Market Overview

The Australia Firearm Sight market is currently valued at approximately USD ~ million, based on the most recent industry data and historical growth trends. This market is primarily driven by the growing demand for high-precision optics in civilian sporting, military, and law enforcement sectors. With increasing firearm ownership and the rise of shooting sports, the market has seen a steady surge in demand for firearm sights that provide enhanced accuracy and performance. The adoption of advanced technologies such as thermal and night vision sights is further propelling market expansion.

Australia’s firearm sight market is dominated by key urban areas with a significant concentration of sporting activities and defense operations. Cities such as Sydney, Melbourne, and Brisbane are at the forefront due to their large population bases, high levels of firearm ownership, and robust sporting infrastructure. Moreover, regions with strong military and law enforcement presences, including Canberra, also contribute to the market’s dominance. The growing focus on hunting and shooting sports in suburban and regional areas adds to the overall demand for firearm sight systems in these dominant cities.

Market Segmentation

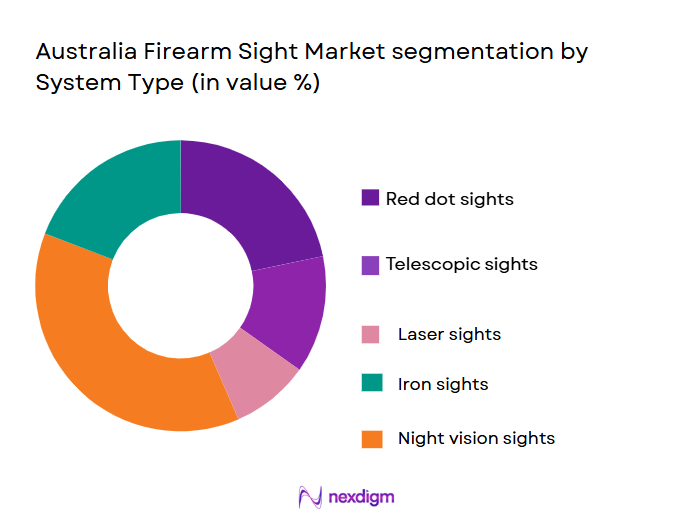

By System Type

The Australia Firearm Sight market is segmented by system type into red dot sights, telescopic sights, laser sights, iron sights, and night vision sights. Among these, red dot sights currently dominate the market due to their popularity in both civilian sporting and tactical applications. Their ease of use, quick target acquisition, and versatility in various lighting conditions have made them the preferred choice for firearm users. As more shooters prioritize speed and accuracy, red dot sights are becoming an integral part of modern firearm setups.

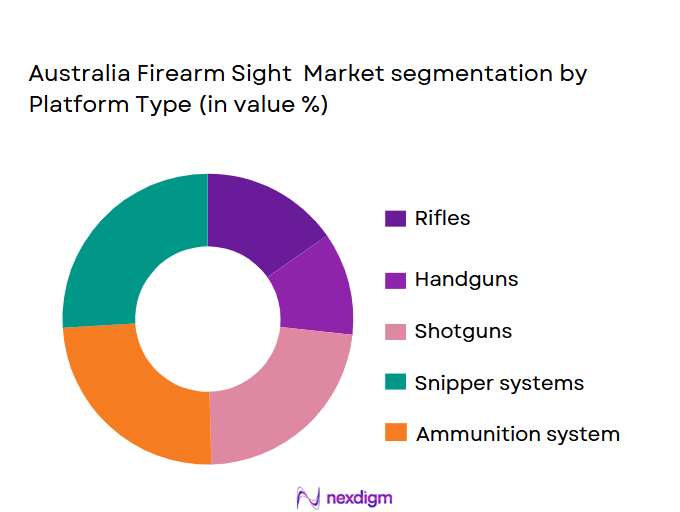

By Platform Type

The market is also segmented by platform type into handguns, rifles, shotguns, sniper systems, and ammunition systems. Rifles have the largest market share, primarily driven by their use in both civilian sporting activities like hunting and professional settings such as law enforcement and military operations. The popularity of long-range shooting and hunting, combined with advancements in rifle scopes and sight systems, has made rifles the dominant platform for firearm sight usage in Australia.

