Market Overview

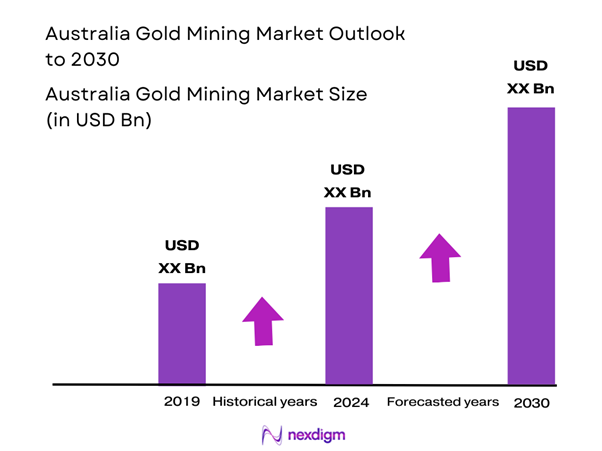

The Australia gold mining market is valued at USD 26 billion in 2024, backed by the country’s rich natural resources and a well-established mining infrastructure. The market growth is driven by the increasing global demand for gold across investment and jewelry sectors, alongside technological advancements that enhance extraction efficiency. Additionally, the favorable regulatory environment and investments aimed at sustainable practices further support the growth trajectory, setting the stage for prosperous future developments.

Key cities that dominate the Australia gold mining market include Perth, Sydney, and Melbourne. Perth, in particular, serves as a mining hub that houses a myriad of mining companies and support services. The city benefits from proximity to mining sites in Western Australia, which is known for its vast gold reserves. Sydney and Melbourne are influential hubs due to their robust financial markets and enabling infrastructure that attracts international investments into the mining sector.

Australia’s economy is projected to grow at 4.5% in 2023, as per the International Monetary Fund. This economic expansion enhances consumer spending and investment, which in turn bolsters the gold mining sector. Sectors such as construction and infrastructure are also benefiting from increased investments, leading to a rise in demand for materials and metal commodities, including gold. Furthermore, the Australian Bureau of Statistics noted that mining investment reached AUD 40 billion in 2022, indicating robust economic conditions that fuel the industry.

Market Segmentation

By Mining Method

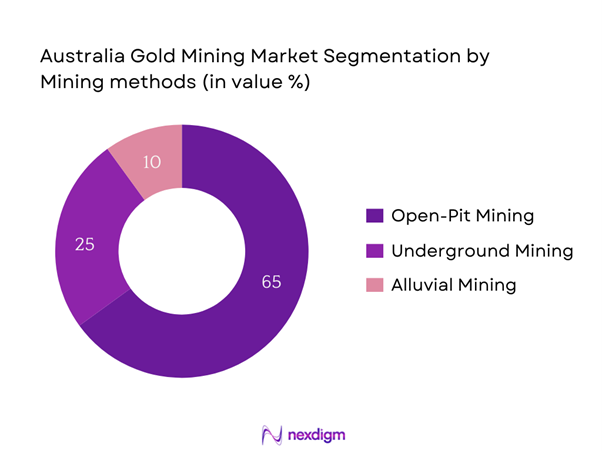

The market is segmented by mining method into open-pit mining, underground mining, and alluvial mining. Open-pit mining holds a dominant market share driven by its cost-effectiveness and efficiency in extracting large volumes of ore. This method also offers the advantage of reduced safety hazards compared to underground mining, which is often more labor-intensive and costly. The favorable geographical conditions and advanced machinery utilized in open-pit operations contribute to its leading position within the market.

By Application

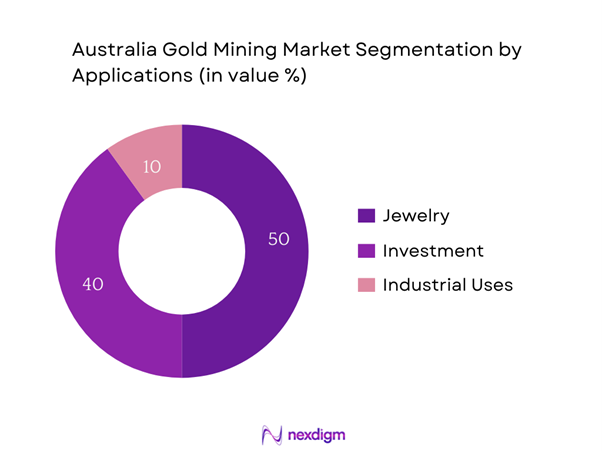

The Australia gold mining market is segmented by application into jewelry, investment, and industrial uses. The jewelry segment has a significant market share, driven by cultural preferences and the prominent use of gold in adornment across various demographics. The luxurious nature of gold jewelry appeals to consumers, and its perceived value makes it a staple in the fashion industry. Additionally, the rising popularity of personalized and artisanal handmade items has bolstered demand, reinforcing the jewelry segment’s dominance.

