Market Overview

The Australia Green Airport market is valued at approximately USD ~billion, driven by the rapid adoption of sustainable technologies and infrastructure within the airport sector. Government policies promoting sustainability, along with international environmental obligations, have fueled the demand for energy-efficient solutions at airports. Australia’s push towards net-zero emissions by 2050 has further accelerated investments in green airport projects. This market’s growth is also attributed to the increasing need for airports to reduce operational costs through energy-saving measures, alongside the growing focus on environmental sustainability within the aviation sector.

Australia’s major airports, such as Sydney, Melbourne, Brisbane, and Perth, dominate the green airport market due to their large scale and high passenger traffic. These airports have increasingly adopted eco-friendly technologies, making them key players in sustainable aviation infrastructure. Sydney Airport, in particular, has been a leader, pioneering green initiatives like solar energy systems and energy-efficient terminals. The dominance of these cities is attributed to both the volume of international and domestic travel and the local government’s commitment to sustainable development, making them significant contributors to Australia’s green airport efforts.

Market Segmentation

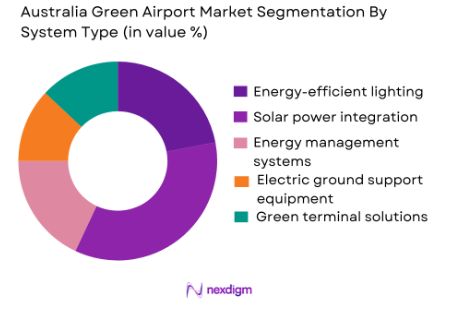

By System Type

The Australian Green Airport market is segmented by system type into energy-efficient lighting systems, solar power integration, energy management systems, electric ground support equipment, and green terminal solutions. Among these, solar power integration holds the largest share due to its ability to reduce operational costs significantly and meet sustainability goals. Solar panels are increasingly being installed on airport rooftops and car parks, reducing dependence on grid energy. The growing awareness about renewable energy sources, combined with government incentives for solar installations, has driven the dominance of this segment. Major airports like Sydney and Melbourne have already invested heavily in solar energy, contributing to the segment’s significant market share.

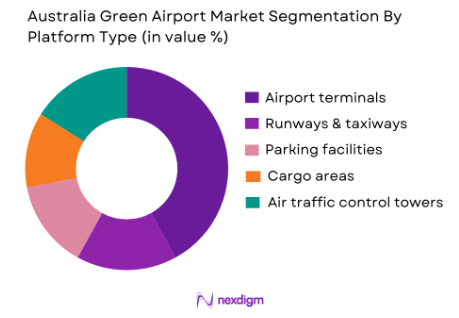

By Platform Type

The market is further segmented by platform type, which includes airport terminals, runways & taxiways, parking facilities, cargo areas, and air traffic control towers. Airport terminals dominate the market share as they are critical in passenger experience and operational efficiency. The increasing adoption of sustainable practices, such as energy-efficient HVAC systems, green building certifications, and renewable energy integration, has driven the demand for green terminals. These initiatives help airports reduce their carbon footprint and improve their environmental reputation. The large-scale renovation projects at airports like Sydney and Melbourne, focusing on green terminal solutions, make this segment the leader.

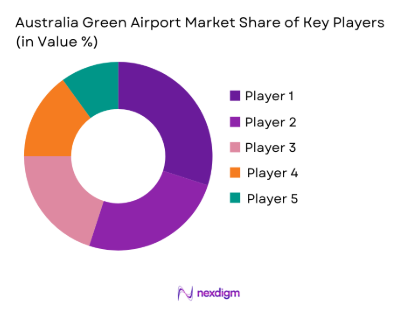

Competitive Landscape

The Australian Green Airport market is dominated by key players such as Sydney Airport, Melbourne Airport, and Brisbane Airport, alongside international players like Siemens AG and Honeywell. These companies lead the market due to their expertise in energy-efficient technologies and their ability to scale solutions across large infrastructures. The competition is strong, with both local authorities and global firms vying for the implementation of green technologies across airports in Australia.