Competitive Landscape

The competitive landscape of the Australia Firearm Sight market is concentrated around several prominent players, both local and international. These companies include global optics brands such as Leupold & Stevens, Vortex Optics, and Trijicon, as well as regional players who are increasingly capturing the attention of consumers with high-quality, cost-effective products. The market is characterized by strong competition, with key players focusing on technological innovation, particularly in the development of night vision and thermal sighting systems, as well as offering a broad product range catering to both military and civilian markets.

| Company Name | Establishment Year | Headquarters | Product Range | Key Technologies | Customer Base | Market Focus |

| Leupold & Stevens | 1907 | USA | ~ | ~ | ~ | ~ |

| Vortex Optics | 1986 | USA | ~ | ~ | ~ | ~ |

| Trijicon | 1981 | USA | ~ | ~ | ~ | ~ |

| Aimpoint | 1975 | Sweden | ~ | ~ | ~ | ~ |

| Meopta | 1933 | Czech Republic | ~ | ~ | ~ | ~ |

Australia firearm sight Market Dynamics

Growth Drivers

Increasing popularity of shooting sports

The increasing popularity of shooting sports and recreational hunting activities in Australia has significantly contributed to the demand for firearm sights. With over ~ million Australians participating in these activities, the demand for enhanced firearm performance and accuracy has surged. As more individuals engage in these sports, they seek precision optics that can offer better targeting capabilities, further fueling the market’s growth. Additionally, Australia’s defense and law enforcement sectors are actively upgrading their equipment, leading to higher procurement of advanced sighting systems for military and tactical applications. As the government continues to boost defense spending, particularly in modernization projects, the demand for cutting-edge firearm sights is expected to rise.

Sighting systems

Technological advancements in sighting systems, including the integration of thermal and night vision technologies, are also driving market growth. The increasing adoption of smart optics, such as red dot and holographic sights, offers superior accuracy, speed, and functionality. As Australia places a greater emphasis on improving its defense capabilities, both in civilian and military sectors, the demand for high-tech sighting systems that offer enhanced performance in diverse environments is accelerating. These innovations are transforming the market, making advanced sight systems more accessible and attractive to a broader range of consumers.

Market Challenges

Australia’s strict firearm regulations and licensing requirements pose significant challenges to the firearm sight market. The National Firearms Agreement (NFA) established stringent controls over the types of firearms and accessories available, and any changes to these laws can impact the availability and demand for specific sighting systems. These regulatory hurdles can make it difficult for manufacturers and distributors to offer certain products, thus limiting market growth. Additionally, high import taxes and tariffs on firearm accessories contribute to the increased cost of advanced sighting systems, making them less affordable for a large segment of the consumer base, particularly those in the civilian sporting sector.

Intense competition and price sensitivity

The high cost of advanced sighting systems remains a critical challenge in the Australian market. As the market continues to lean towards more sophisticated optics, such as thermal and night vision sights, the prices for these products have remained relatively high, limiting their accessibility. Many consumers, particularly in the recreational and hunting segments, are unable to afford premium systems, opting instead for lower-cost alternatives. The pricing barriers, combined with the economic sensitivity of the market, hinder widespread adoption, slowing the growth potential of the firearm sight market. Furthermore, price-sensitive consumers often turn to budget-friendly solutions, reducing demand for premium products with advanced features.

Opportunities

Growing demand for firearm sights in civilian sporting

The growing interest in shooting sports and recreational hunting provides a substantial opportunity for the firearm sight market in Australia. With over 1.5 million active participants in these activities, there is a steady demand for firearm accessories that enhance performance and accuracy. The expansion of shooting ranges, competitions, and hunting events across the country is creating a favorable environment for manufacturers to introduce new sighting technologies. Moreover, the government’s support for shooting sports through funding and infrastructure development further drives market growth by encouraging participation and ensuring a continuous demand for advanced firearm sight systems.

Increase in military modernization projects

The increasing adoption of online sales channels for firearm accessories presents an emerging opportunity for the market. As e-commerce continues to grow, Australian consumers are increasingly turning to online platforms to purchase firearm sights and related accessories due to the convenience, competitive pricing, and wider selection available. This trend has been further accelerated by the COVID-19 pandemic, which led to a surge in online shopping. As more consumers opt for online purchases, manufacturers and distributors have an opportunity to expand their reach and tap into a broader consumer base, driving the demand for firearm sights in both civilian and military segments.