Competitive Landscape

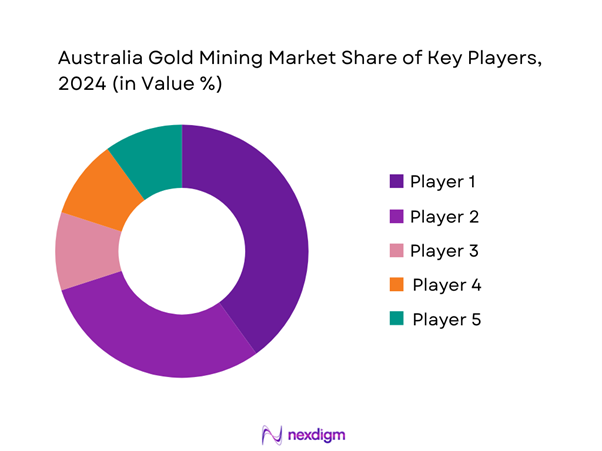

The Australia gold mining market is dominated by a few major players, including Newcrest Mining Limited, Northern Star Resources, and Evolution Mining. This consolidation highlights the significant influence of these key companies in determining market strategies and technological innovations. Their strong investment in exploration and mining technologies allows them to enhance productivity and maintain a competitive edge in the region.

| Company Name | Establishment Year | Headquarters | Market Cap (USD) | Mining Method | Major Products | Geographical Reach |

| Newcrest Mining Limited | 1921 | Melbourne | – | – | – | – |

| Northern Star Resources | 2000 | Perth | – | – | – | – |

| Evolution Mining | 2000 | Sydney | – | – | – | – |

| Saracen Mineral Holdings | 1997 | Perth | – | – | – | – |

| Regis Resources Limited | 2003 | Perth | – | – | – | – |

Australia Gold Mining Market Analysis

Growth Drivers

Rising Global Gold Demand

The global demand for gold has surged significantly, with approximately 4,800 tons of gold being bought in 2022, reflecting an increase in investment and jewelry sectors. Gold remains a safe haven in times of geopolitical and economic uncertainty, prompting central banks to accumulate reserves; in 2022 alone, central banks purchased about 400 tons of gold, according to the World Gold Council. As consumer sentiment remains strong in regions like Asia and North America, Australia benefits as one of the leading gold producing countries, meeting the ongoing global appetite for gold.

Technological Advancements in Mining

The Australian gold mining sector has seen significant investment in innovative technologies, including autonomous mining vehicles and advanced analytics. This technological push enhances productivity and reduces operational costs. A report from the Australian government indicates that investments in mining technology reached AUD 20 billion in 2022. These innovations have aided in increasing the efficiency of ore extraction while minimizing environmental impacts, thereby boosting returns for mining companies operating in the region.

Market Challenges

Environmental Regulations

The gold mining industry in Australia is subject to strict environmental regulations aimed at promoting sustainable practices. In 2023, under the Environment Protection and Biodiversity Conservation Act, compliance requirements have increased, leading many mining companies to incur additional costs averaging AUD 5 million per project in environmental monitoring and restoration. These stringent standards are essential for protecting Australia’s diverse ecosystems, but they also pose challenges for operational efficiency and profitability in mining operations.

Fluctuations in Gold Prices

Gold prices are inherently volatile, influenced by various macroeconomic factors such as inflation rates, currency strength, and global political stability. As of February 2023, gold prices fluctuated around USD 1,900 per ounce, but as geopolitical tensions arose in Eastern Europe, prices surged to USD 2,000 per ounce by April 2023. These fluctuations pose risks to mining profitability and investment decisions. Additionally, the Reserve Bank of Australia forecasts inflation rates to remain between 5% and 6% in 2023, adding more uncertainty to gold pricing.

Opportunities

Expansion in Emerging Markets

Emerging markets, particularly in Asia, are showing increasing interest in gold for both investment and ornamental purposes. In 2022, demand for gold jewelry rose by 10% in India, driven by cultural factors and increasing disposable incomes, where gold is considered auspicious. Australia has the opportunity to export gold to these growing markets, tapping into this rising demand. Additionally, China’s economic recovery post-pandemic is expected to spur additional demand for gold, suggesting a favorable environment for higher sales from Australian mines.

Innovations in Sustainable Mining Practices

The push towards sustainable mining practices offers significant future growth opportunities for Australia’s gold sector. With increasing environmental concerns, mining companies are adopting more eco-friendly techniques, such as using renewable energy sources. As of 2023, the Australian Renewable Energy Agency reported that around 30% of operational energy in mining now comes from renewable sources, which not only enhances sustainability but can also reduce operational costs over time. Companies investing in these technologies are likely to benefit in the long run by conforming to investor and consumer demands for sustainability.