| Company | Establishment Year | Headquarters | Technological Innovations | Sustainability Initiatives | Partnerships | Market Strategy | Revenue (USD) |

| Sydney Airport | 1970 | Sydney, Australia | Solar power, energy-efficient HVAC systems | ~ | ~ | ~ | ~ |

| Melbourne Airport | 1970 | Melbourne, Australia | Smart lighting, green terminals | ~ | ~ | ~ | ~ |

| Brisbane Airport | 1988 | Brisbane, Australia | Electric ground support equipment | ~ | ~ | ~ | ~ |

| Siemens AG | 1847 | Munich, Germany | Smart energy systems, AI integration | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | Morris Plains, USA | Advanced energy management systems | ~ | ~ | ~ | ~ |

Australia Green Airport Market Analysis

Growth Drivers

Government Regulations and Incentives

The Australian government has committed to achieving net-zero emissions by 2050, which has catalyzed green initiatives across various industries, including aviation. Airports are increasingly adopting sustainable technologies and green solutions to comply with these regulations and benefit from government incentives. For example, airport authorities in Australia are benefitting from rebates and subsidies for energy-efficient installations, such as solar panels and electric ground support equipment. These regulatory frameworks not only help reduce the carbon footprint of airports but also provide financial incentives to accelerate the adoption of greener technologies. As a result, Australian airports are becoming frontrunners in the sustainable aviation sector, driving the demand for green airport technologies and solutions.

Increasing Environmental Consciousness and Demand for Sustainable Travel

Passenger demand for environmentally responsible travel options is growing steadily, contributing to the expansion of green airport initiatives in Australia. Travelers are increasingly choosing airlines and airports that align with their environmental values, which puts pressure on airports to adopt green technologies. Sustainable practices such as solar-powered terminals, green building certifications, and electric vehicles are becoming integral to airport operations. This shift is not only driven by consumer demand but also by the need to improve an airport’s reputation as an eco-conscious destination. This growing emphasis on sustainability among travellers is a key driver of green infrastructure investments in airports across Australia, making it a critical factor in market growth.

Market Challenges

High Initial Capital Investment

One of the biggest challenges facing the adoption of green technologies in Australian airports is the high upfront cost of sustainable infrastructure. Installing solar panels, upgrading energy systems, and retrofitting terminals with energy-efficient technologies require significant capital investment, which many airports, especially smaller ones, may struggle to afford. Despite the long-term cost savings from reduced energy consumption, the financial burden of initial investments can be a deterrent, particularly when airports are also dealing with the pressures of regular infrastructure maintenance and operational costs. As a result, airports need to balance the need for green infrastructure with financial constraints, making it a key challenge in the growth of the green airport market.

Integration with Existing Infrastructure

Many Australian airports operate with outdated infrastructure, making it difficult to integrate new sustainable technologies seamlessly. Retrofitting older terminals and systems to meet modern green standards often involves complex challenges, such as ensuring compatibility with existing systems, maintaining operational efficiency, and minimizing disruptions to passengers. In some cases, the necessary technological upgrades require major structural changes or a complete overhaul of systems, which can be time-consuming and expensive. The need for specialized solutions that can integrate with current infrastructure while achieving sustainability goals poses a significant challenge to the widespread adoption of green technologies at Australian airports.

Opportunities

Growth of Solar Power Installations

The opportunity for expanding solar power installations in Australian airports is significant, given the country’s abundant sunlight and the government’s growing focus on renewable energy. Many major airports, such as Sydney and Melbourne, have already begun to invest in solar energy, installing solar panels on terminal rooftops, parking facilities, and other unused areas. As the demand for renewable energy increases, there is a clear opportunity for more airports to adopt solar power as a primary source of energy. This shift not only reduces operating costs but also contributes to Australia’s renewable energy goals. The solar power segment is poised to experience rapid growth, with increased investments and technological innovations making it a promising opportunity for green airport development.

Electric Ground Support Equipment (EGSE) Adoption

Electric ground support equipment is gaining traction in Australian airports due to its environmental benefits and lower operational costs compared to traditional fossil fuel-powered equipment. Airports are increasingly adopting electric baggage tugs, aircraft pushback tractors, and other ground support vehicles to reduce their carbon footprint and operating expenses. The Australian government’s strong push for electric vehicles and infrastructure further supports the adoption of EGSE, with several airports already implementing electric solutions for ground operations. This presents a significant growth opportunity, as airports seek to modernize their ground operations and align with sustainability targets. With the continued development of battery technologies and charging infrastructure, the EGSE segment holds immense potential for expansion in the Australian green airport market.

