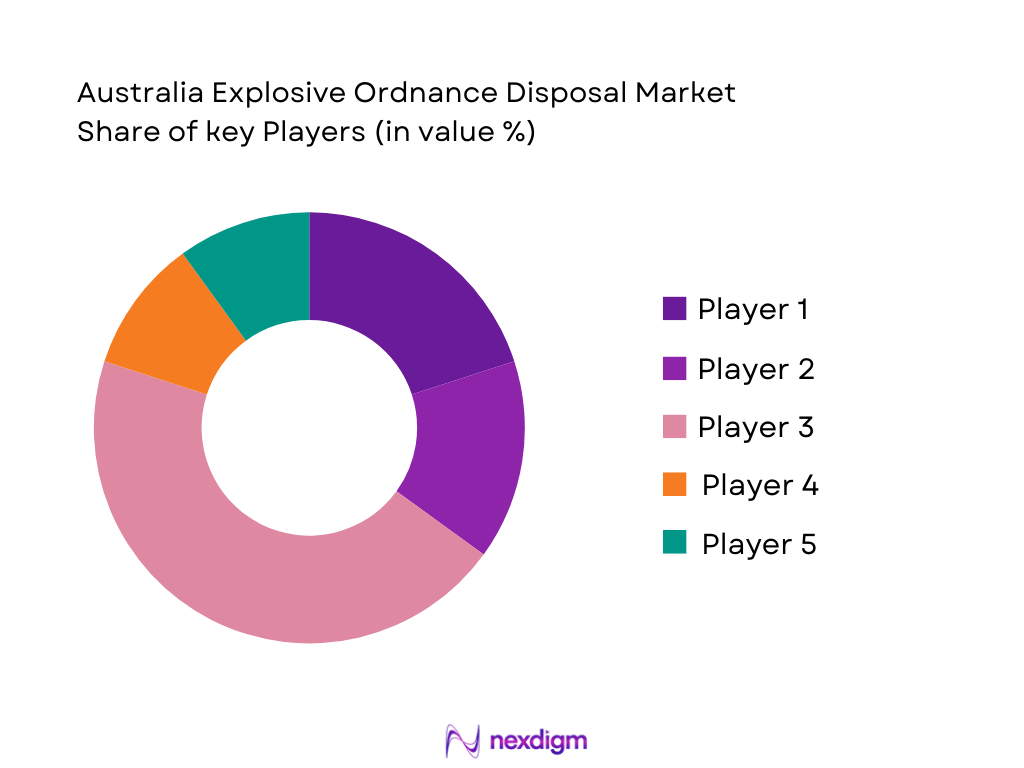

Competitive Landscape

The Australia Explosive Ordnance Disposal market is dominated by a mix of local and global players who offer a wide range of solutions from detection technologies to disposal and containment systems. Major players in the Australian EOD market include multinational corporations like Northrop Grumman, L3Harris Technologies, and Chemring Group, as well as local defense contractors. These companies are leveraging advanced robotics, AI, and sensor technologies to provide solutions tailored to Australia’s unique security and defense needs. Their dominance in the market is attributed to their technological expertise, strong relationships with defense agencies, and high-end service offerings for both military and law enforcement applications.

| Company | Establishment Year | Headquarters | Market Presence | Technology Integration | Key Clients | Government Contracts |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 1895 | USA | ~ | ~ | ~ | ~ |

| Chemring Group | 1905 | UK | ~ | ~ | ~ | ~ |

| QinetiQ | 2001 | Australia | ~ | ~ | ~ | ~ |

| Safariland LLC | 1960 | USA | ~ | ~ | ~ | ~ |

Australia Explosive Ordnance Disposal Market Analysis

Growth Drivers

National Defence Procurement

The Australian government’s substantial defense budget contributes to the expansion of the Explosive Ordnance Disposal (EOD) market. Increased investment in modernizing the Australian Defence Force (ADF) and addressing the growing threat of explosive devices boosts the demand for advanced EOD systems, ensuring national security and counterterrorism capabilities.