Future Outlook

Over the next five years, the Australia gold mining market is projected to experience significant growth driven by technological advancements in mining processes, coupled with sustained global demand for gold. The increasing interest in gold as a stable investment, particularly in times of economic uncertainty, will enhance market viability. Furthermore, the emphasis on environmentally sustainable mining practices will pave the way for innovative solutions, strengthening the sector’s appeal among investors.

Major Players

- Newcrest Mining Limited

- Northern Star Resources

- Evolution Mining

- Saracen Mineral Holdings

- Regis Resources Limited

- Barrick Gold Corporation

- AngloGold Ashanti

- St Barbara Limited

- Gold Road Resources

- OROCOBRE Limited

- IGO Limited

- Fortescue Metals Group

- Whitehaven Coal

- BHP Group

- South32 Limited

Key Target Audience

- Mining companies

- Investors and venture capitalist firms

- Government and regulatory bodies (Department of Industry, Science, Energy and Resources)

- Financial institutions and banks

- Jewellers and retailers

- Mining equipment manufacturers

- Environmental organizations and NGOs

- Supply chain and logistics companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map that encompasses all major stakeholders within the Australia gold mining market. This step relies on extensive desk research, utilizing both secondary and proprietary databases to gather detailed industry-level information. The primary objective at this stage is to identify and define the critical variables influencing market dynamics, including market trends, consumer behaviors, and regulatory frameworks.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Australia gold mining market. This includes assessing mining operations’ scale, types, and geographical distribution, alongside evaluating industry performance indicators. Furthermore, we assess production capacities, revenue generation, and key growth drivers to uncover patterns that define market health and facilitate future projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through comprehensive consultations with industry experts and stakeholders, employing approaches such as computer-assisted telephone interviews (CATI). Engaging diverse representatives from mining companies, financial institutions, and industry associations provides invaluable operational and financial insights, which are instrumental in refining and corroborating the market data collected.

Step 4: Research Synthesis and Final Output

The final phase involves directly engaging with multiple stakeholders in the gold mining sector to acquire detailed insights regarding market segments, operational challenges, and consumer preferences. This interaction serves to verify and complement the statistics derived from the earlier steps, ensuring a comprehensive and validated analysis of the Australia gold mining market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Overview and Genesis of the Gold Mining Sector

- Timeline of Major Players and Developments

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Global Gold Demand

Technological Advancements in Mining

Regional Economic Growth - Market Challenges

Environmental Regulations

Fluctuations in Gold Prices - Opportunities

Expansion in Emerging Markets

Innovations in Sustainable Mining Practices - Trends

Shift Towards Responsible Mining

Growth in E-commerce for Gold - Government Regulation

Mining Compliance Standards

Mining Licenses and Permits - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Mining Method (In Value %)

Open-Pit Mining

– Heap Leach Operations

– Large-Scale Bulk Mining

– Drill and Blast Techniques

Underground Mining

– Decline Access Mining

– Shaft Mining

– Cut-and-Fill / Room and Pillar Methods

Alluvial Mining

– Dry Alluvial Mining

– Wet Alluvial Mining

– Artisanal Surface Collection - By Gold Form (In Value %)

Gold Bullion

– Refined Bars

– Coins and Ingots

– Central Bank Reserves

Gold Ore

– Refractory Gold Ore

– Oxide Gold Ore

– Sulfide Gold Ore

Gold Scrap

– Recycled Jewelry and Watches

– Industrial Scrap

– Dental and Medical Gold Waste - By Application (In Value %)

Jewelry

– Luxury Jewelry Brands

– Retail Gold Ornaments

– Cultural/Traditional Jewelry Markets

Investment

– ETFs and Gold-Backed Funds

– Physical Gold Holding

– Sovereign Reserves and Institutional Demand

Industrial

– Electronics

– Aerospace Components

– Medical Devices and Dental Applications - By Region (In Value %)

Western Australia

New South Wales

Queensland

South Australia - By Company Type (In Value %)

Large Scale Mining Companies

– Established Producers

– Vertically Integrated Operations

– Export-Oriented Producers

Small to Medium Enterprises (SMEs)

– Junior Producers

– Regional and Niche Operators

– Mid-Tier Listed Companies

Exploration Companies

– Prospecting and Greenfield Exploration

– Early-Stage and Feasibility Study Players

– Joint Venture-Backed Explorers

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Mining Method, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Mining Method, Number of Mining Sites, Distribution Channels, Exploration Activities, Unique Value Offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players in Australia Gold Mining Market

- Detailed Profiles of Major Companies

Newcrest Mining Limited

Northern Star Resources

Evolution Mining

Barrick Gold Corporation

AngloGold Ashanti

Saracen Mineral Holdings

Regis Resources Limited

St Barbara Limited

Gold Road Resources

OROCOBRE Limited

IGO Limited

Fortescue Metals Group

Whitehaven Coal

BHP Group

South32 Limited

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030