Future Outlook

Over the next decade, the Australian Green Airport market is set for substantial growth as airports continue to enhance their sustainability efforts in line with Australia’s commitment to achieving net-zero emissions by 2050. Key drivers will include ongoing technological advancements, such as AI-driven energy management and green terminal solutions. Additionally, stricter environmental regulations and the growing importance of eco-friendly infrastructure will further stimulate the market. The Australian government’s push for sustainable development, coupled with increasing passenger demand for greener travel options, will ensure steady growth in the green airport sector.

Major Players

- Sydney Airport

- Melbourne Airport

- Brisbane Airport

- Perth Airport

- Gold Coast Airport

- Adelaide Airport

- Virgin Australia

- Air New Zealand

- Qantas Airways

- Aeroports de Paris

- London Heathrow

- Lufthansa Technik

- GE Aviation

- Siemens AG

- Honeywell International

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport authorities and operators

- Environmental consultancy firms

- Airlines and aviation companies

- Airport construction firms

- Sustainable technology suppliers

- Contractors working on green infrastructure projects

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying all relevant variables that influence the Australian Green Airport market, such as technological advancements, regulatory requirements, and key industry drivers. We rely on secondary data sources like government reports and industry publications for an initial understanding of the market landscape.

Step 2: Market Analysis and Construction

In this step, historical data on market growth, infrastructure development, and technological adoption across Australian airports will be compiled. The analysis focuses on assessing how sustainable practices have evolved within airports and the impact of these changes on overall market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested through consultations with key stakeholders in the aviation sector. These include airport managers, technology providers, and environmental regulators. Interviews and surveys will provide real-world insights into the factors driving sustainability initiatives at airports.

Step 4: Research Synthesis and Final Output

Finally, the data gathered through various research methods will be synthesized into a comprehensive market report. Key inputs from airport authorities and technology companies will be used to validate the findings and refine the market analysis. The final report will offer a complete and accurate picture of the current state and future potential of the Australian Green Airport market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government mandates on carbon emissions and sustainability

Increased airport infrastructure investments

Rising demand for eco-friendly air travel solutions - Challenges

High initial cost of green technologies

Technological limitations in some green airport solutions

Regulatory hurdles in implementing sustainable practices - Opportunities

Advancements in solar energy and renewable tech for airports

Growing global focus on sustainability in aviation

Partnerships between airports and green tech innovators - Trends

Rise in electric vehicles for airport ground support

Implementation of AI in managing green infrastructure

Integration of smart technologies to reduce energy consumption

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electric Aircraft Ground Support Equipment

Renewable Energy-Powered Terminal Systems

Eco-friendly Airfield Lighting Systems

Sustainable Air Conditioning and Heating Solutions

Solar-Powered Air Traffic Control Systems - By Platform Type (In Value%)

Airport Terminals

Ground Support Operations

Airfield Infrastructure

Air Traffic Management Systems

Passenger Transportation Systems - By Fitment Type (In Value%)

Retrofitting Existing Airports

New Airport Developments

Upgrades in Green Infrastructure

Replacement of Obsolete Systems

Expansion of Existing Eco-Friendly Facilities - By End User Segment (In Value%)

Commercial Airports

Private Airports

Cargo Airports

Regional Airports

Military Airports - By Procurement Channel (In Value%)

Direct Procurement by Airports

Third-Party Contractors

Government Tenders

Private Sector Investments

Public-Private Partnerships

- Market Share Analysis

- Cross Comparison Parameters (Market penetration, Technological advancement, Cost competitiveness, Regulatory compliance, Customer satisfaction)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Airports Australia Group

Sydney Airport Corporation

Melbourne Airport

Brisbane Airport Corporation

Perth Airport

Adelaide Airport

Canberra Airport

Gold Coast Airport

Qantas Airways Limited

Virgin Australia Airlines

Linfox Logistics

Civmec Limited

Veolia North America

Siemens Australia

GE Aviation

- Increasing adoption of green technologies by large commercial airports

- Shift in airport procurement strategies towards eco-friendly solutions

- Demand from cargo airports for energy-efficient operations

- Private airports leading the charge in sustainability initiatives

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035