Terror Threat Mitigation

The rising threat of terrorism and the growing need for counter-terrorism efforts are driving the demand for EOD solutions. Bomb disposal technologies are essential for neutralizing explosive threats, particularly in urban areas, and safeguarding military and civilian assets.

Market Restraints

Training Costs

The high cost of specialized training for EOD personnel is a significant challenge. Training requires advanced simulation environments, real-time practice, and constant skill enhancement, increasing operational costs for both government agencies and private sector contractors.

Regulatory Compliance

EOD equipment must comply with rigorous safety standards and government regulations. Ensuring adherence to these regulatory frameworks can lead to increased costs, delays in procurement, and complexities in meeting international safety certification requirements.

Opportunities

Domestic OEM Development

There is a growing opportunity for Australian-based Original Equipment Manufacturers (OEMs) to develop locally-produced EOD solutions. This would reduce dependence on international suppliers, promote national security, and strengthen Australia’s defense industry capabilities.

Localisation

With increasing defense budgets, localizing the manufacturing and assembly of EOD equipment within Australia can provide cost efficiencies and stimulate the local economy. Furthermore, localization supports better integration with domestic defense strategies and fosters innovation in line with national security objectives.

Future Outlook

The Australia Explosive Ordnance Disposal market is poised for steady growth in the coming years, driven by an increase in defense budgets and the continuing modernization of the Australian Defence Force. The demand for advanced robotics, automated systems, and AI-assisted technologies will continue to rise as the threat of IEDs and UXOs remains a priority for national security. Additionally, increasing governmental focus on counterterrorism and improving safety for military personnel will further accelerate the adoption of these cutting-edge technologies in the EOD sector. Furthermore, Australia’s growing defense exports to other countries, particularly in the Asia-Pacific region, will likely drive market expansion and innovation.

Major Players in the Market

- Northrop Grumman

- L3Harris Technologies

- Chemring Group

- QinetiQ

- Safariland LLC

- FLIR Systems

- Med-Eng

- DroneShield

- ReconRobotics

- Thales Group

- Australian Explosive Ordnance Disposal Contractors

- Roboteq

- Cobham PLC

- Maxer Group

- Aardvark Group

Key Target Audience

- Australian Defence Force (ADF)

- Australian Federal Police (AFP)

- Australian State Police Bomb Squads

- Emergency Response Units

- Government and Regulatory Bodies (Department of Defence, Defence Materials Organisation)

- National Procurement Agencies

- Private Sector Contractors (EOD Equipment and Services)

- Investment and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on mapping the Australia Explosive Ordnance Disposal ecosystem, identifying major stakeholders such as the Department of Defence, local contractors, and international defense firms. A combination of secondary research and proprietary databases will be used to collect industry-specific data. This helps in pinpointing critical market drivers like national security policies, technology advancements, and procurement budgets.

Step 2: Market Analysis and Construction

In this phase, we will gather and analyze historical data on the EOD market in Australia, assessing defense spending patterns, product adoption rates, and customer behavior in procurement. This will allow for accurate market sizing and help understand the growth trajectory of key segments such as EOD robotics and detection systems.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be refined through expert consultations, including interviews with defense contractors, regulatory agencies, and industry specialists. This expert validation will provide actionable insights that help refine the data gathered from secondary research, ensuring a reliable market model.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all gathered data to generate a comprehensive market report. This includes field interviews with companies involved in EOD and a review of recent procurement and technology trends. This ensures the final report is a robust, data-backed document that reflects the current and future state of the Australia EOD market.