Future Outlook

Over the next decade, the Australia Firearm Sight market is expected to show steady growth, driven by advances in sighting technologies and an increasing focus on shooting sports and personal defense. As more Australians engage in activities like hunting, tactical training, and recreational shooting, the demand for high-quality firearm sights is anticipated to rise. Additionally, advancements in optical technologies such as smart sights with augmented reality features and thermal imaging are expected to be major growth drivers.

Major Players

- Leupold & Stevens

- Vortex Optics

- Trijicon

- Aimpoint

- Meopta

- Sightmark

- Nikon

- Burris Optics

- EOTech

- Steiner Optics

- Sig Sauer

- ATN Corporation

- Bushnell

- Nightforce Optics

- Zeiss

Key Target Audience

- Investments and venture capitalist firms

- Military organizations (Australian Defence Force)

- Law enforcement agencies (Australian Federal Police)

- Sporting associations (Shooting Australia)

- Firearm manufacturers

- Outdoor retail companies

- Hunting and shooting clubs

- Security firms (private and government contractors)

Research Methodology

Step 1: Identification of Key Variables

In the initial stage, an extensive market ecosystem map is constructed, identifying all key stakeholders within the Australia Firearm Sight Market. This process relies on secondary data from industry reports, governmental publications, and proprietary databases to build a comprehensive framework. The aim is to pinpoint the variables that will shape the market’s future trajectory.

Step 2: Market Analysis and Construction

This stage involves compiling historical data to assess market penetration and dynamics. It also includes evaluating the service providers, key suppliers, and consumer demand to understand the broader market environment. Data validation through expert consultations and direct engagement with manufacturers ensures that accurate trends are captured.

Step 3: Hypothesis Validation and Expert Consultation

Following the construction of market hypotheses, they are validated via computer-assisted telephone interviews (CATIs) with industry experts. These consultations are crucial for refining market estimates and ensuring the reliability of projections, focusing on insights from manufacturers, distributors, and technology developers.

Step 4: Research Synthesis and Final Output

In the final phase, a synthesis of all collected data from market analysis, expert validation, and field surveys is compiled. Discussions with key manufacturers will provide granular insights into product trends and consumer preferences. This data will serve as the foundation for the final report, providing a reliable and detailed overview of the Australia Firearm Sight Market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in hunting and shooting sports in Australia

Growing law enforcement and military expenditure

Technological advancements in sight systems - Market Challenges

Regulatory restrictions on firearms and accessories

High cost of advanced sighting systems

Intense competition and price sensitivity - Market Opportunities

Growing demand for firearm sights in civilian sporting

Increase in military modernization projects

Rise in online sales of firearm accessories - Trends

Shift towards lightweight and compact sight systems

Adoption of smart sights with augmented reality features

Integration of thermal and night vision technologies in sight systems

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Red Dot Sights

Telescopic Sights

Laser Sights

Iron Sights

Night Vision Sights - By Platform Type (In Value%)

Handguns

Rifles

Shotguns

Sniper Systems

Ammunition Systems - By Fitment Type (In Value%)

Integrated Firearm Sights

Clip-on Firearm Sights

Dedicated Firearm Sights

Universal Firearm Sights

Modular Firearm Sights - By EndUser Segment (In Value%)

Military

Law Enforcement

Civilian Sporting

Hunting

Private Security - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Retail

Retail Stores

OEM Sales

- Market Share Analysis

- Cross Comparison Parameters

(Price, Technology, System Type, Regional Reach, Brand Reputation Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Leupold & Stevens

Bushnell

Trijicon

Vortex Optics

EOTech

Aimpoint

Meopta

Sightmark

Sig Sauer

ATN Corporation

Nikon

Steiner Optics

Zeiss

Burris Optics

Nightforce Optics

- Growth in civilian sporting firearms use

- Military and law enforcement procurement boosting market demand

- Increasing interest in long-range shooting for hunting

- Private security firms adopting advanced sighting systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035