- Executive Summary

- Research Methodology (Market Definitions and Scope Boundaries (EOD Hardware, Software & Services Definitions), Data Triangulation Framework (Primary, Secondary, Third‑Party Defense Data Sources), National Defence Spend Calibration and Adjustment Methodology, Market Sizing & Forecasting Modelling Logic (Top‑Down, Bottom‑Up Synthesis), Assumptions and Normalisation of Defence Procurement Cycles, Limitations, Risk Controls & Confidence Intervals in Projections)

- Historical Context and Defence Mandates for EOD

- National Security Imperatives & Unexploded Ordnance (UXO) Backlog

- Evolution of EOD Operational Doctrine across Army, RAAF & Law Enforcement

- EOD Value Chain: R&D → Procurement → Field Deployment → Sustainment

- Technology Adoption Curve (Robotics, Sensors, CBRNE Integration)

- Growth Drivers

National Defence Procurement

Terror Threat Mitigation

Regional Security Cooperation

- Market Restraints

Training Costs

Regulatory Compliance

Budget Cyclicality

- Opportunities

Domestic OEM Development

Localisation

Export Potential

- Emerging Trends

AI‑Driven Detection

Swarm Robotics

Predictive Diagnostics

- Government Policy & Regulatory Landscape

Defence Budgeting

Safety Certification

- National Standards Impacting EOD Equipment Accreditation

- Porter’s Five Competitive Forces

- EOD Supply Chain Mapping & Risk Points

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-202

- By Equipment Category (In Value %)

EOD Robotics & UGVs (Mobility Systems, Payload Capability)

Explosive Detection Systems (Sensor Sensitivity, False Alarm Rate)

Protective & Demining Suits (Blast Protection Ratings)

X‑Ray & Imaging Devices (Penetration Depth, Resolution)

Portable Bomb Containment & Neutralization Tools - By Technology Type (In Value %)

Teleoperated Systems

Autonomous Systems

Hybrid Semi‑Autonomous Systems - By End‑User Segment (In Value %)

Australian Defence Force (ADF) EOD Units

Federal Law Enforcement (AFP, State Police Bomb Squads)

Civil Engineering & UXO Contractors

Emergency Response Units - By Application (In Value %)

Military Counter‑IED / Theatre Clearance

Domestic Counter‑terror EOD Tasks

UXO & Legacy Ordnance Remediation

CBRNE & Hazardous Material Events - By Deployment Environment (In Value %)

Urban Applications

Field / Rural Operations

Maritime & Port EOD Operations

Training Support Services

- Market Size by Company (Revenue / Unit Shipment Basis)

- Cross‑Comparison Parameters (Company Strategic Focus (Defence / Law Enforcement), Technical Capability Scores, System Reliability (MTBF / Availability Rates), Price Competitiveness (LCC / TCO Perspective), Certification & Compliance Coverage, Local Support Network Footprint, Training & After‑Sales Capacity, Integration with National Defence Systems, R&D Investment Intensity)

- SWOT Analysis of Key Competitors

- Pricing Architecture for Major SKU Families

- Detailed Profiles of Strategic Players

Northrop Grumman Corporation (EOD Robotics & Detection)

L3Harris Technologies, Inc. (Integrated EOD Systems)

Cobham PLC (Bomb Disposal Solutions)

Chemring Group (EOD Ordnance Protection)

Safariland LLC (Protective Gear & Shields)

Med‑Eng (Advanced Bomb Suits)

FLIR Systems / Teledyne (Imaging & Detection)

QinetiQ North America (Robotic Platforms)

EOD Hawk (Modular Detection Tools)

ReconRobotics (Confined Space Robots)

ROXON / Roboteq (Custom UGV OEMs

Maxer Group (Portable EOD Tools)

Thales Group (Sensor Integrated Systems)

DroneShield (Counter‑IED / Drone Assisted Detection)

Australian Local OEM

- Force Structure and EOD Unit Operational Tempo

- Procurement Cycles and Capital Acquisition Planning

- Maintenance & Sustainment Budgeting Patterns

- Training & Certification Expenditure Profiles

- End‑User Priorities and Pain Points

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035